ZoomInfo Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ZoomInfo Technologies Bundle

What is included in the product

Tailored analysis for ZoomInfo's product portfolio, with strategic guidance for each quadrant.

Clean, distraction-free view optimized for C-level presentation of ZoomInfo's business units.

Preview = Final Product

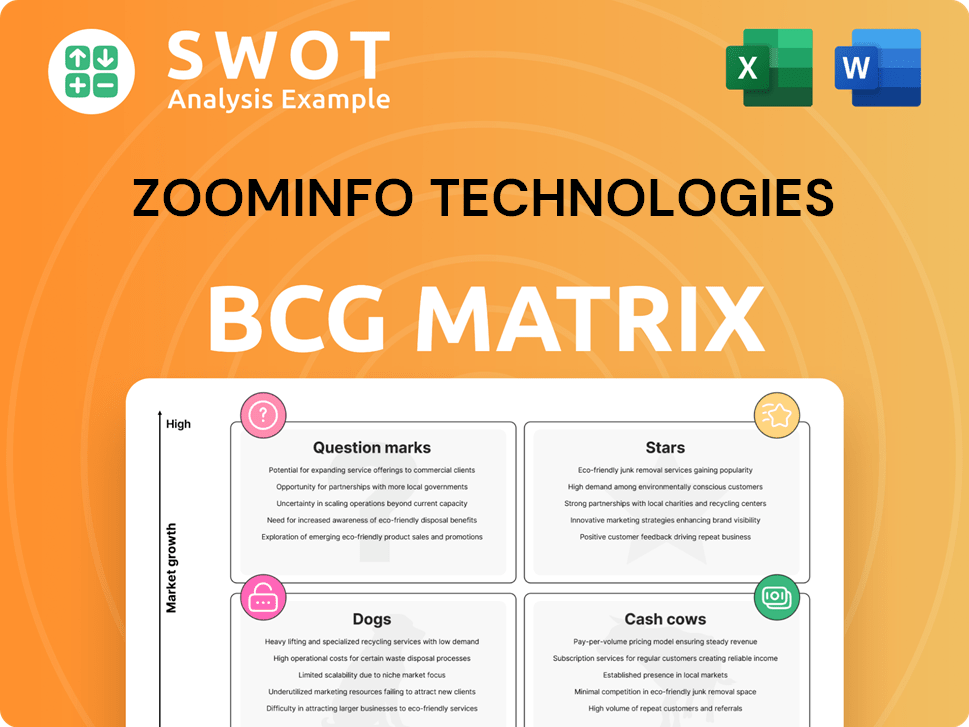

ZoomInfo Technologies BCG Matrix

The displayed ZoomInfo Technologies BCG Matrix is the complete document you'll receive. This is not a sample; it's the fully realized analysis, ready for your strategic initiatives after purchase.

BCG Matrix Template

ZoomInfo's BCG Matrix offers a snapshot of its product portfolio's market position. This framework helps assess which offerings are stars, cash cows, question marks, or dogs. Understanding these classifications is key to strategic decisions. Discover how each product fits into the overall growth strategy. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

ZoomInfo Copilot is a rising star, exceeding expectations with over $150 million in Annual Contract Value (ACV) in 2024. This shows that customers find significant value in the product. The company's focus on AI and go-to-market strategies, makes Copilot a leader. With AI-powered tools, it helps customers leverage data and applications to be successful.

ZoomInfo Operations is booming, with a 27% year-over-year growth in Q4 2024, making it ZoomInfo's fastest-growing segment. This growth stems from the increasing need for robust data foundations to support AI and other internal systems. The data from ZoomInfo Operations powers critical functions like data warehouses and AI projects. Companies are increasingly recognizing the value of this foundational data, driving demand for ZoomInfo's services.

ZoomInfo's focus on the upmarket segment is paying off. This segment, representing over two-thirds of ZoomInfo's business, saw a 2% growth in 2024. It's projected to achieve mid-single-digit growth. ZoomInfo is becoming the top go-to-market data and AI partner for these clients.

Enterprise Go-To-Market Solutions

ZoomInfo's Enterprise Go-To-Market Solutions are a key focus. ZoomInfo was recognized as the top product in 56 reports by G2 in Winter 2025. The company is actively targeting the upmarket segment, which seems successful. This enterprise focus supports ZoomInfo's market position.

- G2's Winter 2025 Reports highlighted ZoomInfo's leading position.

- The upmarket strategy is a core element of ZoomInfo's growth plan.

- Enterprise solutions represent a significant revenue stream for ZoomInfo.

- This strategic move is expected to drive sustained market success.

High-Value Customers

ZoomInfo's focus on high-value customers is paying off, with a notable rise in clients spending over $100,000 annually. In 2024, the company added 58 high-value customers sequentially, reaching a total of 1,867. This growth highlights ZoomInfo's success in attracting and retaining larger clients. These high-value customers are crucial for revenue growth and profitability.

- Increased Customer Base: 1,867 customers with over $100,000 in ACV.

- Sequential Growth: Added 58 high-value customers.

- Revenue Impact: Significant contribution to overall revenue.

ZoomInfo's "Stars" include Copilot and Operations, both showing strong growth. Copilot exceeded $150M ACV in 2024, while Operations grew 27% YoY in Q4 2024. This growth reflects their market success.

| Feature | Details | 2024 Data |

|---|---|---|

| Copilot ACV | Annual Contract Value | Over $150M |

| Operations Growth | Year-over-Year Growth (Q4) | 27% |

| High-Value Customers | Clients spending over $100,000 annually | 1,867 |

Cash Cows

ZoomInfo's Go-To-Market Intelligence Platform, a cash cow, excels with top GTM data, AI tools, and agents. It boosts growth via AI-driven insights, reliable data, and automation. In 2024, ZoomInfo served over 35,000 clients globally. The platform's revenue in Q3 2024 was $311.7 million.

ZoomInfo excels as a SaaS market leader, offering a robust B2B database. It provides contact info, company profiles, and intent data, aiding lead generation. Their platform targets specific industries and roles. In 2024, ZoomInfo's revenue was approximately $1.2 billion.

ZoomInfo excels in data privacy, holding GDPR and CCPA compliance certifications. This focus on compliance boosts customer trust. In Q3 2023, ZoomInfo's revenue grew, showing strong performance. They are taking steps to improve operations and fuel growth. Their commitment to data security is key.

Customer Success Management

Customer Success Management at ZoomInfo is a vital part of its strategy, focusing on delivering value to its customers. CSMs using ZoomInfo reported saving significant time, with some saving over 10 hours weekly, boosting efficiency. This customer-centric approach has led to tangible results, including a double-digit increase in renewal rates. ZoomInfo's commitment to customer success has improved net revenue retention, reaching 87%.

- CSMs save over 10 hours weekly.

- Double-digit increase in renewal rates.

- Net revenue retention at 87%.

- Focus on customer's go-to-market needs.

Free Cash Flow Generation

ZoomInfo's financial prowess is evident in its robust free cash flow generation. In 2024, the company reported an impressive unlevered free cash flow of $447 million, achieving a remarkable margin of 37%. This financial strength allows ZoomInfo to pursue growth strategies while also rewarding its shareholders. The company's focus is on increasing levered free cash flow per share, which underscores its dedication to maximizing shareholder value.

- Unlevered Free Cash Flow: $447 million (2024)

- Free Cash Flow Margin: 37% (2024)

- Strategic Focus: Growing levered free cash flow per share.

- Financial Flexibility: Enables investment in growth and shareholder returns.

ZoomInfo's Go-To-Market Intelligence Platform is a cash cow, excelling in GTM data and AI tools. It boosts growth with reliable data and automation. In 2024, ZoomInfo served over 35,000 clients globally. Their Q3 2024 revenue was $311.7 million.

| Metric | Value | Year |

|---|---|---|

| Clients Served | 35,000+ | 2024 |

| Q3 Revenue | $311.7M | 2024 |

| Unlevered FCF | $447M | 2024 |

Dogs

ZoomInfo's SMB segment, a "Dog" in its BCG Matrix, struggles. The company's net dollar retention rate of 85% reveals issues with customer churn and spending. This down-market segment, representing less than one-third of the business, saw a 9% decline in 2024. Further declines are projected for 2025.

In Q2 2024, ZoomInfo reported a $15 million revenue write-off. This was due to poor collections from smaller clients. The issue highlights risks tied to the SMB market, crucial for ZoomInfo. Elevated write-offs, from operational shifts, affected the financial outcomes.

ZoomInfo's revenue growth was negative, approximately -2.31% as of December 31, 2024, signaling a drop in earnings. For 2025, they anticipate GAAP revenue between $1.185B and $1.205B, with a negative 1.6% annual growth at the midpoint. This negative trend suggests financial performance struggles.

High Debt Levels

ZoomInfo's "Dogs" quadrant status highlights high debt levels, a key concern. Net debt approaches 25% of its market capitalization, signaling significant financial commitments. The debt-to-equity ratio is 0.82, exceeding industry norms, and raising financial leverage concerns. This impacts the company's financial flexibility.

- Net debt near 25% of market cap.

- Debt-to-equity ratio of 0.82.

- Higher leverage compared to peers.

- Concerns over debt management.

Customer Churn

ZoomInfo's "Dogs" status in the BCG Matrix highlights customer churn challenges, especially within the small and medium-sized business (SMB) segment. The company's net revenue retention rate was 87% as of December 31, 2024, signaling persistent difficulties in retaining customers. This impacts overall growth. The company must focus on customer retention.

- Churn is a key issue for ZoomInfo, especially with SMB clients.

- Net revenue retention rate of 87% as of December 2024 shows retention struggles.

- Retaining existing customers and attracting new ones is critical.

ZoomInfo's SMB segment, categorized as a "Dog," faces significant challenges. The negative revenue growth of -2.31% as of December 31, 2024, underscores financial struggles. High debt levels, with net debt approaching 25% of market cap, add to concerns.

| Metric | Value (as of Dec 31, 2024) | Implication |

|---|---|---|

| Revenue Growth | -2.31% | Negative earnings |

| Net Debt/Market Cap | ~25% | High debt burden |

| Net Retention Rate | 87% | Customer retention issues |

Question Marks

ZoomInfo faces a complex landscape with AI. The integration of AI and machine learning is a 'Question Mark' in its BCG matrix. The company must balance the costs of AI infrastructure. Accuracy and fairness of AI outputs are critical. ZoomInfo's effective AI integration determines its future. In 2024, the AI market grew significantly, with investments reaching billions.

ZoomInfo's international expansion is a strategic "Question Mark" within its BCG matrix. The company heavily relies on the U.S., with approximately 90% of its revenue coming from this market as of late 2024. Entering new markets offers growth but demands careful planning. Success hinges on adapting to local regulations and competition.

The business intelligence market is fiercely contested. ZoomInfo competes with Salesforce and Microsoft/LinkedIn. In 2024, Salesforce's revenue was about $34.5 billion. This competition affects market share and pricing. Constant innovation is key for ZoomInfo.

Data Accuracy and Quality

Data accuracy and quality are paramount for ZoomInfo's success, yet present significant challenges. ZoomInfo competes with rivals, and faces the threat of losing customers or market dominance. Ensuring data reliability is crucial for ZoomInfo to maintain its competitive edge. In 2024, the company invested heavily in data verification.

- ZoomInfo's revenue in Q3 2024 was $303.7 million.

- The company's data accuracy is constantly monitored.

- ZoomInfo faces strong competition from other data providers.

- Maintaining data integrity is a continuous process.

Evolving Data Privacy Laws

Evolving data privacy laws and regulations present a significant threat to ZoomInfo Technologies' growth, requiring careful navigation. The company must adhere to complex and changing legal requirements concerning data collection, storage, and usage across various jurisdictions. Compliance is crucial for maintaining customer trust and avoiding legal penalties, which could impact revenue and market position. This necessitates continuous adaptation and investment in compliance measures.

- GDPR and CCPA compliance are ongoing costs.

- Data breaches can lead to significant fines.

- Changing regulations require constant monitoring.

- Customer trust is essential for business.

ZoomInfo's financial strategies are a "Question Mark" within its BCG matrix. The company must balance investment in innovation. Its revenue in Q3 2024 was $303.7 million. Data accuracy and privacy compliance are crucial.

| Aspect | Challenge | Impact |

|---|---|---|

| AI Integration | Balancing costs & accuracy | Future growth dependent |

| International Expansion | Adapting to local markets | Revenue & market share |

| Competition | Salesforce/Microsoft | Market share & pricing |

BCG Matrix Data Sources

ZoomInfo's BCG Matrix uses a multi-source approach, incorporating verified business information, industry analyses, and public data.