Adyen Bundle

How Did a Dutch Company Revolutionize Global Payments?

Adyen, a pivotal player in the fintech world, has reshaped how businesses handle transactions across the globe. Founded in Amsterdam in 2006, this Adyen SWOT Analysis reveals how it disrupted the payment processing industry with its innovative approach. Its direct connection to card networks streamlined operations and offered crucial data insights.

From its humble beginnings, the Adyen company has become a global force, serving giants like McDonald's and Uber. This Dutch company's journey from a startup to a leader showcases its adaptability and strategic vision. This exploration will delve into Adyen's history, examining its key milestones and the innovations that have driven its impressive growth trajectory in the competitive fintech landscape and its impact on payment processing.

What is the Adyen Founding Story?

The story of the Adyen company began on March 26, 2006. The Dutch fintech firm was founded by Pieter van der Does and Arnout Schuijff. Their vision was to revolutionize the payment processing landscape by creating a unified global platform.

Both founders brought extensive experience from their previous venture, Bibit, which was acquired by Royal Bank of Scotland in 2004. This background gave them a deep understanding of the challenges in the payment industry. They understood the inefficiencies of the existing systems.

The initial goal of Adyen was to address the lack of a single, unified payment platform. This platform would handle global transactions efficiently and provide comprehensive data insights. Traditional solutions often required businesses to integrate with multiple providers. This led to operational complexities and higher costs.

Adyen was created to streamline payment processing. The founders aimed to build a modern payment system. The name 'Adyen' means 'start over again' in Surinamese.

- Adyen's initial focus was on simplifying online payments for businesses.

- The company built a direct connection to card schemes and local payment methods.

- Their platform offered payment processing, risk management, and acquiring services.

- Initial funding came from the founders themselves.

Adyen's early business model centered on building a direct connection to card schemes and local payment methods. This allowed them to offer a single platform for payment processing, risk management, and acquiring services. Their first offering was a global payment platform designed to simplify online payments for businesses. The name 'Adyen' reflects the founders' ambition to build a new, modern payment system.

The founders initially bootstrapped the company. Their prior success with Bibit provided credibility and financial means. This enabled them to embark on this ambitious venture. Adyen's target market includes businesses of all sizes. The company has grown to serve many global merchants.

As of 2024, Adyen processes billions of transactions annually. The company has expanded its services to include various payment methods and currencies. Adyen continues to innovate in the payment processing and fintech sectors.

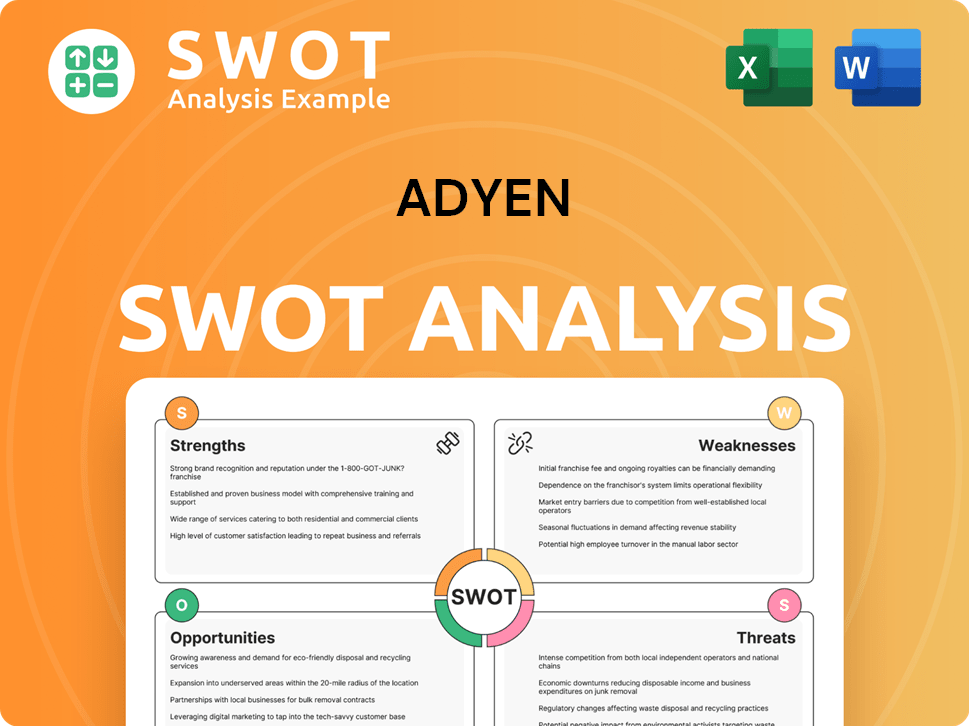

Adyen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Adyen?

The early growth of the Adyen company was marked by a strategic focus on building a strong, scalable platform, and attracting significant enterprise clients. During its initial phase, Adyen concentrated on refining its core payment processing technology to ensure high authorization rates and advanced risk management. This focus helped the Dutch company secure its first major clients, particularly large e-commerce businesses struggling with international payments.

Early on, Adyen prioritized developing robust payment processing technology. This included ensuring high authorization rates and implementing advanced risk management. Securing initial clients, often large e-commerce businesses, was a key milestone.

The company established its headquarters in Amsterdam, which remains its base of operations. Adyen strategically entered new markets, focusing on regions with high e-commerce growth. Expansion into the US market was a crucial step for global reach.

Adyen's growth was largely organic, driven by its reputation for reliability. Key product iterations included enhancing data analytics capabilities. The company adapted its platform to support emerging payment trends, such as mobile payments.

The market reception was positive, especially among enterprise-level businesses. This positive reception solidified its competitive edge in the Fintech industry. For more insights, explore the Marketing Strategy of Adyen.

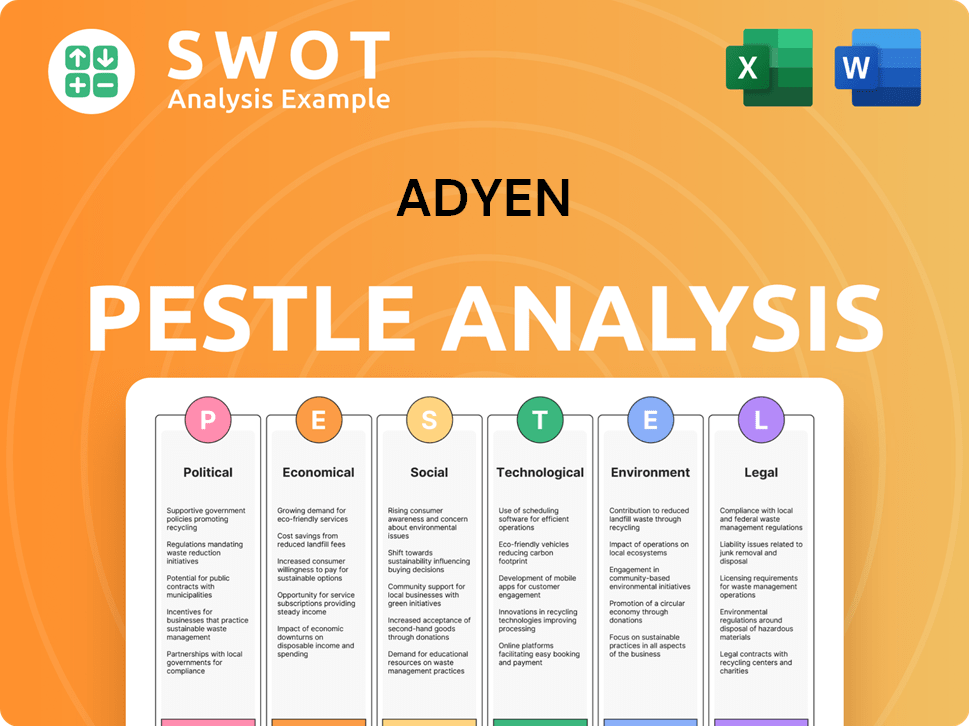

Adyen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Adyen history?

The Adyen history is marked by substantial achievements, including pioneering payment solutions and navigating the complexities of the fintech landscape. From its early days as a Dutch company to its global expansion, Adyen has consistently demonstrated its capacity to adapt and innovate within the payment processing sector.

| Year | Milestone |

|---|---|

| 2006 | Adyen was founded in Amsterdam, Netherlands, by Pieter van der Does and Arnout Schuijff. |

| Early 2010s | Adyen secured key partnerships with global brands such as Netflix, Uber, and Spotify, showcasing the scalability of its platform. |

| June 2018 | The company went public on Euronext Amsterdam with an IPO, valuing it at €7.1 billion, which facilitated further expansion. |

| 2020-2023 | Adyen continued its global expansion, increasing its presence in the Asia-Pacific region and the Americas. |

| 2024 | Adyen continues to innovate and adapt to the evolving payment landscape, focusing on unified commerce and new technologies. |

Adyen's innovations have significantly reshaped the payment processing industry. A groundbreaking innovation was Adyen's direct connection to card networks, bypassing traditional acquiring banks, which improved authorization rates and reduced costs for merchants.

Adyen pioneered a 'full-stack' approach, providing payment processing, risk management, and acquiring services on a single platform.

The company enabled businesses to accept payments seamlessly across online, mobile, and in-store channels, a crucial offering as retail evolved.

Adyen's direct connections to card networks like Visa and Mastercard improved authorization rates and reduced costs for merchants.

Adyen has expanded its services globally, supporting multiple currencies and payment methods to serve international clients.

Continuous investment in technology has allowed Adyen to offer innovative payment solutions, including fraud prevention and data analytics.

Adyen focuses on providing excellent customer service and building strong relationships with its clients.

Despite its successes, Adyen, like any fintech company, has faced challenges. Intense competition from established payment processors and newer fintech entrants has been a constant factor.

Adyen faces strong competition from both established payment processors and emerging fintech companies.

Navigating evolving regulatory landscapes, such as PSD2 in Europe, requires significant investment in compliance and technological adaptation.

Market downturns can impact transaction volumes and revenue, requiring strategic adjustments.

Scaling global operations while maintaining high standards of service and security presents an ongoing challenge.

The rapid evolution of technology necessitates continuous innovation and adaptation to stay ahead of the curve.

The payment processing industry is constantly targeted by cyber threats, requiring robust security measures and vigilant monitoring.

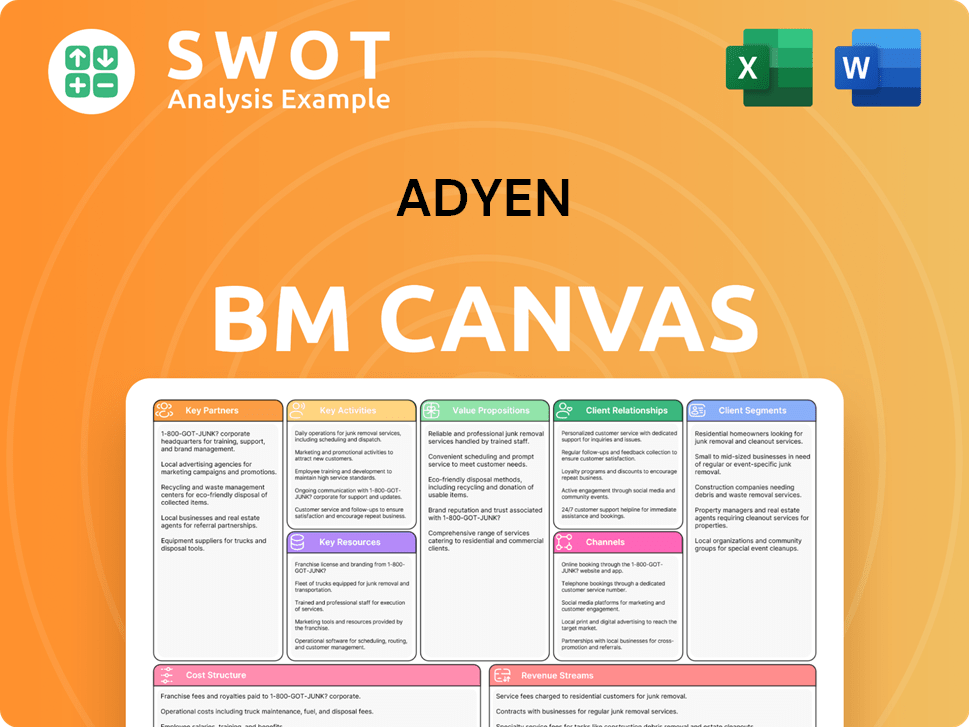

Adyen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Adyen?

The Adyen history is marked by strategic moves that have driven its growth and market dominance. The Dutch company's journey began in Amsterdam, evolving from a startup to a global fintech leader in payment processing. Key milestones include early platform launches, significant partnerships, and a successful IPO, reflecting its dynamic evolution.

| Year | Key Event |

|---|---|

| 2006 | Adyen founded in Amsterdam by Pieter van der Does and Arnout Schuijff. |

| 2007 | Launches its first unified global payment platform. |

| 2009 | Expands operations to the United States. |

| 2012 | Begins working with major tech companies like Spotify and Netflix. |

| 2014 | Processes over $20 billion in transactions annually. |

| 2015 | Achieves profitability and expands into the Asia-Pacific region. |

| 2016 | Introduces its unified commerce solution, bridging online and in-store payments. |

| 2017 | Partners with McDonald's to modernize its payment infrastructure. |

| 2018 | Goes public on Euronext Amsterdam with a successful IPO. |

| 2020 | Navigates the complexities of the global pandemic, supporting merchants through increased online transactions. |

| 2022 | Continues global expansion, focusing on market penetration in key regions. |

| 2023 | Reports significant growth in processed volume, exceeding €800 billion. |

| 2024 | Continues to invest in AI and machine learning for enhanced fraud prevention and data insights. |

| 2025 | Expected to further expand its platform capabilities, including advanced financial services for merchants. |

Adyen's future focuses on deepening relationships with existing clients and expanding into new sectors. The company is heavily investing in AI and machine learning to improve risk management and merchant insights. Expansion into financial services, such as embedded finance and lending, is also a key focus.

The company is set to enhance its platform capabilities, including financial services for merchants. AI and machine learning are central to fraud prevention and data analysis. These advancements are designed to optimize authorization rates and reduce fraud, providing merchants with better tools.

The shift to digital payments and the need for localized payment methods are expected to positively impact Adyen. Analyst predictions remain optimistic, supported by its technology and client base. Adyen's focus on merchant needs and innovation is key to its long-term strategy.

Strategic initiatives involve strengthening its presence in emerging markets and innovating around unified commerce experiences. This includes adapting to the evolving retail landscape with omnichannel strategies. The focus remains on simplifying global payments and building a sustainable business.

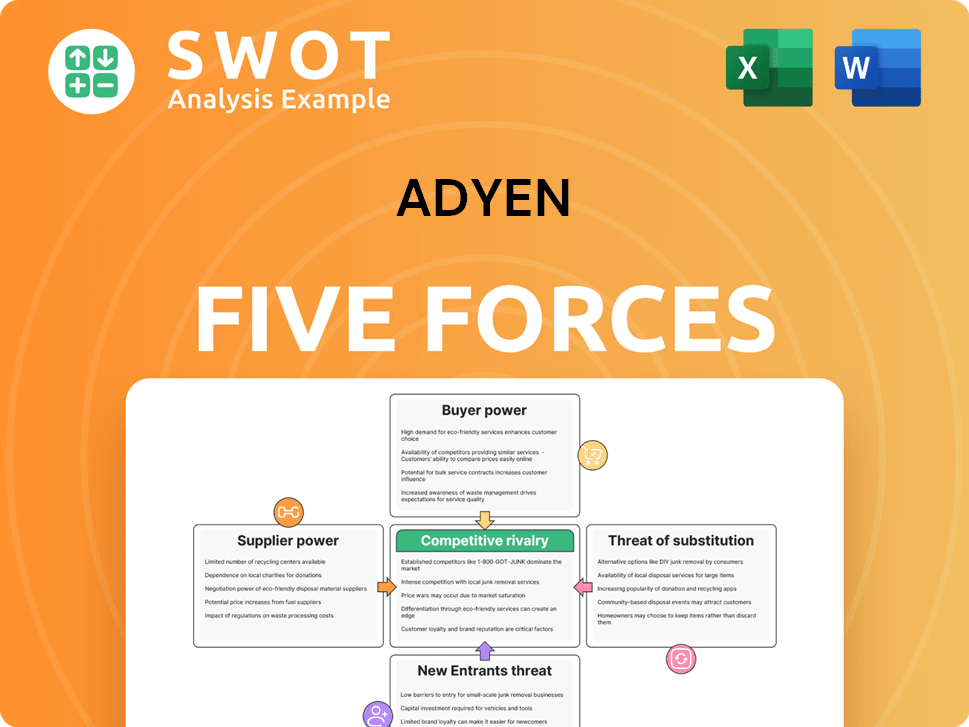

Adyen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Adyen Company?

- What is Growth Strategy and Future Prospects of Adyen Company?

- How Does Adyen Company Work?

- What is Sales and Marketing Strategy of Adyen Company?

- What is Brief History of Adyen Company?

- Who Owns Adyen Company?

- What is Customer Demographics and Target Market of Adyen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.