Alan Allman Associates Bundle

Who Really Controls Alan Allman Associates?

Ever wondered who pulls the strings at Alan Allman Associates (AAA company), the digital transformation powerhouse? Understanding the Alan Allman Associates SWOT Analysis is just the beginning. Unraveling the company's ownership structure is crucial for investors and strategists alike. This deep dive explores the evolution of AAA company's ownership, from its inception to its current standing.

Founded in 2009, Alan Allman Associates, led by Alan Allman, has undergone significant changes, especially after its Euronext Paris listing in 2021. This shift to public markets has influenced the company's strategic direction and investor relations. This analysis will help you understand the key players behind the AAA company and how their stakes impact its future, answering questions like "Who owns what" and "Who is the owner of Alan Allman Associates?"

Who Founded Alan Allman Associates?

The AAA company, Alan Allman Associates, was established in 2009 by Jean-Marie Thual. He brought over two decades of experience to the table, having previously worked as a business engineer and director at Altran. The vision was to build a significant consulting group, primarily through acquisitions and internal development.

The early days of Alan Allman Associates saw a focus on private ownership. Jean-Marie Thual led the company, driving its growth through a series of strategic acquisitions. This approach helped the company nearly double in size every two years, demonstrating a strong founder-led strategy focused on expansion.

Specific details about the initial equity splits or shareholding percentages from the founding phase are not publicly available. However, the company's foundation as an 'ecosystem of strong brands' suggests a model built on integrating various consulting entities.

Jean-Marie Thual founded Alan Allman Associates in 2009.

The initial strategy focused on acquisitions and internal performance development.

Early ownership was primarily private, with Jean-Marie Thual at the helm.

The company nearly doubled in size every two years through external growth.

There is no publicly available information detailing early backers or specific early ownership disputes.

The founding team's vision was to build a robust and international consulting ecosystem.

Understanding the early ownership structure of Alan Allman Associates is crucial for grasping its growth trajectory. The company's success, driven by Jean-Marie Thual, highlights the importance of a clear vision and strategic acquisitions. For more insights, consider reading about the Growth Strategy of Alan Allman Associates.

- Jean-Marie Thual founded the company in 2009.

- The early strategy focused on acquisitions.

- Early ownership was primarily private.

- The company experienced rapid growth through external acquisitions.

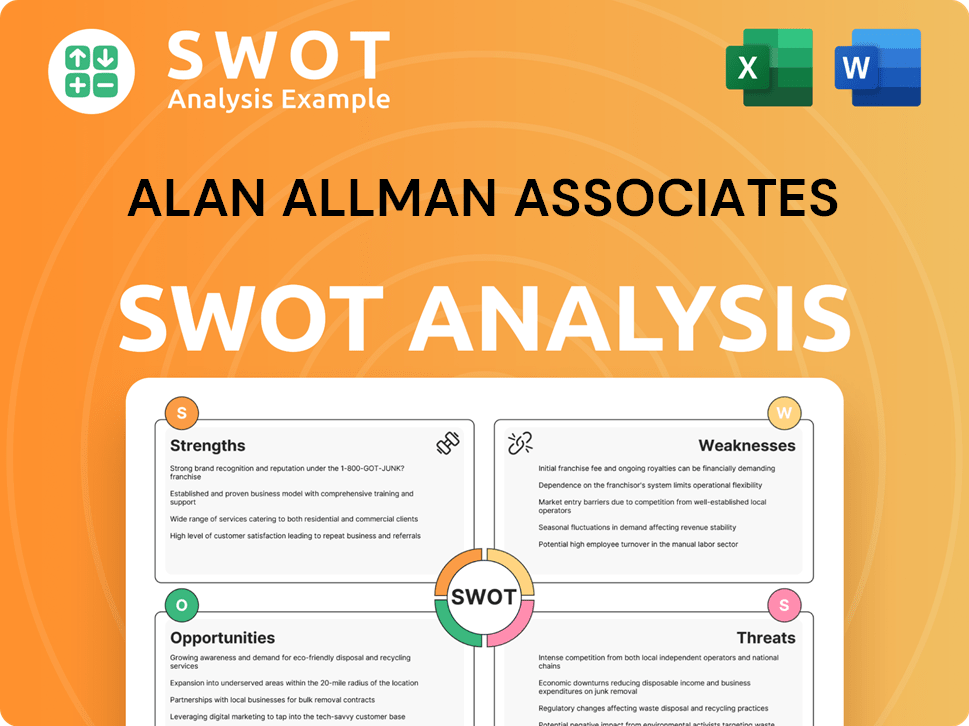

Alan Allman Associates SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Alan Allman Associates’s Ownership Changed Over Time?

The evolution of Alan Allman Associates (AAA company) from a private entity to a publicly listed one marks a significant shift in its ownership structure. This transition occurred on April 9, 2021, when the company was listed on Compartment C of Euronext Paris under the ticker symbol AAA. The listing was facilitated through a reverse takeover (RTO) of Verneuil Finance SA, with all shares of Alan Allman Associates International being contributed to the existing listed company. At the time of the listing, 40,629,326 new shares were introduced to the market.

As of June 12, 2025, the market capitalization of Alan Allman Associates is approximately €190.33 million, with a total of 45,675,754 shares outstanding. This change reflects the company's growth and its strategic moves in the market. The transformation from private to public ownership has opened new avenues for investment and expansion, influencing the dynamics of business ownership.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Reverse Takeover | April 9, 2021 | Public listing on Euronext Paris, shares admitted to trading. |

| Shareholder Structure Update | June 12, 2025 (Approximate) | Reflects current major shareholders and outstanding shares. |

| Acquisitions | Ongoing (As of April 2025) | Expansion of the company's reach, potentially influencing ownership indirectly. |

The major shareholder of Alan Allman Associates is CAMAHËAL Finance SA, holding a substantial 87.86% of the equities, which represents 40,278,226 shares, according to the most recent available data. This significant stake underscores the controlling interest in the company. Alan Allman Associates itself holds a smaller percentage, owning 1.161% of its own shares. Jean-Marie Thual, the founder and CEO, continues to play a crucial role in both the ownership and leadership of the company. The company's strategy, including active external growth with 8 acquisitions completed as of April 2025, has been a key factor in shaping its current ownership landscape. For a deeper dive into the company's strategies, consider reading about the Marketing Strategy of Alan Allman Associates.

Understanding the ownership of the AAA company is crucial for investors and stakeholders.

- CAMAHËAL Finance SA is the major shareholder.

- Jean-Marie Thual, the founder, remains a key figure.

- The company's strategy includes acquisitions to expand its reach.

- Public listing and market capitalization reflect the company's valuation.

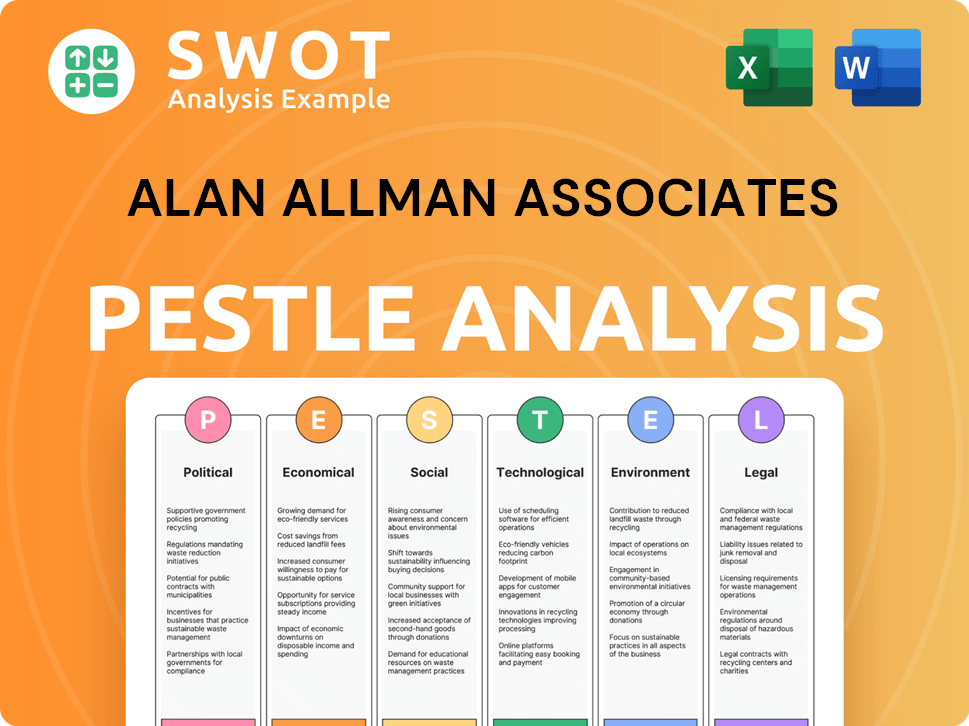

Alan Allman Associates PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Alan Allman Associates’s Board?

The current board of directors of Alan Allman Associates (AAA company) is led by Jean-Marie Thual, who serves as Chairman and CEO. Other key members include Karine Arnold, who also holds the position of Director of Finance/CFO, alongside Charles Gratton and Benjamin Mathieu. Benjamin Mathieu is identified as an Independent Director. This composition reflects a mix of management personnel and independent oversight, though the independent representation is less than half of the board.

This structure indicates a focus on both operational expertise and independent governance. The presence of an independent director like Benjamin Mathieu is a standard practice to ensure a degree of impartiality in decision-making processes. However, the overall balance suggests that the leadership and management teams have a strong influence on the company's strategic direction.

| Board Member | Title | Role |

|---|---|---|

| Jean-Marie Thual | Chairman & CEO | Leadership |

| Karine Arnold | Director of Finance/CFO | Management |

| Charles Gratton | Board Member | Oversight |

| Benjamin Mathieu | Independent Director | Independent Oversight |

The significant shareholding by CAMAHËAL Finance SA, holding 87.86% of the shares, points to a concentrated voting power within Alan Allman Associates. This concentration of ownership strongly influences the company's strategic decisions and governance. The structure of the AAA company aligns with the interests of its primary shareholder. For more information about the company's background, you can read the Brief History of Alan Allman Associates.

The ownership structure of Alan Allman Associates is heavily influenced by CAMAHËAL Finance SA. This concentration of ownership gives the major shareholder significant control over the company's strategic direction.

- CAMAHËAL Finance SA holds a substantial majority of the shares.

- The board composition includes both management and independent members.

- The company’s governance appears aligned with the primary shareholder’s interests.

- The AAA company's ownership structure is a key factor in its strategic decision-making processes.

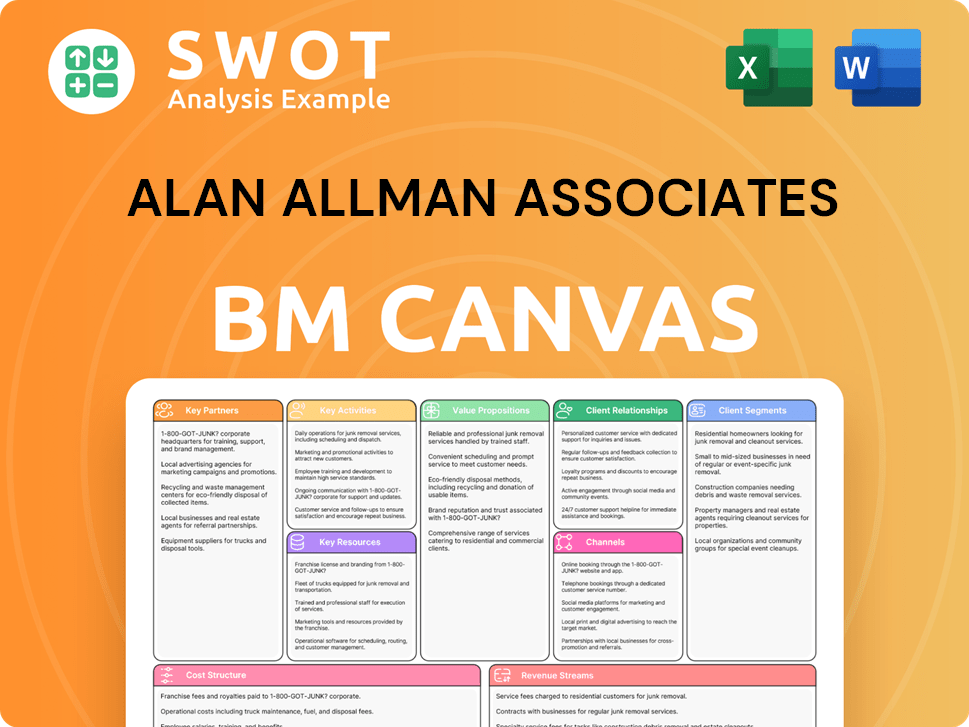

Alan Allman Associates Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Alan Allman Associates’s Ownership Landscape?

Over the past few years, Alan Allman Associates, also known as the AAA company, has actively expanded its operations through acquisitions and international ventures. A notable acquisition in January 2025 was PhoenixDX, a custom software development firm in Australia, which strengthened its presence in the Asia-Pacific region. By April 2025, the AAA company had completed a total of 8 acquisitions, with a focus on France and Canada, demonstrating a clear strategy for growth and market diversification.

Financially, the AAA company reported sales of €374.34 million for the fiscal year ending December 31, 2024, slightly up from €365.6 million the previous year. However, the company reported a net loss of €12.21 million in 2024, a shift from a net income of €5.72 million in the prior year. Despite this, the AAA company aims to achieve a turnover of €1 billion by 2030, targeting high-growth sectors such as artificial intelligence and cybersecurity. As of June 12, 2025, the AAA company's market capitalization stood at €190.33 million, reflecting a decrease of 54.67% over the year. The significant stake held by CAMAHËAL Finance SA suggests a concentrated ownership structure.

| Metric | Value | Year |

|---|---|---|

| Sales | €374.34 million | 2024 |

| Net Loss | €12.21 million | 2024 |

| Market Capitalization | €190.33 million | June 12, 2025 |

The company's annual general meeting is scheduled for June 18, 2025. While specific details on industry trends like increased institutional ownership or founder dilution are not explicitly detailed, the substantial ownership by CAMAHËAL Finance SA points towards a stable ownership profile for Alan Allman Associates.

Alan Allman Associates has focused on strategic acquisitions to expand its global footprint. The AAA company has acquired several companies, including PhoenixDX and WINNING Consulting, to strengthen its market position and diversify its service offerings. The acquisitions have been a key driver of growth.

The AAA company reported sales of €374.34 million in 2024. Despite a slight increase in sales from the previous year, the company reported a net loss of €12.21 million in 2024. The company aims for €1 billion in turnover by 2030.

The ownership structure of Alan Allman Associates appears to be concentrated, with a significant stake held by CAMAHËAL Finance SA. The market capitalization of the AAA company as of June 12, 2025, is €190.33 million. The annual general meeting is scheduled for June 18, 2025.

The AAA company is targeting high-growth sectors like artificial intelligence and cybersecurity. The company's strategic focus is on achieving a turnover of €1 billion by 2030. The AAA company is actively expanding its operations through acquisitions and international ventures.

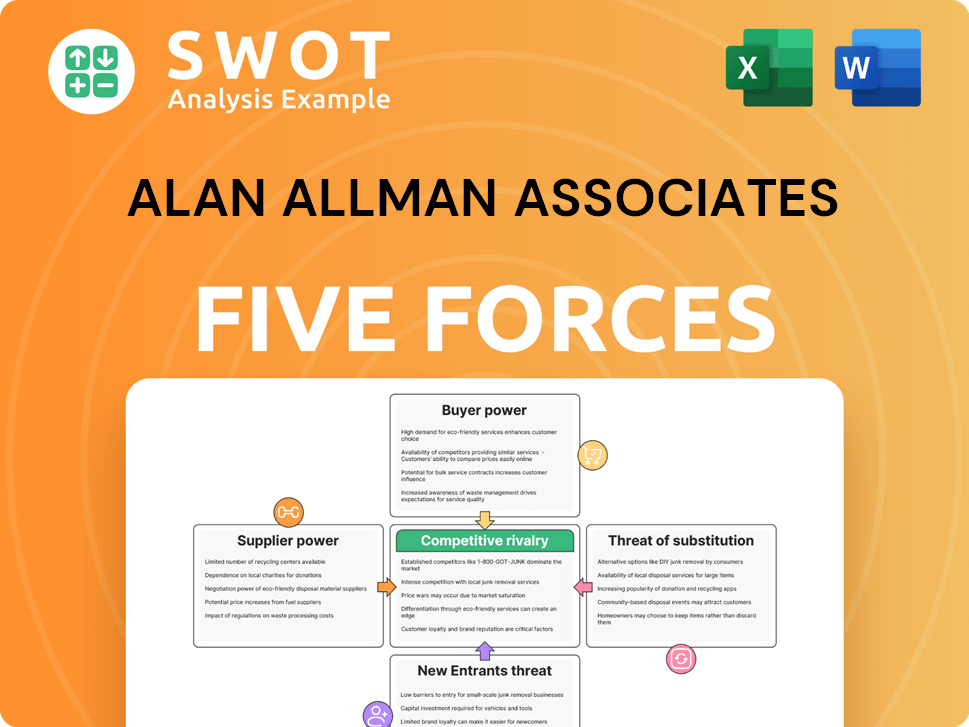

Alan Allman Associates Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Alan Allman Associates Company?

- What is Competitive Landscape of Alan Allman Associates Company?

- What is Growth Strategy and Future Prospects of Alan Allman Associates Company?

- How Does Alan Allman Associates Company Work?

- What is Sales and Marketing Strategy of Alan Allman Associates Company?

- What is Brief History of Alan Allman Associates Company?

- What is Customer Demographics and Target Market of Alan Allman Associates Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.