Alan Allman Associates Bundle

Can Alan Allman Associates Sustain Its Impressive Growth Trajectory?

Founded in 2009, Alan Allman Associates has rapidly transformed from a Paris-based startup into a global powerhouse in business consulting. The company's focus on digital transformation has fueled remarkable expansion, reaching €374.3 million in revenue by 2024. This analysis delves into the Alan Allman Associates SWOT Analysis, exploring the strategic pillars driving its growth and the future prospects of this dynamic company.

Understanding the Alan Allman Associates growth strategy is crucial for investors and strategists alike. This report provides a comprehensive market analysis, examining the company's expansion plans and competitive advantages within the business consulting landscape. We'll explore how Alan Allman Associates leverages strategic partnerships and continuous innovation to navigate industry trends and deliver client success stories, shedding light on its financial performance and long-term investment strategy.

How Is Alan Allman Associates Expanding Its Reach?

Alan Allman Associates is actively pursuing a robust expansion strategy, detailed within its RISE 2025 strategic plan. This plan aims to double its size between 2020 and 2025, targeting a revenue of €500 million by the end of 2025. This ambitious goal is supported by a multi-faceted approach focusing on geographical expansion, new product launches, and strategic acquisitions.

A key element of the company's growth involves extending its reach into new markets, particularly in the Asia-Pacific (APAC) region and Iberia. The company's strategic moves are driven by a desire to access new customers, diversify revenue streams, and stay ahead of industry changes. These initiatives are designed to capitalize on burgeoning sectors like information technology, tourism, renewable energies, and pharmaceuticals within APAC.

The company's expansion strategy is not solely focused on geographical growth; it also includes launching new products and services. Alan Allman Associates is investing heavily in areas such as artificial intelligence, data, cloud computing, and cybersecurity. The company's "3.0" program aims to consolidate brands to create industry leaders and deploy offerings focused on these cutting-edge technologies.

Alan Allman Associates has expanded its presence to new markets, notably in Iberia (Portugal and Spain), and the Asia-Pacific (APAC) region. This includes the acquisition of Winning Consulting in Lisbon and We+ in late 2023, and PhoenixDX in Australia in January 2025. These moves are part of the company's broader strategy to diversify its revenue streams and increase its market share. The company's strategic planning includes an analysis of market trends and opportunities.

The company is focusing on launching new products and services, particularly in fast-growing technological sectors. Alan Allman Associates is investing in areas like artificial intelligence, data, cloud computing, and cybersecurity. The "3.0" program aims to merge brands to create industry leaders and deploy offerings focused on these cutting-edge technologies. This focus aligns with the company's strategic vision for the future.

Alan Allman Associates is implementing an external growth strategy that includes a consistent pace of acquisitions. By 2025, the company plans to have completed 15 acquisitions. This includes 9 in France, 6 in Canada, 1 in the Netherlands, and 2 in Asia. These acquisitions are targeted towards brands in niche or differentiated markets to maximize synergies and create value.

The company plans to recruit 700 talents per year to support its growth and broaden its expertise. This is particularly important in areas where innovation is a major competitive advantage. Investing in talent is a key part of the company's overall strategic plan. The company's focus on talent acquisition is crucial for achieving its strategic objectives.

Alan Allman Associates' growth strategy is multi-faceted, involving geographical expansion, new product launches, and strategic acquisitions. The company's RISE 2025 plan aims to double its size, targeting €500 million in sales by 2025. The company's expansion plans are designed to capitalize on market opportunities and drive sustainable growth.

- Geographical expansion into Iberia and APAC.

- Focus on new products and services in technology sectors.

- Strategic acquisitions to enhance market position.

- Recruitment of 700 talents annually to support growth.

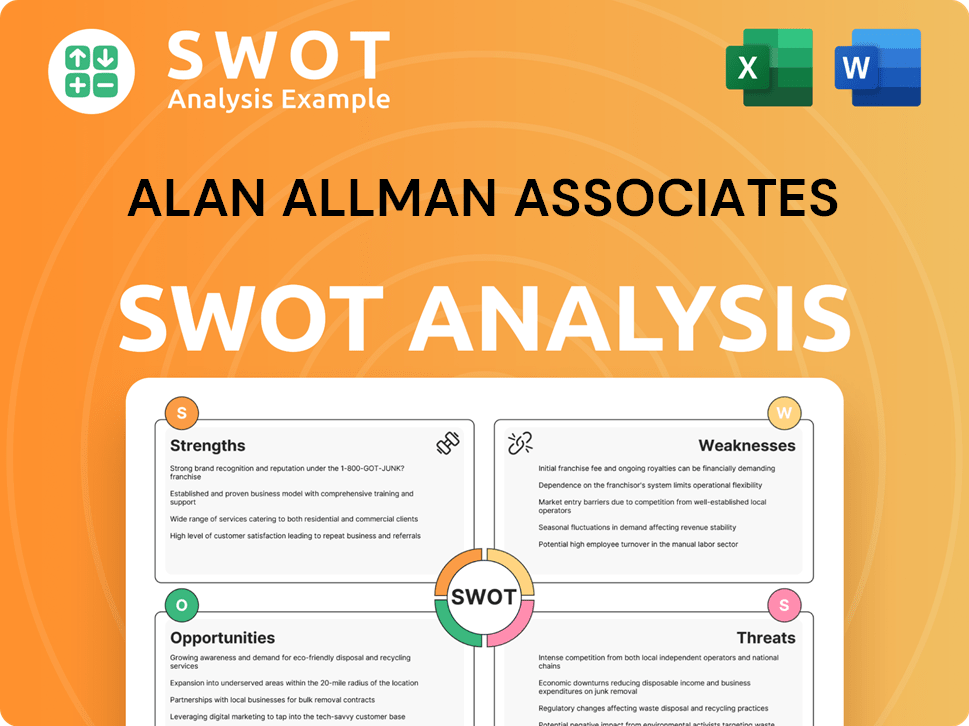

Alan Allman Associates SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Alan Allman Associates Invest in Innovation?

The growth strategy of Alan Allman Associates is deeply intertwined with its innovation and technology initiatives. The company strategically uses technology to drive expansion and meet evolving market demands. This approach includes a strong focus on digital transformation and the adoption of emerging technologies to enhance its service offerings.

Alan Allman Associates' commitment to innovation is reflected in its substantial investments in key areas such as artificial intelligence (AI), data management, cloud computing, and cybersecurity. This commitment is designed to provide clients with cutting-edge solutions. The company's strategic moves, including acquisitions and internal developments, highlight its dedication to staying at the forefront of technological advancements.

The company's dedication to innovation is further demonstrated by its focus on developing strong brands that illustrate its market vision and determination to lead in digital transformation. This focus on technology and innovation is a core component of its business consulting services, supporting its overall growth strategy and future prospects.

Alan Allman Associates has invested significantly in AI and digital transformation. The company provides AI training to over 4,000 talents within its ecosystem. This investment strengthens its ability to offer advanced services.

Acquisitions are a key part of Alan Allman Associates' growth strategy. The acquisition of Humans4Help in 2023 expanded its AI and automation capabilities. The early 2025 acquisition of PhoenixDX further solidified its presence in the APAC region.

The company specializes in AI, IoT, and automation to boost client efficiency, especially in Industry 4.0. This focus helps clients optimize operations and stay competitive. This focus is a key aspect of Owners & Shareholders of Alan Allman Associates.

Alan Allman Associates uses both in-house development and strategic partnerships. The company's approach combines internal innovation with external collaborations. This approach ensures a broad range of technological capabilities.

The acquisition of PhoenixDX in early 2025 is a strategic move to expand into the APAC region. This acquisition enhances digital product engineering capabilities. This expansion supports the company's growth objectives.

Alan Allman Associates enhances its digital product engineering capabilities through acquisitions. This is a key component of its service portfolio. This helps meet evolving client needs in digital transformation.

Alan Allman Associates focuses on several key technological areas to drive its growth strategy and improve its market share. These areas are crucial for providing advanced solutions to clients and maintaining a competitive edge.

- Artificial Intelligence (AI): The company invests heavily in AI to enhance its service offerings and provide clients with cutting-edge solutions.

- Data Management: Effective data management is essential for providing data-driven insights and improving operational efficiency.

- Cloud Computing: Utilizing cloud computing allows for scalable and flexible solutions, meeting diverse client needs.

- Cybersecurity: Cybersecurity is a critical focus, ensuring the protection of client data and maintaining trust.

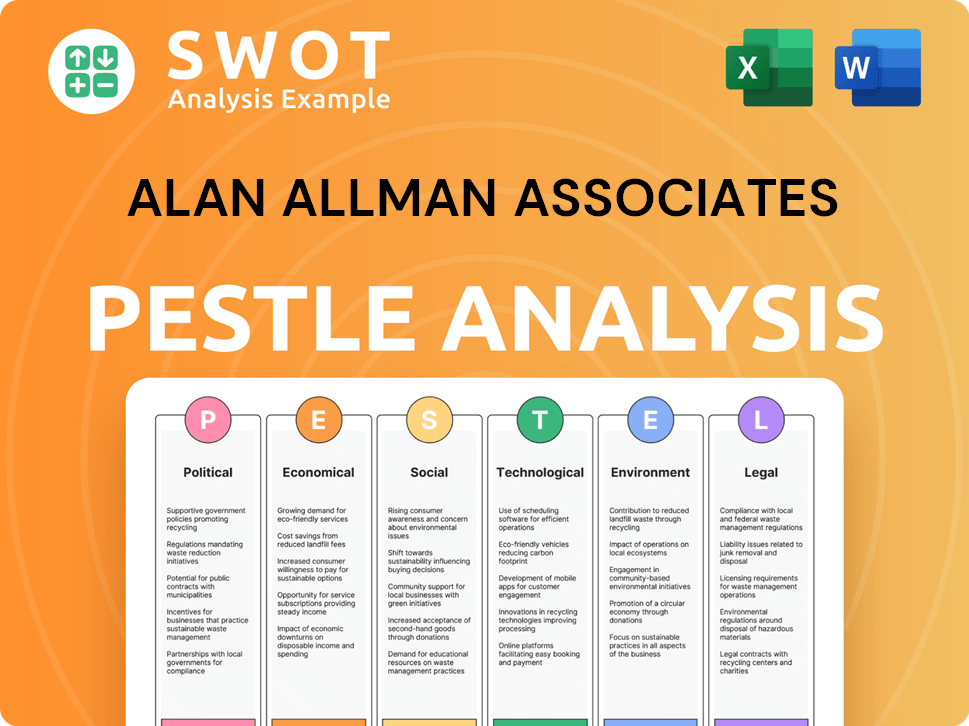

Alan Allman Associates PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Alan Allman Associates’s Growth Forecast?

The financial performance of Alan Allman Associates reflects a dynamic landscape. For the full year ended December 31, 2024, the company reported a consolidated turnover of €374.34 million, marking a 3.3% increase, excluding disposals, despite economic challenges. This growth highlights the company's resilience and ability to adapt to fluctuating market conditions, which is crucial for its future prospects.

In the first half of 2024, Alan Allman Associates experienced a 6% growth in turnover, reaching €192 million, compared to €182 million in the same period of 2023. This indicates a positive trajectory early in the year, though the overall annual results were impacted by various factors. The contrasting performances across different geographical regions also played a significant role in shaping the financial outcome.

The company's financial strategy is focused on achieving ambitious growth targets. The RISE 2025 strategic plan aims for €500 million in sales by 2025 and a substantial €1 billion in turnover by 2030. This ambitious goal is supported by continued external growth initiatives and investments in promising sectors such as artificial intelligence and cybersecurity. The finance division is key in supporting international expansion and M&A activities.

The company saw a 3.3% increase in turnover to €374.34 million in 2024, excluding disposals. While Asia demonstrated significant growth, Europe and North America experienced declines in the banking sector, affecting overall performance. This highlights the importance of diversification and strategic focus in different markets.

Alan Allman Associates aims for €500 million in sales by 2025 and €1 billion in turnover by 2030. These goals are supported by external growth initiatives and investments in AI and cybersecurity. The 'Antelope project' and strategic partnerships are also critical for achieving these targets.

Despite a net loss of €12.21 million in 2024, analysts project that the company will become profitable within the next three years. Earnings are expected to grow by 106.8% per annum, and revenue by 4.8% per annum, indicating strong potential for future financial health.

The finance division plays a crucial role in international expansion and M&A activities. It is responsible for evaluating potential acquisition targets and supporting the company's external growth strategy. This strategic focus is essential for the company's long-term success.

The company's strategic planning and market analysis are crucial for navigating the competitive landscape. For further insights, you can explore the Competitors Landscape of Alan Allman Associates. Alan Allman Associates is focused on leveraging its strengths in business consulting and strategic planning to capitalize on market opportunities and drive sustainable growth. The company's financial performance and future prospects are closely linked to its ability to execute its strategic initiatives and adapt to changing market dynamics.

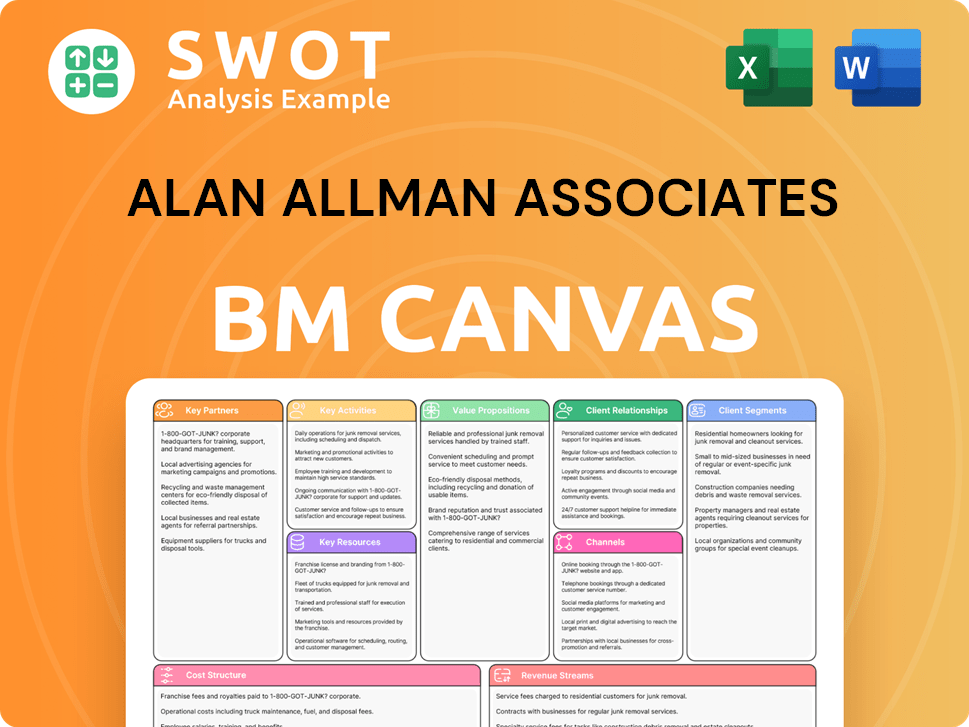

Alan Allman Associates Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Alan Allman Associates’s Growth?

The path to success for Alan Allman Associates is not without its hurdles. The business consulting sector is highly competitive, with numerous firms vying for market share in areas like digital transformation and AI. Furthermore, the fast-paced nature of technology and regulatory changes presents ongoing challenges for the company's growth strategy.

One significant risk stems from the evolving regulatory landscape, especially concerning emerging technologies like AI. The EU AI Act, for instance, is a key development that will impact AI governance, requiring businesses to ensure transparency and compliance in their AI-driven operations. This necessitates continuous adaptation and investment to stay ahead of regulatory changes.

Internal resource constraints, particularly in recruiting, could also pose a challenge. Moreover, the company's international expansion exposes it to geopolitical and economic uncertainties in diverse markets. Addressing these risks through strategic planning and financial discipline is crucial for sustaining the company's growth trajectory.

The business consulting sector is highly competitive. Numerous firms specialize in digital transformation, data science, and AI. This intense competition could impact the company's market share and profitability.

Regulatory changes, particularly concerning new technologies like AI, could pose challenges. The EU AI Act is a key regulatory development that will reshape AI governance. Compliance will require significant resources and adaptation.

Supply chain vulnerabilities and technological disruption are inherent risks in the fast-evolving technology landscape. The company's reliance on cutting-edge technologies means continuous adaptation is essential to avoid disruption.

Internal resource constraints, particularly in recruiting the targeted talent per year, could hinder growth. Attracting and retaining top talent is crucial for the company's success. The company needs to recruit talent to meet its growth targets.

The company's international expansion exposes it to geopolitical and economic uncertainties in diverse markets. These uncertainties could impact the company's financial performance and growth trajectory. Diversification and risk management are key.

Alan Allman Associates addresses these risks through diversification of its customer portfolio and geographical consolidation. The finance division plays a vital role in risk management through audits and analyses. Investing in future expertise and focusing on resilient sectors are key.

To navigate these challenges, Alan Allman Associates employs several strategies. These include diversifying its customer portfolio to reduce dependency on any single client or industry. Geographical consolidation helps optimize operations and manage risks associated with international expansion. The company's finance division conducts comprehensive audits and analyses to identify and mitigate financial risks. Brief History of Alan Allman Associates can provide additional context.

Investing in future expertise is a key aspect of the company's risk management strategy. This involves training and developing its workforce in emerging technologies and business practices. Focusing on promising and resilient sectors helps the company adapt to market fluctuations and maintain its growth trajectory. This proactive approach allows the company to mitigate emerging risks effectively.

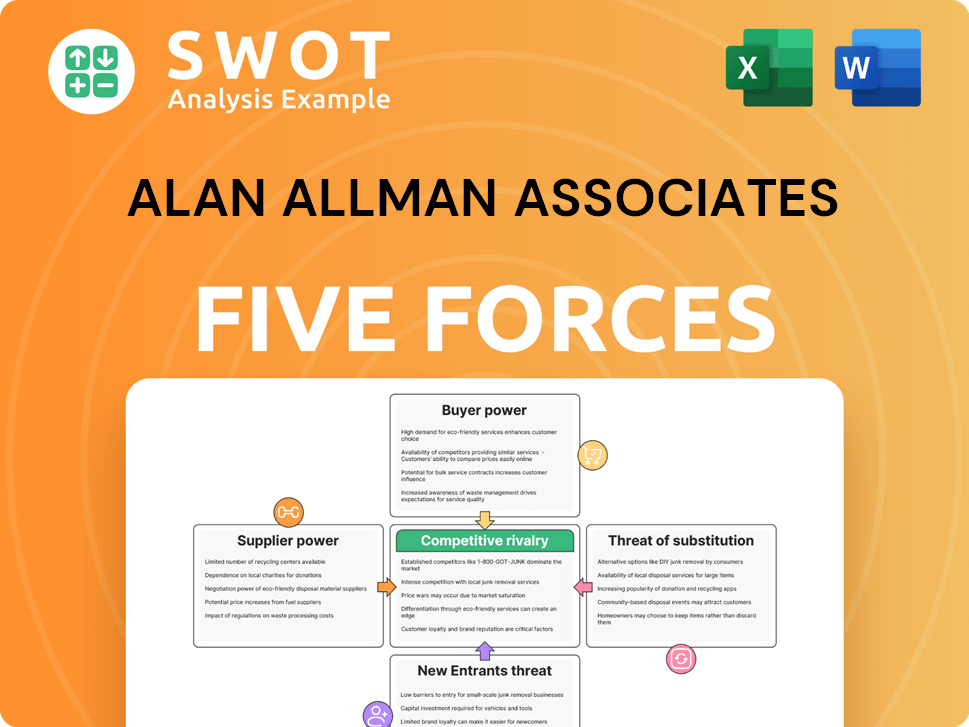

Alan Allman Associates Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Alan Allman Associates Company?

- What is Competitive Landscape of Alan Allman Associates Company?

- How Does Alan Allman Associates Company Work?

- What is Sales and Marketing Strategy of Alan Allman Associates Company?

- What is Brief History of Alan Allman Associates Company?

- Who Owns Alan Allman Associates Company?

- What is Customer Demographics and Target Market of Alan Allman Associates Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.