AGL Bundle

Can AGL Energy Navigate the Shifting Sands of the Australian Energy Market?

The Australian energy sector is in the midst of a dramatic transformation, driven by the urgent need for decarbonization and the rise of renewables. AGL Energy, a long-standing giant in this space, faces both immense opportunities and significant challenges. Understanding the AGL SWOT Analysis is crucial to grasping its position within this dynamic environment.

This analysis will dissect the AGL competitive landscape, providing a detailed AGL market analysis to identify its key AGL competitors. We'll explore AGL's strengths and weaknesses within the Australian energy sector, examining its strategic positioning and response to market changes. Furthermore, we'll investigate AGL's market share 2024 and how its financial performance compares to rivals like Origin Energy to offer actionable insights into the future outlook of this major player in the energy market.

Where Does AGL’ Stand in the Current Market?

AGL Energy holds a significant position in the Australian energy sector. It serves approximately 4.2 million customer accounts across electricity, gas, and telecommunications as of the first half of the 2024 financial year. As one of Australia's largest energy retailers and generators, AGL operates a diverse portfolio that includes thermal generation and a growing presence in renewable energy. This makes AGL a key player in the National Electricity Market (NEM).

Historically, AGL has maintained a strong presence in the retail electricity and gas markets, particularly in New South Wales and Victoria. AGL's strategic focus is on accelerating its decarbonization efforts, aiming to exit coal-fired generation by the end of financial year 2035. This involves significant investments in renewable energy and firming capacity to maintain its competitive edge in a transitioning market. AGL's financial health, as evidenced by its half-year results for FY2024, shows an underlying profit after tax of $399 million, an increase of 23.9% from the previous corresponding period.

AGL's market position is shaped by its extensive customer base and its role in both energy generation and retail. Its strategic shift toward renewable energy reflects a response to changing market dynamics and a commitment to sustainability. The company's financial performance, as demonstrated by its recent results, underscores its capacity to navigate the energy transition while maintaining profitability. AGL is actively working to strengthen its position in renewable energy generation and integrated energy solutions for a sustainable future.

AGL's core operations encompass energy generation, retail, and telecommunications services. It generates power from various sources, including thermal (coal and gas) and renewable energy sources. AGL supplies electricity and gas to residential and business customers across Australia, along with telecommunications services.

AGL's value proposition lies in providing reliable and affordable energy solutions to its customers. This includes offering a range of energy plans and services, as well as investing in renewable energy to support a sustainable future. AGL aims to deliver value through innovation, customer service, and a commitment to reducing its carbon footprint.

AGL's market share in the Australian energy sector is substantial, making it a leading player. The company competes with other major energy retailers and generators, such as Origin Energy. AGL's strengths include its large customer base, diversified generation portfolio, and ongoing investments in renewable energy initiatives.

- AGL's competitive advantages include its established market presence and its strategic shift towards renewable energy.

- The company's financial performance, as highlighted in its latest financial results, reflects its ability to adapt to market changes.

- AGL's response to market changes involves significant investment in renewable energy and firming capacity.

- For more details on AGL's market position and strategic initiatives, refer to the analysis of AGL's competitive landscape.

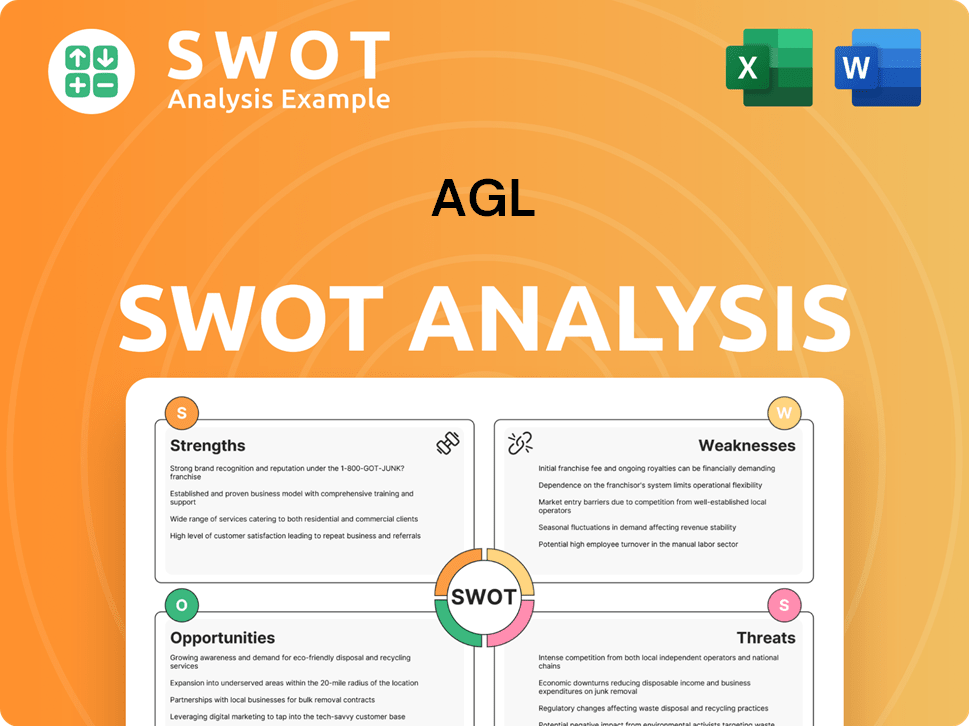

AGL SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging AGL?

The Marketing Strategy of AGL faces a dynamic and competitive environment within the Australian energy sector. The AGL competitive landscape is shaped by a mix of established players and emerging challengers, all vying for market share in a sector undergoing significant transformation. Understanding AGL's main rivals is crucial for assessing its position and future prospects within the Australian energy sector.

AGL's market analysis reveals a complex interplay of factors influencing its competitive standing. The company must navigate the challenges of transitioning to renewable energy sources while maintaining profitability and customer loyalty. AGL's industry position is constantly evolving due to technological advancements, changing consumer preferences, and evolving government regulations.

The Australian energy sector is undergoing a significant transformation, with a shift towards renewable energy sources and a growing focus on customer-centric services. This shift has led to increased competition and the emergence of new business models. AGL's ability to adapt to these changes will be critical for its long-term success.

The primary direct competitors for AGL include integrated energy companies that offer both generation and retail services. These competitors have similar business models and compete for the same customer base across electricity and gas markets.

Origin Energy is a major competitor to AGL, operating in both electricity and gas retail. Origin also possesses a significant generation portfolio, including gas-fired and renewable assets. In FY23, Origin Energy reported a statutory net profit after tax of $1.0 billion.

EnergyAustralia, a subsidiary of CLP Group, is another key competitor. It focuses on customer service and transitioning its generation fleet. EnergyAustralia has been actively investing in renewable energy projects to reduce its carbon footprint.

State-owned entities also pose a competitive challenge. Snowy Hydro, owned by the Commonwealth Government, is a significant generator and retailer (through Red Energy and Lumo Energy). Snowy Hydro is expanding its capacity with projects like Snowy 2.0.

A growing number of smaller retailers are emerging, often using digital platforms and offering competitive pricing or specialized renewable energy plans. These retailers can attract environmentally conscious consumers and gain market share through targeted offerings.

Independent Power Producers (IPPs) are building large-scale wind and solar farms, impacting wholesale electricity prices. These IPPs can influence the competitive dynamics within the market, particularly in the generation segment.

The AGL competitive landscape is influenced by various factors, including government policies, technological advancements, and consumer preferences. AGL's strengths and weaknesses are crucial in determining its market position. AGL's strategic partnerships and renewable energy initiatives are essential for its future outlook.

- Market Share: AGL's market share in the Australian energy sector is a key indicator of its competitive position. Recent data shows that AGL holds a significant share in both electricity and gas retail markets, though these figures fluctuate.

- Pricing Strategies: AGL's pricing strategies are crucial for attracting and retaining customers. The company must balance competitive pricing with profitability, considering factors like wholesale electricity prices and operational costs.

- Customer Acquisition: AGL's customer acquisition strategies involve marketing campaigns, loyalty programs, and digital platforms. These strategies aim to attract new customers and build brand loyalty.

- Renewable Energy: AGL's renewable energy initiatives, including investments in solar and wind projects, are essential for meeting sustainability goals and attracting environmentally conscious consumers.

- Financial Performance: AGL's financial performance, including revenue, profit margins, and debt levels, is a critical factor in assessing its competitive standing. AGL's latest financial results show the company's performance in a dynamic market.

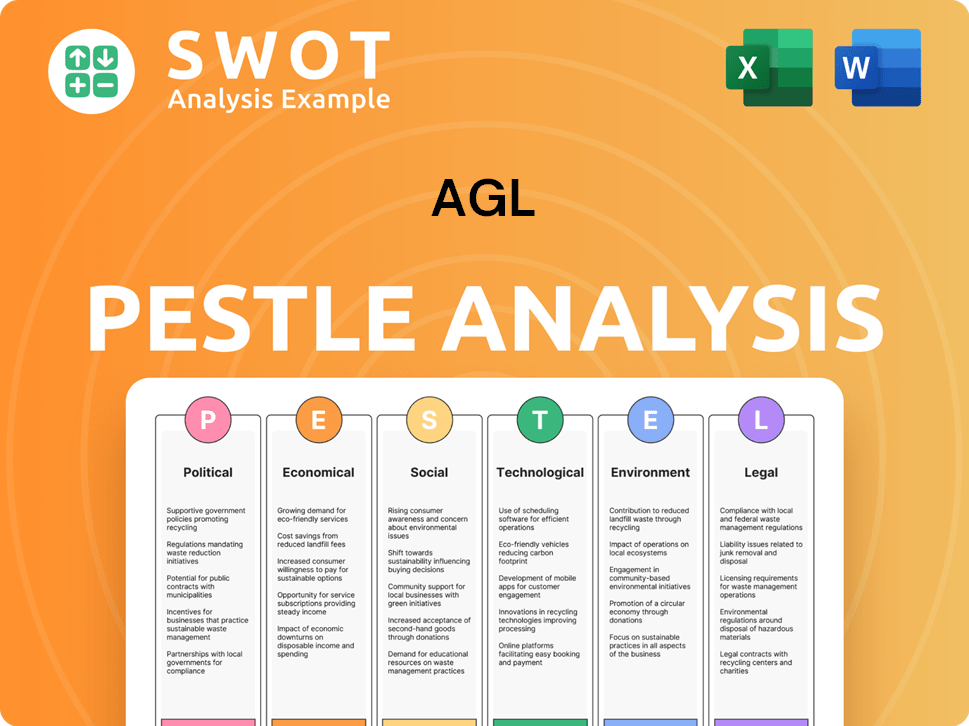

AGL PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives AGL a Competitive Edge Over Its Rivals?

Understanding the AGL competitive landscape involves a deep dive into its strengths and how it navigates the Australian energy sector. AGL Energy's competitive advantages are multifaceted, stemming from its extensive operational scale, integrated business model, and proactive strategic shifts. These elements are crucial in an industry experiencing rapid change and increasing pressure to adopt sustainable practices.

Key to AGL's position is its diverse generation portfolio, which includes both thermal and renewable energy sources. This mix provides a significant baseload capacity and operational flexibility within the National Electricity Market. Furthermore, the company's integrated retail business, which serves millions of customers, offers a stable revenue base and direct access to a large customer base. The company's commitment to decarbonization and investment in renewable energy further strengthens its position in the energy market Australia.

To further understand AGL's operations, you can explore the Revenue Streams & Business Model of AGL. This provides a comprehensive overview of how AGL generates revenue and its core business strategies. This knowledge is essential for assessing AGL's competitive advantages and its ability to maintain a strong position in the market.

AGL's substantial and varied generation portfolio, including both thermal and renewable assets, provides a significant baseload capacity. This scale allows for optimized output and effective supply management. The company's strategic investments in renewable energy are designed to support its transition towards a sustainable energy future, which is crucial for long-term competitiveness.

The integrated retail business, with its millions of customer accounts, offers a stable revenue base and direct access to a large customer base. This integrated model allows for cross-selling new energy solutions and enhancing customer relationships. This direct customer access is a key advantage in a competitive market.

AGL benefits from strong brand recognition and long-standing customer relationships across Australia. This fosters a degree of customer loyalty, which is a valuable asset in a competitive market. Investments in digital transformation and customer service platforms aim to enhance customer experience and improve operational efficiency.

AGL's accelerated decarbonization strategy, with a commitment to exit coal-fired generation by FY2035, is a key competitive advantage. Significant investments in renewable energy and firming capacity, such as batteries, position AGL to capitalize on the growing demand for sustainable energy solutions. This forward-looking approach differentiates AGL from competitors.

AGL's competitive advantages are rooted in its operational scale, integrated business model, and strategic focus on sustainability. These strengths enable AGL to adapt to market changes and regulatory pressures.

- Extensive Generation Portfolio: Provides operational flexibility and baseload capacity.

- Integrated Retail Business: Offers a stable revenue base and direct customer access.

- Brand Recognition and Customer Loyalty: Fosters customer retention and trust.

- Decarbonization Strategy: Positions AGL for the growing demand for sustainable energy.

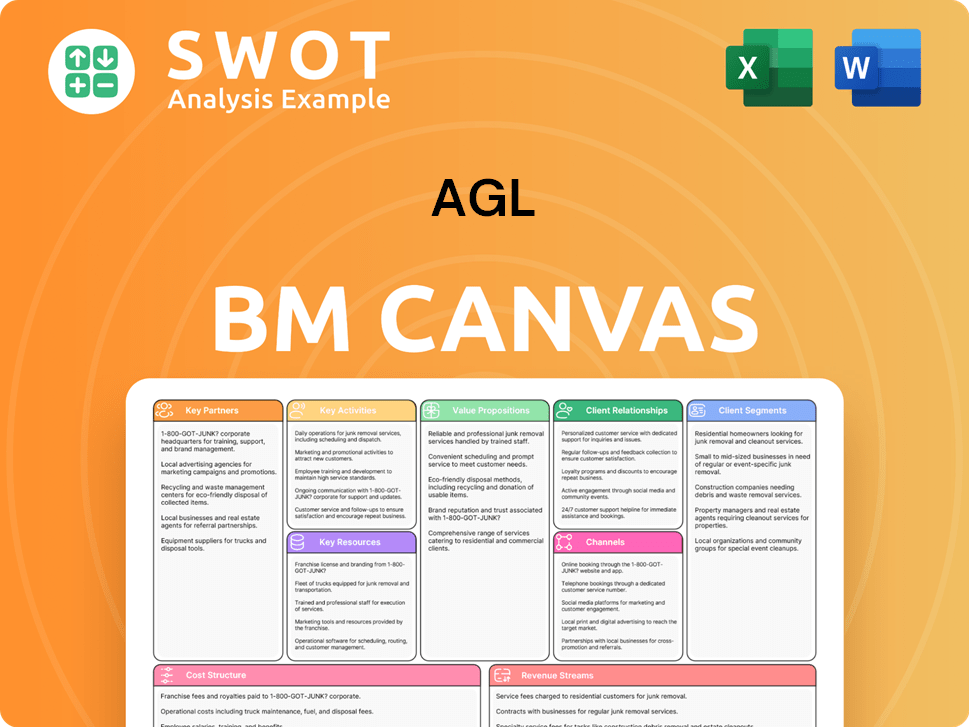

AGL Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping AGL’s Competitive Landscape?

The Australian energy sector is undergoing a significant transformation, with AGL's competitive landscape being reshaped by the shift towards renewable energy and decarbonization. This transition presents both challenges and opportunities for AGL, a major player in the Australian energy sector. The company's strategic decisions and ability to adapt to these changes will be crucial in determining its future position in the Energy market Australia.

AGL's market analysis reveals a complex environment influenced by government policies, technological advancements, and evolving consumer preferences. The company faces the task of balancing its traditional reliance on coal-fired power with the need to invest in renewable energy sources. Understanding the dynamics of the AGL industry and the strategies of its AGL competitors is essential for navigating this evolving landscape.

The primary trend is the rapid growth of renewable energy sources, driven by declining costs and government targets. Decentralization of energy generation, with increasing rooftop solar installations, is also impacting the market. Regulatory changes, including market design reforms and carbon emission targets, are continually reshaping the competitive landscape for AGL.

A key challenge is the successful execution of AGL's energy transition strategy, including the closure of coal-fired power plants by the end of financial year 2035. Managing the financial implications of retiring large assets and the volatility of wholesale energy prices presents further hurdles. Ensuring grid reliability during the transition is also a critical challenge.

AGL has opportunities in developing renewable energy projects and investing in firming capacity, such as grid-scale batteries. The growing demand for integrated energy solutions, including electric vehicle charging, opens new revenue streams. Leveraging its large customer base to offer a wider range of energy services is another key opportunity.

AGL is focusing on renewable energy projects, such as the Central West Pumped Hydro project. Investments in grid-scale batteries aim to enhance grid stability and offer new services. The company is also expanding its offerings to include electric vehicle charging and smart home energy management.

AGL's ability to adapt to industry trends and innovate its offerings is crucial for maintaining its competitive position. The company's strategic partnerships and investments in future-proof technologies will be critical for its long-term success. Successfully navigating these challenges and capitalizing on opportunities will shape AGL's future in the Australian energy market. For further context, you can learn more about the company's history in the Brief History of AGL.

- AGL's market share 2024 is approximately 20% of the electricity market and 10% of the gas market.

- Key competitors include Origin Energy, with a market share of around 25% in electricity, and other smaller players.

- AGL is actively investing in renewable energy projects, with a target to exit coal-fired generation by 2035.

- The company's financial performance in 2024 shows revenue of approximately $12.9 billion, with a focus on cost management and strategic investments.

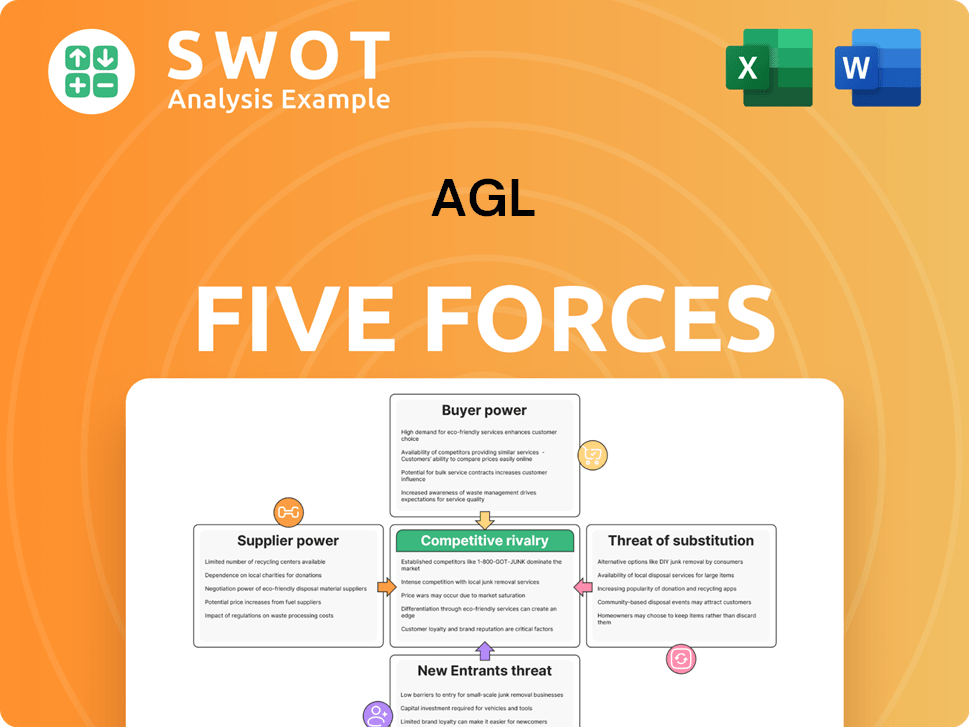

AGL Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AGL Company?

- What is Growth Strategy and Future Prospects of AGL Company?

- How Does AGL Company Work?

- What is Sales and Marketing Strategy of AGL Company?

- What is Brief History of AGL Company?

- Who Owns AGL Company?

- What is Customer Demographics and Target Market of AGL Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.