AGL Bundle

Can AGL Energy Thrive in the Renewable Revolution?

The Australian energy sector is at a pivotal juncture, demanding a rapid shift towards sustainability. For AGL, a company with a rich history dating back to 1837, this transformation presents both hurdles and chances. Understanding AGL's AGL SWOT Analysis is crucial for grasping its position in this evolving market.

This in-depth AGL company analysis will explore the AGL growth strategy, examining its strategic initiatives and how it plans to navigate the complexities of the energy market. We'll delve into AGL's future prospects, analyzing its expansion plans, investment in renewable energy, and its approach to sustainability. Moreover, we will assess AGL's long-term growth potential within the Australian energy sector, considering both the challenges and opportunities it faces in this dynamic environment.

How Is AGL Expanding Its Reach?

The AGL growth strategy is centered on a multi-faceted expansion plan. This plan focuses on transforming its energy portfolio, entering new markets, and improving customer offerings. This strategic shift is in response to the evolving dynamics of the Australian energy sector and the global push for sustainability. These initiatives are designed to diversify revenue streams, attract new customer segments, and align the company with Australia's renewable energy transition goals.

A key component of AGL's strategy is the accelerated decarbonization of its generation fleet. The company is actively investing in renewable energy sources and reducing its reliance on fossil fuels. AGL’s future prospects are closely tied to its ability to successfully execute these initiatives and adapt to the changing energy landscape.

The company aims to exit coal-fired generation by the end of FY35, with the closure of its Loy Yang A power station by 2035. To replace this capacity and meet growing demand for renewable energy, AGL is investing significantly in new grid-scale renewable and firming capacity, targeting 12 GW by 2035. This commitment underscores AGL's dedication to sustainability and its role in the Australian energy sector.

AGL is heavily investing in renewable energy projects to meet its decarbonization goals. These investments are crucial for AGL's strategic initiatives and its long-term growth potential. The company's focus on renewable energy is a key factor in its market share analysis and its ability to compete in the evolving energy market.

AGL is exploring opportunities beyond traditional energy retail to diversify its revenue streams. This includes providing energy services for electric vehicles and developing smart home energy solutions. These initiatives are designed to attract new customer segments and align the company with Australia's renewable energy transition goals.

AGL’s FY24 half-year results highlighted significant progress in its transformation. The underlying profit after tax increased by 23% to $399 million, demonstrating the early successes of these strategic shifts. This positive financial performance reflects the effectiveness of AGL's expansion plans and its ability to adapt to the competitive landscape.

The company is focusing on projects like the proposed 250 MW Torrens Island battery and the 500 MW Liddell battery, both expected to be operational in the coming years. Furthermore, AGL is expanding its distributed energy resources, including virtual power plants and residential battery solutions. These projects are crucial for AGL's carbon emissions reduction targets and its overall sustainability goals.

AGL's expansion initiatives are designed to drive growth and adapt to the changing energy market. These initiatives are central to AGL's long-term growth potential and its ability to overcome challenges. AGL is also focused on its customer acquisition strategy.

- Accelerated decarbonization of the generation fleet.

- Investment in grid-scale renewable and firming capacity, targeting 12 GW by 2035.

- Expansion of distributed energy resources, including virtual power plants and residential battery solutions.

- Exploration of opportunities beyond traditional energy retail, such as energy services for electric vehicles and smart home energy solutions.

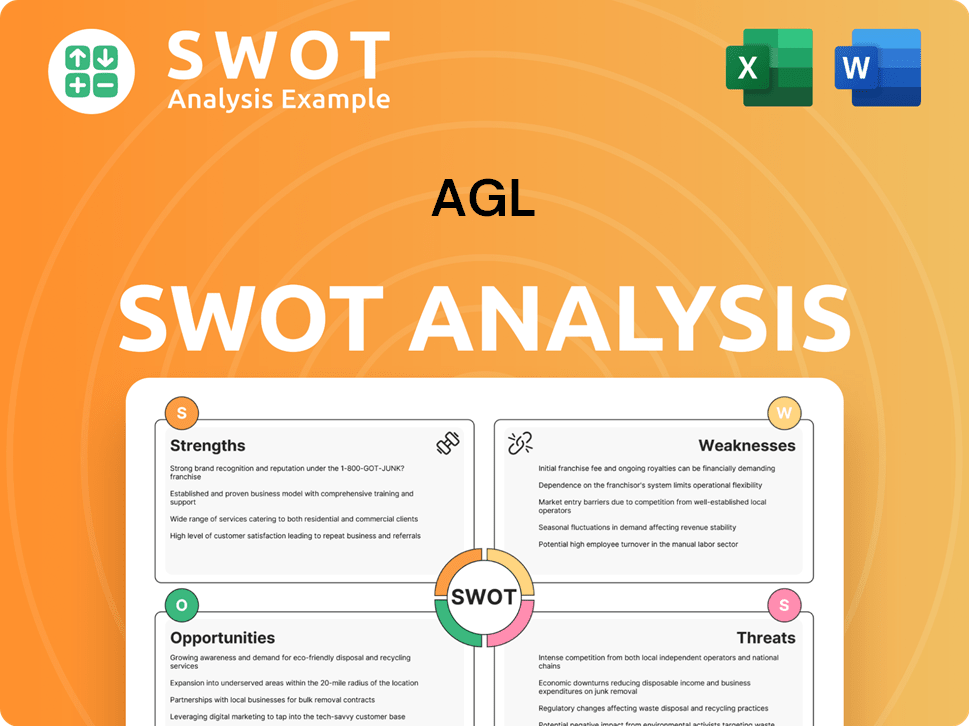

AGL SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AGL Invest in Innovation?

The innovation and technology strategy of AGL is crucial for its sustained growth, focusing on digital transformation, advanced energy solutions, and sustainable practices. This approach is designed to drive the AGL growth strategy, creating new revenue streams and solidifying its position in Australia's evolving energy landscape.

A key element of AGL's strategy involves significant investments in digital platforms. These platforms enhance customer experience, streamline operations, and facilitate the introduction of new energy services. The company is also leveraging data analytics to better understand customer needs and optimize energy consumption, which is vital for its AGL future prospects.

Furthermore, AGL is actively exploring and deploying cutting-edge technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT). These technologies are used to improve grid management, predict energy demand, and enhance the efficiency of its generation assets. For example, AI-driven platforms are being utilized for predictive maintenance at power plants, minimizing downtime and maximizing output, which is a key aspect of AGL company analysis.

AGL is investing in digital platforms to enhance customer experience and streamline operations.

Sophisticated data analytics capabilities are being developed to better understand customer needs and optimize energy consumption.

AI and IoT are being utilized to improve grid management, predict energy demand, and enhance the efficiency of generation assets.

AGL is a significant investor in renewable energy technologies, including large-scale solar, wind, and battery storage projects.

The company is exploring hydrogen as a future energy source, recognizing its potential for decarbonization across various sectors.

Significant capital expenditure, with $445 million invested in the first half of FY24, much of which is directed towards growth projects and IT.

In the realm of sustainability, AGL is a significant investor in renewable energy technologies, including large-scale solar, wind, and battery storage projects. The company's commitment to renewable energy is evident in its grid-scale battery projects, such as the Torrens Island and Liddell batteries. These projects provide essential firming capacity for a renewable-dominated grid. AGL is also exploring hydrogen as a future energy source, recognizing its potential for decarbonization across various sectors. These technological advancements and innovation efforts are designed to reduce operational costs and create new revenue streams. For more insights into AGL's marketing strategies, consider reading about the Marketing Strategy of AGL.

AGL's strategic focus includes digital transformation, advanced energy solutions, and sustainable practices to drive growth and efficiency in the Australian energy sector.

- Digital Platforms: Enhancing customer experience and streamlining operations.

- Data Analytics: Optimizing energy consumption and understanding customer needs.

- AI and IoT: Improving grid management and generation asset efficiency.

- Renewable Energy: Investing in solar, wind, and battery storage projects.

- Hydrogen: Exploring hydrogen as a future energy source.

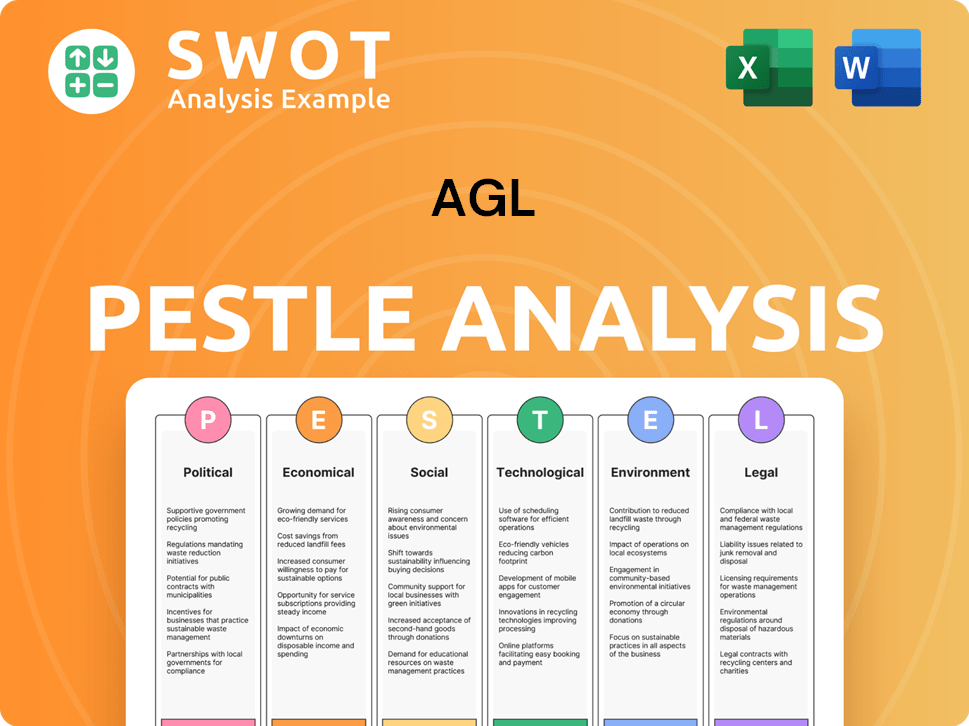

AGL PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is AGL’s Growth Forecast?

The financial outlook for AGL is shaped by its strategic shift towards a decarbonized and customer-focused energy model. This approach prioritizes sustainable earnings growth within the dynamic Australian energy sector. The company's focus on renewable energy and effective portfolio management is central to its financial strategy.

In the first half of FY24, AGL demonstrated strong financial performance. Underlying profit after tax increased by 23%, reaching $399 million, while underlying EBITDA grew by 11% to $879 million. These results reflect improved wholesale market conditions and successful portfolio management. This positive trajectory supports the company's commitment to its long-term growth potential.

AGL's financial strategy is deeply intertwined with its decarbonization pathway, aiming to deliver consistent returns to shareholders while investing in the energy transition. The company's commitment to sustainability goals is evident in its capital allocation strategy, which prioritizes investments in new renewable and firming capacity. A deeper understanding of the company's origins can be found in a brief history of AGL.

AGL has reaffirmed its FY24 underlying profit after tax guidance, expecting it to be between $780 million and $930 million, demonstrating confidence in its strategic initiatives. This forecast highlights the company's ability to navigate the challenges and opportunities within the energy market.

The company’s capital allocation strategy prioritizes investments in its transition, including the development of new renewable and firming capacity. This approach supports AGL's expansion plans and its commitment to renewable energy projects, contributing to its long-term growth potential.

AGL's strong financial position is supported by a healthy operating cash flow, which reached $680 million in the first half of FY24. This financial health enables AGL to invest in its strategic initiatives and pursue its sustainability goals.

Analyst forecasts generally align with AGL's positive outlook, recognizing the challenges of the energy transition but also acknowledging the company's proactive measures and strategic investments. This positive sentiment supports AGL's share price forecast.

AGL's financial performance reflects its commitment to adapting to the energy transition. Key metrics include:

- 23% increase in underlying profit after tax in the first half of FY24.

- 11% increase in underlying EBITDA in the first half of FY24.

- FY24 underlying profit after tax guidance between $780 million and $930 million.

- Operating cash flow of $680 million in the first half of FY24.

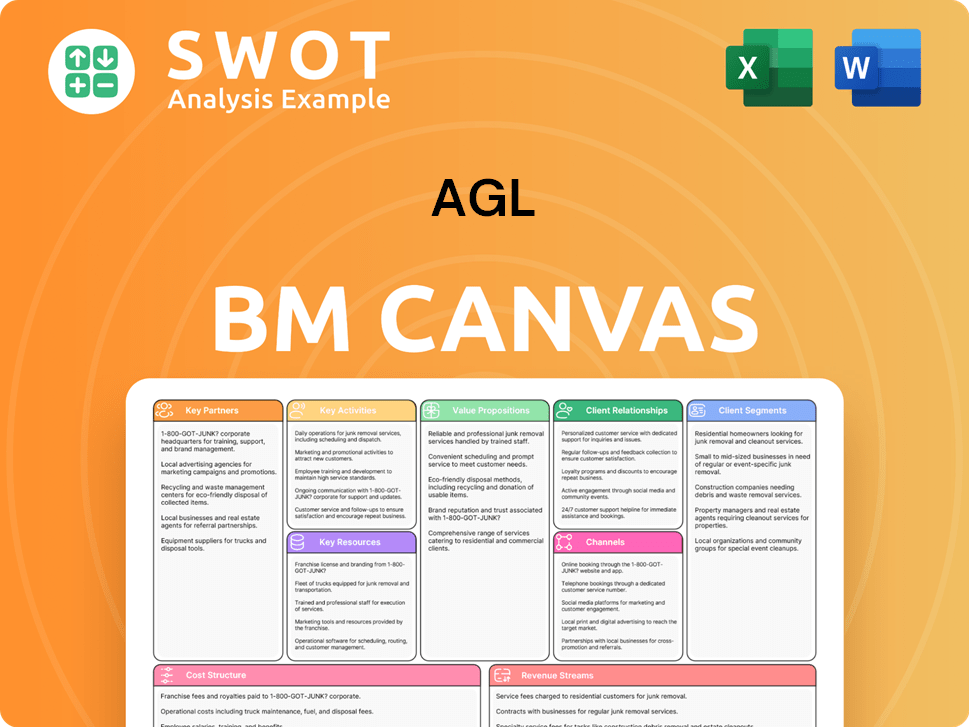

AGL Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow AGL’s Growth?

The future of AGL is subject to a number of risks and obstacles inherent in the dynamic energy sector. These challenges range from regulatory shifts to competitive pressures and operational complexities. Understanding these potential pitfalls is crucial for assessing AGL's long-term growth potential and its ability to navigate the evolving energy landscape.

One of the main hurdles is the fast pace of change in regulations and policies concerning climate change and renewable energy goals within Australia. Shifting government stances can affect investment certainty for new projects and market mechanisms. Additionally, AGL faces intense competition from new entrants in the renewable energy space, as well as evolving customer preferences for distributed energy solutions. Supply chain vulnerabilities, especially for key components of renewable energy projects and battery storage, could lead to delays and increased costs.

The successful implementation of AGL's decarbonization strategy, which involves retiring coal-fired power plants and developing significant new renewable capacity, presents complex operational and financial challenges. Cybersecurity threats to critical energy infrastructure and digital platforms also pose an increasing concern. A comprehensive risk management framework, including scenario planning for different market and regulatory outcomes, is essential for AGL to navigate these obstacles. For an in-depth look at AGL's customer base, check out the article on Target Market of AGL.

Changes in government policies related to climate change and renewable energy targets can significantly impact AGL's investment strategies. Shifting policies can affect the economics of new projects and market mechanisms, potentially increasing uncertainty. The Australian energy sector is highly regulated, making it susceptible to policy-driven volatility.

The energy market is becoming increasingly competitive with new entrants in the renewable energy sector. Existing competitors and new players are vying for market share, potentially squeezing profit margins. Evolving customer preferences for distributed energy solutions also pose a competitive challenge.

Supply chain disruptions, particularly for essential components of renewable energy projects and battery storage, can lead to project delays and increased costs. Geopolitical events and global economic conditions can exacerbate these vulnerabilities. Securing reliable supply chains is critical for project execution.

The execution of AGL's decarbonization strategy, including the decommissioning of coal-fired power plants and the development of new renewable capacity, presents complex operational and financial challenges. Managing the transition while ensuring grid stability and meeting customer demand is crucial. The transition requires substantial capital investment.

Cybersecurity threats to critical energy infrastructure and digital platforms are a growing concern. Protecting against cyberattacks is essential to maintain the reliability of the energy supply and protect sensitive data. The increasing reliance on digital technologies increases the risk.

Integrating large-scale intermittent renewables into the grid poses technical challenges. Managing the variability of solar and wind energy requires advanced grid management systems and energy storage solutions. Ensuring grid stability with a high penetration of renewables is critical.

AGL employs a comprehensive risk management framework, including scenario planning for different market and regulatory outcomes. The company actively diversifies its energy portfolio to reduce reliance on any single generation source. Investments in robust cybersecurity measures are also a key part of their strategy.

These risks can affect AGL's financial performance, including revenue, profitability, and investment returns. Delays in projects, increased costs, and lower market share can impact financial results. The company's ability to manage these risks will influence its long-term financial health.

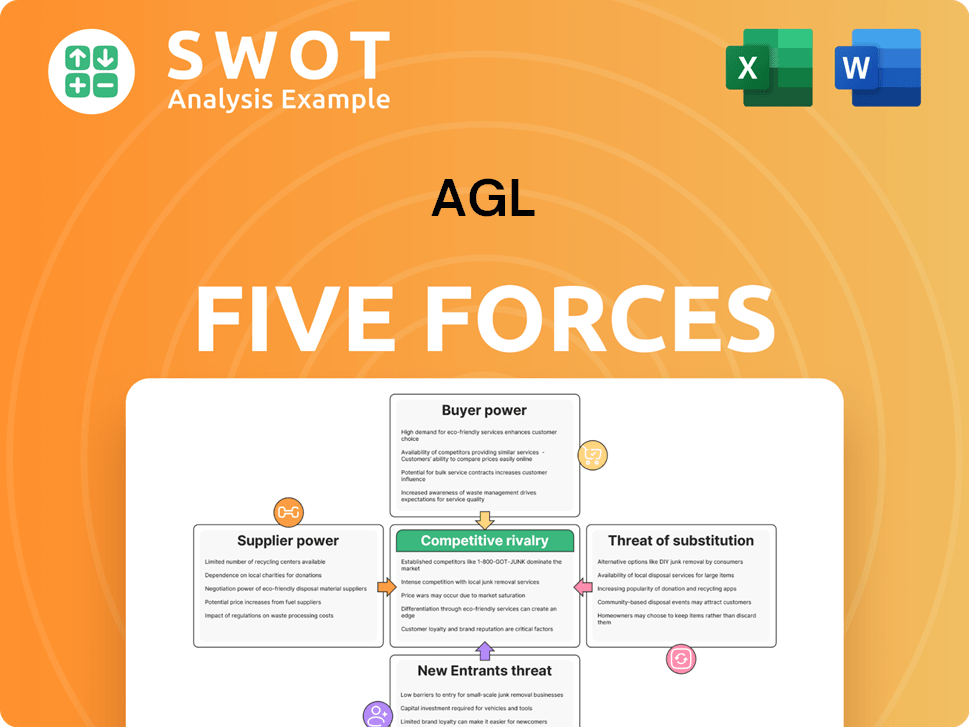

AGL Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.