AEM Bundle

Can AEM Holdings Continue Its Ascent in the Semiconductor Industry?

AEM Holdings Ltd. (AEM) is a pivotal player in the fast-evolving semiconductor and electronics sectors, offering innovative test and handling solutions crucial for optimizing manufacturing. With a strategic focus on high-performance computing and artificial intelligence, AEM has significantly expanded its global presence. This article dives deep into AEM's plans for future growth, examining its strategic initiatives and financial outlook.

From its humble beginnings in Singapore, AEM has transformed into a global leader, serving major semiconductor manufacturers. Understanding the AEM SWOT Analysis is crucial to grasping its competitive strengths and weaknesses. This exploration will provide a comprehensive AEM market analysis, offering insights into its business development strategies and the future of its digital experience platform.

How Is AEM Expanding Its Reach?

The company is actively pursuing several expansion initiatives to strengthen its market presence and diversify its revenue streams. Its strategy encompasses both geographical market penetration and the expansion of its product and service offerings. A key element of the company's growth strategy involves entering new markets by leveraging its existing relationships with global semiconductor leaders and adapting its solutions to regional demands. This approach is designed to capture new customer segments and address the evolving testing requirements of the semiconductor ecosystem.

A significant focus is on expanding its capabilities to support advanced packaging technologies, which are critical for next-generation semiconductors. This includes developing new test handlers and equipment that can accommodate the increased complexity and higher pin counts of these advanced packages. In terms of its product pipeline, the company is investing in the development of new testing solutions for emerging technologies such as silicon photonics and chiplets, which are expected to drive significant growth in the semiconductor industry. These initiatives align with the broader trends in the digital experience platform market, as discussed in Marketing Strategy of AEM.

The company also explores strategic partnerships and potential mergers and acquisitions to accelerate its expansion into new areas or strengthen its position in existing ones. The focus on providing comprehensive solutions, from design validation to manufacturing test, allows it to offer a more integrated value proposition to its customers, further supporting its expansion goals. This strategic approach aims to capitalize on the growing demand for advanced semiconductor testing solutions, driving AEM's business development.

The company is targeting new markets by leveraging existing relationships with global semiconductor leaders. It adapts its solutions to meet regional demands, ensuring relevance and competitiveness. This expansion is crucial for sustaining AEM's growth strategy and increasing its market share.

AEM is expanding its product offerings to include testing solutions for emerging technologies like silicon photonics and chiplets. These solutions are designed to meet the evolving needs of the semiconductor industry. This diversification is a key aspect of the company's future prospects.

The company is exploring strategic partnerships and potential mergers and acquisitions to accelerate expansion. These initiatives aim to strengthen its position in existing markets and enter new areas. Such moves are essential for long-term growth and competitiveness.

The company focuses on providing comprehensive solutions, from design validation to manufacturing test. This integrated approach enhances the value proposition for customers. It also supports expansion goals by addressing a wider range of customer needs.

The company's expansion strategy is focused on several key areas to drive future growth. These include entering new geographical markets, developing advanced testing solutions, and forming strategic partnerships. These initiatives are designed to improve AEM's ROI and enhance its position in the competitive landscape.

- Advanced Packaging Technologies: Investment in new test handlers and equipment.

- Emerging Technologies: Development of testing solutions for silicon photonics and chiplets.

- Strategic Alliances: Exploration of partnerships and mergers and acquisitions.

- Comprehensive Solutions: Focus on providing end-to-end testing solutions.

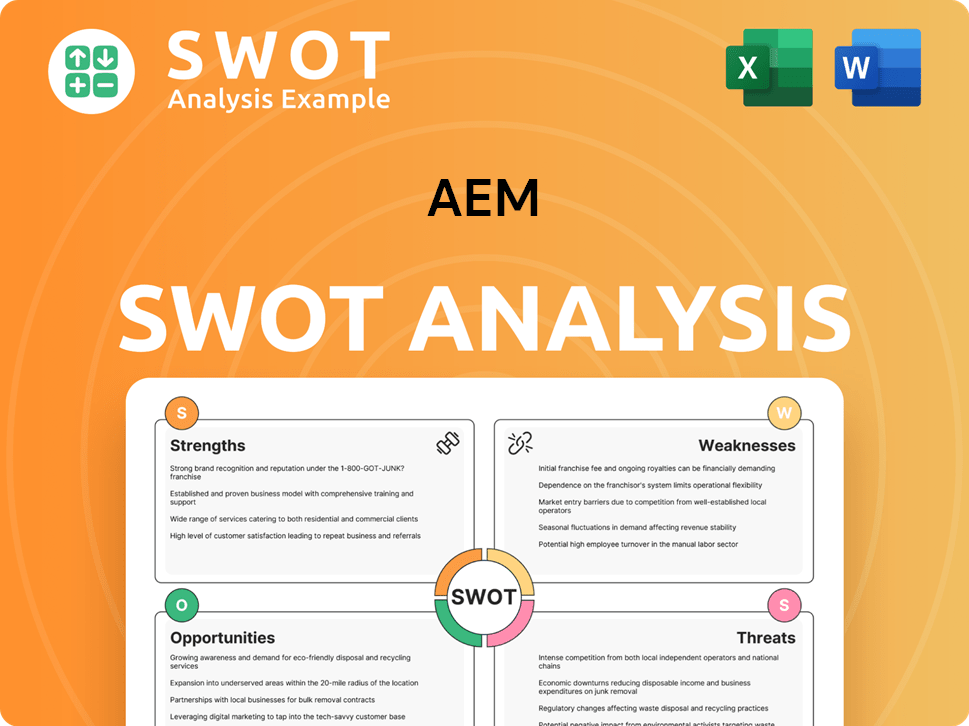

AEM SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AEM Invest in Innovation?

The growth of AEM is closely tied to its innovation and technology strategy. This strategy focuses on significant investments in research and development (R&D) and strategic collaborations. The company consistently invests resources in creating advanced test and handling solutions to meet the increasing demands of semiconductor manufacturing. This includes internal development of sophisticated algorithms for test optimization and precision mechanics for high-throughput handling systems.

AEM's approach to digital transformation is evident in its efforts to integrate automation and data analytics into its equipment. This integration enables predictive maintenance and enhances operational efficiency for its clients. The company is actively exploring and incorporating cutting-edge technologies like artificial intelligence (AI) and the Internet of Things (IoT) into its product offerings to enhance testing capabilities and provide more insightful data to its customers.

For example, AI-powered defect detection and predictive analytics for equipment performance are key areas of focus. AEM's commitment to sustainability initiatives also plays a role in its innovation, as it develops more energy-efficient and environmentally friendly testing solutions. These technological advancements directly contribute to AEM's growth objectives by enabling the company to offer higher-value solutions, secure new contracts, and maintain its competitive edge in a rapidly evolving industry.

AEM allocates a significant portion of its revenue to research and development. This investment is crucial for staying ahead in the competitive semiconductor testing market. The focus is on developing cutting-edge solutions to meet the evolving needs of the industry.

The company is actively integrating AI and IoT technologies into its products. This integration enhances testing capabilities and provides valuable data insights. AI-powered defect detection and predictive analytics are key areas of focus.

AEM is committed to sustainability, developing energy-efficient and environmentally friendly testing solutions. This commitment aligns with the growing demand for sustainable practices in the semiconductor industry. These initiatives are part of the company's broader growth strategy.

AEM is focused on digital transformation by integrating automation and data analytics. This enhances operational efficiency and enables predictive maintenance. This approach helps clients optimize their processes.

Strategic partnerships are crucial for AEM's innovation strategy. These collaborations help in accessing new technologies and expanding market reach. They enable the company to offer comprehensive solutions.

The company's technological advancements help maintain a competitive edge in the market. By offering higher-value solutions, AEM secures new contracts. This focus on innovation drives long-term growth.

AEM's commitment to innovation and technology directly impacts its ability to achieve its growth objectives. The company's focus on R&D, AI, IoT, and sustainability initiatives enables it to offer advanced solutions and maintain a competitive edge. For more information, you can read a brief history of AEM.

- Increased Revenue: By offering advanced solutions, AEM can secure new contracts and increase its revenue.

- Market Expansion: Technological advancements enable AEM to expand its market reach and enter new segments.

- Customer Satisfaction: Enhanced testing capabilities and data insights lead to higher customer satisfaction.

- Operational Efficiency: Integration of automation and data analytics improves operational efficiency.

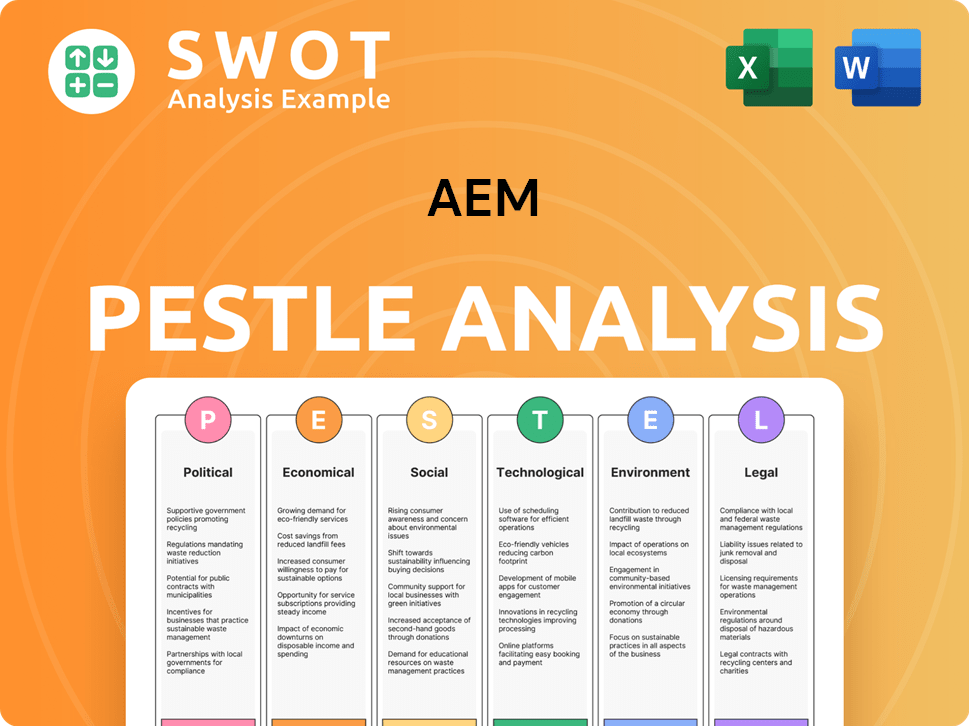

AEM PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is AEM’s Growth Forecast?

The financial performance of AEM Holdings Ltd. is a key indicator of its strategic direction and future prospects. For the fiscal year ending December 31, 2024, the company reported a revenue of S$480.0 million, demonstrating its market position and operational efficiency. This solid revenue base is critical for supporting its ambitious growth strategies within the dynamic semiconductor industry.

AEM's financial health is further underscored by a net profit of S$28.3 million for the same period. This profitability allows the company to reinvest in critical areas such as research and development, ensuring it remains at the forefront of technological advancements. The company's ability to generate profits is crucial for sustaining its competitive edge and driving long-term value creation.

Looking ahead, AEM anticipates a revenue guidance of S$460 million to S$520 million for the financial year 2025. This projection reflects a balanced perspective, acknowledging the cyclical nature of the semiconductor market while also expressing optimism about the company's growth potential. This outlook is supported by AEM's focus on high-growth segments, particularly those related to advanced packaging and AI, which are expected to drive future revenue streams.

In 2024, AEM recorded revenues of S$480.0 million and a net profit of S$28.3 million. These figures highlight the company's robust financial performance and its ability to generate profits in a competitive market. The strong profitability provides resources for strategic investments and expansion.

For 2025, AEM projects revenues between S$460 million and S$520 million. This forecast takes into account the cyclical nature of the semiconductor industry. The guidance reflects a cautious yet optimistic outlook, supported by strategic focus areas.

AEM continues to invest significantly in research and development. These investments are critical for driving innovation. This commitment to innovation is a key driver of future revenue and market leadership.

The company's strong balance sheet and cash flow generation provide financial flexibility. This allows AEM to pursue strategic expansion initiatives, including potential mergers and acquisitions. This financial strength supports long-term growth.

AEM is concentrating on high-growth segments within the semiconductor market. This includes advanced packaging and AI-related applications. By targeting these areas, AEM aims to capitalize on emerging opportunities and drive revenue growth.

The company's financial strategy is designed to maximize shareholder value. This is achieved through strategic investment and disciplined capital allocation. AEM's financial management aims to deliver sustainable returns.

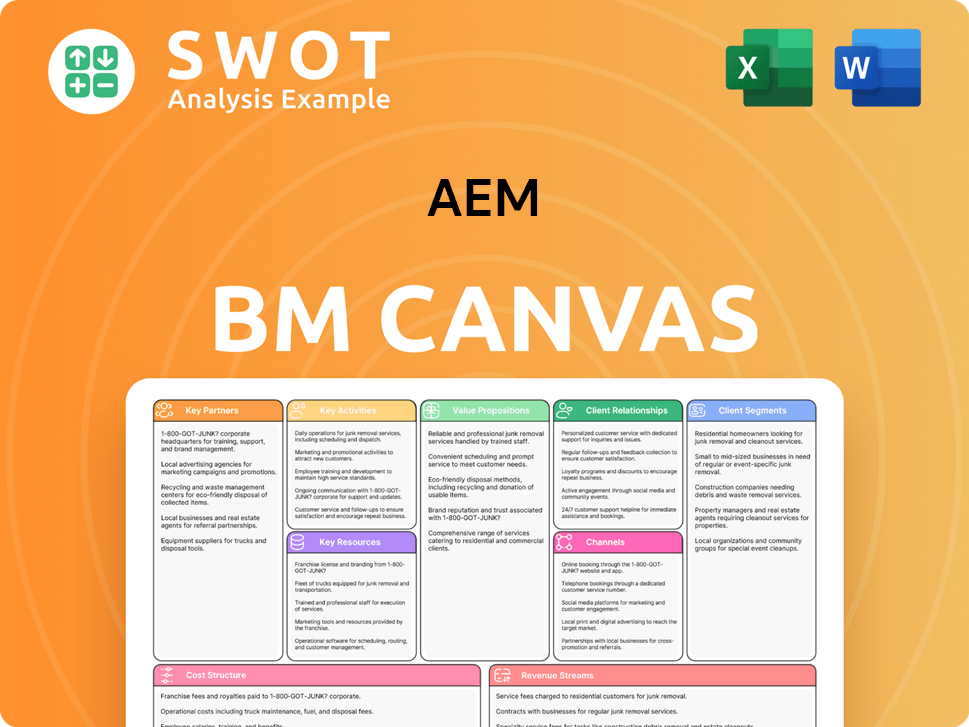

AEM Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow AEM’s Growth?

The path to growth for AEM is not without its challenges. The semiconductor industry is intensely competitive, with established players and new entrants constantly vying for market share. The company must continuously innovate to keep pace with evolving semiconductor architectures and testing requirements.

Regulatory changes, especially those concerning international trade and technology transfers, could impact AEM's global operations and supply chain. Supply chain vulnerabilities, including reliance on specific component suppliers or geopolitical events, could disrupt manufacturing and delivery schedules.

To mitigate these risks, AEM focuses on diversifying its customer base and product offerings, implementing robust risk management frameworks, and proactive scenario planning. The company's ability to adapt to these challenges will be crucial for its sustained growth trajectory, especially in a rapidly changing market.

The semiconductor market is highly competitive, with numerous companies vying for market share. Competition can lead to price pressures and the need for continuous innovation. This requires significant investment in research and development to stay ahead.

Rapid technological advancements pose a constant threat. The company must adapt quickly to new architectures and testing requirements. Failure to do so could result in a loss of market share to competitors.

Reliance on specific suppliers or disruptions in the supply chain can impact manufacturing. Geopolitical events and raw material availability are critical factors. Diversifying suppliers and exploring regional manufacturing options are essential strategies.

Changes in international trade and technology transfer regulations can affect global operations. Compliance with new regulations can be costly and time-consuming. Proactive monitoring and adaptation are crucial.

The semiconductor industry is cyclical, and economic downturns can reduce demand. Focusing on long-term strategic partnerships and investing in technologies less susceptible to short-term fluctuations is vital. AEM's management has demonstrated its ability to navigate downturns.

Geopolitical events can disrupt supply chains and impact market access. Companies must monitor these risks and develop contingency plans. Diversification of operations can help mitigate these risks.

AEM addresses these risks through various strategies. These include diversifying its customer base and product offerings to reduce reliance on any single customer or product. The company also implements robust risk management frameworks to identify and mitigate potential threats proactively. Furthermore, proactive scenario planning helps the company prepare for unexpected events and market changes. For more information about the AEM market analysis, check out Target Market of AEM.

Strengthening supply chain resilience is a key focus. This involves working with multiple vendors to ensure access to components. Exploring regional manufacturing options can also reduce the impact of geopolitical events. These strategies aim to create a more robust and flexible supply chain. In 2024, the semiconductor industry saw significant supply chain disruptions, highlighting the need for these proactive measures. The AEM business development will depend on its ability to manage these risks.

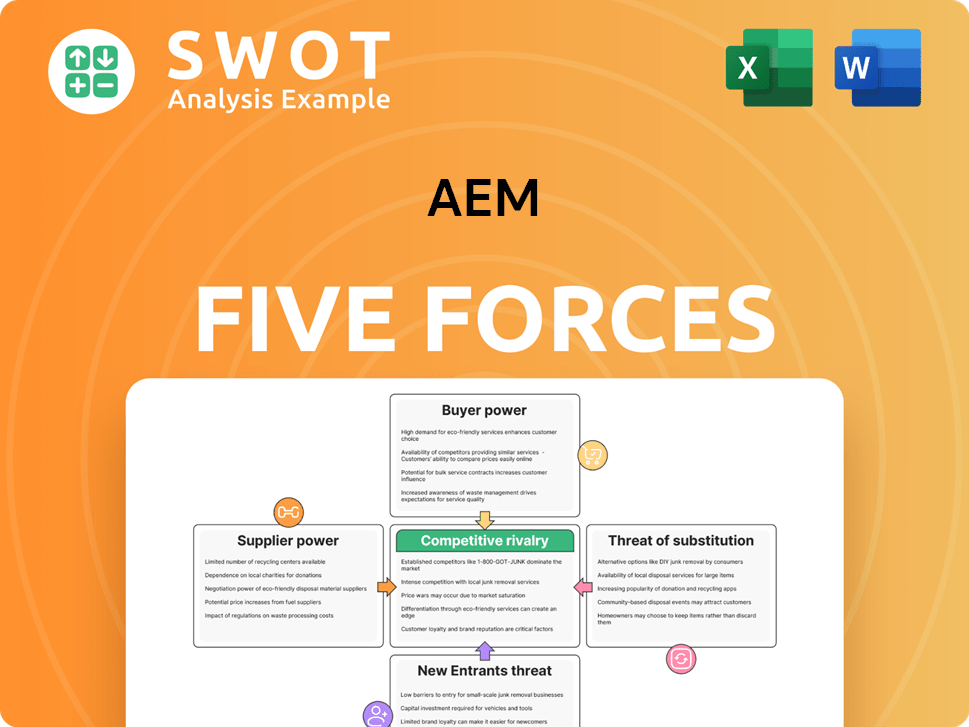

AEM Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.