Alan Allman Associates Bundle

Who Does Alan Allman Associates Serve?

In the competitive world of consulting, understanding your audience is crucial. This deep dive into Alan Allman Associates SWOT Analysis explores the company's customer demographics and target market, revealing the core of its business strategy. Discover how this understanding shapes its service offerings and drives its financial success.

This analysis of Alan Allman Associates' customer base, encompassing market segmentation and audience profiling, is essential for any business strategist. We'll examine the company's evolution, from its initial focus to its current expansive reach, including a detailed look at its ideal client profile. This exploration will help you understand how to identify target markets for consulting services, and how Alan Allman Associates effectively analyzes customer demographics to drive growth and adapt to market changes.

Who Are Alan Allman Associates’s Main Customers?

Understanding the primary customer segments for Alan Allman Associates is crucial for effective business strategy. Their focus is firmly on business-to-business (B2B) engagements, providing consulting services aimed at transforming and improving performance. This strategic direction means their target market primarily consists of organizations seeking expertise in operational excellence, digital transformation, and strategic alignment.

While specific demographic data on individual client contacts isn't publicly available, the nature of B2B consulting suggests that their clients are typically decision-makers within organizations. This includes individuals in C-suite positions, department heads, and project managers. The company's services are designed to boost efficiency, drive innovation, and support sustainable growth for their clients.

The company's approach to customer segmentation is dynamic, adapting to market trends and technological advancements. Their strategic investments in sectors like artificial intelligence (AI), data, cloud, and cybersecurity, as well as their development in sectors like energy, public sector, luxury, and healthcare, reflect a forward-thinking approach to meeting client needs. This is further emphasized by their international expansion and acquisitions, such as PhoenixDX in Australia in January 2025, and the acquisition of GURUS Solutions, to broaden its B2B client base.

The primary customer groups for Alan Allman Associates are large corporations and organizations. These clients seek expertise in areas like operational excellence, digital transformation, and strategic alignment. Their focus is on helping these organizations achieve sustainable growth and improve overall performance. The company's services are tailored to meet the specific needs of these key clients.

Alan Allman Associates serves various sectors, including high-tech, industrial transformation, digital marketing, and strategy and management. They have strategically invested in fast-growing sectors such as artificial intelligence (AI), data, cloud, and cybersecurity. They are also developing their positioning in promising sectors like energy, the public sector, luxury, and healthcare. These choices reflect their focus on adapting to evolving client needs and market trends.

In 2024, the company focused on internationalization and diversifying its client portfolio. Acquisitions like PhoenixDX in Australia and GURUS Solutions demonstrate their commitment to adapting to market changes. These strategic moves are part of a broader plan to achieve €1 billion in turnover by 2030. This expansion is driven by market research and emerging technologies.

The ideal client for Alan Allman Associates is an organization seeking to improve its operational efficiency, drive innovation, and ensure sustainable growth. These clients often operate in sectors like high-tech, industrial transformation, and digital marketing. They are typically led by decision-makers, including C-suite executives and department heads, who are looking for strategic guidance and implementation support. The company's focus on building a diverse customer portfolio is a key element of its business strategy.

The primary customer segments for Alan Allman Associates are large corporations and organizations across various sectors, with a focus on B2B consulting. Their target market analysis reveals a strategic emphasis on clients seeking operational excellence, digital transformation, and strategic alignment. The company's approach to market segmentation is dynamic, adapting to market trends and technological advancements, as illustrated by its strategic investments and acquisitions. Learn more about the Growth Strategy of Alan Allman Associates.

- Focus on B2B consulting services for large corporations.

- Target sectors include high-tech, industrial transformation, and digital marketing.

- Strategic investments in AI, data, cloud, and cybersecurity.

- International expansion and acquisitions to diversify the client portfolio.

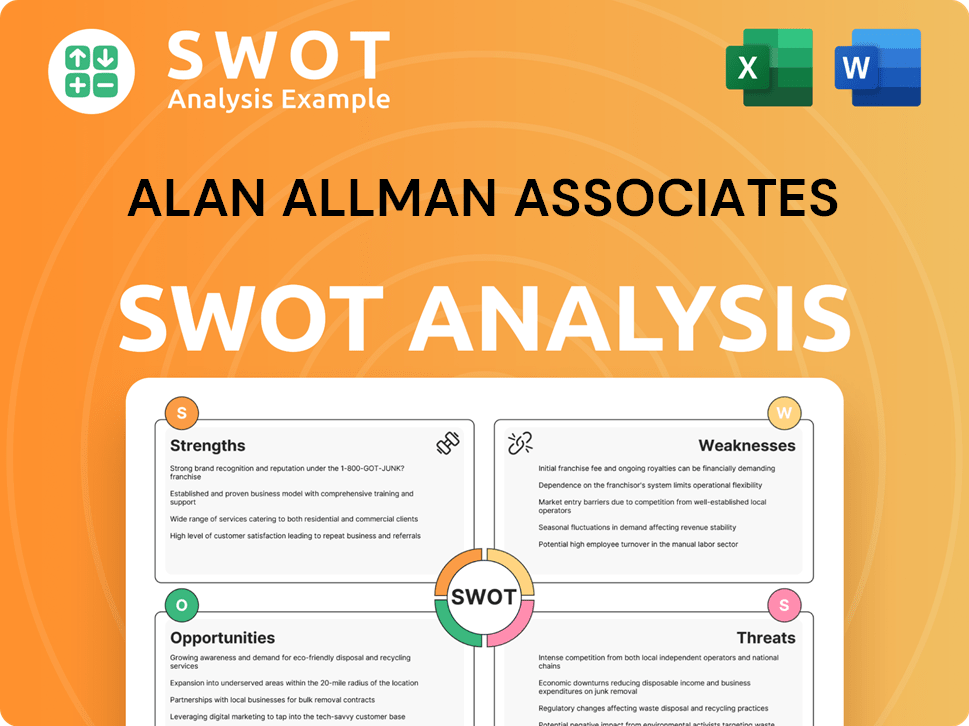

Alan Allman Associates SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Alan Allman Associates’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for Alan Allman Associates, this involves a deep dive into the motivations and requirements of their clientele. Their customers, driven by the complexities of the modern business landscape, seek solutions that drive business transformation, enhance operational efficiency, and foster sustainable growth. This focus shapes their purchasing behaviors and decision-making processes.

The clients of Alan Allman Associates are looking for specialized expertise, a measurable return on investment (ROI), and a dependable partnership. They often face challenges like digital disruption, supply chain optimization, cybersecurity risks, and the need to improve overall organizational performance. By addressing these pain points, the company aims to provide value and build strong, lasting relationships with its clients.

The psychological and practical drivers behind choosing Alan Allman Associates' offerings include a desire for a competitive edge, risk mitigation, and access to cutting-edge technological and strategic insights. The company’s investments in areas like AI, cybersecurity, and data solutions directly address the evolving needs of its clients for advanced technological capabilities. Clients also value a partner that offers comprehensive solutions, from initial consulting to project delivery.

Clients are primarily seeking business transformation to adapt to market changes. This includes digital transformation, which is a key area of focus for many businesses today. The company's offerings are designed to help clients navigate these changes effectively and achieve their strategic goals.

Improving operational efficiency is another critical need. Clients want to streamline their processes, reduce costs, and enhance productivity. This can involve supply chain optimization, which is a common challenge for many businesses.

Sustainable growth is a long-term goal for many clients. They are looking for strategies and solutions that can help them achieve lasting success in a competitive market. This includes a focus on innovation and adapting to future trends.

Clients value specialized expertise and a demonstrable return on investment. They want to see tangible results from the services they receive. This is a key factor in their decision-making process.

Reliable partnership is essential. Clients seek a trusted advisor who can provide comprehensive solutions and support their long-term goals. This involves building strong relationships and fostering open communication.

The company addresses common client pain points, such as digital disruption, cybersecurity risks, and supply chain issues. By focusing on these areas, they provide solutions that directly address the challenges clients face.

The decision-making process of clients is influenced by several key factors. These factors include the need for specialized expertise, a demonstrable return on investment, and reliable partnership. Understanding these factors helps to identify the Revenue Streams & Business Model of Alan Allman Associates and tailor services to meet client expectations.

- Specialized Expertise: Clients seek consultants with deep knowledge in specific areas like digital transformation, cybersecurity, and supply chain management.

- Return on Investment (ROI): Demonstrable ROI is a critical factor, as clients want to see tangible results from the services provided.

- Reliable Partnership: Clients value a long-term partnership with a trusted advisor who understands their business and provides comprehensive solutions.

- Competitive Advantage: Clients aim to gain a competitive edge through innovation and strategic insights.

- Risk Mitigation: Clients seek to mitigate risks related to cybersecurity, market changes, and operational inefficiencies.

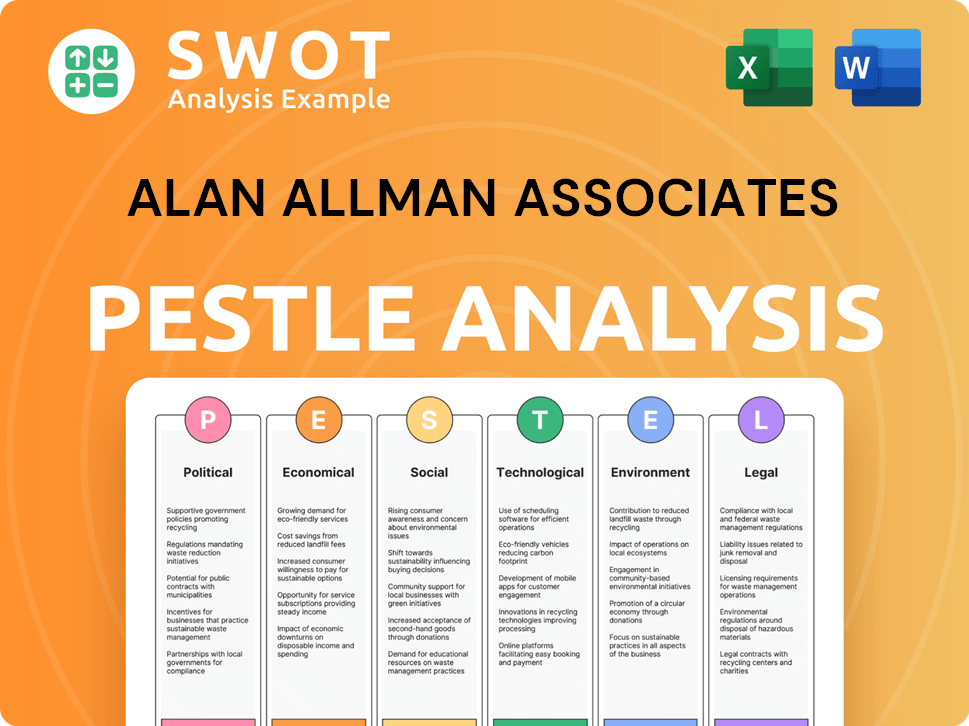

Alan Allman Associates PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Alan Allman Associates operate?

The geographical market presence of Alan Allman Associates is extensive and growing, focusing on Europe, North America, and the Asia-Pacific region. Headquartered in Issy-les-Moulineaux, France, the company has established a strong international footprint. By March 2025, the company had a presence in 21 countries worldwide, demonstrating significant global expansion.

In 2024, the company expanded into new markets, including Iberia, and strengthened its international presence. While Europe saw a slight decrease in Q1 2025, the company reinforced its position in the public and industrial sectors there. North America remains stable, recognized as a leader in its field, and among the top 5 in digital transformation in Canada. The Asia-Pacific region showed substantial growth, with a 45.7% increase in Q1 2025, driven by strategic expansion.

The company adapts its offerings and marketing to succeed in diverse markets. The creation of its Center of Excellence (COE) promotes knowledge sharing internationally, ensuring excellent support for clients based on their location and sector. Sales distribution in 2024 showed Europe with €210.3 million, North America with €152.5 million, and Asia with €11.5 million. For 2025, the company aims for further growth, focusing on digital transformation and innovation.

Despite a slowdown in the banking sector in Europe during Q1 2025, Alan Allman Associates strengthened its presence in the public and industrial sectors. This strategic focus helped mitigate some of the regional economic challenges. The company's ability to adapt to sector-specific needs is a key factor in its continued success in Europe.

North America continues to be a stable market for the company, with Alan Allman Associates recognized as a leader in its field. The company's strong presence in Canada, even amid geopolitical uncertainties, highlights its resilience and strategic focus. Its position among the top 5 in digital transformation in Canada further solidifies its market standing.

The Asia-Pacific region demonstrated significant growth, with a 45.7% increase in Q1 2025. Strategic expansion via the we+ brand and the acquisition of PhoenixDX in Australia in January 2025, extended its presence in the APAC region and strengthened its digital product engineering capabilities, contributing to this growth. This expansion is a key element of their business strategy.

To succeed in diverse markets, the company localizes its offerings and marketing. This approach ensures that services are relevant and resonate with local clients. The creation of the Center of Excellence (COE) supports this strategy by promoting knowledge sharing and providing excellent, tailored support.

Sales distribution in 2024 showed Europe with €210.3 million, North America with €152.5 million, and Asia with €11.5 million. These figures highlight the importance of each region to the company's overall revenue. These numbers reflect the success of Alan Allman Associates' market segmentation strategies.

For 2025, the company is aiming for an even more ambitious dynamic, with continued support for clients in their digital transformation. A particular focus on sectors where innovation remains a major competitive lever is expected. This strategic focus is crucial for long-term growth. You can find more about their competitors in Competitors Landscape of Alan Allman Associates.

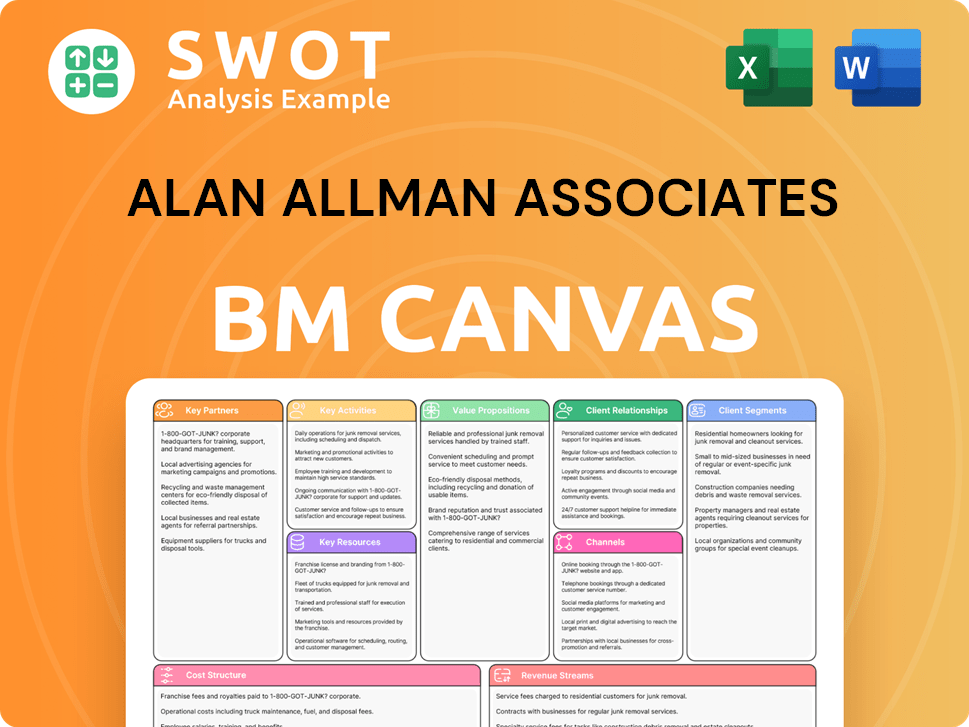

Alan Allman Associates Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Alan Allman Associates Win & Keep Customers?

Customer acquisition and retention are critical for the success of any consulting firm, and Alan Allman Associates is no exception. Their strategies are designed to leverage their ecosystem model and specialized expertise to attract and retain clients. By focusing on strategic acquisitions and providing high-quality, tailored services, they aim to build lasting relationships and expand their market presence.

The company's approach to customer acquisition involves strategic mergers and acquisitions, integrating new consulting firms to expand its service offerings and geographic reach. This method allows Alan Allman Associates to quickly gain access to established client bases and specialized capabilities. Simultaneously, their marketing efforts emphasize their expertise and value proposition, positioning them as leaders in digital transformation and leveraging certifications to build trust with potential clients.

For customer retention, Alan Allman Associates prioritizes client satisfaction through tailored, high-quality services. Their commitment to long-term partnerships is evident in their strategic plan and investments in talent development, ensuring that they meet evolving client demands. This approach, combined with a focus on providing comprehensive solutions through their ecosystem model, helps foster strong client loyalty and supports sustained business growth.

Alan Allman Associates uses mergers and acquisitions as a key strategy for acquiring new customers. This approach allows them to integrate firms with established client bases and expand their service offerings. Recent acquisitions, such as PhoenixDX in January 2025 and WINNING Consulting in December 2024, exemplify this strategy, broadening their reach and capabilities.

The company focuses on demonstrating its expertise and value proposition through strong branding. While specific digital marketing strategies are not detailed, they emphasize thought leadership. Certifications like ISO 9001 and ISO 27001, along with the Ecovadis Gold Medal, serve as trust signals, helping to attract potential clients. This approach is key to understanding the Marketing Strategy of Alan Allman Associates.

Alan Allman Associates prioritizes client satisfaction to retain customers. A customer satisfaction survey conducted in June 2024 reported an NPS score of 69.3%, indicating strong client loyalty. Their ecosystem model allows for cross-selling and comprehensive solutions, meeting a wide range of client needs.

Investing in talent is crucial for delivering high-quality services. The company offers AI training to over 4,000 professionals, ensuring consultants can meet evolving client demands. The RISE 2025 strategic plan emphasizes developing promising sectors, maintaining a diverse customer portfolio, and preserving customer independence, all contributing to long-term client relationships.

Alan Allman Associates employs a multifaceted approach to acquire and retain customers, focusing on strategic acquisitions, strong branding, and client satisfaction. These strategies are supported by investments in talent and a commitment to long-term partnerships.

- Strategic Acquisitions: Integrating firms like PhoenixDX (January 2025) and WINNING Consulting (December 2024) to expand service offerings and client base.

- Brand Building: Emphasizing thought leadership and leveraging certifications (ISO 9001, ISO 27001, Ecovadis Gold Medal) to build trust.

- Client Satisfaction: Achieving a Net Promoter Score (NPS) of 69.3% in June 2024, indicating strong client loyalty.

- Talent Development: Training over 4,000 professionals in AI to meet evolving client demands.

- Long-Term Partnerships: Focusing on the RISE 2025 strategic plan to develop promising sectors and maintain customer independence.

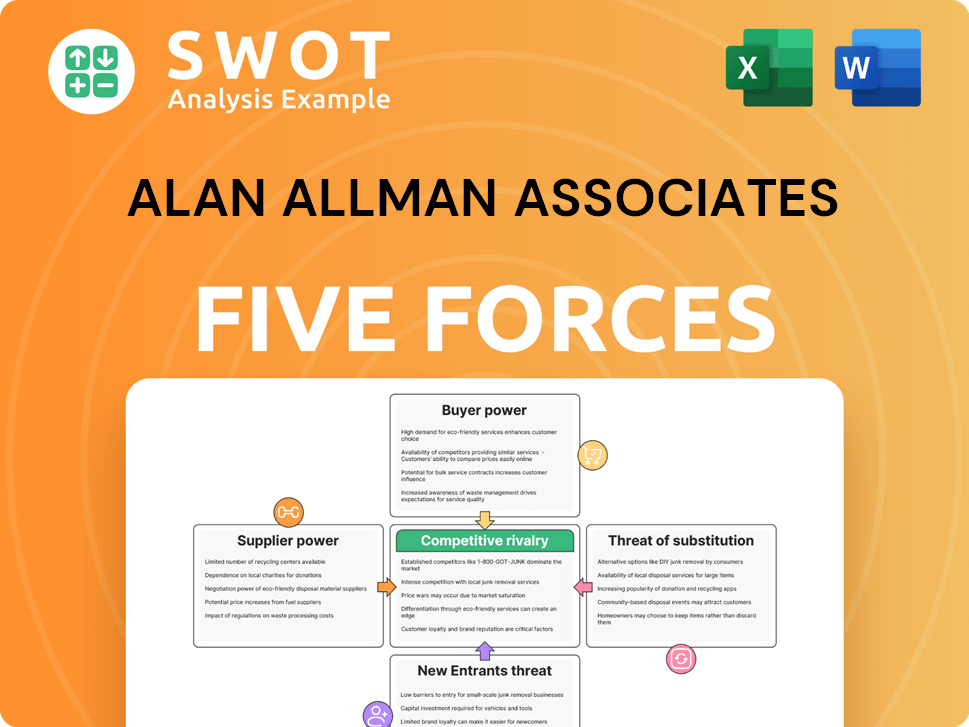

Alan Allman Associates Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Alan Allman Associates Company?

- What is Competitive Landscape of Alan Allman Associates Company?

- What is Growth Strategy and Future Prospects of Alan Allman Associates Company?

- How Does Alan Allman Associates Company Work?

- What is Sales and Marketing Strategy of Alan Allman Associates Company?

- What is Brief History of Alan Allman Associates Company?

- Who Owns Alan Allman Associates Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.