ALS Bundle

From Soap to Science: How Did ALS Company Evolve?

Journey back in time to 1863 Brisbane, Australia, where a simple soap-making venture sparked the incredible ALS SWOT Analysis of a global testing and analysis giant. From its humble beginnings as 'Campbell Brothers,' how did ALS Limited transform into a multi-billion dollar enterprise? Discover the pivotal moments and strategic shifts that shaped the ALS history and its rise to become a leader in the TIC industry.

The ALS company profile reveals a remarkable story of adaptation and expansion. Initially focused on chemical manufacturing, the company, now known as ALS Group, strategically diversified its services. Today, ALS operates across six continents, offering comprehensive testing solutions that span mining, environmental, and pharmaceutical sectors. Understanding the ALS company timeline helps to appreciate its global impact.

What is the ALS Founding Story?

The story of the ALS Company began in 1863, a journey marked by significant transformations and strategic pivots. From its humble beginnings as a soap manufacturer to its current status as a global testing, inspection, and certification leader, the company's evolution is a testament to its adaptability and vision.

This transformation highlights an entrepreneurial spirit and a keen eye for emerging market opportunities. The company's ability to recognize and capitalize on these opportunities has been crucial to its sustained success and growth. The company's history is a compelling example of how a business can evolve and thrive in response to changing market dynamics.

The

ALS history

started in 1863 when Peter Morrison Campbell, a Scottish immigrant, founded 'Campbell Brothers' in Brisbane, Australia. Initially, the company focused on soap manufacturing before expanding into cleaning chemicals. The business model was centered around chemical manufacturing.- In 1863, 'Campbell Brothers' was established in Brisbane, Queensland, Australia.

- The company relocated to Bowen Hills in 1881, where it manufactured soaps and cleaning chemicals for a century.

- In 1952, the company, then known as 'Campbell Brothers Limited,' went public on the Australian Stock Exchange.

- A pivotal moment arrived in 1981 with the acquisition of Australian Laboratory Services Pty Ltd, a geochemistry laboratory.

- By the mid-1980s, Campbell Brothers had acquired all shares of Australian Laboratory Services.

- In August 2012, the company officially changed its name to 'ALS Limited,' reflecting its shift to laboratory services.

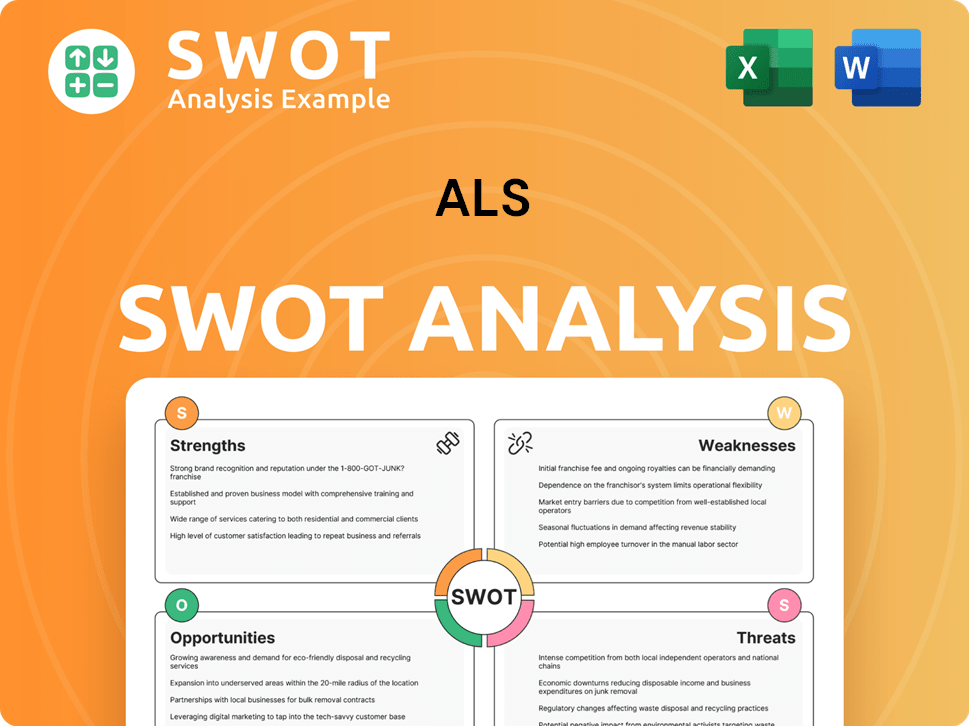

ALS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of ALS?

Following the acquisition of Australian Laboratory Services in 1981, the ALS Company experienced significant growth and diversification. The company expanded rapidly throughout Australia during the 1980s, fueled by its analytical chemistry services for the oil shale and mineral exploration industries. The 1990s marked the beginning of its international expansion, extending into Asia and South America. This set the stage for further global expansion in the early 2000s, reaching North America, Africa, and Europe, with the Middle East following in 2011.

Strategic moves during this period included integrating acquired businesses and improving operational efficiencies. In March 2024, ALS Limited announced the acquisitions of York Analytical Laboratories in the Northeast USA and Wessling Holding GmbH & Co. KG in Western Europe. These acquisitions were expected to contribute approximately A$195 million in revenues annually.

The company's H1 FY2025 results, ending September 30, 2024, reflected this growth. Revenue increased by 14% to $1.4 billion, primarily driven by strong performance in its minerals and environmental divisions. The acquisitions cost around A$225 million and were funded from existing bank debt facilities.

ALS Group maintained a solid balance sheet with available liquidity of $375 million as of September 30, 2024, and an EBITDA cash conversion of 91%. This financial stability supported its continued expansion and operational improvements. The company's growth efforts have consistently shaped its trajectory.

Through strategic acquisitions and organic growth, ALS has become one of the world's largest providers of analytical and testing services. This global presence allows it to serve a diverse range of industries and clients worldwide, solidifying its position in the market. The company's expansion continues to be a key factor in its success.

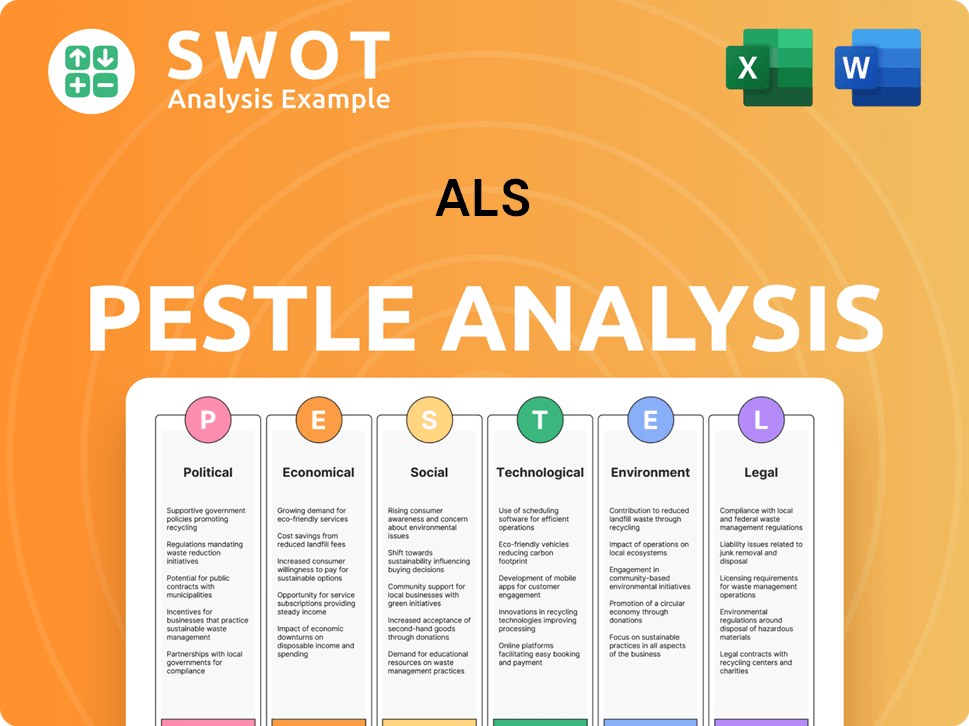

ALS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in ALS history?

The ALS Company, also known as ALS Limited, has achieved numerous milestones, solidifying its position as a global leader in scientific analysis and testing services. Throughout its ALS history, the company has consistently expanded its capabilities and geographic reach, adapting to the evolving needs of various industries.

| Year | Milestone |

|---|---|

| 2022 | Introduced digital transformation initiatives to strengthen infrastructure and enhance its corporate brand. |

| 2024 | Recognized as a finalist for multiple Society of Food and Hygiene Awards. |

| Ongoing | Focus on advancing life sciences through service diversification and geographic expansion. |

ALS Group has consistently embraced innovation to enhance its service offerings. A key focus has been on leveraging state-of-the-art technologies and methodologies to deliver high-quality testing services across diverse sectors. The company's commitment to optimizing analytical testing methods for renewable energy metals within its commodities segment also showcases its innovative approach.

Initiatives introduced in 2022 to strengthen infrastructure and enhance the corporate brand.

Focused on advancing life sciences through service diversification and geographic expansion.

Optimizing analytical testing methods for renewable energy metals within its commodities segment.

Despite its achievements, ALS has faced challenges, including financial impacts and legal proceedings. In FY2024, the company experienced a significant statutory profit drop due to write-downs related to its European drug testing business, Nuvisan, and restructuring charges. The company also faced headwinds in its commodities division, with a 1.7% revenue drop due to foreign exchange impacts.

In FY2024, the company faced a significant statutory profit drop due to write-downs related to its European drug testing business, Nuvisan, and restructuring charges.

The ongoing Nuvisan transformation program is ahead of schedule in delivering cost reductions, with annualised cost savings of approximately €19 million by the end of FY2025.

Foreign exchange headwinds in Latin America contributed to a 1.7% revenue drop in the commodities division.

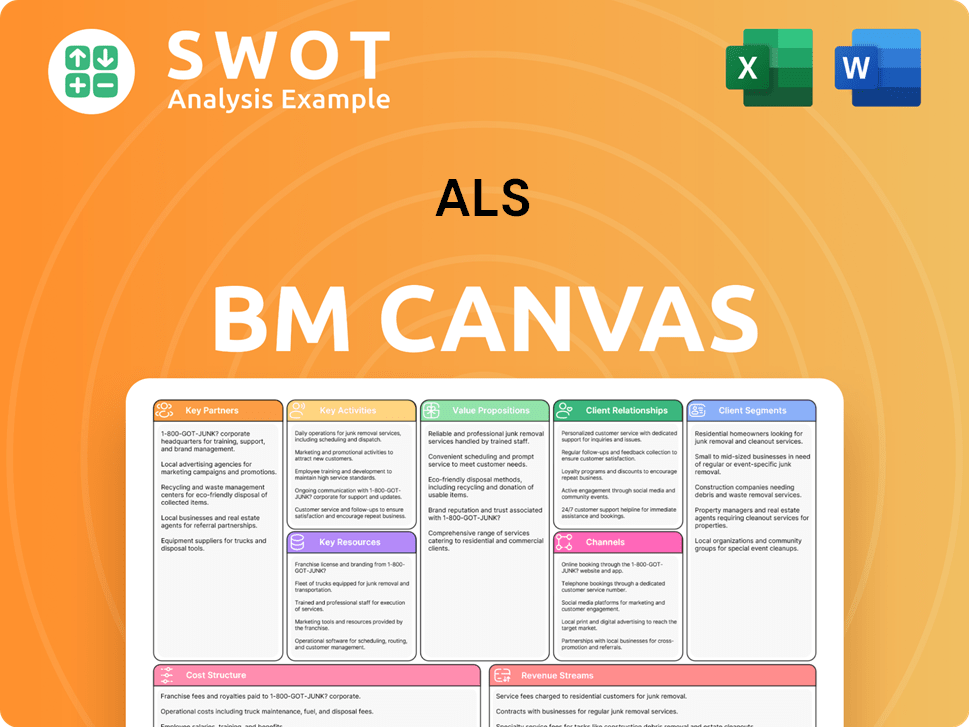

ALS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for ALS?

The ALS Company, now known as ALS Limited, has a rich history. Starting as a soap manufacturer, the company evolved into a global leader in laboratory testing and analytical services. Key moments in the ALS history include strategic acquisitions, expansions into new markets, and a focus on innovation and digital transformation.

| Year | Key Event |

|---|---|

| 1863 | Peter Morrison Campbell establishes Campbell Brothers, a soap manufacturer in Brisbane, Australia. |

| 1952 | Campbell Brothers Limited is listed on the Australian Stock Exchange (ASX). |

| 1976 | Australian Laboratory Services (ALS) begins as a geochemistry laboratory in Brisbane. |

| 1981 | Campbell Brothers acquires Australian Laboratory Services, marking a shift towards laboratory testing. |

| 1990s | ALS expands into Asia and South America. |

| 2000s | Expansion into North America, Africa, and Europe. |

| 2011 | Official launch of presence in the Middle East. |

| 2012 | Campbell Brothers Limited is renamed ALS Limited. |

| 2017 | Raj Naran named Managing Director and CEO. |

| 2022 | ALS introduces digital transformation initiatives. |

| 2023 | Malcolm Deane named CEO & Managing Director. |

| March 2024 | Acquisition of York Analytical Laboratories and Wessling Holding GmbH & Co. KG, enhancing Life Sciences portfolio. |

| July 2024 | Legal proceedings commenced against ALS subsidiary ACIRL Quality Testing Services Pty Ltd. |

| November 2024 | ALS reports resilient H1 FY25 results despite mixed market conditions, with revenue up 14% to $1.4 billion. |

| May 2025 | ALS delivers solid FY25 results with underlying revenue of $3 billion and announces a $350 million equity raising to fund developments and future growth. |

| July 2025 | ALS's operational headquarters will relocate from Houston, Texas, to Madrid, Spain. |

ALS aims for mid-single digit organic revenue growth across the group, demonstrating a commitment to sustainable expansion. The company is focused on strategic initiatives, including integrating recent acquisitions and completing the Nuvisan transformation program. By FY2027, ALS targets revenue growth to $3.3 billion, indicating a strong growth trajectory for the ALS Group.

The company is targeting an underlying EBIT of $600 million by FY2027, with a minimum EBIT margin of 19%. This demonstrates the company's focus on profitability and efficiency. ALS continues to emphasize strong cash generation, with an EBITDA cash conversion rate of 95% in FY2025, reflecting robust financial management.

ALS is strengthening its regional presence in pharmaceuticals without extensive global expansion. The company's future outlook is tied to its vision of being the global leader in scientific analysis, leveraging data-driven insights. Continued margin resilience in Minerals is also a key area of focus.

The Nuvisan transformation program is ahead of schedule in delivering cost reductions, improving operational efficiency. The relocation of operational headquarters to Madrid, Spain, in July 2025, is a strategic move to optimize operations. The company's strong cash generation, with an EBITDA cash conversion rate of 95% in FY2025, highlights its financial health.

ALS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of ALS Company?

- What is Growth Strategy and Future Prospects of ALS Company?

- How Does ALS Company Work?

- What is Sales and Marketing Strategy of ALS Company?

- What is Brief History of ALS Company?

- Who Owns ALS Company?

- What is Customer Demographics and Target Market of ALS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.