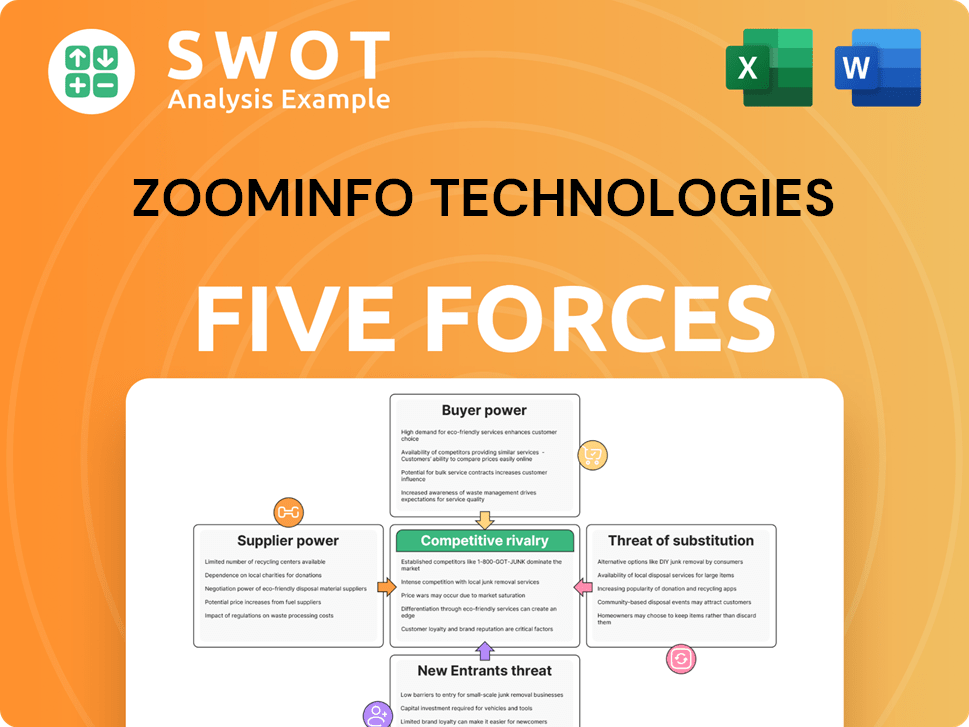

ZoomInfo Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ZoomInfo Technologies Bundle

What is included in the product

Analyzes ZoomInfo's competitive landscape by assessing threats, power dynamics, and market entry barriers.

Customize pressure levels to quickly adapt to shifting competitive environments.

What You See Is What You Get

ZoomInfo Technologies Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis of ZoomInfo Technologies. The document details each force: competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. It's a professionally written, ready-to-use analysis. You get instant access to this exact file after purchase. There are no changes.

Porter's Five Forces Analysis Template

ZoomInfo Technologies operates in a competitive landscape, significantly influenced by buyer power due to diverse customer needs. The threat of new entrants is moderate, given the existing market complexities. Strong supplier power, stemming from data providers, impacts its cost structure. Intense rivalry exists among data analytics competitors. The threat of substitutes is moderate, primarily from alternative data sources and platforms.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ZoomInfo Technologies’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ZoomInfo's reliance on data suppliers and tech infrastructure makes supplier power moderate. While alternatives exist, switching is costly, and data quality matters. Strong supplier relationships are key for operations. In 2024, ZoomInfo spent $62.3 million on data and content costs, reflecting supplier importance.

ZoomInfo's value heavily relies on data accuracy. Suppliers of high-quality, verified data exert greater influence. In 2024, ZoomInfo's data accuracy rate was reported at 95%, showing its reliance on reliable data sources. Strong supplier relationships are key to maintaining data integrity and platform effectiveness.

ZoomInfo's reliance on technology infrastructure, like cloud services, gives suppliers some leverage. For example, in 2024, cloud computing spending is projected to reach $678.8 billion globally, indicating the market power of these providers. Specialized service suppliers can exert more influence. Ensuring service continuity requires careful management of these supplier relationships.

Contractual agreements matter

ZoomInfo's supplier power hinges on contract terms. Pricing, service levels, and data rights are crucial. Favorable terms and supplier diversification are key strategies. In 2023, ZoomInfo spent $147.9 million on cost of revenue, impacting profitability. Strong contracts help control these costs.

- Contract terms directly affect ZoomInfo's costs and operational flexibility.

- Negotiating favorable terms is essential for cost control.

- Supplier diversification reduces dependency and risk.

- ZoomInfo's cost of revenue was $147.9 million in 2023.

Strategic partnerships influence

ZoomInfo's strategic partnerships with data and technology providers impact supplier bargaining power. These relationships offer access to proprietary data and innovation. However, they also create dependencies that need careful management to mitigate risks. For example, in 2024, ZoomInfo's partnerships with AI and data analytics firms were crucial for enhancing its platform's capabilities. Balancing innovation with risk management is vital.

- Strategic partnerships provide access to unique data and technology.

- Dependencies can arise, requiring careful management.

- Innovation must be balanced with risk mitigation strategies.

- ZoomInfo invested heavily in partnerships in 2024 to stay competitive.

ZoomInfo's supplier power is moderate due to data and tech dependencies. Data accuracy and quality are crucial, reflected in its 95% accuracy rate in 2024. Cloud computing spending hit $678.8B globally in 2024, impacting supplier influence. Effective contract terms and diversification are key for cost control, with $147.9M spent on cost of revenue in 2023.

| Factor | Impact | 2024 Data |

|---|---|---|

| Data Dependency | High | 95% Data Accuracy |

| Tech Infrastructure | Moderate | $678.8B Cloud Spending |

| Contract Terms | Crucial for costs | $147.9M Cost of Revenue (2023) |

Customers Bargaining Power

ZoomInfo's sales and marketing customers experience moderate switching costs. Competitors exist, but integrating ZoomInfo's data and learning new platforms adds friction. Customer retention is a key objective. In 2024, ZoomInfo's customer retention rate was around 90%. This indicates the platform's value despite moderate switching costs.

ZoomInfo's subscription model grants customers some bargaining power. Customers can cancel renewals if the service doesn't meet their needs. To retain subscribers, ZoomInfo must consistently deliver value and top-notch customer service. In 2024, the customer retention rate was around 80%. Addressing customer needs effectively is crucial for ZoomInfo's success.

Customers have several options for B2B data, increasing their power. ZoomInfo competes with providers like Apollo.io and Cognism. In 2024, the B2B data market was valued at around $75 billion. ZoomInfo must differentiate via features and pricing. Staying competitive is vital.

Pricing sensitivity exists

Customers' price sensitivity affects ZoomInfo, particularly smaller businesses. These clients often have budget constraints, making them highly value-conscious. To maintain its competitive edge, ZoomInfo must offer flexible pricing and prove a strong return on investment. Providing clear value is essential to justify the cost of its services.

- In 2024, ZoomInfo's average contract value (ACV) was approximately $27,000, showcasing a need for scalable pricing.

- Smaller businesses are more likely to churn if they perceive a lack of value, highlighting the need for tailored solutions.

- Demonstrating ROI is key; a study showed that businesses using ZoomInfo saw a 20% increase in lead generation.

- Offering tiered pricing plans allows customers to choose options that fit their budgets.

Customization needs vary

Customer bargaining power in ZoomInfo is influenced by their diverse needs and the level of customization required. ZoomInfo's capacity to provide tailored solutions and integrate with existing tools significantly affects customer satisfaction and retention. Flexibility is a key factor in how customers perceive the value of ZoomInfo's offerings. This impacts pricing and contract terms.

- Customization needs vary significantly among ZoomInfo's customer base, with some requiring extensive tailoring.

- Integration capabilities with other platforms are crucial for customer satisfaction and loyalty.

- In 2024, ZoomInfo reported a customer retention rate of approximately 88%.

- The ability to offer flexible pricing models and contract terms enhances customer bargaining power.

ZoomInfo customers wield moderate bargaining power due to subscription-based services and available alternatives. Clients can cancel renewals, compelling ZoomInfo to consistently deliver value and top-notch customer service. The competitive B2B data market, valued at $75 billion in 2024, also influences customer power, requiring differentiation in features and pricing. Price sensitivity among smaller businesses further shapes this dynamic.

| Aspect | Details | Impact |

|---|---|---|

| Retention Rate (2024) | ~88% | Reflects customer satisfaction and service value. |

| ACV (2024) | ~$27,000 | Highlights the need for scalable pricing and varied contract terms. |

| Market Size (2024) | ~$75B | Intensifies competition, requiring differentiated offerings. |

Rivalry Among Competitors

The B2B data and intelligence market is fiercely competitive. ZoomInfo contends with established firms and new entrants. Competition drives pricing pressure and innovation. In 2024, key rivals include LinkedIn Sales Navigator and Apollo.io. Staying ahead requires constant improvement and differentiation.

Differentiation is vital in the competitive landscape. ZoomInfo must highlight its data quality, unique features, and innovative solutions. Continuous innovation is crucial for maintaining its competitive edge. In 2024, ZoomInfo's revenue reached $1.1 billion, reflecting its market position. Staying ahead of rivals is key to long-term success.

Aggressive marketing and sales are typical, fueling intense competition for clients. ZoomInfo needs robust marketing to gain and keep customers. Customer acquisition is key for growth. In 2024, ZoomInfo's sales and marketing expenses were a significant portion of its revenue, indicating the investment needed to stay competitive. They invested $173.5 million for sales and marketing in Q4 2023.

Pricing pressures are present

Pricing pressures are evident in the competitive landscape, driven by readily available alternative providers and a growing emphasis on cost-effective solutions. ZoomInfo faces the challenge of balancing its pricing strategy with the value it offers to stay competitive. Competitive pricing is crucial for attracting and retaining customers in this market. This is particularly true given the presence of rivals like Apollo.io and Cognism.

- ZoomInfo's 2023 revenue was approximately $1.1 billion, reflecting its market position.

- Competitors like Apollo.io have raised significant funding, intensifying the competitive environment.

- The demand for sales intelligence tools continues to rise, creating pricing sensitivity among buyers.

- ZoomInfo's ability to maintain or grow its market share depends on its pricing and value proposition.

Consolidation trends impact

Consolidation in the industry, with larger firms like ZoomInfo acquiring smaller ones, has intensified competitive rivalry. This strategy aims to broaden service portfolios and increase market presence. Adaptability to evolving market dynamics is crucial for sustained success. The consolidation trend influences pricing strategies and service offerings.

- ZoomInfo's revenue for Q3 2023 was $304.6 million.

- The company's acquisitions, such as acquiring RingLead, expanded its data offerings.

- Market share battles are evident as companies vie for customer acquisition.

- Adaptation includes product innovation and strategic partnerships.

Competitive rivalry in the B2B data market is high. ZoomInfo faces strong competition from LinkedIn Sales Navigator and Apollo.io, as well as other companies. Continuous innovation and effective marketing are vital for ZoomInfo to maintain its market position and grow revenues.

| Metric | Value | Year |

|---|---|---|

| 2023 Revenue | $1.1B | 2023 |

| Q3 2023 Revenue | $304.6M | 2023 |

| Sales & Marketing Expenses (Q4) | $173.5M | 2023 |

SSubstitutes Threaten

Manual research, including data collection, presents a viable substitute for ZoomInfo, especially for smaller businesses or those with specialized requirements. This is a significant consideration, as it allows companies to sidestep the costs associated with ZoomInfo's services. In 2024, about 30% of businesses still rely heavily on manual research methods for their data needs. Reducing reliance on these manual processes is a key objective for many firms aiming to improve efficiency and reduce operational costs.

Alternative data sources, including social media and industry directories, pose a threat to ZoomInfo. These sources offer similar business and contact information. In 2024, the use of such platforms expanded significantly. This expansion underscores the importance of diversifying data collection methods. This helps maintain a competitive edge.

The threat of substitutes for ZoomInfo includes in-house data teams. Larger companies can develop their own data teams for B2B data analysis, potentially decreasing reliance on external services. This internal shift poses a challenge to ZoomInfo's market position. Recent data indicates that companies with over $1 billion in revenue are increasingly investing in internal data capabilities, with a 15% rise in 2024.

Free or low-cost options

Free or low-cost data tools pose a threat to ZoomInfo, especially for basic contact needs. These alternatives can undercut ZoomInfo's value proposition if they provide adequate, albeit simpler, solutions. ZoomInfo must differentiate itself by offering superior features and data quality to justify its cost. This includes advanced analytics and deeper insights beyond basic contact details.

- Data.com, a similar service, was acquired by and shut down by Dun & Bradstreet in 2015

- In 2024, ZoomInfo's revenue was approximately $1.2 billion, showing its market position.

- The rise of AI-powered lead generation tools presents a growing threat, as they often provide similar data at a lower cost.

CRM integration capabilities

The availability of CRM and marketing automation systems with built-in data enrichment features poses a substitution threat to ZoomInfo. Seamless integration with these systems is vital for users. This integration directly impacts the perceived value and ease of use of ZoomInfo's services. In 2024, the CRM market is projected to reach $80 billion, with a significant portion incorporating data enrichment capabilities.

- Competition: CRM providers like Salesforce and HubSpot are enhancing their data features.

- Impact: Reduced reliance on external data providers like ZoomInfo.

- Market Trend: Increasing integration of data enrichment in core CRM platforms.

ZoomInfo faces substitution threats from various sources, impacting its market position. Manual research, still used by roughly 30% of businesses in 2024, provides a cost-effective alternative. Free and low-cost data tools also challenge ZoomInfo, especially for basic contact needs. The rise of AI-powered tools and CRM systems with built-in data enrichment further intensify the competition.

| Substitute Type | Description | 2024 Impact |

|---|---|---|

| Manual Research | In-house data collection. | 30% of businesses still use it. |

| Free/Low-Cost Tools | Basic data alternatives. | Undercut ZoomInfo's value. |

| AI-Powered Tools | Lead gen with lower costs. | Growing threat to ZoomInfo. |

Entrants Threaten

The B2B data and intelligence sector demands substantial upfront capital. New entrants face high costs for data acquisition, tech infrastructure, and marketing. For example, ZoomInfo spent $29.8 million on research and development in Q3 2023, showcasing the investment needed to compete. This financial burden acts as a significant deterrent.

New entrants face major hurdles in building a B2B database. The quality of data is paramount in this industry, and obtaining that data is complex. A 2024 study found that data accuracy in B2B databases can vary widely, with some databases reporting error rates exceeding 20%. It requires significant investment in technology and human resources.

Brand reputation is crucial; it takes time to build. ZoomInfo's established reputation creates a significant barrier. Customer trust is hard to replicate quickly. New entrants face an uphill battle against this. In 2024, ZoomInfo's revenue was approximately $1.2 billion, showcasing its strong market position.

Regulatory compliance hurdles

New companies entering the market face significant obstacles due to regulatory compliance. Data privacy laws such as GDPR and CCPA demand strict adherence, which increases the cost of entry. These regulations require substantial investment in infrastructure and legal expertise. For example, in 2024, companies spent an average of $500,000 to comply with GDPR.

- Data privacy laws increase compliance costs.

- Compliance needs significant investment.

- GDPR compliance cost: $500,000 (2024 average).

- Regulatory hurdles create barriers to entry.

Economies of scale advantages

Established companies like ZoomInfo have a significant advantage due to economies of scale. This makes it tough for new competitors to match their pricing. ZoomInfo's ability to offer competitive pricing is a key factor in maintaining its market position. New entrants often struggle to compete with the pricing strategies of established firms. Offering competitive pricing is vital for any business.

- ZoomInfo's revenue for 2023 was reported at $1.16 billion.

- ZoomInfo's scale allows for cost efficiencies in data collection and analysis.

- Smaller firms face higher costs per customer, impacting their pricing strategies.

- Competitive pricing is essential for attracting and retaining customers in the industry.

New entrants face high barriers. They must invest in data, tech, and marketing. Regulations like GDPR add to costs. Established firms, like ZoomInfo with $1.2B revenue in 2024, have economies of scale.

| Barrier | Description | Impact |

|---|---|---|

| Capital Costs | Data, infrastructure, marketing | High initial investment |

| Data Quality | Database creation is complex | Error rates exceed 20% |

| Brand Reputation | Takes time to build trust | Competitive disadvantage |

| Regulatory | GDPR, CCPA compliance | Increased compliance cost |

| Economies of Scale | Pricing | Competitive pricing is essential |

Porter's Five Forces Analysis Data Sources

ZoomInfo's analysis leverages SEC filings, market reports, and competitor analysis. It also uses industry publications and proprietary databases.