AEM Bundle

How Does AEM Company Thrive in the Semiconductor Realm?

Dive into the world of AEM Holdings Ltd. (SGX: AWX), a critical player in the global semiconductor landscape. This isn't just another tech company; AEM is deeply embedded in the supply chains of industry giants, ensuring the quality and reliability of cutting-edge electronics. Discover how AEM's innovative solutions are shaping the future of technology.

With a remarkable financial turnaround in 2024, AEM demonstrates its resilience and strategic prowess, even amidst market fluctuations. The company's focus on test innovation, offering comprehensive solutions like test handlers and data analytics, positions it perfectly to capitalize on the burgeoning trillion-dollar semiconductor industry. To gain a deeper understanding of AEM's strategic advantages, explore the AEM SWOT Analysis.

What Are the Key Operations Driving AEM’s Success?

The core operations of AEM Holdings revolve around providing comprehensive test solutions for the semiconductor and electronics industries. These solutions span from advanced engineering to high-volume manufacturing, ensuring quality and efficiency throughout the product lifecycle. AEM's value proposition lies in its ability to deliver innovative and customized testing systems that meet the evolving needs of its customers, including industry leaders like Intel.

AEM's offerings include equipment systems solutions (ESS), which provide customized system solutions with innovative mechanical design and sophisticated graphical user interfaces (GUIs). The company also specializes in test solutions for micro-electro-mechanical systems (MEMS) and specialized wafer probing. A significant part of its operations involves working closely with key customers to design, engineer, and manufacture test handlers, along with providing field support and post-sales replacements.

The company's global presence and technological expertise are key differentiators. AEM operates manufacturing plants in Singapore, Malaysia, China, and Finland, supported by a global network of engineering support, sales offices, and distributors. This extensive network allows AEM to offer robust support and innovation, serving customers 24/7 across the entire manufacturing lifecycle.

ESS provides customized system solutions with innovative mechanical design and sophisticated graphical user interfaces (GUIs). These systems are designed for both mass volume manufacturers and new technology development laboratories. AEM's ESS solutions are integral in supporting the complex testing needs of the semiconductor industry.

AEM specializes in test solutions for micro-electro-mechanical systems (MEMS) and specialized wafer probing. These solutions cater to a range of needs, from research and development to high-volume production and system-level testing. This specialization underscores AEM's commitment to addressing diverse testing requirements.

AEM operates manufacturing plants in key locations such as Singapore, Malaysia, China, and Finland, supported by a global network of engineering support, sales offices, and distributors. This global presence allows AEM to offer robust support and innovation, serving customers 24/7. This extensive network enables AEM to provide comprehensive support.

AEM works closely with key customers to design, engineer, and manufacture test handlers, along with providing field support and post-sales replacements. This collaborative approach ensures that AEM's solutions are tailored to meet specific customer needs and provides ongoing support. This customer-centric approach is key to AEM's success.

AEM is a pioneer in providing system-level testing (SLT) solutions, often considered one generation ahead of its competitors. This technological advantage is particularly beneficial given the increasing complexity of chips and the growing need for advanced heterogeneous packaging. This leadership position allows AEM to capture a significant market share in the SLT sector.

- AEM's focus on SLT solutions provides a competitive edge.

- The company's commitment to innovation addresses thermal challenges faced by leading AI and HPC chip manufacturers.

- AEM's PX offering and AMPS-BI system have achieved customer acceptance and transitioned into volume production.

- These capabilities enhance test cell throughput and lower test costs, optimizing manufacturing processes.

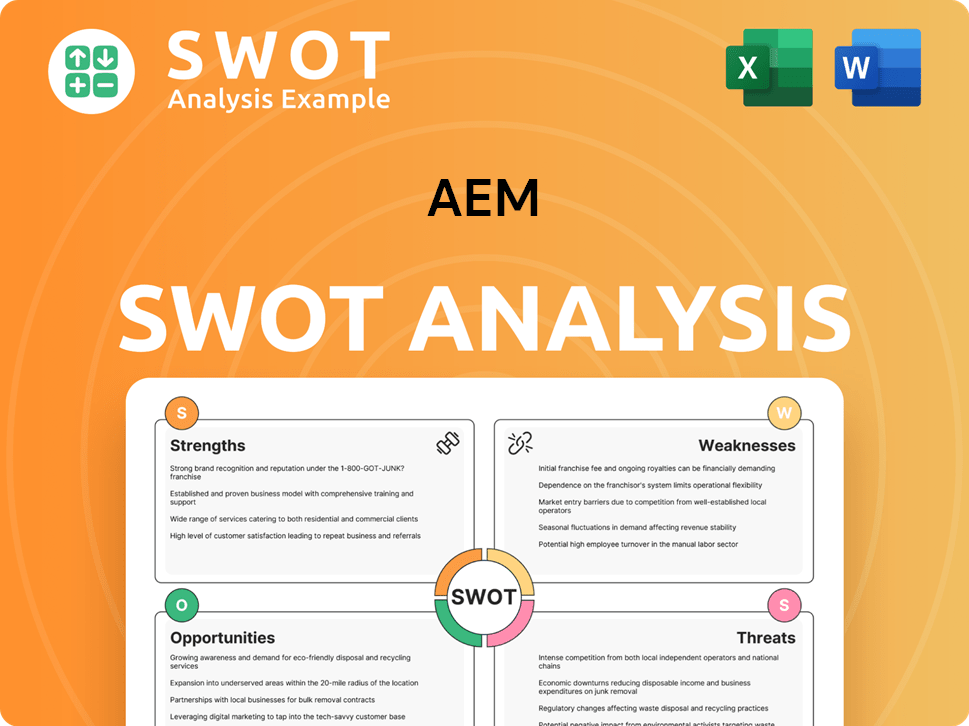

AEM SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AEM Make Money?

The AEM company generates revenue primarily through two main segments: Test Cell Solutions (TCS) and Contract Manufacturing (CM). These segments contribute significantly to the company's financial performance, with TCS being the larger revenue driver in the second half of 2024.

Understanding the revenue streams and monetization strategies of the AEM company is crucial for assessing its financial health and growth potential. The company's approach to generating income involves both product sales and service offerings, targeting diverse customer needs in the technology sector.

The AEM platform focuses on strategic diversification and expansion into high-growth areas like AI and High-Performance Compute (HPC) to reduce reliance on a single major customer and capitalize on emerging market opportunities. This approach is designed to ensure sustained revenue growth and market leadership.

In the second half of 2024, the TCS segment accounted for S$131.2 million, or 63.4% of the Group's revenue. This represents a 31.4% increase compared to the first half of 2024, driven by sales to new customers and pull-in orders from its key customer.

The CM segment contributed S$71.0 million, or 34.3% of Group revenue in the second half of 2024. This segment showed a 1.0% increase from the first half, supported by a diversified customer base across various sectors.

For the full year 2024, the company reported a total revenue of S$380.4 million, demonstrating strong overall performance despite market fluctuations. This figure highlights the company's financial strength.

The revenue guidance for the first half of 2025 is projected to be in the range of S$155 million to S$170 million. This reflects the impact of order adjustments and strategic shifts in customer demand.

Monetization includes product sales of test handlers, testers, and consumables, as well as services like field support and post-sales replacements. This diversified approach supports multiple revenue streams.

The company is actively pursuing customer diversification, with revenue from TCS customers, excluding its key customer, projected to exceed S$100 million in FY2025. This strategy aims to mitigate risks.

The AEM company focuses on several key strategies to drive revenue and maintain its market position. These include expanding into new customer accounts, particularly in the AI/High-Performance Compute (HPC) sector, where their AMPS-BI system has achieved customer acceptance and transitioned into volume production. This strategic move is crucial for long-term growth.

- Product Sales: Revenue from test handlers, testers, and consumables.

- Service Offerings: Field support and post-sales replacements.

- Customer Diversification: Expanding into new markets and reducing reliance on a single customer.

- Market Expansion: Focusing on the AI/HPC sector to capitalize on emerging opportunities.

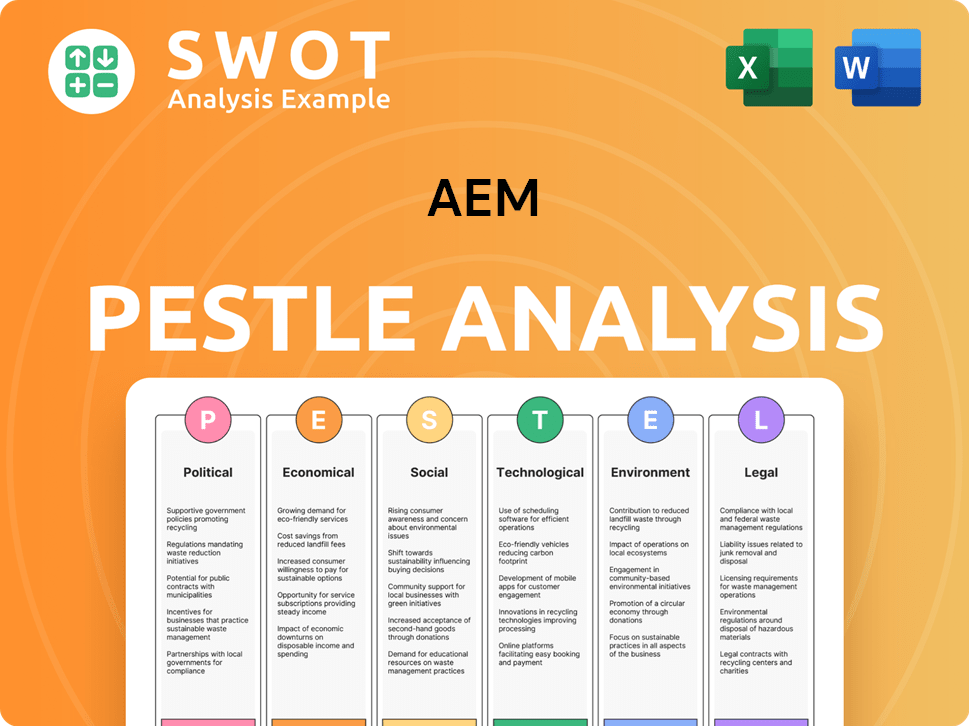

AEM PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AEM’s Business Model?

AEM Holdings has navigated significant milestones, strategic shifts, and competitive advantages. A key highlight in 2024 was a financial turnaround, with earnings of S$12 million, a marked improvement from a S$1 million loss in 2023. This was partly due to strategic order management with a major customer. Further developments include the successful adoption of its AMPS-BI system, designed for high-voltage stress testing, and the upcoming customer evaluations of its PX offering for advanced node foundry suppliers by late 2025.

Operationally, AEM has addressed challenges like moderate test utilization by proactively rationalizing costs and realigning its workforce. The company is also focusing on customer diversification, with several key accounts entering the production test phase in 2025. This strategy aims to reduce reliance on a single major customer, which previously accounted for a significant portion of revenue. The company continues to adapt to new trends by investing in research and development for AI/HPC testing and advanced packaging.

AEM's competitive edge stems from its technological leadership in system-level testing (SLT). This superiority is crucial given the increasing complexity of chips and higher test coverage requirements, especially with advanced heterogeneous packaging. The company’s ability to develop innovative full-stack test solutions, including active thermal control technology, enhances test cell throughput and lowers test costs for its customers.

Significant milestones include a financial turnaround in 2024, reporting S$12 million in earnings. Successful customer acceptance and transition into volume production of its AMPS-BI system. Anticipated customer engineering evaluations of its PX offering by late 2025.

Proactive cost structure rationalization and talent realignment to fuel new business growth. Focus on customer diversification, with several key accounts entering the production test phase in 2025. Investment in research and development for AI/HPC testing and advanced packaging.

Technological leadership in system-level testing (SLT), being approximately one generation ahead of competitors. Development of innovative full-stack test solutions, including active thermal control technology. Strong balance sheet with a debt-to-equity ratio of 0.1x as of March 2025.

The company demonstrated a significant improvement in financial performance in 2024. AEM's ability to adapt to market changes and customer needs is crucial. The company maintains a strong financial position.

AEM's strategic moves and competitive advantages are crucial for its long-term success. The company's focus on innovation and customer diversification positions it well in the evolving semiconductor market. For more insights, explore a brief history of AEM.

- Focus on AI/HPC testing and advanced packaging.

- Customer diversification to reduce concentration risk.

- Technological leadership in SLT solutions.

- Strong financial stability with a low debt-to-equity ratio.

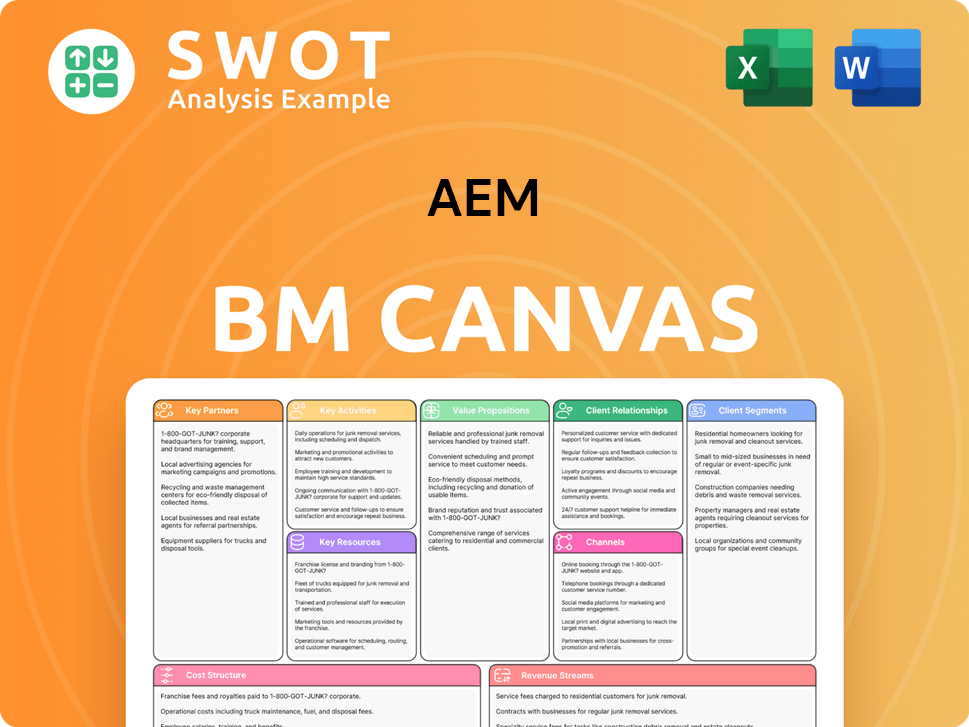

AEM Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AEM Positioning Itself for Continued Success?

The AEM company, a key player in the semiconductor and electronics industries, specializes in test innovation. It provides comprehensive test solutions, including test handlers, testers, consumables, and data analytics. While historically dependent on a single major customer, the company is actively diversifying its customer base, with several key accounts entering the production test phase in 2025.

AEM's global presence includes manufacturing plants in Singapore, Malaysia, China, and Finland, supported by a worldwide network of engineering support and sales offices. The company anticipates a robust recovery in the second half of 2025, driven by the ramp-up timing of key customers' devices and a recovery in the contract manufacturing business.

AEM is a global leader in test innovation within the semiconductor and electronics industries. It offers comprehensive test solutions. The company is focused on customer diversification.

Regulatory changes, such as semiconductor-specific tariffs and AI chip export restrictions, pose uncertainty. Slowing momentum from new fabless AI customers could also impact the company. The timing and market receptiveness of new product introductions are also risks.

AEM anticipates a strong recovery in the second half of 2025, driven by key customer device ramp-ups and a recovery in contract manufacturing. The company is confident in its long-term growth prospects, particularly in thermal technology. AEM's strategic plan for 2025-2027 focuses on industry collaboration, member prosperity, and data-driven solutions.

Revenue from Test Cell Solutions (TCS) customers, excluding its key customer, is projected to exceed S$100 million in FY2025. AEM's revenue guidance for the first half of 2025 is between S$155 million and S$170 million. The company expects triple-digit revenue growth from new customers in 2025.

AEM's strategic initiatives include continued investment in research and development to address thermal challenges faced by leading AI and HPC chip manufacturers. The company is focusing on the ramp-up of key customers' devices and a recovery in the contract manufacturing business. For more insights, consider reading about Owners & Shareholders of AEM.

- Customer engineering evaluations of its PX offering are expected to commence in late 2025.

- The company's strategic plan for 2025-2027 focuses on unifying industry priorities.

- AEM aims to drive member prosperity through increased engagement with its resources.

- The company plans to leverage collective member intelligence for data-driven solutions.

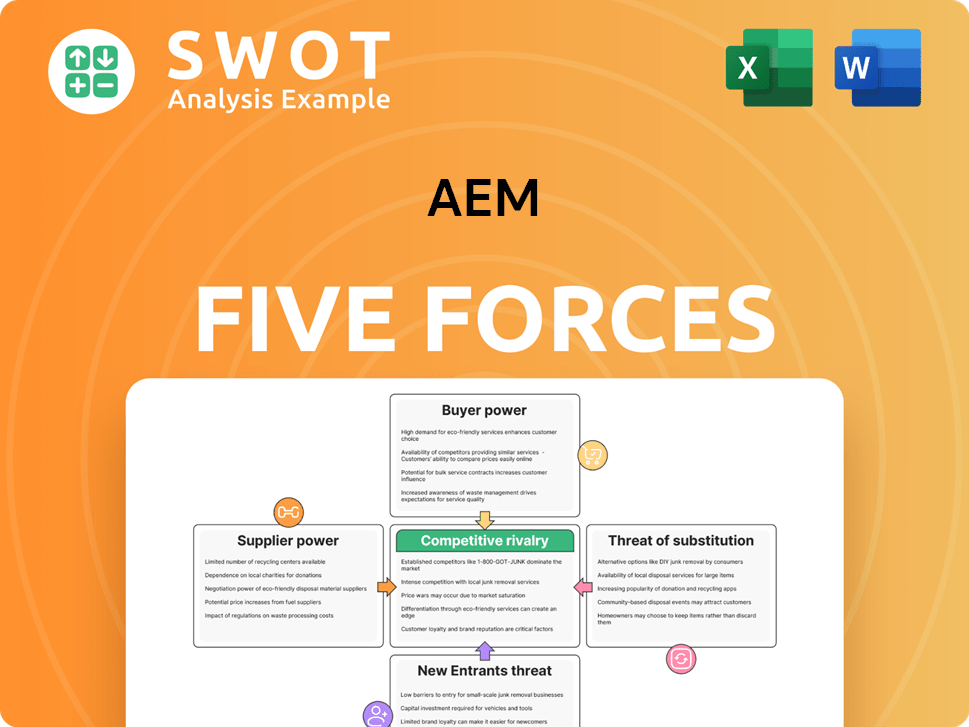

AEM Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AEM Company?

- What is Competitive Landscape of AEM Company?

- What is Growth Strategy and Future Prospects of AEM Company?

- What is Sales and Marketing Strategy of AEM Company?

- What is Brief History of AEM Company?

- Who Owns AEM Company?

- What is Customer Demographics and Target Market of AEM Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.