Adyen Bundle

Can Adyen Maintain Its Fintech Dominance?

Adyen, a global financial technology platform, has revolutionized the payments industry with its innovative approach. Its 2018 IPO marked a pivotal moment, showcasing its ambition to reshape the global payments landscape. Founded in Amsterdam, Adyen's vision was to build a modern, end-to-end infrastructure to replace legacy systems.

From its origins, Adyen has become a significant force, processing payments for major companies and establishing a strong global presence. This success is a testament to its strategic approach and its ability to provide a unified platform for online, mobile, and in-store payments. To understand Adyen's trajectory, explore the Adyen SWOT Analysis, which provides a comprehensive overview of the company's strengths, weaknesses, opportunities, and threats, offering valuable insights into its future. This deep dive will analyze Adyen's growth strategy, its future prospects, and its potential to maintain its position in the competitive fintech market, considering its business model and financial performance.

How Is Adyen Expanding Its Reach?

The Adyen growth strategy is centered on expanding its global reach and enhancing its product offerings. This approach aims to capture new market segments and solidify its position in the digital payments landscape. A key aspect of this strategy involves international expansion, especially in regions with high growth potential for digital payments, to drive Adyen future prospects.

The company is actively investing in strengthening its presence in key markets, such as North America, which is crucial for its enterprise clients. This includes expanding teams and infrastructure in the US to capitalize on the diverse merchant base. Moreover, Adyen company focuses on diversifying revenue streams through new product launches and strategic partnerships to enhance its Adyen business model.

Beyond geographical expansion, Adyen is focused on diversifying its revenue streams through new product launches and strategic partnerships. The company has been enhancing its platform to support a wider range of payment methods and financial services, including embedded finance solutions. This involves enabling its merchant customers to offer financial products, such as banking or lending services, directly to their own customers, thereby deepening Adyen's integration into their clients' ecosystems. Furthermore, Adyen consistently seeks to onboard new enterprise clients across various industries, including retail, digital goods, and subscriptions, which contributes significantly to its transaction volume growth. The company's focus on building direct connections to card schemes and local payment methods globally remains a core tenet of its expansion strategy, allowing it to offer superior authorization rates and a more streamlined payment experience for its merchants.

Adyen's expansion includes a strong focus on North America, with significant investments in the US market. This expansion aims to capture a larger share of the enterprise client base. The company is also exploring opportunities in high-growth markets to increase its global footprint. The goal is to provide comprehensive Adyen global payment solutions and support to merchants worldwide.

Adyen is enhancing its platform to support a wider array of payment methods and financial services. This includes embedded finance solutions, allowing merchants to offer financial products directly to their customers. The company aims to deepen its integration within its clients' ecosystems, enhancing its Adyen technology and innovation. This diversification is crucial for sustained Adyen revenue growth drivers.

Adyen actively seeks partnerships to expand its service offerings and reach. These collaborations are aimed at enhancing payment processing capabilities and extending market reach. Strategic alliances are key to accelerating growth and providing innovative solutions. These partnerships are vital for improving Adyen customer acquisition strategy.

Adyen focuses on onboarding new enterprise clients across various industries, including retail, digital goods, and subscriptions. This strategy is a significant contributor to transaction volume growth. The company's focus on direct connections to card schemes and local payment methods supports this growth. This approach enhances Adyen impact on e-commerce.

Adyen's expansion strategy includes geographical growth, product diversification, and strategic partnerships. These initiatives are designed to enhance its market position and drive revenue. The company is focused on building direct connections to card schemes and local payment methods globally, allowing it to offer superior authorization rates and a more streamlined payment experience for its merchants.

- Expanding into high-growth markets, particularly in North America and Europe.

- Enhancing the platform to support a wider range of payment methods and financial services.

- Forming strategic partnerships to expand service offerings and market reach.

- Onboarding new enterprise clients across various industries.

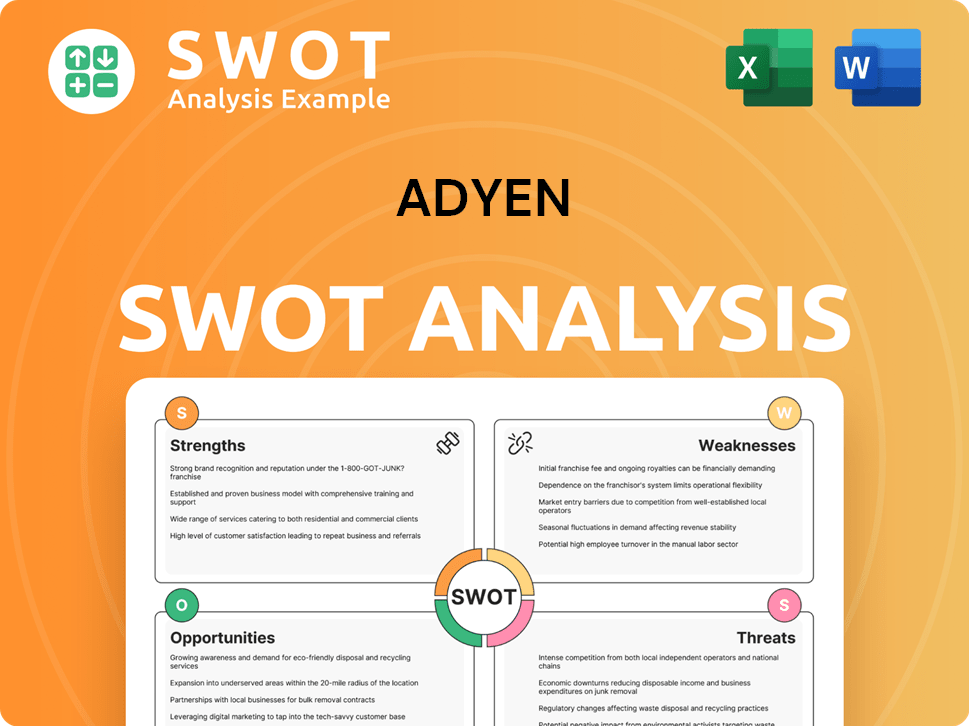

Adyen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Adyen Invest in Innovation?

The sustained growth of the company is significantly driven by its commitment to innovation and a robust technology strategy. The company's focus on research and development (R&D) is crucial for maintaining its competitive edge in the evolving global payments landscape. This approach allows it to address the specific demands of businesses and consumers worldwide, ensuring its solutions remain relevant and effective.

The company's dedication to technological advancement is evident in its end-to-end payment platform, which is developed in-house. This contrasts with many competitors that rely on third-party solutions. The company's direct connections to card networks and local payment methods globally enhance its technological capabilities, providing superior authorization rates and a unified payment experience for merchants and their customers.

The company's digital transformation strategy is central to its offerings, providing merchants with real-time data and insights to optimize payment flows and reduce fraud. The firm leverages cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) for enhanced risk management and fraud detection, continuously refining its algorithms to adapt to new threats. For instance, its 'RevenueAccelerate' and 'Risk' products utilize AI to help businesses increase revenue by optimizing payment routing and minimizing fraudulent transactions.

The company's end-to-end payment platform is developed in-house, setting it apart from competitors. This approach allows for greater control over the technology and faster innovation cycles. This also enables the company to provide more customized solutions to its clients.

Direct connections to card networks and local payment methods worldwide are a key technological advantage. These direct links facilitate higher authorization rates and a more seamless payment experience. This direct access also allows for more efficient transaction processing.

The company utilizes artificial intelligence (AI) and machine learning (ML) to enhance risk management and fraud detection. These technologies enable the company to adapt to new threats rapidly. This proactive approach helps protect both merchants and consumers from fraudulent activities.

The company focuses on developing solutions that support omnichannel commerce, integrating online, mobile, and in-store payment experiences. This integration allows businesses to gain a holistic view of customer interactions and payment data. This approach improves customer satisfaction and operational efficiency.

The company is committed to building a single, global platform, providing a scalable and flexible infrastructure for businesses worldwide. This unified platform simplifies payment processing across different regions and currencies. This global approach supports the company's long-term growth strategy.

The company provides merchants with real-time data and insights to optimize payment flows and reduce fraud. This capability enables businesses to make data-driven decisions. This real-time data access is crucial for improving operational efficiency.

The company's commitment to innovation is further demonstrated by its focus on omnichannel commerce, which seamlessly integrates online, mobile, and in-store payment experiences. This integration allows businesses to gain a holistic view of their customer interactions and payment data, driving efficiency and improving customer satisfaction. The company's approach to digital payments trends and its Revenue Streams & Business Model of Adyen underscores its leadership in innovation, providing a scalable and flexible infrastructure for businesses worldwide. This commitment to innovation is crucial for the company's long-term investment potential and its ability to navigate the challenges and opportunities within the competitive landscape.

The company's technological advancements are central to its growth strategy, with a strong emphasis on in-house platform development and direct network connections. The use of AI and ML for risk management and fraud detection is also a key differentiator. The company's focus on omnichannel solutions and real-time data insights further enhances its value proposition for merchants.

- End-to-End Platform: In-house development ensures control and customization.

- Direct Connections: Enhances authorization rates and payment experience.

- AI and ML: Improves risk management and fraud detection.

- Omnichannel Commerce: Integrates online, mobile, and in-store payments.

- Real-time Data: Provides insights for optimizing payment flows.

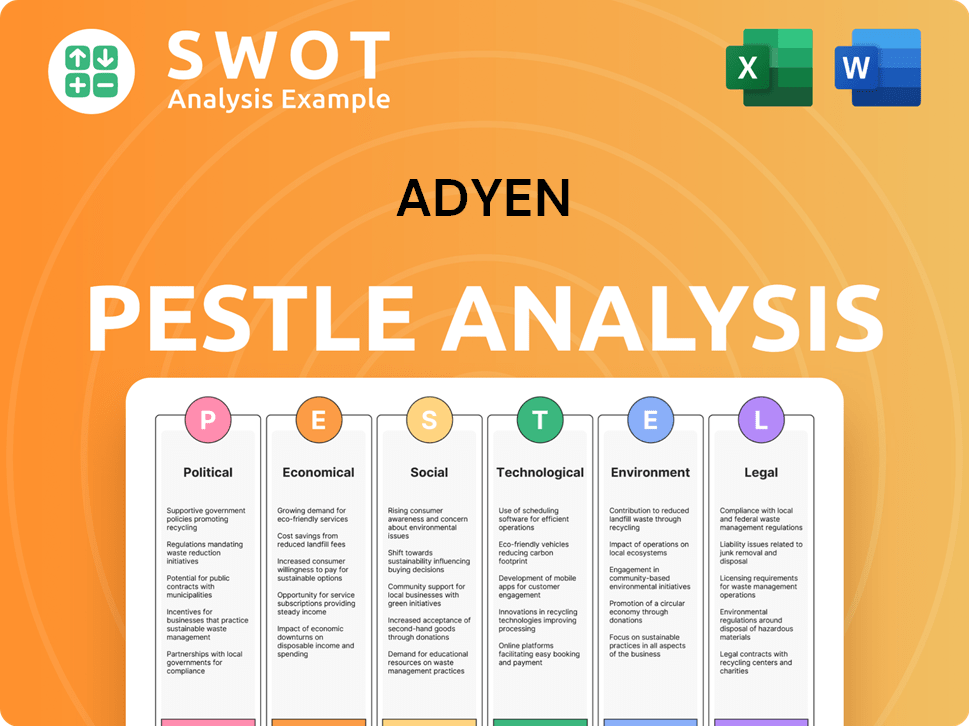

Adyen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Adyen’s Growth Forecast?

The financial outlook for the company indicates a strong growth trajectory, supported by its expanding merchant base and increasing transaction volumes. The company's Adyen growth strategy focuses on capturing a larger share of the global payments market, aiming for sustainable and profitable growth. This strategy is underpinned by continued investment in its platform and personnel, alongside disciplined cost management.

In the first half of 2024, the company reported a 21% increase in net revenue year-over-year, reaching €890 million. This growth highlights the effectiveness of its Adyen business model and the increasing adoption of its platform by businesses worldwide. The company's financial health is further demonstrated by a 28% increase in processed volume, which reached €426.0 billion in the first half of 2024, showcasing its robust Adyen financial performance.

For the full year 2024, the company projected net revenue growth in the low twenties percentage range, with a medium-term ambition for net revenue to grow in the low to high twenties percentage range. The company's financial strategy includes continued investment in its platform and personnel to support future expansion, while also maintaining a disciplined approach to cost management. The company's financial performance continues to align with its long-term goals of capturing a larger share of the global payments market and delivering sustainable, profitable growth.

The company's net revenue increased by 21% year-over-year in the first half of 2024, reaching €890 million. This growth reflects the company's ability to attract new merchants and increase transaction volumes. This growth is a key indicator of the company's success in the competitive payment processing market.

Processed volume grew by 28% to €426.0 billion in the first half of 2024. This significant increase demonstrates the growing adoption of the company's platform by businesses across various sectors. The rise in processed volume is a testament to the company's expanding market share.

The company aims for a sustained EBITDA margin above 50% in the long term. This target highlights the company's focus on profitability and efficient operations. Achieving and maintaining a high EBITDA margin is crucial for long-term financial health.

For the full year 2024, the company anticipates net revenue growth in the low twenties percentage range. The medium-term ambition is for net revenue to grow in the low to high twenties percentage range. This outlook suggests continued strong performance and expansion.

The company's financial strength is further supported by its strong balance sheet and healthy cash flow generation. This financial flexibility allows the company to pursue strategic initiatives, including potential mergers and acquisitions, and to navigate economic fluctuations effectively. For more insights into the company's target market, consider reading about the Target Market of Adyen.

The company is committed to continuous investment in its platform and personnel to support future expansion. This investment strategy is crucial for maintaining a competitive edge and driving innovation. This approach supports the company's long-term growth goals.

The company maintains a disciplined approach to cost management to ensure sustainable profitability. This focus on efficiency helps the company maintain healthy margins and allocate resources effectively. This is a key element of the company's financial strategy.

The company's strong financial position enables it to pursue strategic initiatives, including potential mergers and acquisitions. These initiatives can accelerate growth and expand market presence. This proactive approach is essential for Adyen future prospects.

The company's financial flexibility allows it to navigate economic fluctuations effectively. This resilience is crucial in a dynamic market environment. This ability to adapt ensures long-term stability and growth.

The company aims to capture a larger share of the global payments market. This is a key objective driving its Adyen company strategy. This focus on expansion is central to its financial goals.

The company is focused on delivering sustainable, profitable growth. This balanced approach ensures long-term value creation for stakeholders. This is a core principle of the company's financial strategy.

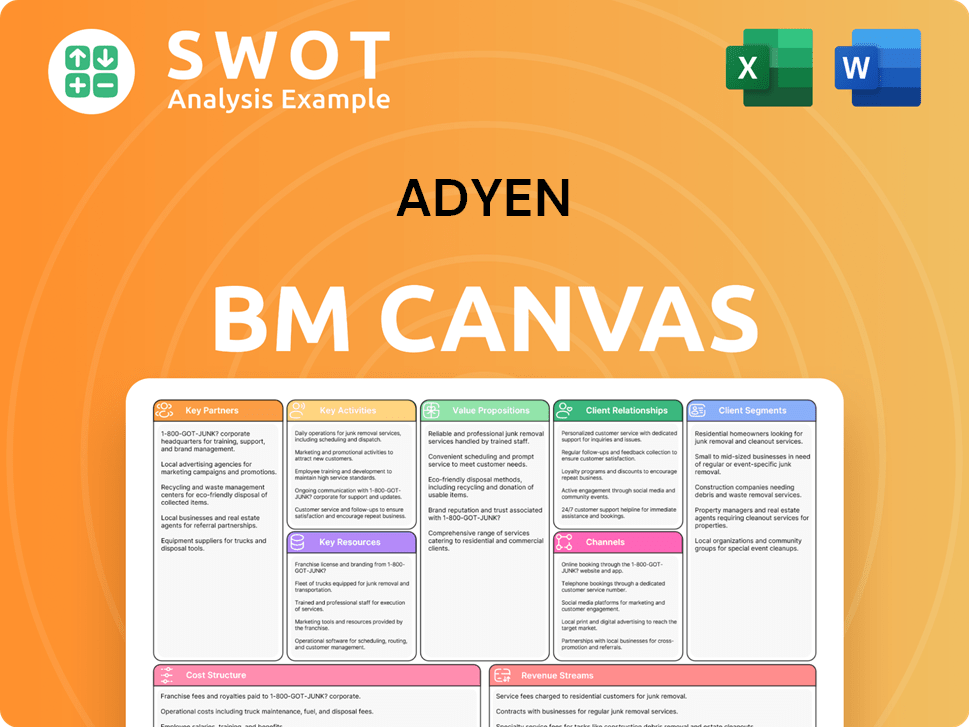

Adyen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Adyen’s Growth?

The future of the Adyen company faces potential risks and obstacles that could influence its Adyen growth strategy and overall Adyen future prospects. These challenges span competitive pressures, regulatory complexities, and technological disruptions within the dynamic payments landscape. Understanding these potential hurdles is crucial for assessing the long-term investment potential of the company.

Intense competition from established players like Stripe and PayPal, along with new fintech entrants, poses a constant threat to Adyen's business model. The payments industry's rapid evolution demands continuous innovation and adaptation to maintain a competitive edge. Additionally, navigating the diverse and changing regulatory environments globally presents significant operational and financial burdens.

Technological advancements and evolving consumer preferences also introduce risks. The emergence of new payment technologies could potentially disrupt Adyen's core offerings, requiring substantial investments in research and development to stay ahead. Strategic risk management is vital for the company's continued success.

The payments industry is highly competitive. Adyen competes with established players such as Stripe and PayPal, as well as numerous fintech startups. These competitors continuously innovate and expand their offerings, putting pressure on Adyen to differentiate its services and maintain market share.

The payments industry is heavily regulated, with new laws concerning data privacy, anti-money laundering, and consumer protection. Adapting to these diverse and evolving regulatory landscapes globally requires significant resources and vigilance. Compliance costs can impact Adyen's financial performance.

Rapid technological advancements could disrupt Adyen's payment processing offerings. Continuous R&D investment is necessary to stay ahead of the curve. The emergence of new payment technologies and business models could change the landscape.

Reliance on a concentrated number of large enterprise clients could create vulnerability. If significant clients were to switch to competitors, it could negatively affect Adyen's revenue growth drivers. Diversifying the client base is crucial.

Economic downturns can reduce consumer spending and business activity, impacting the volume of transactions processed by Adyen. This can lead to lower revenue and profitability. Economic uncertainty creates risks.

Cybersecurity breaches and data leaks can damage Adyen's reputation and lead to financial losses. Protecting sensitive customer data is essential. Robust security measures are necessary to mitigate this risk.

To mitigate these risks, Adyen emphasizes continuous platform innovation, client base diversification, and a robust risk management framework. The company focuses on building strong, long-term relationships with its merchants. This approach is part of their Adyen customer acquisition strategy.

The Adyen competitive landscape includes established players like Stripe and PayPal, as well as numerous fintech startups. These companies are constantly innovating and expanding their offerings. Understanding the market dynamics is key for Adyen's strategy.

Regulatory changes across various jurisdictions pose a substantial risk. Compliance with data privacy laws, anti-money laundering regulations, and consumer protection rules is essential. Adapting to these changes requires significant resources and vigilance. See the Mission, Vision & Core Values of Adyen for more insights.

The rapid pace of technological advancement necessitates continuous investment in R&D. New payment technologies and business models could disrupt Adyen's core offerings. Staying ahead of the curve is crucial for long-term success. This is a key aspect of their Adyen technology and innovation strategy.

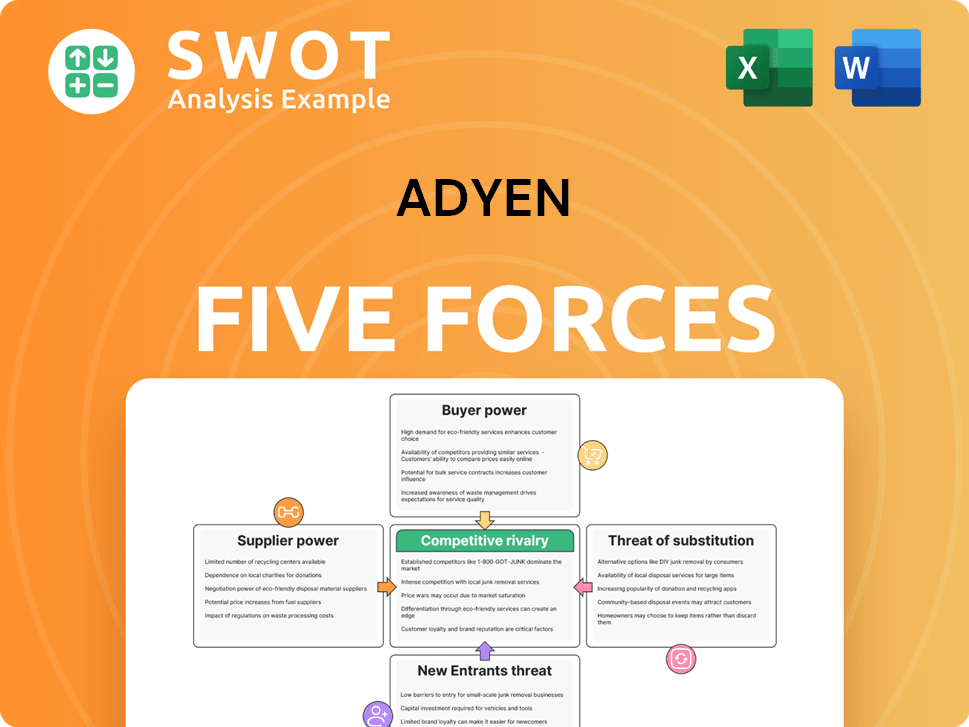

Adyen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Adyen Company?

- What is Competitive Landscape of Adyen Company?

- How Does Adyen Company Work?

- What is Sales and Marketing Strategy of Adyen Company?

- What is Brief History of Adyen Company?

- Who Owns Adyen Company?

- What is Customer Demographics and Target Market of Adyen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.