AGL Bundle

How Well Do You Know the AGL Company's Past?

Journey back in time to uncover the fascinating AGL SWOT Analysis of AGL Australia, a company that has illuminated Australian homes and businesses for nearly two centuries. From its inception as the nation's first gas company in 1837, AGL's story is a compelling narrative of innovation, resilience, and adaptation within the ever-evolving Australian energy sector. Discover the pivotal moments that shaped this energy provider into the powerhouse it is today.

This brief history delves into the AGL history, exploring its transformation from a gas lighting pioneer to a leading integrated energy provider. Understanding AGL's early years and key milestones provides valuable context for analyzing its current market position and future prospects. Explore how AGL company navigated challenges and embraced opportunities, shaping its legacy within the Australian energy landscape.

What is the AGL Founding Story?

The AGL company, a significant player in the Australian energy market, has a rich

AGL history

dating back to the early days of urban development in Australia. The company's origins are deeply rooted in the need for modern infrastructure to support a growing city.The

AGL Australia

story began in 1837 with the formal establishment of the Australian Gas Light Company in Sydney. This marked the start of the company's journey to become a leadingenergy provider

in the region. The primary goal was to bring efficient lighting to the city, a critical need for urban growth and safety.The Australian Gas Light Company was founded in 1837 in Sydney, driven by 'An Act for lighting with Gas the Town of Sydney.' This legislation set the stage for the company's initial focus on urban gas lighting.

- In 1841, AGL lit the first gas lamp in Australia, marking a significant achievement.

- Within two years, the company had installed a total of 166 gas lamps in Sydney.

- AGL introduced gas purification, expanding the use of town gas for lighting homes.

- The company became the second to list on the Sydney Stock Exchange in 1871, highlighting its early success.

The initial challenge for the company was to address the lack of effective lighting in Sydney, a problem that hindered both public safety and urban development. The company's business model centered on providing town gas for lighting purposes.

A major achievement came in 1841 when AGL lit the first gas lamp in Australia, specifically a street lamp in Sydney. Within two years, the company had installed an additional

165

gas lamps, demonstrating the rapid expansion of its infrastructure. AGL also introduced gas purification, enabling the use of town gas for lighting homes.The company's early success and importance in the public sphere were further solidified when it became the second company to list on the Sydney Stock Exchange in 1871. While the names of the founders are not extensively detailed, the company's creation was strongly influenced by the demands of a growing colonial city that needed modern infrastructure.

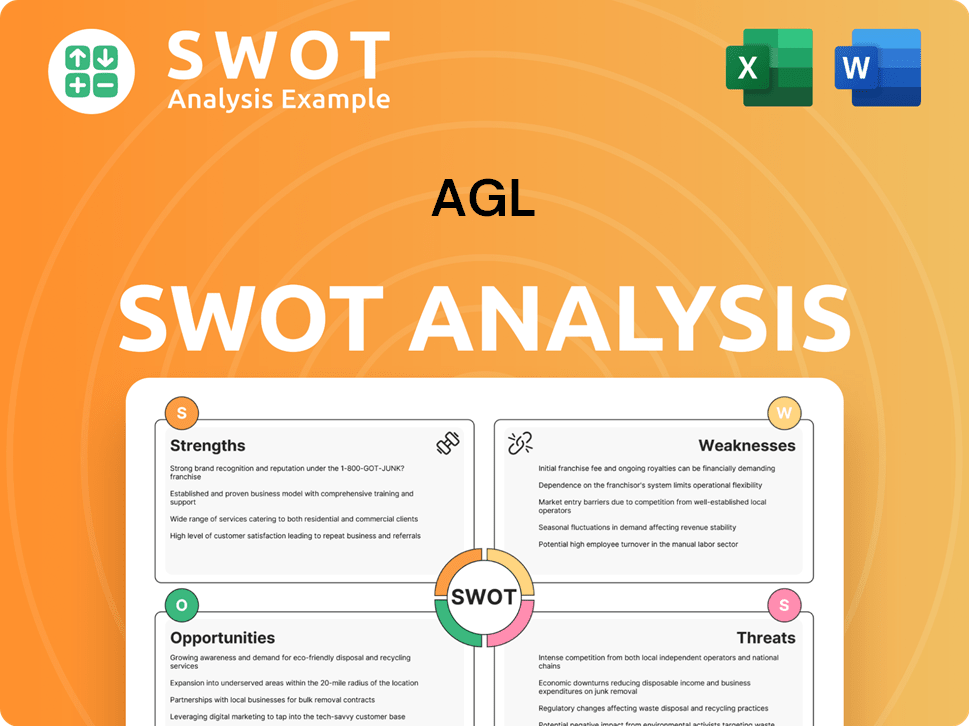

AGL SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of AGL?

The early growth and expansion of the AGL company, a significant player in the Australian energy market, involved a gradual diversification from its initial gas lighting services. This expansion included strategic moves within the Australian energy sector and into new markets. The company's history is marked by key acquisitions and ventures that have shaped its current position as a leading energy provider.

In the 1850s, AGL's gas lighting facilitated late-night shopping in Australia and introduced gas purification for residential use. A major milestone was becoming the second company listed on the Sydney Stock Exchange in 1871. By 1873, AGL imported Australia's first gas-cooking stove, and in the 1890s, it opened the first gas cooking showroom in Sydney, offering free cooking classes. These early innovations and strategic moves set the stage for future growth.

Over time, AGL diversified into electricity and expanded its operations across Australia. In 2000, it formed ActewAGL, a joint venture with Icon Water. International expansion included acquiring Transalta NZ's electricity retail business in 2001, though this was later sold at a loss. These steps reflect the company's evolving business model.

A significant restructuring occurred on October 6, 2006, when the Australian Gas Light Company and Alinta merged and then separated, leading to the creation of AGL Energy Ltd. Key acquisitions included the Loy Yang A Power Station and the adjacent Loy Yang coal mine in Victoria in June 2012, adding 2,200 MW of capacity. In September 2020, AGL acquired Click Energy for $115 million.

In late 2020 and early 2021, AGL ventured into telecommunications, launching broadband internet services and AGL Mobile. As of December 31, 2024, AGL supplied around 4.5 million energy, telecommunications, and Netflix customer services, demonstrating substantial growth and diversification. Further insights into the company's journey can be found in a detailed AGL company profile.

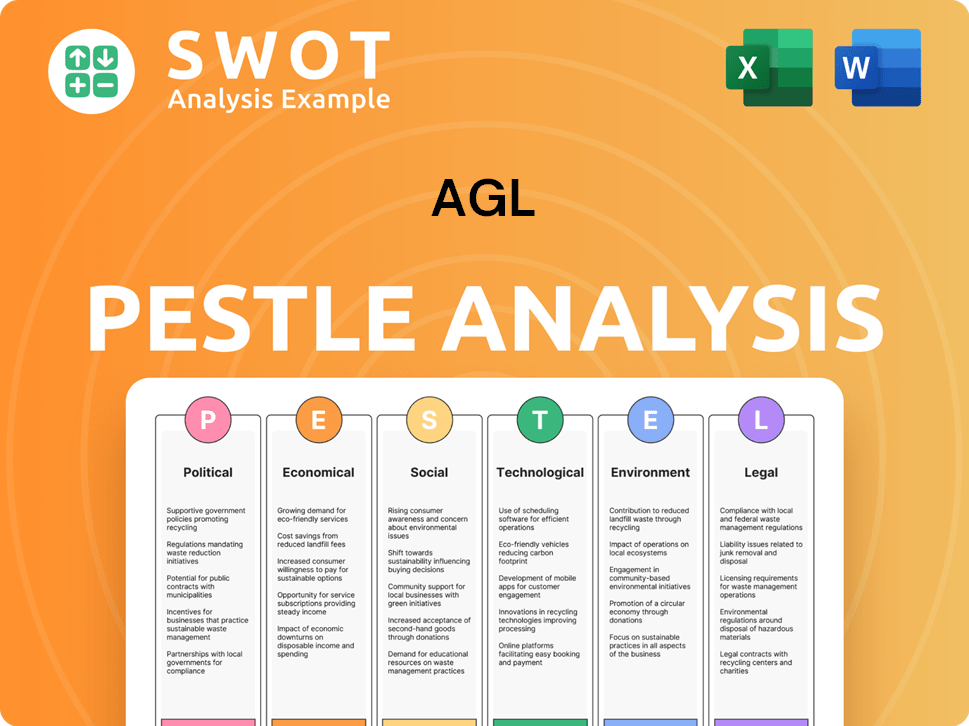

AGL PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in AGL history?

The AGL company has a rich history marked by significant milestones, innovations, and responses to challenges, particularly in the context of the Australian energy market. The company's evolution reflects its adaptation to changing energy landscapes and its commitment to sustainability.

| Year | Milestone |

|---|---|

| 2016 | Successful trial of a virtual power plant (VPP) concept, connecting solar batteries in homes. |

| 2020 | Launched the AGL Assistant, an AI-powered self-service tool to improve customer experience. |

| FY24 | Development pipeline for renewable and firming assets almost doubled to 6.2 GW. |

| FY24 | 800 MW of grid-scale batteries in operation, testing, or under construction. |

| December 2024 | Federal Court order to pay $25 million in penalties for failing to comply with overcharging obligations related to Centrepay payments. |

| February 2025 | AGL appealed the Federal Court order regarding the Centrepay payments. |

One of the key innovations for the Australian energy provider has been the development and national rollout of its virtual power plant (VPP), which integrates residential solar batteries. Furthermore, the company has invested in advanced technologies, such as the AI-powered AGL Assistant, to enhance customer service and streamline operations.

The VPP connects solar batteries in homes, forming a distributed energy resource. After a successful trial in 2016, it was rolled out nationally.

Launched in early 2020, this AI-powered self-service tool aimed to enhance customer experience. This led to a reported over 30-point Net Promoter Score improvement in the past five years.

The company faces considerable challenges, particularly in transitioning from its reliance on coal-fired power stations. The unpredictable regulatory environment and rising gas costs, as legacy supply contracts expire, also pose significant hurdles for the AGL company.

As Australia's largest electricity generator, exiting coal-fired generation by the end of FY35 is a major challenge. This transition requires significant investment in renewable energy and firming capacity.

The company is exposed to an estimated decline in EBITDA of approximately -$300 million from FY27 to FY30 due to the roll-off of gas and coal contracts. Recent legal penalties also present financial challenges.

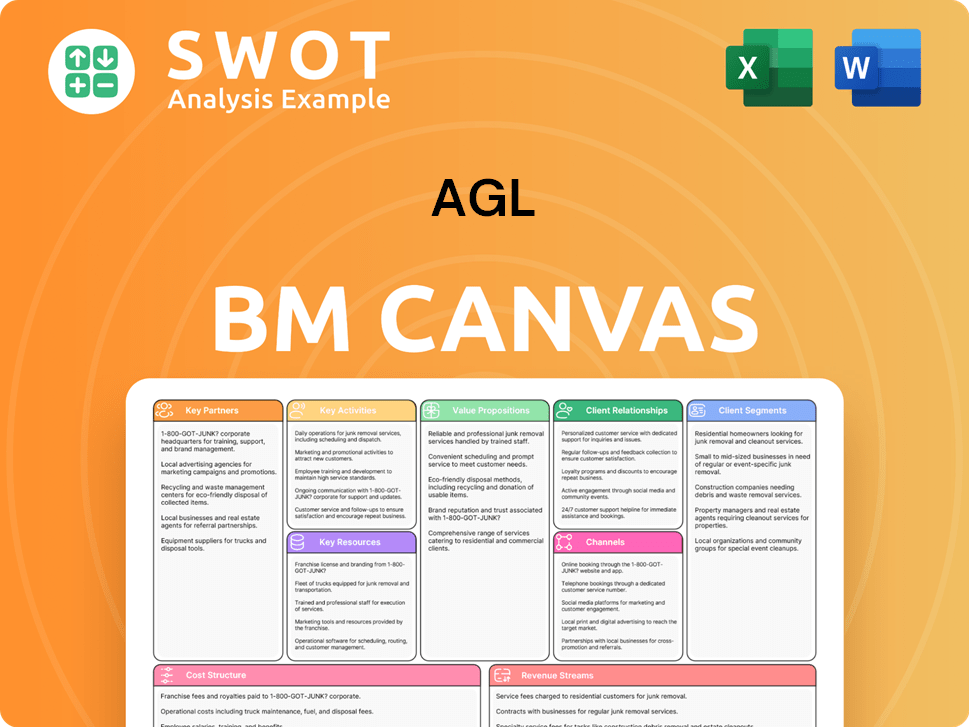

AGL Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for AGL?

The AGL company has a rich AGL history dating back to the 19th century, marked by significant milestones and strategic shifts. From its origins as the first gas company in Australia to its current focus on renewable energy, AGL Australia has consistently adapted to the evolving energy landscape.

| Year | Key Event |

|---|---|

| 1837 | The Australian Gas Light Company is formed in Sydney, marking the beginning of AGL. |

| 1841 | AGL lights Australia's first gas street lamp in Sydney. |

| 1871 | AGL becomes the second company to list on the Sydney Stock Exchange. |

| 1971 | Liddell Power Station commences operation. |

| October 2000 | ActewAGL, a joint venture, is formed. |

| 2006 | The Australian Gas Light Company and Alinta merge and restructure, creating AGL Energy Ltd. |

| June 2012 | AGL acquires Loy Yang A Power Station and Loy Yang Coal Mine. |

| 2016 | AGL successfully trials its virtual power plant (VPP) concept, later rolled out nationally. |

| June 2017 | AGL announces the development of the Barker Inlet Power Station in South Australia. |

| Early 2020 | Barker Inlet Power Station is completed; AGL launches its AI-powered AGL Assistant. |

| September 2020 | AGL acquires energy retailer Click Energy for $115 million. |

| November 2020 | AGL begins selling broadband internet services. |

| February 2021 | AGL launches AGL Mobile, a mobile phone service provider. |

| April 2023 | Liddell Power Station closes after almost 52 years of operation. |

| August 2023 | The 250 MW / 250 MWh Torrens Island Battery is completed. |

| August 2024 | AGL's Annual Report for FY24 is released, highlighting a 23.3% reduction in Scope 1 and 2 greenhouse gas emissions against a FY19 baseline. AGL also acquires Firm Power and Terrain Solar, adding 5.8GW to its development pipeline. |

| November 2024 | AGL secures approval for its 500MW/2,000MWh Tomago battery energy storage system (BESS) in New South Wales. |

| December 2024 | AGL is ordered to pay $25 million in penalties related to Centrepay overcharging. |

| February 2025 | AGL releases its HY25 Half-Year results, reporting a 1% decrease in Underlying EBITDA to $1.07 billion and a 7% decrease in Underlying Net Profit After Tax (NPAT) to $373 million for the six months to December 31, 2024. AGL also announces a clear pathway to Financial Investment Decision (FID) for 1.4 GW of batteries over the next 12-18 months. |

| May 2025 | AGL acquires Upper Hunter pumped hydro projects. AGL submits plans to expand the Kwinana swift power station (KSPS) by 250 MW by 2029. |

AGL is committed to exiting coal-fired generation by the end of FY35, with Bayswater Power Station targeted for closure in 2033 and Loy Yang A Power Station in 2035. The company aims to significantly reduce its carbon footprint through strategic closures of coal-fired plants.

AGL plans to develop 12 gigawatts of new renewable energy capacity by 2035 and 12 GW by 2036, with 5.4 GW by the end of 2030. This expansion includes investments in solar, wind, and battery storage projects to meet growing energy demands.

AGL is investing heavily in battery energy storage systems (BESS), targeting 1.4 GW of battery capacity to reach a Financial Investment Decision within the next 12-18 months. The construction of the 500 MW Liddell Battery is progressing, with the first 250 MW expected to be operational by early 2026 and the remaining 250 MW by April 2026.

AGL is focused on digital transformation and enhancing customer experience through innovative technologies. The company anticipates a consistent growth rate of 5% annually over the next five years, driven by its transition to cleaner energy solutions and strategic investments in technology.

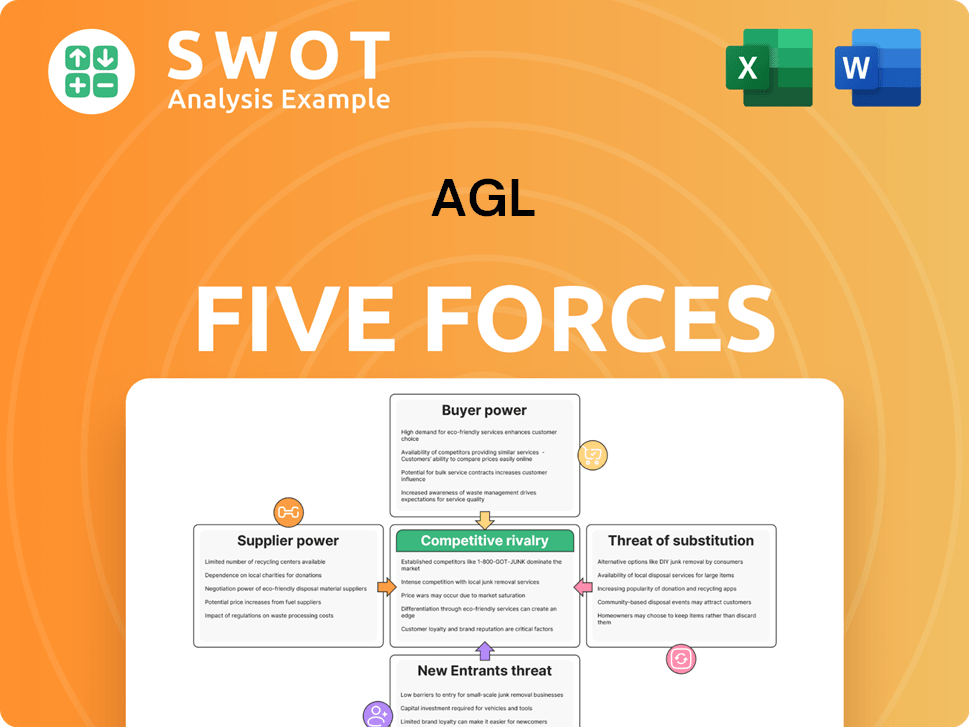

AGL Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of AGL Company?

- What is Growth Strategy and Future Prospects of AGL Company?

- How Does AGL Company Work?

- What is Sales and Marketing Strategy of AGL Company?

- What is Brief History of AGL Company?

- Who Owns AGL Company?

- What is Customer Demographics and Target Market of AGL Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.