Adyen Bundle

Can Adyen Maintain Its Dominance in the Payment Processing Arena?

The payment processing industry is a battlefield of innovation and competition, with companies constantly vying for market share. Adyen, a leading player since 2006, has revolutionized how businesses handle transactions globally. This article dives deep into the Adyen SWOT Analysis to understand its strengths and weaknesses within the complex competitive landscape.

Understanding the Adyen competitive landscape is crucial for anyone navigating the payment processing industry. We'll dissect Adyen competitors, analyze its market share, and explore how Adyen's technology and strategic moves position it against rivals like Stripe and PayPal. This analysis will provide valuable insights for investors, businesses, and anyone interested in the future of online payment solutions and Fintech companies.

Where Does Adyen’ Stand in the Current Market?

Adyen has established a strong foothold as a leading global financial technology platform. It primarily serves large, complex enterprises and fast-growing platforms. In 2024, Adyen's processed volume reached a substantial €1.29 trillion, demonstrating its significant scale within the payment processing industry.

The company's core operations revolve around payment processing, risk management, and acquiring services. These services are all delivered through a single, in-house built technology stack. This integrated approach allows for seamless transactions and efficient operations. Adyen's value proposition lies in its ability to provide a unified commerce solution, integrating online, in-app, and in-store payments.

Adyen's market position is further solidified by its focus on large, global businesses, while also expanding its reach into the small and medium-sized business (SMB) sector. Geographically, Adyen has a strong presence in Europe, the Middle East, and Africa (EMEA), which accounted for 60% of its revenue in H2 2024. The company is actively expanding its presence in North America and the Asia-Pacific (APAC) region.

Adyen's competitive landscape includes other major players in the payment processing industry. Comparing Adyen vs Stripe, Stripe's TPV reached $1.4 trillion in 2024, highlighting the competitive nature of the market. Understanding the Adyen competitive landscape is crucial for assessing its market position.

Adyen offers a comprehensive suite of services, including payment processing, risk management, and acquiring services. These are all integrated into a single platform. This unified approach simplifies payment operations for merchants, making it a strong contender among top payment gateways like Adyen.

Adyen's financial health remains robust, with a 50% EBITDA margin for the full year 2024, up from 46% in FY 2023, and reaching 53% in H2 2024. The company expects further margin expansion in 2025 and aims for an EBITDA margin above 50% in 2026. This strong financial performance underscores its competitive edge.

Adyen is actively expanding its global footprint, particularly in North America and the Asia-Pacific (APAC) region. The company's global expansion strategy includes investments in key markets like Japan and India. For more insights into the company's ownership, check out the article about Owners & Shareholders of Adyen.

Adyen's key strengths include its unified commerce solutions and strong financial performance. A potential weakness could be the increasing competition in the payment processing industry. Understanding Adyen's key strengths and weaknesses is essential for a thorough Adyen competitor analysis 2024.

- Strong unified commerce solutions.

- Robust financial performance with high EBITDA margins.

- Focus on large, global businesses.

- Expansion into SMB and APAC markets.

Adyen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Adyen?

The Adyen competitive landscape is shaped by a dynamic mix of established players and innovative fintech companies. The payment processing industry is fiercely competitive, with companies constantly vying for market share. Understanding Adyen's key competitors is crucial for assessing its market position and future prospects.

Adyen faces competition from both agile fintech platforms and well-established incumbents. These competitors challenge Adyen across various segments, including digital payments, unified commerce, and platform solutions. Adyen's market share is impacted by the strategies and performance of these rivals.

Adyen's primary competitors include Stripe, PayPal, and other major payment processors. These companies offer similar services but often have different strengths and weaknesses. Analyzing these competitors helps to understand how Adyen differentiates itself and where it faces the most significant challenges.

Stripe is a significant competitor, particularly in the digital and platforms space. Stripe's total payment volume (TPV) reached $1.4 trillion in 2024, showing a year-over-year growth of 38%. Stripe's broader software suite aims to create a stickier ecosystem, competing directly with Adyen's offerings.

PayPal, through its Braintree offering, processes substantial payment volumes, with a TPV of $1.68 trillion in FY 2024. PayPal leverages its brand and ecosystem to compete. The new 'PayPal Open' initiative directly challenges Adyen's single-platform strength.

Fiserv and Verifone are entrenched incumbents with vast existing relationships and scale. These companies have a strong presence in the market and pose a competitive challenge to Adyen.

Checkout.com is a resurgent competitor, demonstrating strong growth with a 45% core net revenue increase in 2024. This highlights the dynamic nature of the fintech companies landscape.

In Europe, Worldline and Nexi face competition from Adyen in the enterprise sector, and from smaller players like Flatpay, myPOS, and SumUp in the small business sector. These companies are key players in the online payment solutions market.

Mergers and alliances, such as Shift4's acquisition of Global Blue, also impact the competitive dynamics within the payment processing industry. These strategic moves can shift market share and influence the competitive landscape.

Adyen's ability to compete effectively depends on its technological innovation, pricing strategies, and customer service. The company's success is also influenced by broader market trends and the actions of its competitors. For a deeper understanding of Adyen's journey, consider reading Brief History of Adyen.

- Adyen's key strengths and weaknesses are constantly tested by its competitors' strategies.

- Adyen vs Stripe comparison reveals the different approaches these companies take to capture market share.

- Adyen's market position in Europe is influenced by local competitors and regulatory environments.

- How Adyen competes with PayPal involves leveraging its platform's capabilities and focusing on customer needs.

Adyen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Adyen a Competitive Edge Over Its Rivals?

Analyzing the Adyen competitive landscape reveals a company built on a foundation of technological innovation, global reach, and a strong customer-centric approach. Adyen's strategic moves, including its direct global acquiring capabilities and expansion into new markets, have positioned it as a significant player in the payment processing industry. Revenue Streams & Business Model of Adyen provides deeper insights into the company's operational framework.

Adyen's ability to offer a unified platform for online, in-app, and in-store payments is a key differentiator. This contrasts with many competitors that rely on fragmented solutions. The company's focus on building intelligent, AI-powered features further enhances its competitive edge, driving merchant profitability and customer loyalty.

Adyen's competitive advantages are rooted in its technology, global presence, and customer focus. These factors contribute to its strong market position and ability to compete effectively within the fintech landscape.

Adyen's in-house built technology stack provides a cohesive view of payments data. This allows for continuous improvement and innovation. The single platform handles diverse payment types, streamlining operations and providing rich consumer insights for global merchants.

Adyen operates as a direct clearing partner in many markets, reducing reliance on third parties. This lowers the cost per transaction and enhances control. Expansion includes obtaining licenses and direct integrations, such as in India and Brazil in 2024.

Adyen leverages its vast dataset to build intelligent, AI-powered features. Products like Adyen Uplift optimize payment conversion rates. Intelligent Payment Routing for US Debit achieved significant cost savings and improved authorization rates in pilots.

Adyen's 'Land and Expand' strategy fosters strong customer loyalty. The company's Net Promoter Score (NPS) reached a company-high of 66 in 2024. This approach drives long-term relationships and sustained growth.

Adyen's competitive advantages include its unified platform, global reach, and data-driven features. These strengths are difficult for competitors to replicate. The company's direct connections, global licensing, and integrated technology stack contribute to its sustainable market position.

- Unified, in-house built technology stack.

- Direct global acquiring capabilities and extensive licenses.

- AI-powered features that impact merchant profitability.

- 'Land and Expand' strategy driving customer loyalty.

Adyen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Adyen’s Competitive Landscape?

The competitive landscape for Adyen is shaped by evolving industry trends, presenting both challenges and opportunities. Understanding these dynamics is crucial for assessing Adyen's market position and future outlook. The company's ability to adapt to technological advancements, regulatory changes, and shifting consumer preferences will be key to its continued success in the payment processing industry.

Adyen's focus on innovation and strategic expansion, particularly in emerging markets, positions it well for growth. However, global economic shifts and intense competition from other fintech companies pose significant risks. The company's financial performance and strategic decisions will be critical in navigating these challenges and capitalizing on new opportunities. For a deeper dive into the company's growth trajectory, consider reading about the Growth Strategy of Adyen.

Technological advancements, especially in AI, are reshaping the payment space. Regulatory changes and evolving consumer preferences, such as the demand for omnichannel experiences, are also key drivers. Global economic shifts and currency fluctuations can impact transaction volumes, creating challenges.

Navigating complex and evolving regulations and maintaining robust compliance frameworks is a continuous challenge. Global economic pressures and currency fluctuations can impact consumer spending. Customer concentration also presents a potential vulnerability.

Significant growth opportunities exist in emerging markets like Japan and India. Product innovations, such as embedded finance, and strategic partnerships offer new revenue streams. Adyen aims for a 'slight acceleration' in net revenue growth in 2025, expecting mid-twenties percentage growth.

Adyen focuses on gaining wallet share with existing customers and winning new clients. The company prioritizes organic growth, rejecting M&A as a primary growth strategy. Adyen's commitment to innovation and its unified commerce platform are key differentiators.

Adyen faces a dynamic competitive landscape driven by technological advancements and regulatory changes. The company's ability to leverage AI, expand globally, and adapt to consumer preferences will be crucial for its growth. Understanding Adyen's market position, challenges, and opportunities is essential for making informed decisions.

- Adyen is leveraging AI for payment optimization and fraud prevention.

- Unified Commerce volumes increased by 35% year-over-year in H2 2024.

- Issuing volumes surged 258% year-over-year to nearly €1 billion annually.

- Adyen is targeting mid-twenties percentage net revenue growth in 2025.

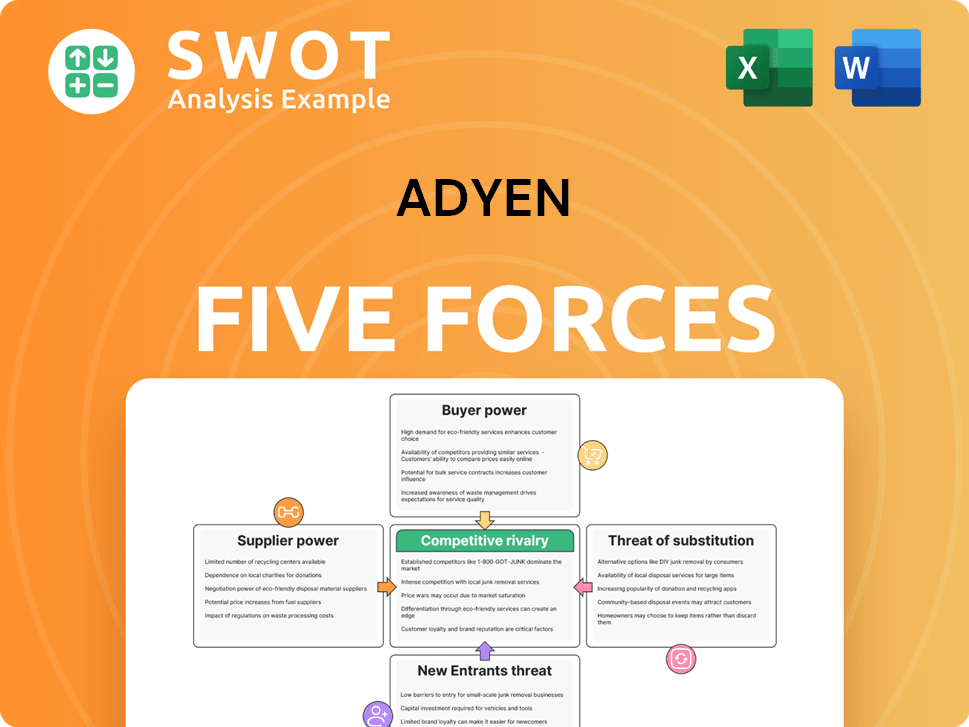

Adyen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Adyen Company?

- What is Growth Strategy and Future Prospects of Adyen Company?

- How Does Adyen Company Work?

- What is Sales and Marketing Strategy of Adyen Company?

- What is Brief History of Adyen Company?

- Who Owns Adyen Company?

- What is Customer Demographics and Target Market of Adyen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.