AGL Bundle

How Does AGL Energy Shape Australia's Energy Future?

AGL Energy, an established AGL SWOT Analysis, is a key player in Australia's energy sector, delivering vital gas and electricity services nationwide. With a market capitalization of AUD 6.84 billion as of June 2025 and a history spanning over 185 years, AGL serves approximately 4.5 million customer accounts. Understanding the inner workings of this major AGL company is critical for anyone interested in the Australian energy market.

This exploration delves into AGL's operational structure and revenue streams, particularly in light of its shift towards renewable energy sources. The AGL energy transition and its financial performance, such as the AUD 97 million profit after tax for the half-year ended December 31, 2024, highlight the company's adaptability. Whether you're investigating AGL services, comparing AGL gas prices comparison, or wondering 'Is AGL a good energy provider', this analysis provides valuable insights.

What Are the Key Operations Driving AGL’s Success?

The AGL company operates through integrated operations, encompassing power generation, energy retailing, and related services. Its core business involves providing electricity, gas, solar solutions, and energy efficiency products. They also offer broadband, mobile, and voice services to residential, small business, and large business customers. This integrated model, combining generation and supply, helps stabilize its market position and provides a hedge against fluctuating wholesale electricity prices.

As an energy provider, AGL manages a significant electricity generation portfolio, including coal, gas, wind, and hydro facilities, along with grid-scale batteries. The operational processes involve sourcing energy from wholesale markets, managing its generation fleet, and developing new energy projects. AGL's supply chain is further supported by its natural gas storage and production facilities.

A key element of AGL energy's strategy is its commitment to a lower-emissions future. The company is actively investing in renewable energy projects, including wind, solar, and battery storage, with a goal of having 50% of its generation capacity from renewables by 2025. This focus on sustainability, combined with its strong brand reputation and customer loyalty, helps differentiate AGL from competitors.

AGL provides electricity, gas, and solar products to residential, small business, and large business customers. The company also offers energy efficiency products, along with broadband, mobile, and voice services. These services are designed to meet the diverse needs of its customer base.

AGL sources energy from wholesale markets and manages a large generation fleet. They are involved in developing new energy projects and own natural gas storage and production facilities. The company also invests in technology, such as its electric vehicle (EV) software platform, to improve customer interactions and efficiency.

AGL's value proposition centers on transitioning to a lower-emissions energy future, investing in renewable energy, and aiming for 50% renewable generation capacity by 2025. This focus, along with strong brand reputation and customer loyalty, differentiates AGL from competitors. The integrated model strengthens its market standing.

As of the latest reports, AGL holds a significant market share in the Australian energy market. The company's integrated business model, encompassing both generation and supply, provides a competitive advantage. For more insights into their strategic approach, check out the Marketing Strategy of AGL.

AGL distinguishes itself through its commitment to renewable energy and an integrated business model. This approach provides a natural hedge against volatile wholesale electricity prices and strengthens its market position.

- Focus on renewable energy sources, including wind, solar, and battery storage.

- Integrated model combining generation and supply to manage market risks.

- Strong brand reputation and customer loyalty within the AGL services portfolio.

- Ongoing investments in technology and customer service enhancements.

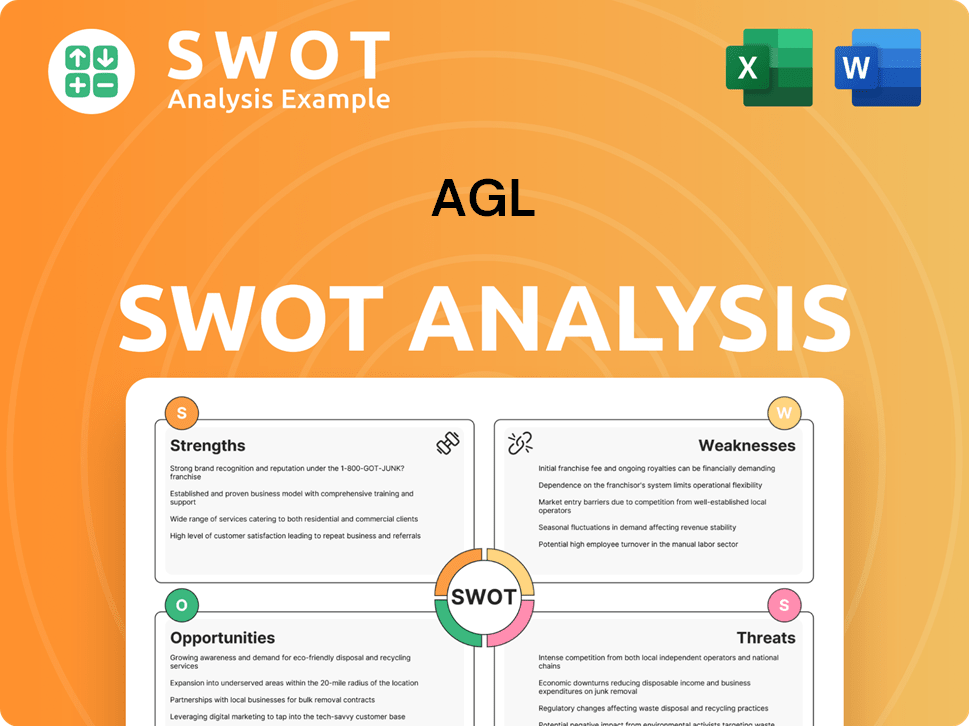

AGL SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AGL Make Money?

The AGL company generates revenue through multiple avenues, primarily focusing on selling electricity and gas. This includes sales to residential, small business, and large business customers. Additionally, the company generates revenue from solar and energy efficiency products, as well as telecommunications and entertainment services.

For the half-year ending December 31, 2024, AGL reported a 15.3% increase in revenue, reaching AUD 7,132 million. While the specific contribution of each revenue stream isn't detailed in the most recent reports, electricity and gas sales remain the most significant contributors to the company's total revenue.

AGL utilizes various monetization strategies to generate income. These include standard product sales for electricity and gas, potentially bundled services that integrate energy with telecommunications and other offerings. The company's dividend policy targets a payout ratio of 50% to 75% of annual Underlying Net Profit after tax.

The AGL energy business model is centered on providing essential services and expanding its offerings. This approach is supported by strong financial performance, as detailed in the company's recent reports. Understanding the revenue streams and monetization strategies is crucial for assessing the company's overall financial health and growth potential. For more insights, you can explore the Growth Strategy of AGL.

- Electricity and gas sales form the core revenue, serving a broad customer base.

- Sales of solar and energy efficiency products contribute to revenue diversification.

- Telecommunications and entertainment services offer additional revenue streams.

- For the full year ended June 30, 2024, AGL reported a statutory profit after tax of AUD 711 million and an underlying net profit of AUD 812 million.

- The company declared a fully franked interim dividend of 23 cents per share for FY25, paid on March 27, 2025.

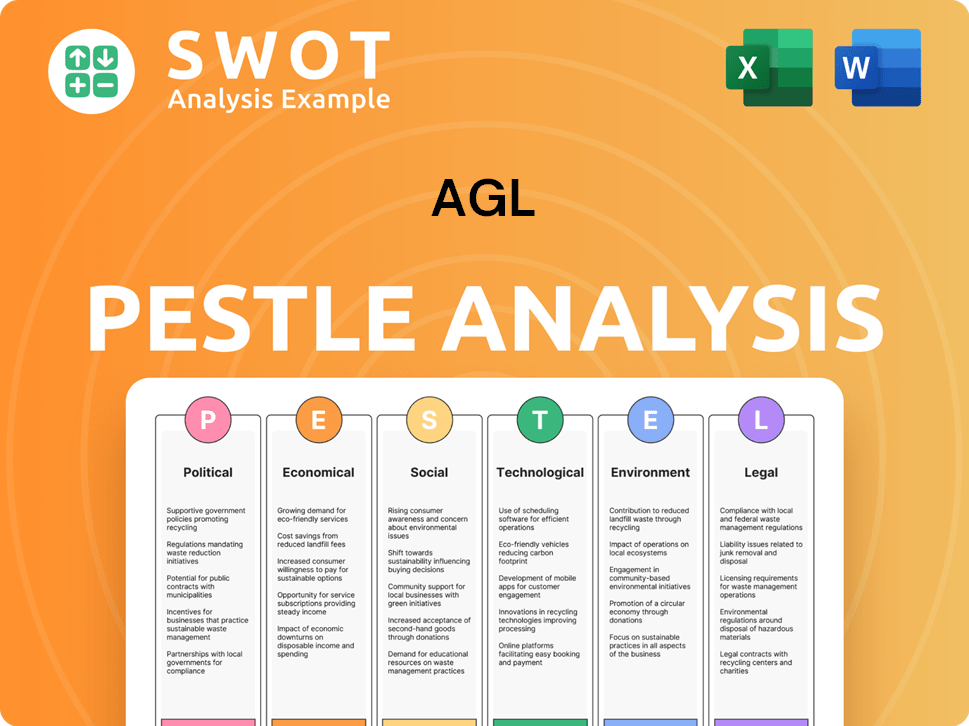

AGL PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AGL’s Business Model?

The AGL company has undergone significant strategic shifts and achieved key milestones, particularly in its transition towards a cleaner energy portfolio. These moves aim to enhance its market position and adapt to the evolving energy landscape. Recent acquisitions and investments highlight AGL's commitment to expanding its renewable energy capacity and improving its operational efficiency.

These strategic actions are critical for AGL energy to maintain its competitive edge in the dynamic energy market. The company faces operational challenges, including margin compression and increased costs, which it is addressing through strategic investments and operational improvements. The focus is on balancing current operational needs with long-term sustainability and growth objectives.

The company's competitive advantages are rooted in its diverse energy portfolio, vertical integration, and strong brand reputation. It is also investing heavily in technology and sustainability. These elements are essential for AGL services to remain a leading energy provider and adapt to the changing demands of the market, ensuring its long-term viability and success.

In August 2024, AGL acquired Firm Power and Terrain Solar, adding 5.8 GW to its development pipeline. In May 2025, AGL acquired 100% ownership of two early-development stage pumped hydro energy storage projects with a combined capacity of up to 1,393 MW. The Tomago battery energy storage system (500 MW/2,000 MWh) received approval in November 2024.

AGL is actively transitioning towards renewable energy sources and enhancing its storage capabilities. These strategic moves include acquisitions and investments in pumped hydro projects and battery storage systems. These initiatives are designed to support its long-term sustainability goals and reduce its reliance on fossil fuels.

AGL's competitive advantages include a diverse energy portfolio, vertical integration, and a strong brand reputation. The company benefits from economies of scale as one of the largest energy retailers in Australia. AGL's focus on renewable energy generation, with a development pipeline that increased to 7.0 GW in 1H FY25, further strengthens its market position.

AGL faces consumer customer margin compression due to lower customer pricing and increased market competition. Increased operating costs, driven by inflation and strategic investments, also impact profitability. Despite these challenges, AGL's underlying EBITDA for the first half of FY25 was AUD 1,068 million.

AGL's strategy involves a shift towards renewable energy and storage solutions to reduce its carbon footprint and improve its market position. The company's future depends on its ability to manage operational costs, navigate competitive pressures, and successfully execute its renewable energy projects. For more insights, check out the Growth Strategy of AGL.

- Focus on renewable energy projects and storage solutions.

- Managing operational costs and competitive pressures.

- Leveraging economies of scale and brand reputation.

- Adapting to changing market dynamics and consumer preferences.

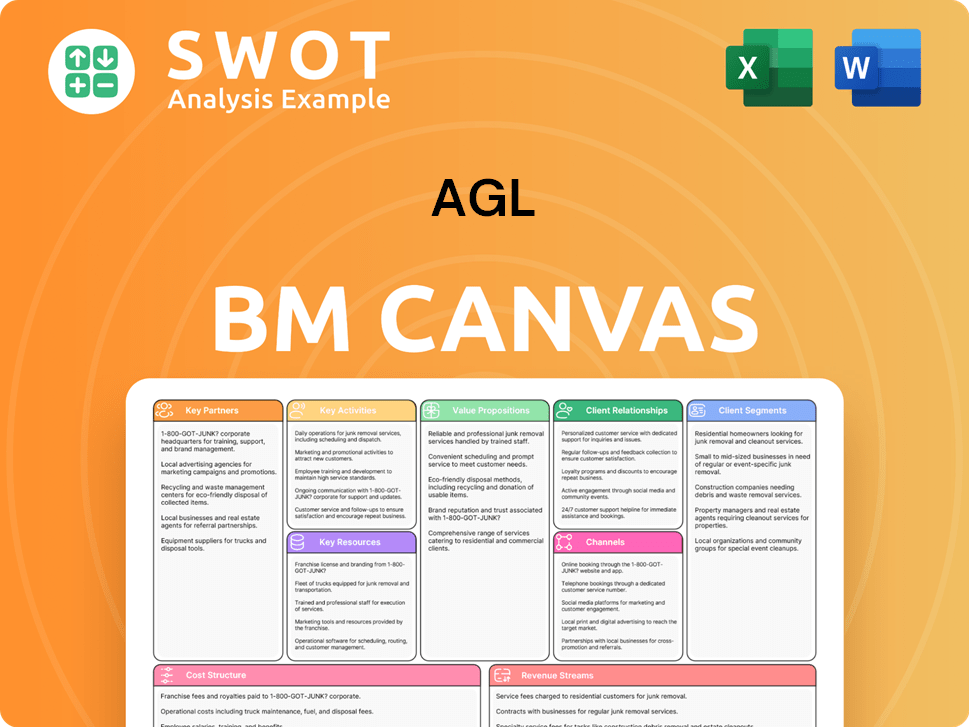

AGL Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AGL Positioning Itself for Continued Success?

The AGL company holds a significant position in the Australian energy market. As one of the 'big three' energy providers, alongside Origin Energy and EnergyAustralia, AGL plays a crucial role in supplying electricity and gas to consumers. The company's strong market presence is supported by its long-standing reputation and commitment to reliable services, making it a key player in the industry.

However, AGL faces several challenges and risks. These include regulatory changes, intense competition, technological disruptions, and shifts in consumer preferences towards renewable energy. Supply risks, such as gas shortages, and the management of aging thermal power stations also pose challenges. The company's future outlook focuses on strategic initiatives to navigate these challenges and capitalize on emerging opportunities.

As of June 2024, AGL, along with Origin Energy and EnergyAustralia, collectively held a 62% market share in the National Electricity Market (NEM). AGL specifically controls approximately 34.8% of the residential gas market share. This solidifies its status as a leading energy provider.

AGL faces several risks, including regulatory changes and intense competition. The company was ordered to pay a AUD 25 million penalty in December 2024 for overcharging related to Centrepay payments, which it appealed in February 2025. These factors impact the company's operations and financial performance.

AGL is focused on its decarbonization pathway, aiming to add 5 GW of renewables and firming capacity by 2030. The company is targeting net zero for operated Scope 1 and 2 emissions by 2035. AGL plans to make a final investment decision on an additional 1.4 GW of battery projects in the next 12-18 months.

The company's narrowed FY25 underlying earnings guidance is between AUD 1,935 million and AUD 2,135 million for EBITDA, and AUD 580 million and AUD 710 million for net profit after tax. This reflects a strong first half performance and anticipated moderation in the second half due to seasonal factors and ongoing competition.

AGL's strategic initiatives include accelerating its decarbonization pathway and disciplined capital allocation. The company aims to transition its assets while maximizing shareholder returns. These initiatives are crucial for AGL's long-term sustainability and growth in the evolving energy market.

- Focus on renewable energy sources and firming capacity.

- Investment in battery projects to support grid stability.

- Disciplined capital allocation to deliver on transition goals.

- Adaptation to changing consumer preferences for green energy options.

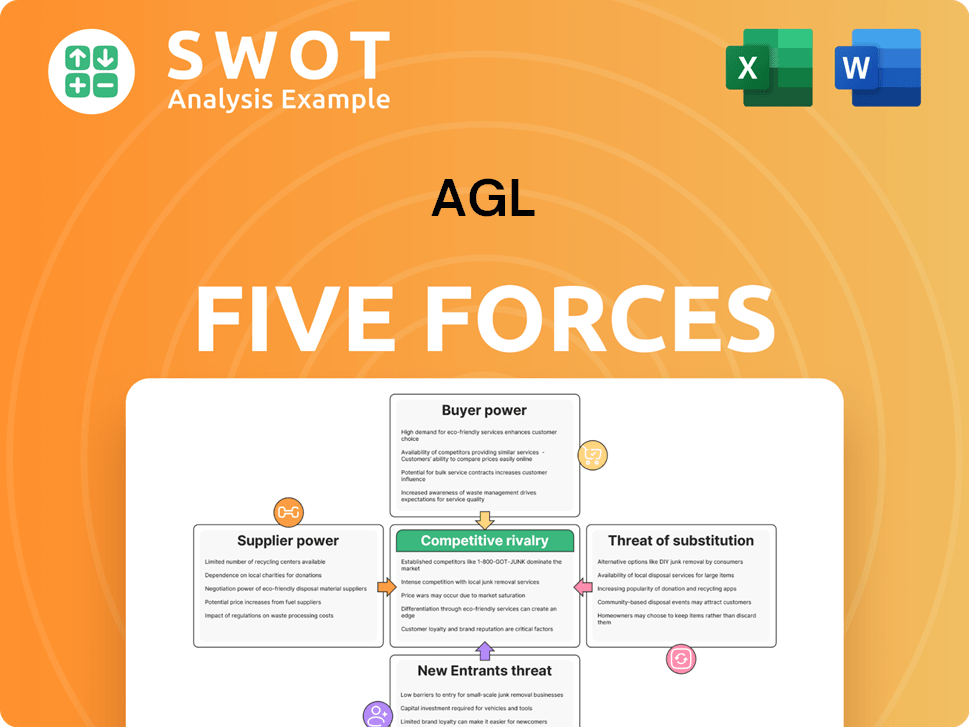

AGL Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AGL Company?

- What is Competitive Landscape of AGL Company?

- What is Growth Strategy and Future Prospects of AGL Company?

- What is Sales and Marketing Strategy of AGL Company?

- What is Brief History of AGL Company?

- Who Owns AGL Company?

- What is Customer Demographics and Target Market of AGL Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.