AEM Bundle

What's the Story Behind AEM's Rise?

Ever wondered how a company becomes indispensable in the fast-paced world of semiconductors? AEM Holdings Ltd. plays a critical role in the global semiconductor and electronics industries. From its humble beginnings, AEM has evolved into a global force, providing essential equipment and services that power the technology we use every day.

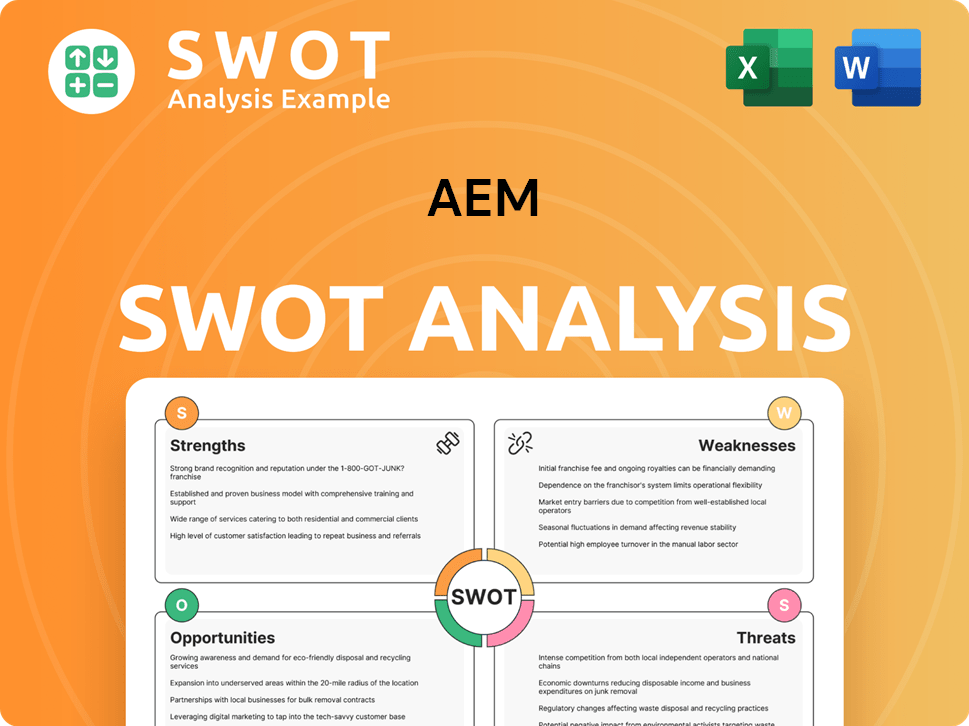

While the exact origins of AEM, including its founding year and original name, may not be readily available in all sources, the company's growth trajectory is undeniable. AEM's strategic positioning within the semiconductor industry is further highlighted by its ability to capitalize on the rising demand for advanced AI chips, and you can learn more about their strategic advantages with our AEM SWOT Analysis. This evolution underscores AEM's significance in the global chip production process and its commitment to test innovation.

What is the AEM Founding Story?

While the exact founding details of AEM Holdings Ltd. aren't explicitly available, the company's story centers on providing essential equipment and services to the semiconductor and electronics sectors. AEM's core focus is on test solutions for the semiconductor manufacturing process, including handling, testing, and inspection.

The company's early vision was to offer comprehensive semiconductor and electronics test solutions. AEM aimed to achieve this through superior technologies, processes, and customer support. This approach highlights an early emphasis on innovation and customer-centric solutions to meet industry demands.

AEM's origins are rooted in addressing the evolving needs of the semiconductor industry. The company's early strategy involved close collaboration with key customers, such as Intel, to design and manufacture test handlers.

- AEM's business model was built on deep customer partnerships and tailored solutions.

- The company initially focused on system-level test (SLT) solutions, positioning itself as a pioneer in this area.

- AEM has been expanding its customer base beyond its key customer, with revenue from Test Cell Solutions (TCS) customers (excluding its key customer) projected to exceed S$100 million in FY2025.

- AEM's commitment to innovation is also evident in its recent securing of key patents and the introduction of new products like PiXL™ and AMPS-BI, which are tailored for AI and high-performance computing applications.

AEM SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of AEM?

The early growth and expansion of AEM Holdings Ltd. has been marked by strategic diversification and innovation. The company has focused on expanding its customer base and entering new market segments, particularly in AI and high-performance computing. This strategic approach is expected to yield significant returns in the coming years, with revenue from new customer accounts, excluding its key customer, projected to exceed S$100 million in FY2025.

Key product launches and innovations have been central to AEM's growth. The company commercialized its expanded AMPS platform, including burn-in and system-level test capabilities designed for AI and HPC applications. The deployment of its PiXL™ thermal management technology for advanced system-level validations has been a significant development, addressing the need for high-power thermal management in next-generation chips. AEM also expanded its installed base for its memory customer to test GDDR6 devices and is developing capabilities to support upcoming AI and GDDR7 devices expected to ramp up in late 2025.

Financially, AEM reported a net profit of S$11.6 million in FY2024, a significant turnaround from a net loss of S$1.2 million in FY2023. While FY2024 revenue saw a 21% decrease year-on-year to S$380.4 million, the company's profit before tax increased to S$14.1 million. The company's balance sheet remains robust, with a debt-to-equity ratio of 0.2x. AEM's revenue guidance for the first half of 2025 is S$155 million to S$170 million, with a stronger second half anticipated due to the ramp-up timing of key customers' devices and recovery in contract manufacturing.

The company's growth efforts have been shaped by a competitive landscape and market reception that increasingly demands advanced testing solutions for complex chips. AEM's 'Test 2.0' paradigm, which emphasizes highly parallel, advanced intelligent automation with powerful thermal engines and application-optimized test instrumentation, reflects its strategic shift to meet these evolving industry needs. The company's focus on innovation and strategic expansion aligns with the evolving demands of the semiconductor industry.

AEM's early growth and expansion is a testament to its strategic vision. The company's focus on diversification, particularly in the AI and HPC sectors, positions it well for future growth. The development of advanced testing solutions, such as the AMPS platform and PiXL™ technology, underscores AEM's commitment to meeting the evolving needs of the semiconductor industry. To learn more about the company's values and mission, read Mission, Vision & Core Values of AEM.

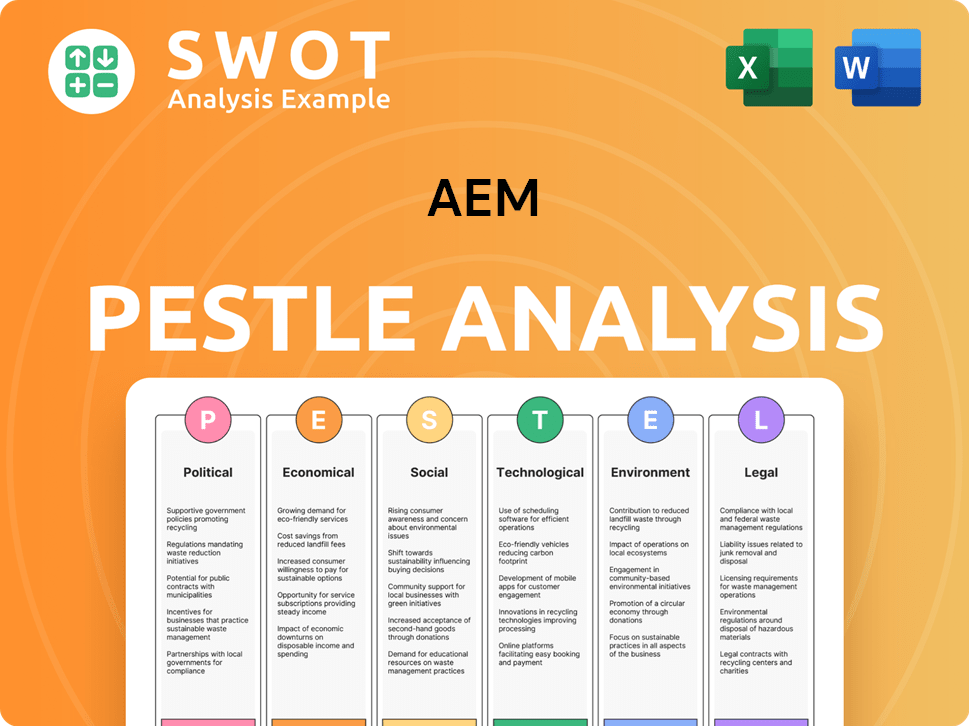

AEM PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in AEM history?

The journey of AEM Holdings Ltd. has been marked by significant achievements in the semiconductor industry. AEM's history is characterized by its pioneering role in system-level test (SLT) solutions, which has positioned it as a leader in a rapidly evolving market. This has allowed the company to capitalize on the growing demand for advanced testing capabilities.

| Year | Milestone |

|---|---|

| Ongoing | Pioneering role in system-level test (SLT) solutions, placing it ahead of competitors. |

| 2023 | Awarded nine new patents, underscoring its commitment to innovation and intellectual property. |

| 2025 (Expected) | Customer engineering evaluations for its PX offering are expected to commence. |

AEM has consistently introduced innovative solutions to meet the evolving needs of the semiconductor industry. Recent innovations include the AMPS-BI system, the industry's first fully automated high-throughput high-power system. The company also expanded its customer base for System-Level Test solutions through the deployment of its proprietary PiXL™ thermal management technology.

The introduction of AMPS-BI, the industry's first fully automated high-throughput high-power system, improved testing capabilities. This innovation enables high-voltage stress testing and significantly lowers testing costs per device.

The deployment of PiXL™ thermal management technology expanded the customer base for System-Level Test solutions. This technology is critical for validating GPU performance and expanding installed bases at leading memory customers.

In 2023, AEM was awarded nine new patents, demonstrating a strong commitment to research and development. This expansion of intellectual property supports AEM's position as a technology leader.

AEM's dedication to addressing thermal challenges faced by leading AI and HPC chip manufacturers is significant. Customer engineering evaluations for its PX offering are expected to commence in late 2025, highlighting its forward-thinking approach.

Despite its successes, AEM has faced challenges, particularly due to industry downturns and internal issues. The semiconductor industry experienced a slump, and the semiconductor test equipment market contracted by 17%. AEM also reported an inventory shortfall in January 2024, which impacted its profitability.

The semiconductor industry faced a downturn, with demand decreasing by 8.2% year-on-year in 2023. This slowdown significantly impacted AEM's revenue, which saw a 21% drop in FY2024 to S$380.4 million from S$481.3 million in the previous year.

An inventory shortfall in January 2024, caused by human error, negatively impacted AEM's profitability for FY2023. The shortfall was estimated to be between S$17.9 million and S$25.1 million.

AEM experienced a leadership transition with the departure of its CEO in July 2024. This change required strategic adjustments to ensure continued growth and stability.

In response to challenges, AEM has focused on customer diversification and expansion into new market segments. The company has also emphasized operational excellence and continued investment in its 'Test 2.0' leadership.

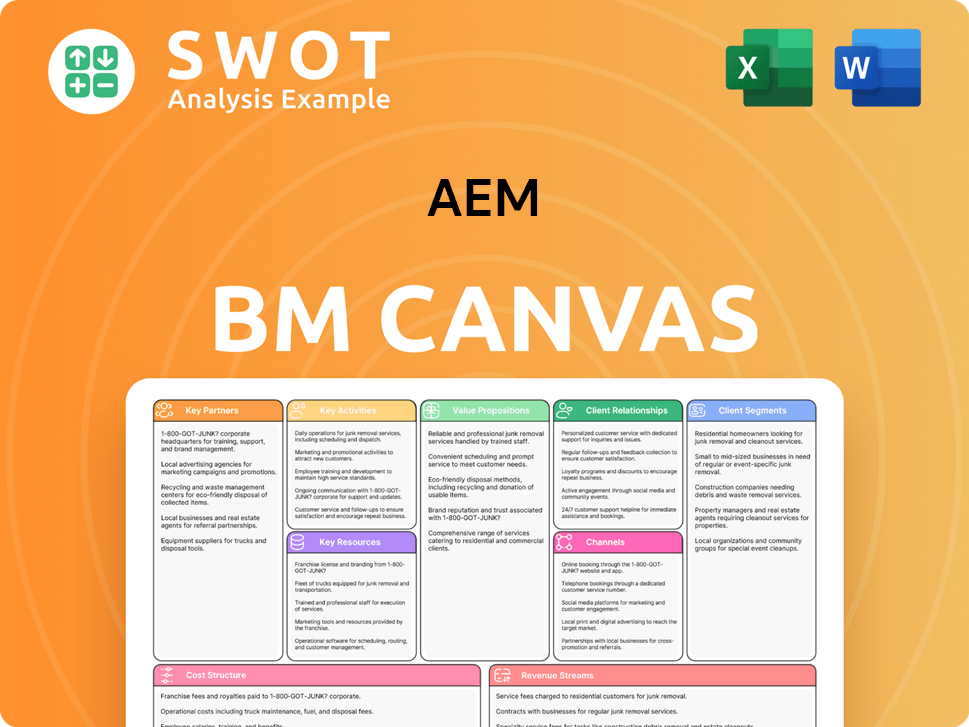

AEM Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for AEM?

The AEM history reflects its journey through market challenges and strategic adaptations. The company has navigated periods of both financial losses and significant turnarounds, demonstrating resilience and a commitment to innovation in the semiconductor industry. Key milestones include securing significant patents, launching new products, and expanding its market presence, particularly within the high-performance computing and AI sectors. Despite facing headwinds, such as inventory shortfalls and revenue declines, the company has shown a strong capacity to recover and capitalize on emerging opportunities.

| Year | Key Event |

|---|---|

| FY2023 | Reported a net loss of S$1.2 million due to market conditions. |

| January 2024 | Announced an inventory shortfall impacting FY2023 profitability. |

| FY2024 | Achieved a net profit of S$11.6 million despite a revenue decrease. |

| July 1, 2024 | Amy Leong appointed as CEO. |

| 2H2024 | Revenue surged to S$207 million, up 19% from the first half. |

| 4Q2024 | Won an additional project for the AMPS-BI product and expanded its installed base. |

| February 18, 2025 | Shares surged after being highlighted in Singapore's Budget 2025 speech. |

| 1Q2025 (Ended March 31, 2025) | Reported a profit before tax of S$3.8 million, with revenue at S$86.03 million. |

| April 23, 2025 | Held its Annual General Meeting in Singapore. |

The company anticipates a stronger second half of 2025, fueled by the ramp-up of key customers' devices and a recovery in contract manufacturing. Customer diversification is expected to boost revenue, with new customer revenue projected to exceed S$100 million in FY2025. Investments in high-performance computing (HPC) and AI sectors are key strategic moves.

AEM is focusing on long-term strategic initiatives to leverage industry trends. Upcoming product developments include next-generation capabilities to support AI and GDDR7 devices, expected to ramp up in late 2025. The company aims to grow revenue, achieve operational excellence, and continue investments in 'Test 2.0' leadership.

While the first half of 2025 revenue guidance is lower, the outlook for a robust recovery in the second half remains positive. Management is confident that revenue from new test insertion wins could grow more than 5x from low double-digit millions in FY2023 to triple-digit millions in FY2025. The company's strategic goals for 2025-2027 are focused on growth and market diversification.

AEM's long-term growth prospects are underpinned by its differentiation in thermal technology, crucial for testing AI/HPC devices and chiplet-based advanced packages. This technological advantage positions the company well to meet the evolving demands of the semiconductor industry. The company's focus remains on providing comprehensive and best-in-class semiconductor and electronics test solutions.

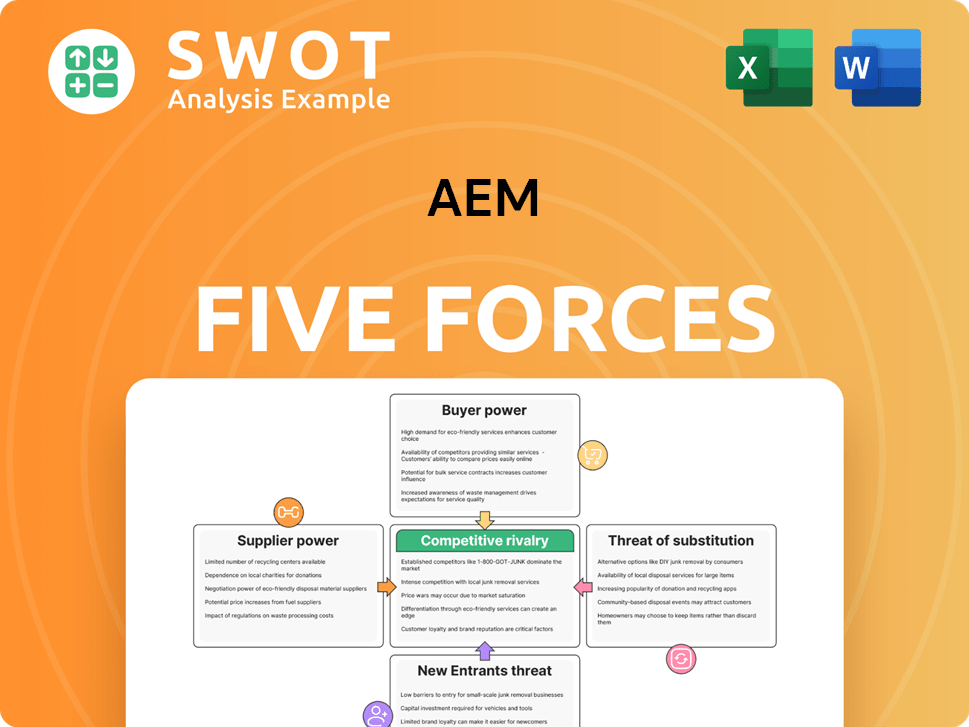

AEM Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of AEM Company?

- What is Growth Strategy and Future Prospects of AEM Company?

- How Does AEM Company Work?

- What is Sales and Marketing Strategy of AEM Company?

- What is Brief History of AEM Company?

- Who Owns AEM Company?

- What is Customer Demographics and Target Market of AEM Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.