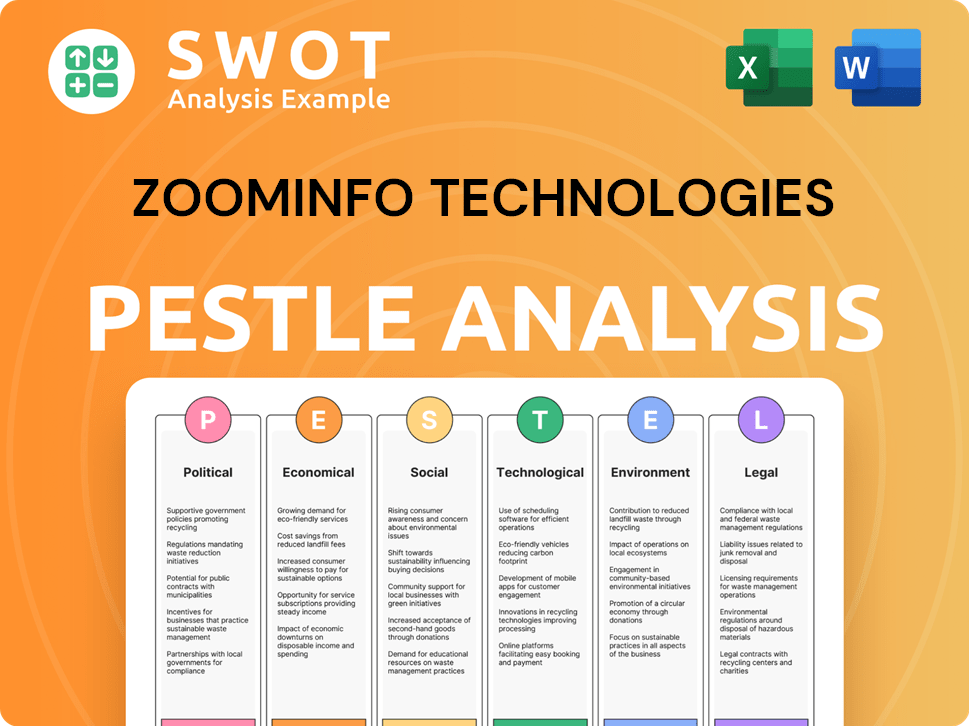

ZoomInfo Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ZoomInfo Technologies Bundle

What is included in the product

Examines how PESTLE factors impact ZoomInfo across key areas, offering data-driven insights for strategic planning.

A clean, summarized version for easy referencing during meetings or presentations.

What You See Is What You Get

ZoomInfo Technologies PESTLE Analysis

What you're previewing is the actual file. This detailed PESTLE analysis of ZoomInfo Technologies, with its political, economic, social, technological, legal, and environmental factors, is ready for download right after purchase. The structure and content are exactly as you see them.

PESTLE Analysis Template

Uncover the external forces shaping ZoomInfo Technologies. Our PESTLE Analysis examines Political, Economic, Social, Technological, Legal, and Environmental factors. Understand the challenges and opportunities impacting their strategy. Get actionable insights to refine your own plans. Don't miss out – download the complete PESTLE analysis now!

Political factors

Governments worldwide are intensifying data privacy regulations, impacting ZoomInfo's operations. GDPR and CCPA set stringent standards, requiring companies to protect user data. Non-compliance can lead to substantial fines; for example, GDPR fines can reach up to 4% of global annual turnover.

Geopolitical instability poses risks. Conflicts and tensions can disrupt ZoomInfo's global operations, increasing expenses. For example, the Russia-Ukraine war impacted various tech firms. The US-China trade relationship also creates uncertainty. In 2024, political risks continue to influence international business strategies.

Trade policies and tariffs are significant. ZoomInfo's international operations face risks. Restrictions could increase costs. In 2024, global trade tensions increased. The US-China trade war impacted tech firms.

Government Use of B2B Data

Government use of B2B data, like that from ZoomInfo, is growing. Agencies use such data for market analysis, fraud detection, and regulatory compliance. This creates opportunities for B2B data providers but also raises data privacy concerns. For example, the FTC has increased scrutiny of data brokers.

- FTC settlements in 2024 and 2025 have targeted data privacy violations.

- Government spending on data analytics is projected to reach $100 billion by 2026.

Political Influence on Technology Adoption

Government policies significantly shape the tech landscape, impacting platforms like ZoomInfo. Initiatives supporting digital transformation, such as tax incentives or grants, can boost demand for B2B data solutions. Conversely, regulations around data privacy and cybersecurity can increase compliance costs. The US government's tech spending is projected to reach $143 billion in 2024, illustrating its influence.

- Data Privacy Regulations: GDPR, CCPA, and others impact data collection and usage.

- Government Tech Spending: Drives demand for technology solutions.

- Digital Transformation Initiatives: Can provide incentives for tech adoption.

- Cybersecurity Policies: Affect the security of data platforms.

Political factors heavily influence ZoomInfo's operations.

Data privacy regulations, like GDPR, remain critical. The FTC actively enforces data privacy, with significant fines in 2024 and 2025. Government spending on data analytics is expected to hit $100 billion by 2026.

| Aspect | Impact on ZoomInfo | 2024/2025 Data |

|---|---|---|

| Data Privacy | Increased compliance costs | FTC settlements on violations |

| Government Spending | Creates demand | US tech spending reaches $143B (2024) |

| Trade Policies | Affect international ops | Continued trade tensions |

Economic factors

Economic growth significantly influences ZoomInfo's performance. Rising GDP, like the projected 2.1% in 2024, boosts business spending. Increased investment in sales and marketing platforms, such as ZoomInfo, is expected. This directly impacts revenue and growth.

Inflation plays a crucial role in ZoomInfo's financial health. Rising inflation can increase operational costs, potentially impacting profitability. ZoomInfo has adjusted pricing to navigate market conditions, as evidenced by slight increases in 2024. For example, the U.S. inflation rate was 3.5% in March 2024, influencing business decisions.

ZoomInfo's subscription-based revenue model hinges on customer retention. Elevated churn rates, especially within the small and medium-sized business (SMB) segment, pose a risk to revenue and growth. In Q4 2024, ZoomInfo reported a 3.2% quarterly churn rate. This rate, if unaddressed, could hinder long-term financial stability. Maintaining a low churn rate is vital for sustained revenue generation and market share.

Currency Exchange Rates

ZoomInfo, with its global presence, faces currency exchange rate risks. In 2024, a stronger dollar could reduce the value of international sales when converted. Conversely, a weaker dollar might boost reported revenue from foreign markets. These fluctuations directly impact financial statements, affecting reported earnings and investor perceptions.

- Impact on Revenue: Currency fluctuations can change the reported value of international sales.

- Impact on Profitability: Exchange rate changes can affect the cost of goods sold and operating expenses.

- Hedging Strategies: ZoomInfo may use financial instruments to mitigate currency risk.

- Example: A 5% adverse currency movement can significantly impact quarterly results.

Market Competition and Pricing Pressure

The B2B data and intelligence market is highly competitive, affecting ZoomInfo's pricing strategies. Intense competition necessitates constant innovation to retain market share. For instance, the global market for business intelligence and analytics is projected to reach $34.2 billion in 2024. This competitive pressure can limit ZoomInfo's ability to raise prices, impacting revenue growth. ZoomInfo must continually enhance its offerings to stay ahead.

- Market size: $34.2 billion (2024)

- Competitive landscape: Intense

- Impact: Pricing pressure, need for innovation

Economic factors, like GDP and inflation, heavily affect ZoomInfo. The projected 2.1% GDP growth in 2024 fuels business spending, benefiting platforms. Inflation, at 3.5% in March 2024, influences costs.

| Economic Factor | Impact on ZoomInfo | 2024/2025 Data |

|---|---|---|

| GDP Growth | Influences Business Spending | Projected 2.1% (2024) |

| Inflation | Affects Operational Costs | 3.5% (March 2024) |

| Currency Exchange | Impacts Revenue, Profits | USD fluctuations |

Sociological factors

The rise of remote and hybrid work significantly impacts sales and marketing strategies. ZoomInfo's digital tools become essential for lead generation and client engagement. A 2024 study showed that 60% of companies use hybrid models, increasing reliance on platforms like ZoomInfo. This shift demands adaptable data solutions. Companies are investing in data-driven insights.

Data privacy is a growing worry for professionals, influencing how they view B2B data platforms. A 2024 survey showed that 70% of professionals are very concerned about data privacy. This concern affects the adoption and trust of platforms like ZoomInfo. Professionals are increasingly demanding transparency and control over their data.

Demand for personalization is surging, compelling businesses to adopt tailored sales and marketing strategies. This shift boosts the value of platforms like ZoomInfo, which offer detailed professional data. In 2024, spending on personalization reached $1.3 trillion globally. ZoomInfo's revenue in 2024 was $1.15 billion, reflecting this trend.

Talent Acquisition Trends

Talent acquisition is evolving, with companies increasingly using data-driven platforms. This shift directly impacts ZoomInfo's services, as businesses seek better ways to find and assess talent. In 2024, the global talent acquisition market was valued at $10.9 billion. The market is projected to reach $15.8 billion by 2029, growing at a CAGR of 7.7% from 2024 to 2029.

- Data-driven recruitment tools are becoming essential for many companies.

- ZoomInfo's ability to provide detailed candidate information and insights is key.

- The demand for skilled tech professionals is high, driving competition.

- Remote work and hybrid models are changing talent pools.

Trust and Reputation in Data Providers

ZoomInfo's reputation hinges on user trust in its data accuracy and ethical sourcing, impacting customer acquisition and retention. Data breaches and inaccuracies can erode trust, leading to churn. Conversely, a strong reputation fosters loyalty and positive word-of-mouth. Maintaining data integrity and ethical practices are thus paramount for sustainable growth.

- In 2024, ZoomInfo reported a customer retention rate of approximately 90%.

- Data privacy concerns have led to increased regulatory scrutiny, impacting data collection practices.

- User reviews and ratings significantly influence prospective customer decisions.

Societal trends like remote work influence sales and marketing. Data privacy concerns shape B2B platform adoption. Personalization drives demand for detailed professional data. Talent acquisition evolves with data-driven tools.

| Trend | Impact on ZoomInfo | Data (2024-2025) |

|---|---|---|

| Remote/Hybrid Work | Increased use of digital tools | 60% of companies use hybrid models (2024) |

| Data Privacy | Affects platform trust | 70% of professionals concerned (2024) |

| Personalization | Boosts value of detailed data | $1.3T spent on personalization globally (2024) |

| Talent Acquisition | Impacts services, recruitment | $10.9B global market (2024), CAGR of 7.7% (2024-2029) |

Technological factors

ZoomInfo's operations are significantly influenced by AI and machine learning. These technologies are vital for data accuracy and providing valuable business insights. In 2024, the AI market is projected to reach $200 billion, highlighting the importance of AI advancements. As of Q1 2024, ZoomInfo's revenue was $300 million, indicating a strong reliance on tech.

ZoomInfo, as a data provider, is constantly targeted by cyber threats. In 2024, cybercrime costs are projected to exceed $10.5 trillion globally. Strong data security is crucial to protect customer trust and sensitive data. ZoomInfo invests heavily in cybersecurity, including advanced threat detection and data encryption. These measures help safeguard against breaches and maintain data integrity.

ZoomInfo's success hinges on tech. Innovation in web crawling, data partnerships, and verification is key. These advancements directly affect its database's size and accuracy. For instance, in Q4 2024, ZoomInfo processed over 100 billion data points. This data fuels its platform, providing insights for its users. Data verification rates reached 95% in 2024, improving reliability.

Integration with Other Sales and Marketing Technologies

ZoomInfo's success hinges on how well it connects with other tech. This includes CRM systems and marketing tools. Seamless integrations boost the platform's appeal and usefulness. ZoomInfo reported $304.9 million in revenue in Q1 2024, marking 10% year-over-year growth, showing the importance of its tech integrations. Effective integrations improve data flow and streamline workflows for sales and marketing teams.

- API integrations with platforms like Salesforce and HubSpot are key.

- Data synchronization ensures real-time updates across all tools.

- This boosts sales productivity by over 20%, according to recent studies.

Rise of Alternative Data Sources and Technologies

The B2B intelligence landscape is rapidly evolving with the rise of alternative data sources and technologies. ZoomInfo must stay ahead of competitors by continuously innovating its platform. The company invests in AI and machine learning to enhance data accuracy and provide more sophisticated analytics. For example, in 2024, ZoomInfo's R&D spending was approximately $150 million, reflecting its commitment to technological advancement.

- AI-driven data processing is crucial for maintaining data quality.

- Integration of new data sources, such as social media and web scraping, is essential.

- Competition from platforms utilizing advanced analytics could intensify.

- Cybersecurity and data privacy are growing concerns.

ZoomInfo's tech relies heavily on AI and machine learning for data accuracy, with the AI market expected to hit $200 billion in 2024. Cybersecurity, including advanced threat detection and encryption, is vital to protect data; global cybercrime costs are projected to exceed $10.5 trillion. Innovation in web crawling and data partnerships enhances ZoomInfo's database; data verification reached 95% in 2024.

| Technology Aspect | Impact | Data |

|---|---|---|

| AI & Machine Learning | Enhances data accuracy | $150M R&D spend in 2024 |

| Cybersecurity | Protects against data breaches | Cybercrime costs >$10.5T |

| Data Innovation | Improves data quality | 95% data verification rate |

Legal factors

ZoomInfo must adhere to data privacy laws such as GDPR and CCPA, affecting how it gathers, uses, and stores data. Non-compliance can lead to substantial fines; for example, GDPR fines can reach up to 4% of global annual turnover. In 2024, data privacy lawsuits saw a 20% increase. These regulations necessitate rigorous data protection measures, influencing ZoomInfo's operational costs and market access.

ZoomInfo has encountered class action lawsuits related to its data collection practices. These legal challenges underscore the risks associated with gathering and utilizing personal data. For instance, in 2024, several cases alleged violations of privacy laws. The outcomes of these lawsuits could significantly impact ZoomInfo's operational costs and reputation.

ZoomInfo heavily relies on intellectual property, particularly for its data and technology. Protecting its assets through patents, copyrights, and trade secrets is crucial. In 2024, ZoomInfo's R&D expenses were approximately $100 million, reflecting its investment in innovation. Legal costs related to IP protection are significant.

Regulations on Marketing and Sales Practices

ZoomInfo must navigate complex legal landscapes affecting marketing and sales. Anti-spam laws like CAN-SPAM in the U.S. and GDPR in Europe directly influence how clients utilize ZoomInfo's data. These regulations require strict adherence to data privacy and consent rules, impacting sales strategies. Non-compliance can lead to significant penalties and reputational damage for both ZoomInfo and its users.

- GDPR fines can reach up to 4% of annual global turnover.

- CAN-SPAM violations can result in fines of up to $50,120 per email.

- Data privacy lawsuits increased by 20% in 2024.

Contract Law and Subscription Agreements

ZoomInfo's operations heavily depend on subscription agreements and contract law adherence. These contracts dictate the terms of service, pricing, and data usage rights, all critical for revenue generation and customer satisfaction. Any legal discrepancies or breach of contract can lead to financial penalties and reputational damage, affecting future sales. In 2024, the company's revenue from subscriptions was a significant portion of its total income, around 90%.

- Adherence to data privacy regulations like GDPR and CCPA is a must.

- Contractual disputes can impact cash flow and require legal resources.

- Clear and enforceable contract terms are vital for long-term relationships.

ZoomInfo faces strict data privacy laws, with potential for hefty fines under GDPR, potentially up to 4% of global turnover, and CAN-SPAM penalties reaching $50,120 per email, emphasizing the importance of compliance.

The company manages numerous contracts vital for its subscription-based revenue model. These agreements, constituting about 90% of 2024 income, influence operations and relationships.

Legal battles over data collection practices and IP protection add risks, particularly as data privacy lawsuits rose by 20% in 2024; ZoomInfo allocated roughly $100 million for R&D.

| Aspect | Legal Implication | Financial Impact |

|---|---|---|

| Data Privacy | GDPR/CCPA Compliance | Fines up to 4% global revenue |

| Contract Law | Breach of Contract | Financial Penalties |

| Intellectual Property | IP Protection | R&D cost ~ $100M in 2024 |

Environmental factors

ZoomInfo's platform relies heavily on data centers, which are energy-intensive. Globally, data centers consumed an estimated 2% of the total electricity in 2023. This consumption is expected to increase. In 2024, the energy usage is projected to be even higher. The company's environmental impact is directly linked to its technology infrastructure.

ZoomInfo, as a tech firm, creates e-waste from its hardware. Proper e-waste disposal and reuse are key environmental factors. In 2024, global e-waste hit 62 million tons, a 2.8 million ton rise from 2023. This highlights the growing importance of responsible tech waste management.

ZoomInfo is actively working towards carbon neutrality, focusing on specific emission scopes. The company is investing in renewable energy and improving data center efficiency. For example, the tech industry's energy consumption rose by 16% in 2024. ZoomInfo's efforts align with broader industry sustainability trends.

Customer Demand for Sustainable Business Practices

Customer demand for sustainable business practices is growing, influencing purchasing decisions. Consumers are increasingly prioritizing environmentally responsible companies. A 2024 survey showed 73% of consumers are willing to pay more for sustainable products. This trend impacts ZoomInfo's reputation and market position.

- 73% of consumers are willing to pay more for sustainable products (2024 data).

- Growing consumer preference for eco-friendly vendors.

- Impact on brand reputation and market share.

Environmental Reporting and Disclosure Regulations

ZoomInfo could face new rules about environmental reporting. These might affect how they share information about their environmental impact. Increased disclosure requirements could lead to higher compliance costs. Investors are increasingly focused on Environmental, Social, and Governance (ESG) factors. The global ESG investment market is projected to reach $50 trillion by 2025.

- Compliance costs could increase due to new regulations.

- Investors increasingly consider ESG factors in their decisions.

- The ESG investment market is rapidly growing.

- ZoomInfo might need to adapt its reporting practices.

ZoomInfo's significant energy consumption and e-waste generation pose environmental challenges. In 2024, data centers' energy usage continued to climb, reflecting the broader trend in the tech sector. The company's commitment to carbon neutrality and sustainable practices is vital.

Growing consumer and investor interest in ESG factors shapes market dynamics. New environmental regulations may require increased reporting. ZoomInfo must adapt to evolving sustainability expectations to maintain a competitive edge and attract investment.

| Environmental Factor | Impact | 2024/2025 Data |

|---|---|---|

| Energy Consumption | Data centers & e-waste generation | Tech energy up 16% (2024), E-waste up to 62M tons (2024). |

| Sustainability Focus | Consumer preference, regulatory compliance | 73% consumers pay more for sustainable goods (2024) ESG market to $50T (2025 est.) |

| Regulatory | Reporting & compliance | Possible new regulations. |

PESTLE Analysis Data Sources

ZoomInfo's PESTLE leverages gov. data, financial reports, and tech/market insights. Information comes from a range of credible global sources.