AEM Bundle

Can AEM Holdings Thrive in the Semiconductor Arms Race?

The semiconductor industry is a battlefield of innovation, with companies like AEM Holdings at the forefront. As demand for AI chips explodes, the pressure is on to ensure quality and reliability. Understanding the AEM SWOT Analysis and its position within this dynamic environment is critical.

This exploration of the AEM competitive landscape will dissect its position in the AEM industry analysis, examining key AEM competitors and AEM alternatives. We'll analyze AEM market share within the broader Adobe Experience Manager market, uncovering the strategies that allow AEM to compete in this high-stakes arena. This AEM competition analysis report aims to provide a comprehensive view of AEM's standing amidst the top AEM competitors 2024, offering insights into its strengths, weaknesses, and future prospects.

Where Does AEM’ Stand in the Current Market?

AEM Holdings Ltd. focuses on the semiconductor equipment industry, particularly in back-end testing. They provide comprehensive test solutions, including test handlers, testers, consumables, and data analytics. In 2024, the company demonstrated a strong recovery, with revenue reaching S$380.4 million and a net profit of S$11.6 million.

The company's core operations revolve around Test Cell Solutions (TCS), Instrumentation (INS), and Contract Manufacturing (CM). TCS is the primary revenue generator. AEM serves a global customer base, helping them optimize manufacturing processes and improve product quality.

AEM has a strategic focus on system-level testing (SLT) solutions, positioning it well in a growing market segment. They are also actively pursuing customer diversification. For the first half of 2025, revenue is projected to be between S$155 million and S$170 million. AEM's total equity as of December 31, 2024, was S$492.3 million, and its debt-to-equity ratio was 0.2x, or 14.8%.

AEM holds a significant position in the semiconductor equipment industry, specializing in back-end testing solutions. They offer a range of products, including test handlers and testers. Their financial performance in 2024 reflects a solid market standing and recovery.

AEM's primary product lines are Test Cell Solutions (TCS), Instrumentation (INS), and Contract Manufacturing (CM). TCS generates the majority of the revenue. The company serves a global customer base, with a strong presence in Asia, Europe, and the United States.

AEM has a strong relationship with a key customer, Intel, designing and manufacturing test handlers for them. AEM is also focused on customer diversification. Revenue from TCS customers, excluding the key customer, is projected to exceed S$100 million in FY2025.

As of December 31, 2024, AEM's total equity was S$492.3 million, with a debt-to-equity ratio of 0.2x, or 14.8%. The revenue guidance for the first half of 2025 is projected to be in the range of S$155 million to S$170 million. This demonstrates their financial stability and growth potential.

AEM's focus on system-level testing (SLT) solutions positions it favorably in a growing market segment. The company's ability to provide comprehensive test solutions, combined with its strong customer relationships and financial health, supports its competitive edge. To understand more about their business model, you can read Revenue Streams & Business Model of AEM.

- Focus on SLT solutions.

- Strong customer relationships.

- Financial stability.

- Customer diversification efforts.

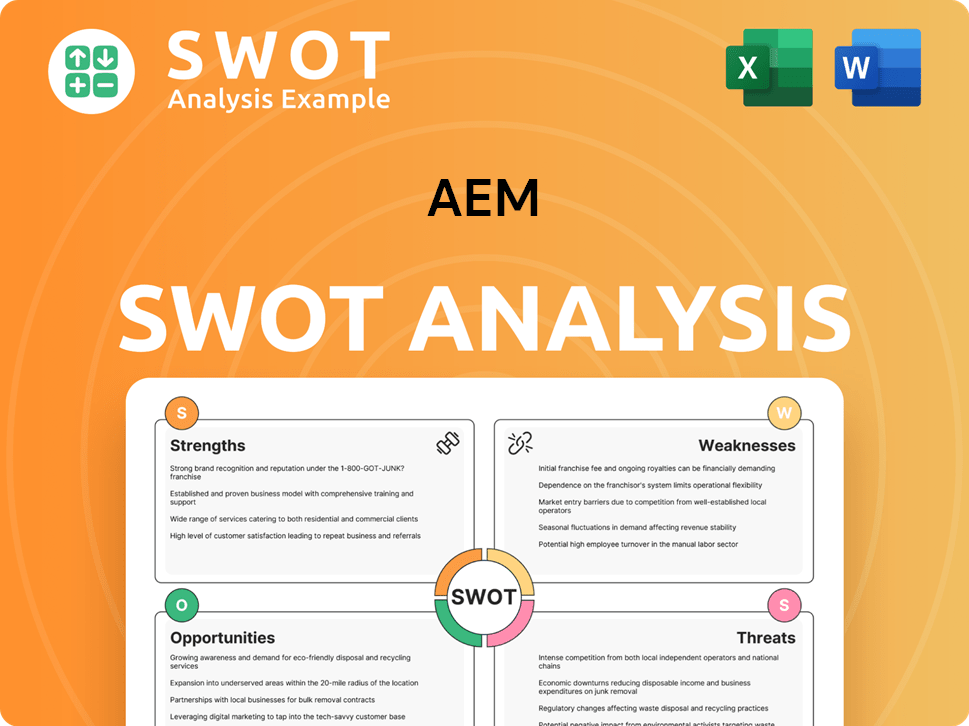

AEM SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging AEM?

The competitive landscape for AEM Holdings is primarily within the semiconductor and electronics test equipment sector. The company faces competition from both direct and indirect rivals, influencing its market position and strategic decisions. Understanding the AEM competitive landscape is crucial for assessing its performance and future prospects.

Key players in this industry compete on various fronts, including technological innovation, cost-effectiveness, and the ability to meet evolving customer demands. The semiconductor equipment market is dynamic, with companies constantly striving to improve their offerings and secure market share. This environment necessitates a focus on continuous improvement and adaptation to maintain a competitive edge. For a deeper understanding, consider reading about the Growth Strategy of AEM.

AEM's strategy includes customer diversification, with a target of over S$100 million in revenue from new Test Cell Solutions customers in FY2025, highlighting its efforts to navigate the competitive environment and reduce reliance on its key customer.

ASA directly competes with AEM by providing automated backend equipment. This puts them in the same market segment, targeting similar customers in the semiconductor manufacturing process. ASA's focus on automation makes it a direct rival in this area.

Cohu offers test and inspection equipment and services for back-end semiconductor manufacturing. This overlaps directly with AEM's core offerings, making Cohu a significant competitor. The competition includes similar product lines and customer bases.

Teradyne designs, develops, and manufactures automated test equipment across various industries, including semiconductors. Its broad scope and established market presence make it a formidable competitor. Teradyne's diverse product range allows it to compete across multiple segments.

Tessolve is another player in the semiconductor industry, providing services and solutions that may overlap with AEM's offerings, particularly in testing and engineering. This competition affects market share and customer acquisition.

NI offers test and measurement solutions, which can compete with AEM in certain areas, particularly in automated testing. The competition involves similar technological solutions and customer bases. NI's comprehensive offerings make it a notable competitor.

The semiconductor and electronics test equipment industry is characterized by a variety of competitors, each with its own strengths and market focus. These competitors constantly innovate and adapt to meet customer needs. The competitive landscape includes both direct and indirect rivals.

The semiconductor equipment industry is highly competitive, with companies constantly vying for market share through technological advancements and cost-effectiveness. AEM and its competitors must continually innovate to meet evolving customer demands. The industry's cyclical nature and the need for continuous innovation drive companies to compete on technological advancements. High-profile 'battles' or market share shifts often occur as new technologies emerge or existing customers diversify their supplier base.

- Technological Advancements: Continuous innovation is crucial for staying competitive.

- Cost-Effectiveness: Offering competitive pricing is essential for attracting customers.

- Customer Demand: Adapting to changing customer needs is key to success.

- Market Share: Companies are constantly working to increase their market share.

- Customer Diversification: AEM is focused on diversifying its customer base.

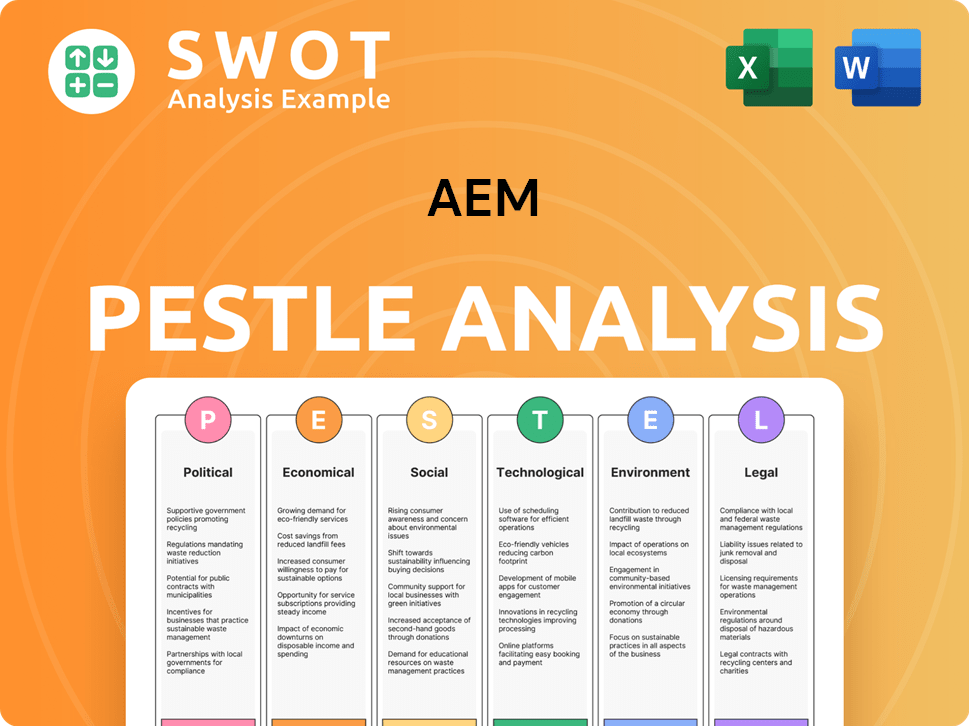

AEM PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives AEM a Competitive Edge Over Its Rivals?

AEM Holdings Ltd. distinguishes itself through several key competitive advantages in the semiconductor and electronics test solutions market. Its technological leadership, particularly in system-level testing (SLT), positions it as a pioneer. This is crucial as chip complexity increases, demanding advanced testing capabilities. AEM's focus on innovation and strategic partnerships underscores its commitment to maintaining a competitive edge.

The company's proprietary technologies, such as its PiXL thermal technology, are critical assets. This technology, along with high-throughput burn-in systems, enables AEM to provide solutions for next-generation devices. AEM's long-standing collaboration with key customers, such as Intel Foundry, provides invaluable insights into future technology roadmaps.

Strategic investments in research and development (R&D) enable AEM to transition new products and technologies from the R&D stage to full-scale production. This approach allows it to cater to a diverse customer base. These advantages are built on continuous innovation, strong customer partnerships, and a deep understanding of the evolving semiconductor testing needs, although they do face threats from imitation and rapid industry shifts.

AEM's leadership in system-level testing (SLT) solutions is a primary advantage. The company is often recognized as being ahead of its competitors by about one generation. This technological edge is vital for addressing the increasing complexity of chips and the need for advanced testing methodologies. This positions AEM well within the evolving AEM brief history.

AEM holds a significant advantage through its proprietary technologies, including its PiXL thermal technology. This technology is crucial for managing the heat generated by high-performance computing (HPC) and AI chips during testing. This capability is especially relevant given the growing adoption of AI chips and chiplet manufacturing.

AEM's strong collaboration with its key customer, Intel Foundry, provides a deeply integrated SLT and Burn-In ecosystem. This partnership offers invaluable insights into future technology roadmaps. It also facilitates deep engineering collaboration, accelerating time-to-market for fabless customers and leveraging an established installed base of systems worldwide.

Strategic investments in research and development (R&D) have enabled the transition of new products and technologies from the R&D stage to full-scale production. AEM offers a spectrum of solutions, from more affordable 'Gen-1 pixel technology' to advanced systems for cutting-edge AI chips. This approach allows AEM to cater to a diverse customer base.

AEM's competitive advantages include technological leadership in SLT, proprietary technologies like PiXL, and strong strategic partnerships. These factors contribute to its ability to innovate and meet the evolving demands of the semiconductor industry. The company's focus on R&D and a diverse product range further strengthen its market position.

- Technological superiority in SLT solutions.

- Proprietary technologies, including PiXL thermal management.

- Strong partnerships, particularly with Intel Foundry.

- Strategic R&D investments and a diverse product portfolio.

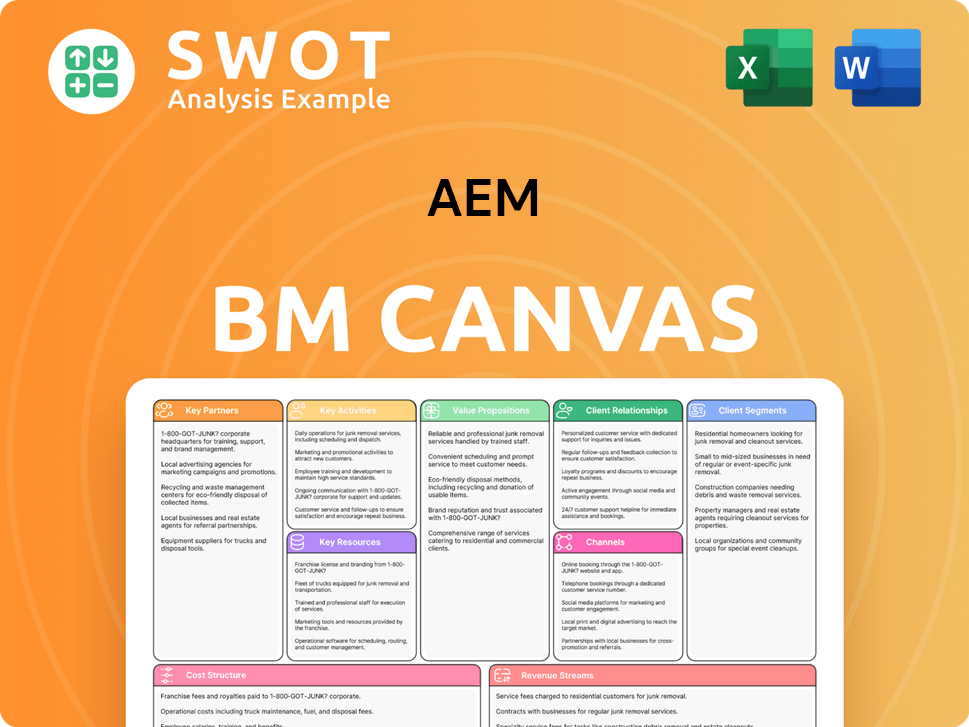

AEM Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping AEM’s Competitive Landscape?

The semiconductor industry, where AEM Holdings operates, is currently experiencing significant growth driven by the surging demand for high-performance computing (HPC) and artificial intelligence (AI) chips. This demand is propelling the semiconductor market towards a projected $1 trillion valuation by 2030. This growth presents both challenges and opportunities for AEM, particularly in areas like system-level testing (SLT) and active thermal control (ATC).

Technological advancements are reshaping how businesses interact with technology. The semiconductor equipment market is also growing, forecast to increase by USD $41.76 billion at a CAGR of 7.4% between 2024 and 2029. However, the industry faces cyclical downturns and geopolitical uncertainties, influencing supply chains and market access. Despite these challenges, AEM is strategically expanding its customer base and investing in new test capabilities.

The primary driver of growth in the semiconductor market is the increasing demand for AI and HPC chips, which necessitates advanced testing solutions. Digitalization across automotive, data centers, and consumer electronics continues to fuel demand for semiconductors. The market is also influenced by investments in fabrication facilities and an increasing number of chip fabrication plants globally.

The semiconductor market is cyclical, with periods of growth followed by contractions. Geopolitical tensions and trade restrictions can impact supply chains and market access, creating near-term uncertainties. Maintaining historical margins and managing inventory surpluses are also challenges, as seen by AEM's revenue decline in 2024 compared to 2023.

AEM has the opportunity to expand its customer base beyond its key customer, with new customers contributing the majority of test cell solutions revenue in Q1 FY2025. Investing in differentiated test capabilities for AI/HPC applications, like thermal management, is another key opportunity. The demand for semiconductors in various industries will continue to drive the need for advanced testing solutions.

AEM is focused on leveraging its technological superiority in SLT and thermal management. The company is diversifying its customer base and innovating to meet the demands of AI and advanced computing. AEM aims to remain resilient and capitalize on future growth opportunities by investing in 'Test 2.0 leadership,' achieving operational excellence, and cultivating talent.

The AEM competitive landscape is shaped by the company's focus on system-level testing and thermal management solutions within the semiconductor industry. The Adobe Experience Manager market, while related to digital experience platforms, indirectly influences the demand for underlying semiconductor components. Understanding AEM competitors and their strengths is crucial for strategic positioning.

- AEM's ability to innovate in response to AI and advanced computing demands.

- Diversifying customer base to reduce reliance on a single key customer.

- Investing in 'Test 2.0 leadership' and operational excellence.

- The push towards digitalization across various industries.

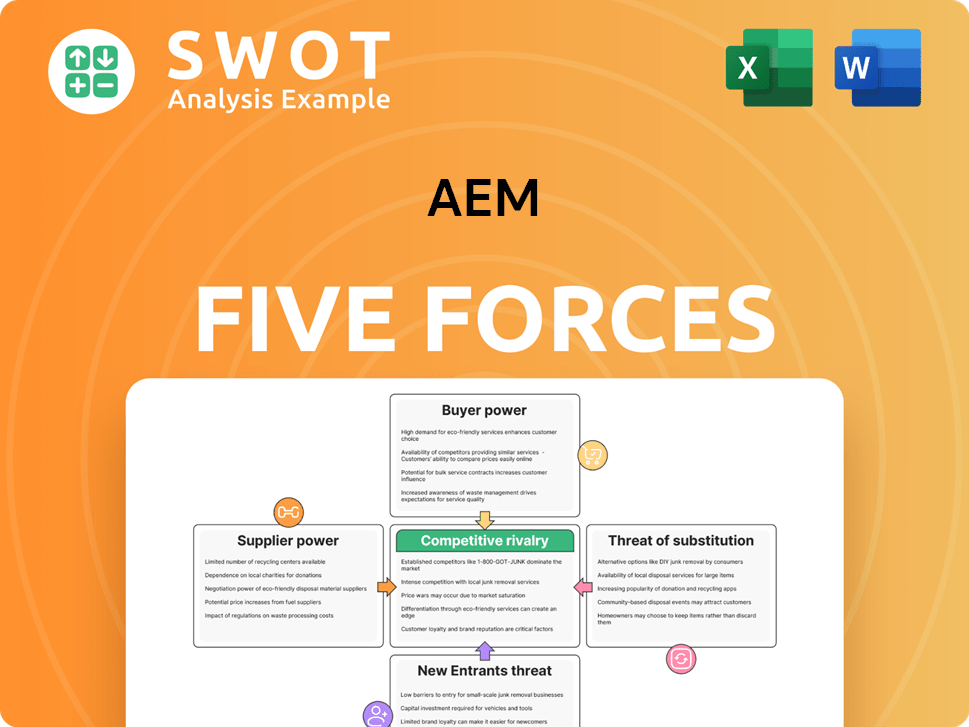

AEM Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AEM Company?

- What is Growth Strategy and Future Prospects of AEM Company?

- How Does AEM Company Work?

- What is Sales and Marketing Strategy of AEM Company?

- What is Brief History of AEM Company?

- Who Owns AEM Company?

- What is Customer Demographics and Target Market of AEM Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.