Woodward SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Woodward Bundle

What is included in the product

Analyzes Woodward’s competitive position through key internal and external factors.

Facilitates interactive planning with a structured, at-a-glance view.

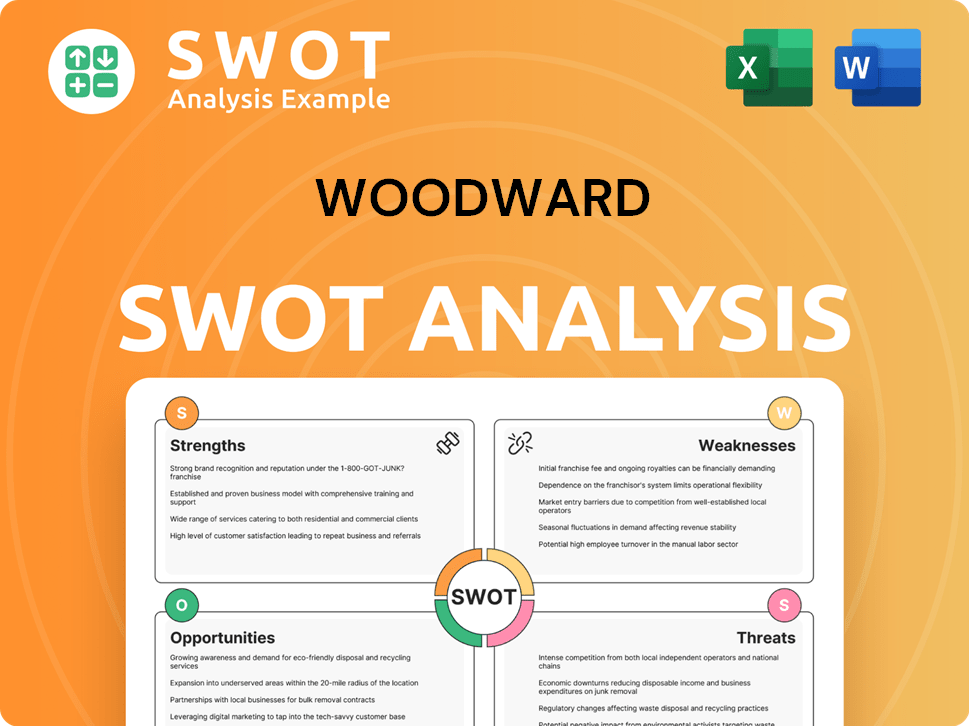

Preview the Actual Deliverable

Woodward SWOT Analysis

This preview is a live view of the Woodward SWOT analysis you'll receive.

The same expertly crafted document downloads after purchase, complete with all sections.

No need to worry; this isn't a snippet—it's the full report!

Get immediate access to the detailed, insightful analysis when you buy.

Review it and make your purchase with confidence.

SWOT Analysis Template

Woodward's SWOT analysis unveils key areas for growth, highlighting their strengths, weaknesses, opportunities, and threats. Explore how Woodward leverages its advantages and tackles challenges in the market. Identify potential for expansion and strategic positioning for success. The analysis provides insights into competitive landscapes. See the full story for deep analysis. Purchase now for in-depth strategic insights.

Strengths

Woodward's Aerospace segment is a powerhouse, fueled by strong demand. This segment significantly boosts revenue and profitability. Recent reports show solid sales growth in both commercial and defense sectors. For instance, in fiscal year 2024, the Aerospace segment saw a 15% increase in sales.

Woodward's fiscal year 2024 saw record sales, surpassing $3 billion. This surge in revenue was accompanied by substantial earnings growth. The strong financial results reflect high market demand. Operational improvements played a key role in this success.

Woodward's strengths include technological expertise and innovation. They are known for engineering excellence in energy control. The company develops next-gen aircraft tech and clean energy solutions. In 2024, R&D spending was approximately $180 million, supporting innovation. This positions them well for future market demands.

Diversified Product Portfolio

Woodward's diverse product offerings span aerospace and industrial sectors, providing a strong foundation. This diversification helps buffer against downturns in any single market segment. For instance, in fiscal year 2024, aerospace represented 58% of sales and industrial 42%. This balance supports overall financial stability. This strategy is vital for sustained growth and resilience.

- Aerospace sales accounted for $1.66 billion in fiscal year 2024.

- Industrial sales totaled $1.21 billion in fiscal year 2024.

- Woodward's diverse portfolio helps manage market volatility.

Operational Excellence and Efficiency

Woodward's dedication to operational excellence is a key strength. The company has been undergoing facility transformations and automation efforts. These improvements are designed to boost efficiency and better serve customer needs. This focus leads to higher margins and increased productivity. In Q1 2024, Woodward reported a 10% increase in net sales, showing the impact of these strategies.

- Facility transformations and automation efforts enhance efficiency.

- These improvements aim to better meet customer demands.

- Operational excellence leads to improved margins.

- Woodward saw a 10% increase in net sales in Q1 2024.

Woodward's technological prowess, particularly in aerospace and energy control, fuels its competitive advantage and future growth. Their robust financial performance, marked by record sales exceeding $3 billion in fiscal year 2024, demonstrates solid market demand. Diverse product offerings across aerospace and industrial sectors provide stability.

| Strength | Details | Fiscal Year 2024 Data |

|---|---|---|

| Technological Expertise | Engineering excellence in energy control, R&D focus. | R&D spending approx. $180M. |

| Strong Financials | Record sales & earnings growth, operational improvements. | Sales > $3B. Aerospace sales $1.66B, Industrial $1.21B. |

| Diversified Portfolio | Aerospace and Industrial segments provide balance. | Aerospace 58%, Industrial 42%. |

Weaknesses

Woodward's industrial segment faces challenges due to the China on-highway natural gas truck market's downturn. This weakness significantly impacts sales, creating a notable headwind. In Q1 2024, the industrial segment saw a revenue decrease, partially due to these market conditions. The drop in demand for natural gas trucks in China continues to affect Woodward's financial performance.

Woodward's Industrial segment faces cyclical risks tied to economic ups and downs. The industrial market's volatility directly impacts this sector's revenue. In 2023, the industrial sector's growth was moderate, influenced by global economic uncertainty. This cyclical nature can pressure profitability during economic slowdowns, as seen in past downturns.

Woodward's Aerospace segment is still grappling with supply chain disruptions, which can hinder production efficiency. These disruptions pose operational uncertainty and financial risks. In Q1 2024, supply chain issues led to a 5% decrease in sales volume for some products. The company is actively working to mitigate these challenges, but the impact lingers.

High R&D and SG&A Expenses

Woodward faces significant financial pressures due to high R&D and SG&A expenses. These expenses consume a substantial portion of the company's revenue, potentially impacting profitability. In fiscal year 2024, Woodward reported R&D expenses of $160.5 million. Managing these costs is essential for maintaining competitiveness and financial health.

- High R&D and SG&A expenses impact profitability.

- R&D expenses were $160.5 million in fiscal year 2024.

- Cost control is important for long-term success.

Dependence on Key Customers

Woodward's reliance on a few major clients represents a significant weakness. A substantial portion of its revenue comes from a limited customer base. This concentration introduces vulnerability to shifts in these key customers' needs or business relationships. Any disruption with these pivotal clients could drastically impact Woodward's financial performance. For instance, in fiscal year 2024, the top 10 customers accounted for over 40% of total net sales.

- Top 10 customers contributed over 40% of net sales in FY2024.

- Changes in customer demand directly affect revenue.

- Relationship issues with major clients pose financial risks.

Woodward is sensitive to market downturns, as seen in China's natural gas truck market impacting industrial revenue. Cyclical risks and supply chain disruptions affect both industrial and aerospace segments. High R&D and SG&A expenses, with R&D at $160.5M in FY2024, pressure profitability, while major client concentration creates revenue vulnerability.

| Weakness | Description | Impact |

|---|---|---|

| Market Downturns | China on-highway natural gas market decline. | Decreased revenue in Industrial segment. |

| Cyclical Risks | Industrial market volatility. | Pressure on profitability during slowdowns. |

| Supply Chain | Disruptions, impacting production. | Operational uncertainty, reduced sales. |

| High Expenses | R&D and SG&A. | $160.5M R&D in FY2024, impacts profitability. |

| Client Concentration | Reliance on a few major customers. | Vulnerability to shifts in client needs. |

Opportunities

Woodward benefits from the commercial aerospace aftermarket's expansion. High aircraft use and passenger numbers boost demand. The aftermarket is projected to reach $107.8 billion by 2025. This growth offers Woodward significant opportunities.

Rising global tensions and geopolitical instability are fueling increased defense spending. Woodward benefits from this trend, particularly in its aerospace and defense segments. The company projects robust growth in its defense portfolio, driven by higher demand for its products. In 2024, the U.S. defense budget is approximately $886 billion, presenting significant opportunities.

The shift towards clean energy offers Woodward significant growth prospects. The global renewable energy market is projected to reach $1.977 trillion by 2030. Woodward's expertise in energy control systems positions it well to capitalize on this trend. This includes wind turbine controls and solar power applications. Investments in sustainable technologies are increasing.

Growth in Power Generation and Marine Transportation

Woodward anticipates growth in power generation and marine transportation within its Industrial segment. Rising investments in gas-powered generation and the marine industry's shift towards alternative fuels present opportunities. The global power generation market is projected to reach $875.2 billion by 2028. The marine sector's adoption of LNG and other alternative fuels will drive further expansion.

- Power generation market to reach $875.2 billion by 2028.

- Marine industry's shift towards alternative fuels.

Strategic Acquisitions and Partnerships

Woodward's strategic acquisitions and partnerships, like acquiring Safran's electromechanical actuation business, boost its market position. These moves broaden Woodward's technological capabilities in crucial sectors. For example, the aerospace segment is projected to grow, with a 2024 market size of $7.2 billion. Such partnerships fuel expansion.

- 2024 aerospace market size: $7.2 billion.

- Acquisition of Safran's business strengthens market position.

- Partnerships drive expansion and technological advancement.

Woodward's opportunities include expanding the commercial aerospace aftermarket, projected to reach $107.8 billion by 2025, and benefiting from increased defense spending, with the 2024 U.S. defense budget at $886 billion.

The shift toward clean energy also presents growth prospects. The global renewable energy market is expected to hit $1.977 trillion by 2030.

Additionally, strategic moves like acquisitions and partnerships strengthen its market position. The aerospace market is worth $7.2 billion in 2024.

| Opportunity | Description | Market Data/Projections |

|---|---|---|

| Aerospace Aftermarket | Expansion driven by increased aircraft use and passenger numbers. | $107.8 billion market by 2025 |

| Defense Spending | Benefiting from global tensions and increased defense budgets. | 2024 U.S. defense budget: $886 billion |

| Clean Energy | Growth through renewable energy, wind, and solar applications. | $1.977 trillion global market by 2030 |

Threats

Global economic uncertainty poses a significant threat to Woodward. Potential recessions and financial market volatility could reduce demand. The aerospace and industrial sectors, key markets for Woodward, are vulnerable. For example, in 2024, the global GDP growth slowed to around 3.1%, impacting various industries.

Geopolitical instability and trade tensions pose significant threats. Disruptions in supply chains and increased costs are a concern. For example, tariffs could increase the price of raw materials. In 2024, global trade growth slowed to 3.0%, impacting companies like Woodward.

Woodward faces intense competition in aerospace and industrial markets. Competitors include major players like Collins Aerospace and Honeywell. This competition can lead to price wars, impacting profitability. For example, in 2024, gross profit margins dipped due to pricing pressures.

Fluctuations in Commodity Pricing

Fluctuations in commodity pricing pose a significant threat to Woodward. Volatility in prices, especially for oil and gas, directly impacts demand within the Industrial segment. This particularly affects the oil and gas subsegment, creating uncertainty. For instance, in 2024, oil prices saw considerable swings, affecting project viability.

- Oil prices fluctuated significantly in 2024, impacting industrial demand.

- The oil and gas subsegment is highly sensitive to these price changes.

Regulatory Changes

Regulatory changes pose a threat to Woodward. Fluctuations in government regulations concerning emissions, safety, and defense spending can significantly affect Woodward. For instance, stricter emissions standards might necessitate costly product redesigns. Changes in defense spending could directly impact the demand for Woodward's aerospace and defense products. These shifts demand adaptability and strategic foresight.

- In 2024, defense spending saw a 3% decrease, potentially affecting Woodward's defense segment.

- New emissions standards, effective from 2025, may require substantial R&D investments.

- Compliance costs are projected to increase by 5% due to evolving regulations.

- Woodward's defense sales accounted for 35% of total revenue in 2024.

Woodward faces economic uncertainties like slowed GDP growth, affecting key sectors.

Geopolitical instability and competition further threaten the business.

Commodity price swings, regulatory changes, and 2024's defense spending decrease also add challenges.

| Threat | Impact | 2024 Data |

|---|---|---|

| Economic Slowdown | Reduced demand | GDP grew ~3.1% |

| Geopolitical Risks | Supply chain disruption | Trade grew 3% |

| Regulatory Changes | Higher costs | Defense spending fell 3% |

SWOT Analysis Data Sources

This analysis relies on credible data, including financial reports, market trends, expert evaluations, and industry research.