ALS Bundle

How Does ALS Limited Thrive in the Global TIC Arena?

The testing, inspection, and certification (TIC) industry is a massive, dynamic market, and ALS Limited has become a key player. From its beginnings in the Australian mining sector in 1863, ALS has grown into a global leader. Understanding the ALS SWOT Analysis is crucial to grasping its competitive strategy.

This article provides a deep dive into the ALS competitive landscape, examining its position within the broader TIC market. We'll identify key competitors and analyze the factors that have propelled ALS to its current prominence. The analysis will also touch upon the ALS market analysis and how it navigates the complexities of a highly regulated and evolving industry, offering insights applicable to understanding the strategies of Amyotrophic lateral sclerosis companies and the broader healthcare landscape.

Where Does ALS’ Stand in the Current Market?

ALS Limited holds a strong position within the global TIC (Testing, Inspection, and Certification) industry, with a notable focus on specialized analytical testing services. The company is a leader in certain segments, particularly in mining and environmental testing. Its extensive network of over 350 laboratories across more than 65 countries highlights its significant geographic presence, serving a wide range of clients, from multinational corporations to local businesses.

The company's core operations are divided into three main segments: Commodities, Life Sciences, and Industrial. The Commodities division, including mining and metallurgy, forms a significant part of ALS's business. The Life Sciences division, which has seen considerable growth, covers environmental, food, pharmaceutical, and consumer product testing. The Industrial division offers asset care and tribology services. This diversification has shifted ALS's focus beyond its traditional mining sector to include high-demand sectors like food safety and pharmaceutical quality control.

In the first half of the 2024 financial year, ALS reported a strong revenue of AUD 2.3 billion, demonstrating healthy financial performance. Strategic acquisitions, such as the 2023 purchase of Nuvisan, have strengthened its market position, especially in the pharmaceutical and life sciences contract research organization (CRO) space. ALS's presence is particularly strong in regions with significant mining activities, like Australia, North America, and South America, and it is growing in Europe and Asia for its Life Sciences operations. For more details on the company's financial structure, see Revenue Streams & Business Model of ALS.

ALS is one of the largest providers of assaying and metallurgical testing services globally, making it a key player in the mining sector. This leadership is supported by its extensive laboratory network and a wide range of specialized services. The company's expertise helps clients ensure the quality and safety of their products and processes.

The expansion into Life Sciences and Industrial divisions has broadened ALS's service offerings. This diversification helps reduce reliance on the mining sector and allows the company to capitalize on growth opportunities in areas like environmental testing and pharmaceutical services. This strategic move strengthens its overall market position.

With over 350 laboratories across more than 65 countries, ALS maintains a significant global footprint. This extensive network enables the company to serve a diverse client base, from large multinational corporations to smaller local businesses. Its global presence supports its ability to offer consistent services worldwide.

ALS demonstrated strong financial performance in the first half of the 2024 financial year, with revenues of AUD 2.3 billion. Strategic acquisitions, such as Nuvisan, have enhanced its market position, particularly in the pharmaceutical and life sciences CRO sector. These moves support its growth and expand its service capabilities.

ALS's competitive advantage stems from its strong market position, global presence, and diversified service offerings. The company's focus on specialized analytical testing services, particularly in the mining and environmental sectors, has allowed it to establish a strong foothold in the industry. The diversification into Life Sciences and Industrial divisions has further strengthened its market position.

- Strong presence in the mining sector with assaying and metallurgical testing services.

- Diversification into Life Sciences and Industrial sectors to capture growth opportunities.

- Extensive global network of laboratories, providing services to a wide range of clients.

- Healthy financial performance, with revenue of AUD 2.3 billion in the first half of 2024.

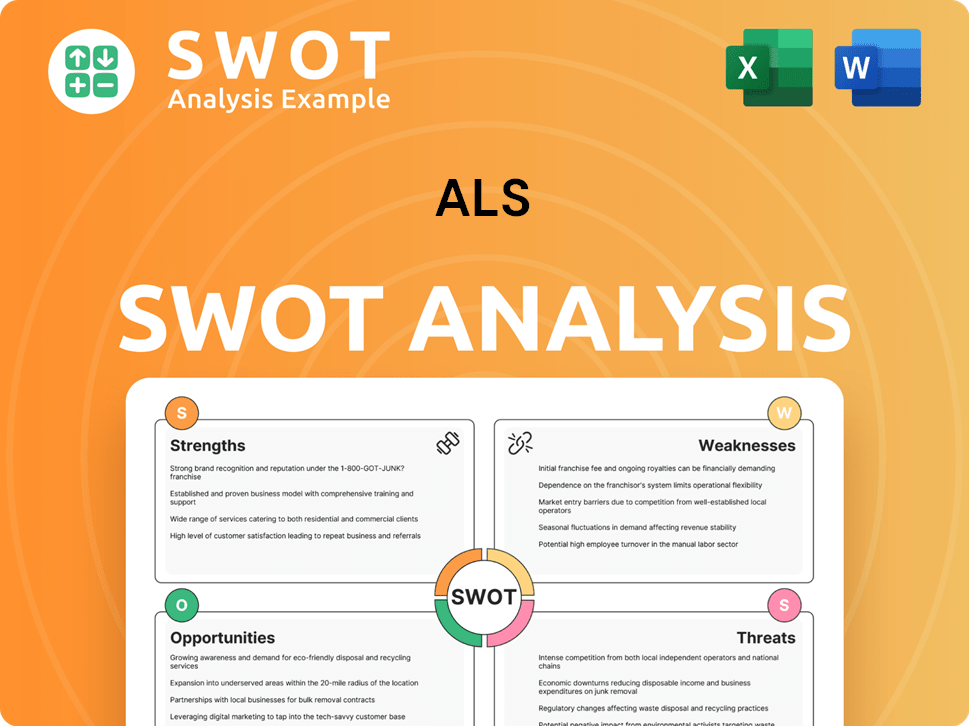

ALS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ALS?

The competitive landscape for ALS Limited is complex, shaped by its diverse service offerings and the global Testing, Inspection, and Certification (TIC) market dynamics. ALS faces competition from multinational corporations and specialized niche players across several sectors, including mining, commodities, life sciences, and environmental testing. The company's ability to maintain its market share and grow depends on its strategic responses to these competitors and industry trends.

Understanding the competitive environment is crucial for ALS to make informed decisions about its business strategies, including resource allocation, service offerings, and market expansion. The company must continuously assess its strengths and weaknesses relative to its competitors to maintain a competitive edge. This involves monitoring market trends, technological advancements, and regulatory changes within the industries it serves.

The Growth Strategy of ALS is significantly influenced by its competitive environment, requiring the company to adapt and innovate to sustain and enhance its position in the market. This includes efforts to improve operational efficiency, expand its service portfolio, and pursue strategic partnerships or acquisitions.

In the mining and commodities sector, ALS competes with major players like SGS S.A., Bureau Veritas S.A., and Intertek Group plc. These companies offer similar services, including assaying, inspection, and testing of minerals and metals. Competition is intense, particularly for large-scale contracts.

In the Life Sciences segment, ALS faces competition from companies like Eurofins Scientific, Thermo Fisher Scientific, and Labcorp. This sector includes environmental, food, and pharmaceutical testing. Eurofins, in particular, has grown rapidly through acquisitions, posing a significant challenge.

Indirect competition comes from in-house laboratories of large corporations and specialized firms. These entities may offer innovative testing solutions, creating additional pressure on ALS to remain competitive. The market is also influenced by mergers and acquisitions.

Key competitors include SGS, Bureau Veritas, Intertek, Eurofins Scientific, Thermo Fisher Scientific, and Labcorp. Each company has its strengths, such as global reach, specialized expertise, or diverse service offerings. These companies compete for market share in various segments.

Market dynamics are constantly evolving due to mergers, acquisitions, and technological advancements. ALS must adapt to these changes by improving operational efficiency, expanding its service portfolio, and pursuing strategic partnerships. The company's ability to innovate and respond to market changes is critical.

Strategic considerations for ALS involve maintaining a strong market position, expanding service offerings, and potentially engaging in mergers or acquisitions. The company needs to focus on innovation and customer service to stay competitive. Monitoring industry trends and regulatory changes is also essential.

The ALS competitive landscape is shaped by global market dynamics and the specific industries it serves. The company's ability to maintain and grow its market share depends on its strategic responses to these competitors and industry trends. The company's focus on innovation and customer service is critical.

- SGS S.A.: A Swiss multinational with a vast global network and a strong presence in mineral services, directly competing with ALS in assaying and inspection. In 2024, SGS reported revenues of approximately CHF 7.3 billion.

- Bureau Veritas S.A.: A French company offering extensive services in commodities inspection and testing, leveraging its global footprint. Bureau Veritas reported revenues of approximately EUR 5.7 billion in 2024.

- Intertek Group plc: A UK-based provider competing in the minerals and metals testing space. Intertek's revenue in 2024 was around GBP 3.3 billion.

- Eurofins Scientific: A Luxembourg-based company with a diversified portfolio in food, environmental, and pharmaceutical testing. Eurofins' revenue in 2024 was approximately EUR 6.7 billion.

- Thermo Fisher Scientific: Competes through its analytical services. Thermo Fisher's total revenue in 2024 was approximately USD 42.5 billion.

- Labcorp: Competes in CRO services. Labcorp's revenue in 2024 was around USD 16.2 billion.

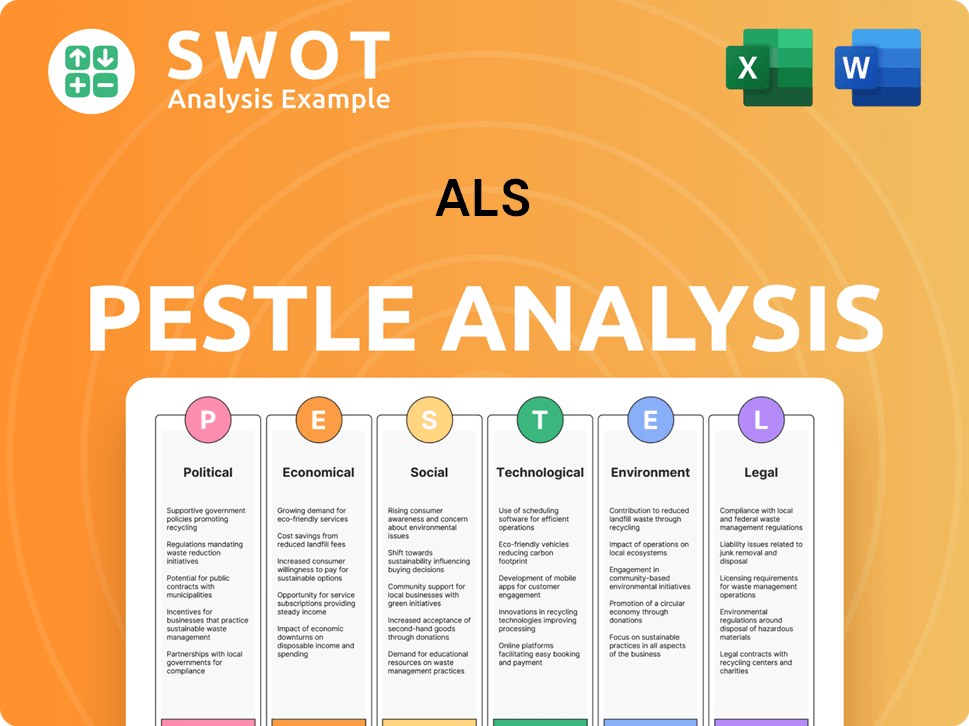

ALS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ALS a Competitive Edge Over Its Rivals?

The competitive landscape for companies involved in Amyotrophic Lateral Sclerosis (ALS) is shaped by factors such as research advancements, regulatory approvals, and market dynamics. The Growth Strategy of ALS highlights the importance of strategic positioning. ALS market analysis reveals a focus on innovative therapies and patient-centric approaches.

Key milestones in the ALS pharmaceutical sector include breakthroughs in treatment options and progress in clinical trials. Strategic moves involve collaborations, acquisitions, and investments in research and development. A company's competitive edge is determined by its ability to innovate, secure regulatory approvals, and establish market presence.

The ALS competitive landscape is dynamic, with companies vying for market share through innovative treatments and research breakthroughs. The ALS treatment market trends indicate a focus on personalized medicine and combination therapies. The ALS drug pipeline overview shows a diverse range of treatments in various stages of development.

ALS Limited operates a vast global network, with over 350 laboratories across more than 65 countries. This extensive presence allows the company to offer localized services while maintaining global standards. This expansive network is crucial for multinational clients, especially in sectors like mining, where proximity to exploration sites is vital.

The company has invested significantly in advanced analytical techniques and specialized instrumentation. This technological leadership allows ALS to provide highly accurate and reliable results, critical for compliance and decision-making. ALS has accumulated a deep pool of intellectual property in testing protocols and data interpretation over its long history.

With over 160 years of operation, ALS has built a strong reputation for quality, integrity, and technical excellence. This long-standing trust translates into high customer retention rates and a preferred partner status. Economies of scale, particularly in high-volume operations, allow ALS to achieve cost efficiencies that smaller competitors cannot match.

ALS's talent pool of skilled professionals, coupled with a robust quality assurance system, underpins its operational excellence. The company's strategic focus on diversifying into high-growth Life Sciences sectors demonstrates an evolving competitive advantage. This diversification is supported by targeted acquisitions, adapting to market demands.

The competitive advantages of companies in the ALS market are multifaceted, including proprietary technologies, strong brand reputation, and a global presence. These factors contribute to high customer retention and a preferred partner status. The ALS research funding landscape is also a key factor, with significant investments driving innovation.

- Extensive Global Network: Over 350 laboratories across more than 65 countries, providing localized services.

- Proprietary Technologies: Advanced analytical techniques and specialized instrumentation for accurate results.

- Strong Brand Reputation: Over 160 years of operation, building trust and high customer retention.

- Economies of Scale: Cost efficiencies in high-volume operations, enabling competitive pricing.

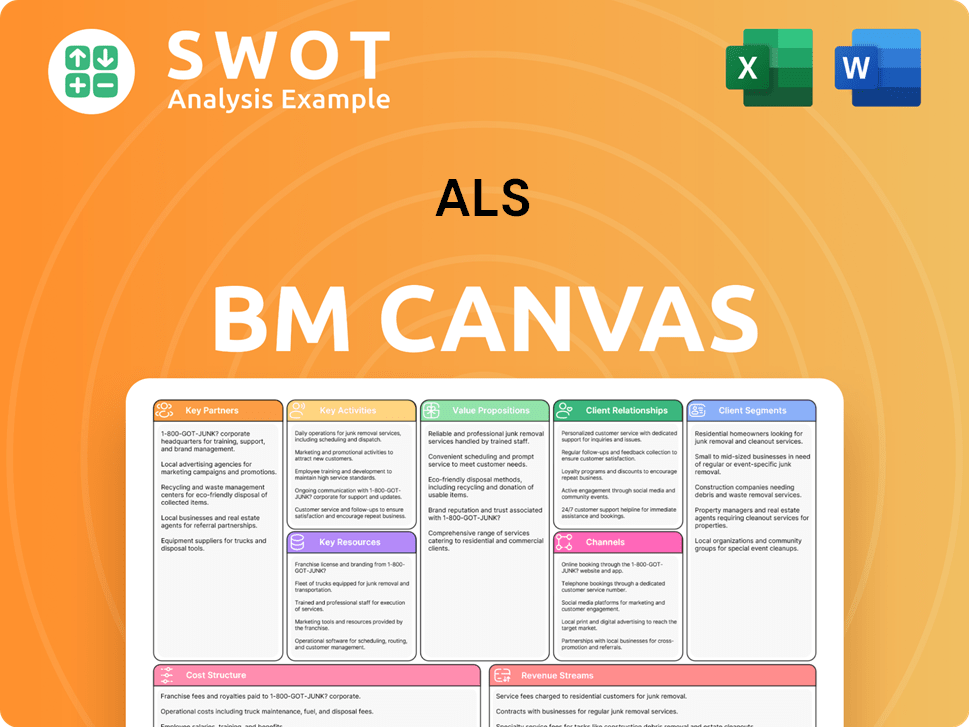

ALS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ALS’s Competitive Landscape?

The testing, inspection, and certification (TIC) industry is experiencing significant shifts, impacting companies like ALS Limited. These changes present both challenges and opportunities. Technological advancements, regulatory changes, and evolving consumer preferences are key drivers of the current landscape. Understanding these dynamics is crucial for navigating the future.

For ALS, the competitive landscape is shaped by these trends, along with global economic shifts and the rise of new technologies. The company's ability to adapt to these changes, capitalize on emerging opportunities, and mitigate potential risks will be critical for maintaining its market position and achieving long-term growth. Brief History of ALS provides additional context on the company's evolution.

Technological advancements are transforming testing methodologies, with automation and data analytics gaining prominence. Regulatory changes, driven by environmental and safety concerns, are increasing testing requirements. Consumer demand for transparency and sustainability is also driving demand for TIC services.

Potential disruptions include the rise of in-situ testing and new market entrants offering innovative solutions. Declining demand in specific commodity markets and increased regulatory burdens pose risks. Aggressive pricing strategies from new competitors could also impact ALS.

Growth opportunities exist in emerging markets and through product innovations, such as advanced materials testing. Strategic partnerships and collaborations can unlock new market segments. ALS's focus on Life Sciences, digital transformation, and acquisitions supports its growth strategy.

The ALS competitive landscape is dynamic, with established players and emerging competitors. The company's strategies focus on continuous investment and strategic initiatives to maintain its competitive edge. Market analysis reveals the importance of adaptability and innovation.

ALS is focusing on several key strategies to navigate industry trends and capitalize on opportunities. These strategies include significant investment in the Life Sciences division, digital transformation initiatives, and targeted acquisitions to enhance its service offerings and market reach. The company aims to maintain a strong position in the evolving TIC market.

- Continuous Investment: Ongoing investment in technology and infrastructure to improve efficiency and accuracy.

- Digital Transformation: Implementing digital solutions to streamline operations and enhance customer experience.

- Strategic Acquisitions: Expanding service offerings and market presence through strategic acquisitions.

- Emerging Markets: Expanding into new markets where industrialization and regulatory enforcement are driving TIC demand.

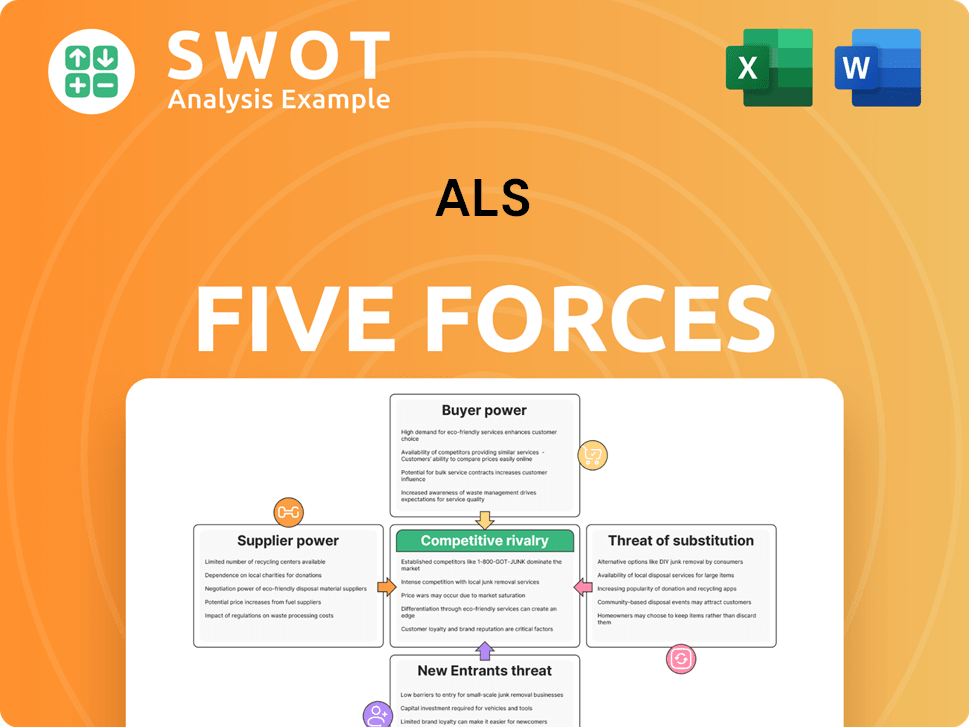

ALS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ALS Company?

- What is Growth Strategy and Future Prospects of ALS Company?

- How Does ALS Company Work?

- What is Sales and Marketing Strategy of ALS Company?

- What is Brief History of ALS Company?

- Who Owns ALS Company?

- What is Customer Demographics and Target Market of ALS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.