Alan Allman Associates Bundle

How Did Alan Allman Associates Rise to Consulting Power?

Ever wondered how a consulting firm can quickly become a global force? This article delves into the Alan Allman Associates SWOT Analysis, tracing its journey from a 2009 startup to a major player in digital transformation and business consulting. Discover the strategic moves and vision that propelled the AAA company history forward, shaping its impressive growth trajectory.

The AAA company history is a compelling narrative of strategic expansion and adaptation. Founded by company founder Jean-Marie Thual, Alan Allman Associates rapidly expanded its reach, establishing a strong presence across Europe and beyond. This remarkable growth, fueled by a focus on high-tech and management consulting, showcases the firm's ability to thrive in a dynamic market, making it a fascinating case study for any business strategist.

What is the Alan Allman Associates Founding Story?

The story of Alan Allman Associates, often referred to as AAA, began in 2009. The AAA company history is rooted in the vision of Jean-Marie Thual, the company founder.

Thual, bringing a wealth of experience as a business engineer and a director at Altran, saw an opportunity to build a consulting group. His strategy centered on acquisitions and external growth, fueled by his passion for the consulting sector. The initial aim was to create a multi-brand ecosystem, offering specialized expertise across various sectors.

This approach focused on digital transformation and performance improvement. The business model involved acquiring and integrating expert consulting firms. This allowed for hyper-specialization within the ecosystem while providing comprehensive solutions to clients.

The company's early years were shaped by a focus on specialized consulting services.

- The primary focus was on building a multi-brand ecosystem.

- The business model revolved around acquiring and integrating expert consulting firms.

- The company aimed to offer value-driven solutions in high-tech consulting, industrial transformation, digital marketing, and strategy and management consulting.

- A key milestone was the listing on Euronext Paris in April 2021, which supported further development and international visibility.

The services offered included high-tech consulting, industrial transformation consulting, digital marketing consulting, and strategy and management consulting. The company's growth strategy included a listing on Euronext Paris in April 2021. This move aimed to support further development and international visibility. The establishment of AAA was influenced by the growing demand for specialized consulting services in an increasingly digitized global economy. For more insights, check out the Marketing Strategy of Alan Allman Associates.

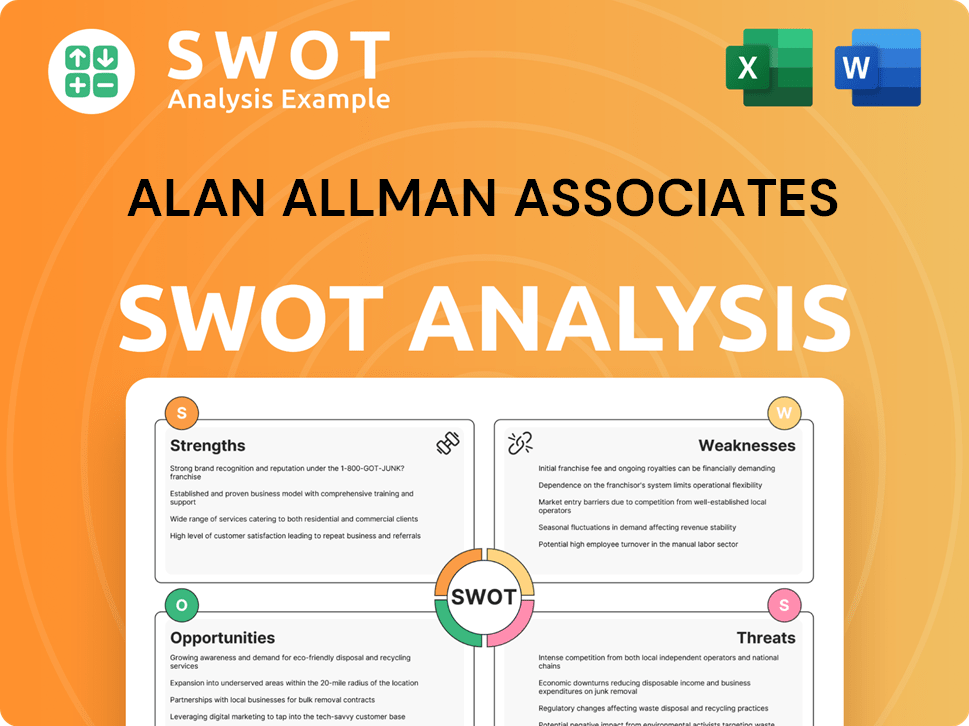

Alan Allman Associates SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Alan Allman Associates?

The early growth and expansion of Alan Allman Associates, often referred to as the AAA company history, has been marked by strategic acquisitions and organic development since its founding in 2009. This approach has enabled the company to broaden its geographical reach and diversify its expertise. The AAA company history demonstrates a commitment to building a robust and resilient business model, even in challenging economic times. Learn more about the Competitors Landscape of Alan Allman Associates.

Alan Allman Associates has leveraged acquisitions to fuel its growth. In September 2023, the acquisition of Data eXcellence in the Netherlands expanded its presence in Benelux. This acquisition added over 50 experts and offices, strengthening its European footprint. The company’s strategy includes a "3.0 program" focused on merging brands to create industry leaders.

The AAA company history includes significant geographical expansion through acquisitions. The acquisition of WINNING Consulting in late 2023 expanded its presence into the Iberian Peninsula. This move added over 250 consultants across Portugal and Spain. In January 2025, the acquisition of PhoenixDX marked its expansion into Australia.

In the first half of 2024, Alan Allman Associates achieved a 6% growth in turnover, reaching €192 million. The company's revenue for 2023 reached $0.40 billion USD. While 2024 saw a slight decrease to $0.38 billion USD, the overall trend reflects substantial expansion. The company aims to recruit approximately 700 talents per year.

Alan Allman Associates focuses on risk diversification, geographical consolidation, and investment in future expertise. The company’s RISE 2025 strategic plan supports these goals. Strategic initiatives include brand alliances and the deployment of new offerings focused on Artificial Intelligence, cybersecurity, and data.

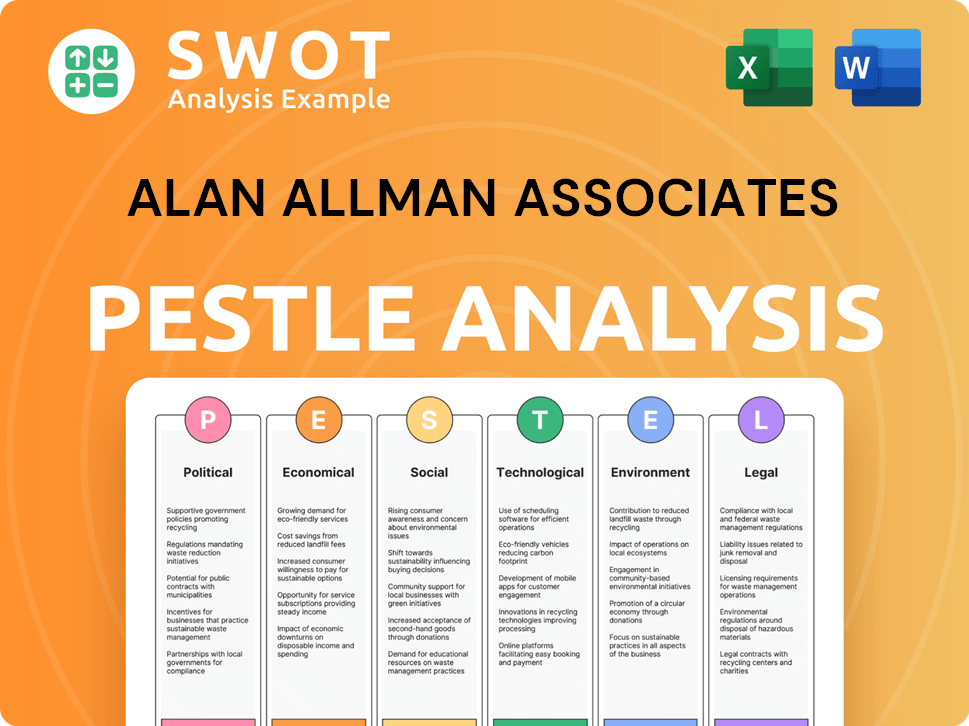

Alan Allman Associates PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Alan Allman Associates history?

The journey of Alan Allman Associates, often referred to as the AAA company, has been marked by significant milestones that have shaped its trajectory in the business world. A key moment in the Alan Allman Associates history was its listing on Euronext Paris in April 2021, designed to boost growth and expand its international presence. The company's evolution reflects a dynamic approach to business consulting and management consulting, adapting to market changes and fostering innovation.

| Year | Milestone |

|---|---|

| April 2021 | Listing on Euronext Paris to exploit growth opportunities and increase international visibility. |

| Late 2023 | Operated as a multi-brand ecosystem, managing a portfolio of 28 expert brands. |

| January 2025 | Acquisition of PhoenixDX to strengthen AI-powered low-code solutions. |

Alan Allman Associates has consistently focused on innovation, especially in areas like artificial intelligence and cybersecurity. The company invested heavily in future technologies, offering AI training to over 4,000 talents within its ecosystem in 2024. This commitment is further demonstrated by acquisitions like PhoenixDX, enhancing its capabilities in AI-driven solutions.

In 2024, Alan Allman Associates provided AI training to over 4,000 talents within its ecosystem, showcasing a strong commitment to technological advancement.

The acquisition of PhoenixDX in January 2025, enhanced the company's capabilities in AI-powered low-code solutions, demonstrating its proactive approach to innovation.

The multi-brand ecosystem, managing 28 expert brands as of late 2023, allows for hyperspecialization in various consulting areas.

Alan Allman Associates has achieved ISO 9001 certification, indicating its commitment to quality management systems.

The company has received an EcoVadis Gold Medal for its CSR performance, highlighting its dedication to corporate social responsibility.

Alan Allman Associates has earned the Happy At Work label, reflecting a positive work environment.

Despite its successes, Alan Allman Associates has faced challenges, including a complex global economic environment in 2024. The company reported a net loss of €12.21 million for the full year ended December 31, 2024, despite a 3.3% increase in consolidated turnover (excluding disposals) to €374.3 million. The company has responded by optimizing its portfolio, including carve-out operations in Q4 2024.

The company navigated a complex global economic context in 2024, influencing its financial performance.

For the full year ended December 31, 2024, the company reported a net loss of €12.21 million, reflecting strategic adjustments.

Carve-out operations in Q4 2024, such as the disposal of entities like HRPartners and Sirus, were part of a strategic refocus.

Consolidated turnover for 2024 increased by 3.3% (excluding disposals) to €374.3 million, indicating underlying business strength.

The company optimized its portfolio through strategic disposals to concentrate on core activities and promising sectors.

Alan Allman Associates aims to expand its international presence, focusing on strategic growth opportunities.

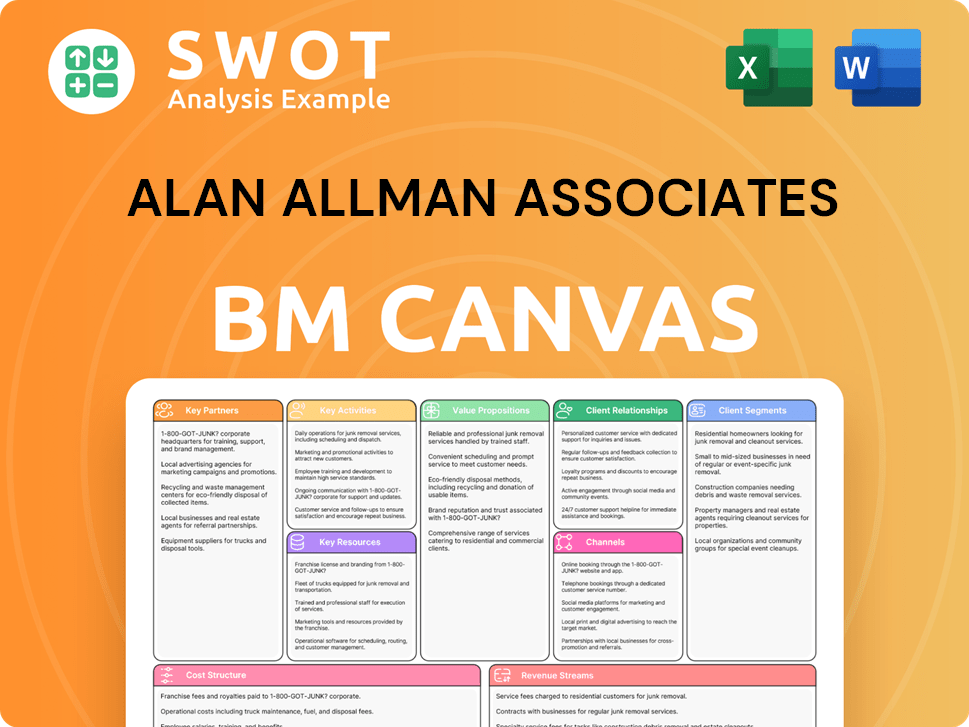

Alan Allman Associates Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Alan Allman Associates?

The AAA company history is marked by strategic moves and global expansion. Founded in 2009 by Jean-Marie Thual, the company has grown significantly, achieving key milestones through acquisitions and strategic initiatives.

| Year | Key Event |

|---|---|

| 2009 | Alan Allman Associates is founded by Jean-Marie Thual in Issy-les-Moulineaux, France. |

| 2021 (April) | The company lists on Euronext Paris to support further development and international visibility. |

| 2023 (September) | Acquires Data eXcellence, expanding its presence into the Netherlands and strengthening its data expertise. |

| 2023 (November) | Acquires WINNING Consulting, extending its reach into the Iberian Peninsula (Portugal and Spain). |

| 2024 (H1) | Reports a 6% growth in turnover compared to H1 2023, reaching €192 million. |

| 2024 (Q4) | Conducts carve-out operations of HRPartners and Sirus to optimize its portfolio and refocus on strategic activities. |

| 2024 (December 31) | Reports full-year sales of €374.34 million, a 3.3% increase excluding disposals. |

| 2025 (January) | Acquires PhoenixDX, marking its expansion into Australia and enhancing its AI and low-code capabilities. |

| 2025 (March 31) | Announces its 2024 annual results, confirming growth in turnover while stabilizing operational profitability. |

The company aims for a turnover of €1 billion by 2030. This ambitious goal highlights the company's commitment to significant expansion. The focus is on key sectors like artificial intelligence and cybersecurity to drive growth.

The RISE 2025 plan focuses on doubling the company's size between 2020 and 2025. This plan includes strategic acquisitions and geographical consolidation, particularly in Europe and North America. The company is targeting €500 million in sales by 2025.

To support its growth, the company plans to recruit approximately 700 talents per year. This talent acquisition strategy is crucial for expanding its expertise. The goal is to bolster its capabilities in key areas.

Leadership emphasizes a resilient and independent model to thrive in a complex economic environment. This positions the company to continue supporting clients in their digital transformation journeys. The company aims to be a key player in the international consulting market.

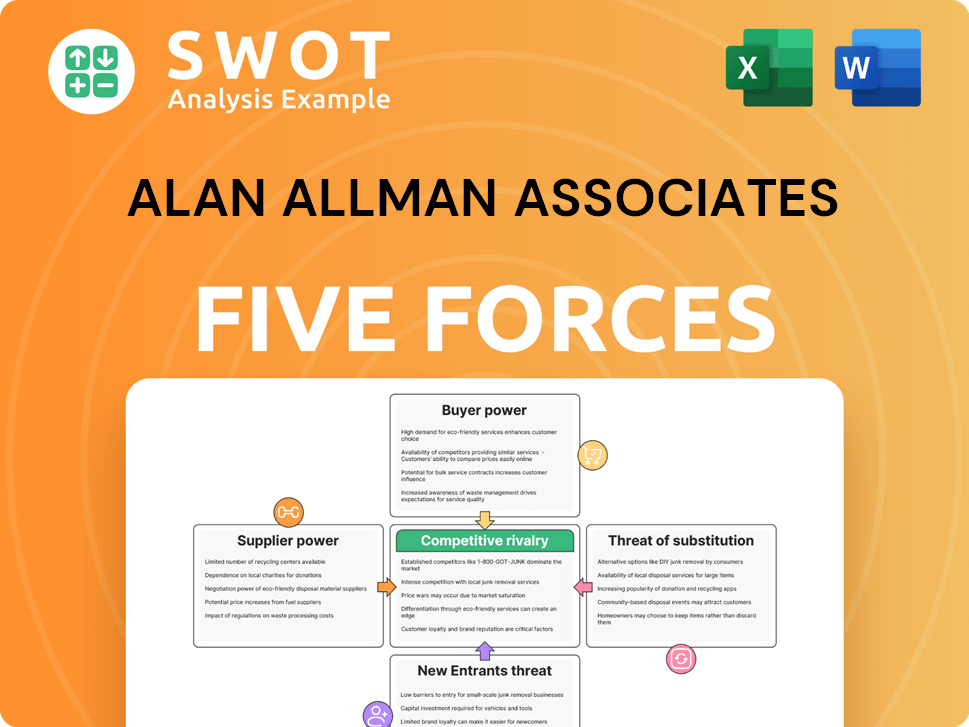

Alan Allman Associates Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Alan Allman Associates Company?

- What is Growth Strategy and Future Prospects of Alan Allman Associates Company?

- How Does Alan Allman Associates Company Work?

- What is Sales and Marketing Strategy of Alan Allman Associates Company?

- What is Brief History of Alan Allman Associates Company?

- Who Owns Alan Allman Associates Company?

- What is Customer Demographics and Target Market of Alan Allman Associates Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.