ALS Bundle

Who Really Owns the ALS Company?

Ever wondered who steers the ship at a global testing and inspection giant like ALS Limited? From its humble beginnings as a family soap maker in 1863, ALS has transformed into a powerhouse operating in 65 countries. Understanding the ALS SWOT Analysis is key to grasping the company's strategic maneuvers and market position.

This exploration into ALS ownership will unravel the intricate web of shareholders, from early investors to current major stakeholders, providing a comprehensive view of who influences this global leader. Knowing who owns ALS is vital for anyone seeking to understand the company's financial performance, strategic direction, and its role in the global market. Discover the answers to questions like: Is ALS a publicly traded company? and Who are the major shareholders of ALS?

Who Founded ALS?

The story of the ALS company, now known as ALS Limited, begins with two separate entities. One was a soap manufacturer, and the other a laboratory services provider. Understanding their origins is key to grasping the current ALS ownership structure.

The initial company, 'Campbell Brothers,' started in 1863 in Brisbane, Australia, as a privately held soap manufacturing business. It later became 'Campbell Brothers Limited' and was listed on the stock exchange in 1952. Meanwhile, 'Australian Laboratory Services' (ALS) began in 1976, also in Brisbane, focusing on analytical chemistry for industries like oil and mineral exploration.

The transformation of the ALS ownership occurred through a strategic acquisition. In 1981, Campbell Brothers gained control of Australian Laboratory Services, eventually acquiring all shares by the mid-1980s. This move integrated the laboratory services into the publicly traded Campbell Brothers. The company officially changed its name to ALS Limited in 2012, reflecting its shift to testing services.

The evolution of ALS ownership is a story of strategic acquisitions and a shift in business focus, with the initial ownership rooted in a soap manufacturing company. Here's a breakdown:

- 1863: Peter Morrison Campbell founds Campbell Brothers.

- 1952: Campbell Brothers Limited is listed on the stock exchange.

- 1976: Australian Laboratory Services (ALS) begins operations.

- 1981: Campbell Brothers acquires a controlling stake in ALS.

- Mid-1980s: Campbell Brothers fully acquires ALS.

- 2012: Campbell Brothers Limited rebrands as ALS Limited.

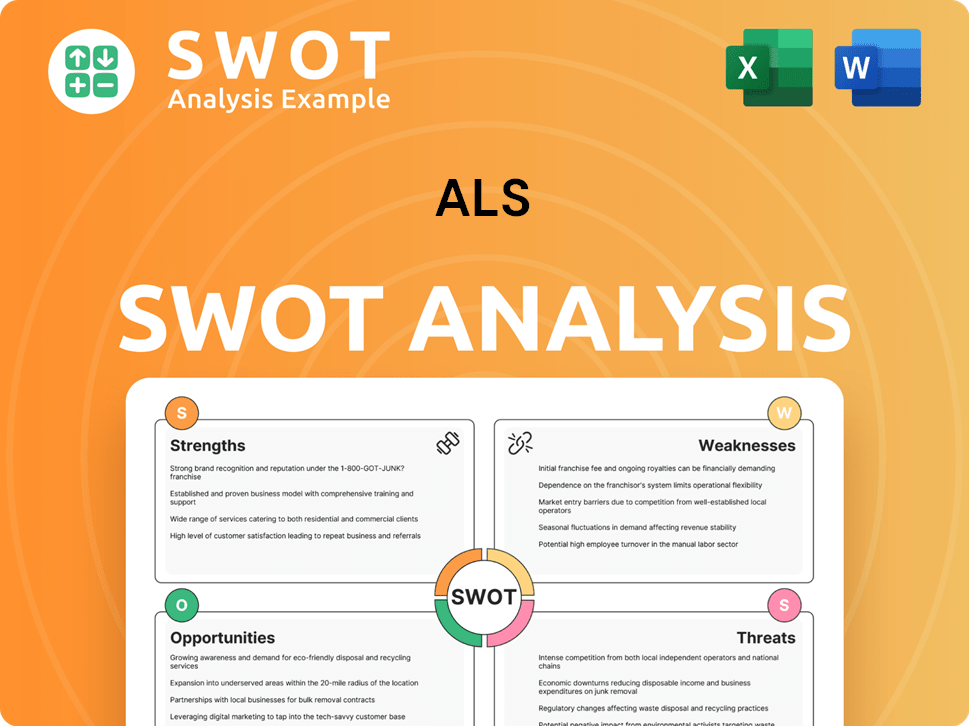

ALS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ALS’s Ownership Changed Over Time?

The evolution of ALS's ownership reflects its growth from Campbell Brothers Limited, listed in 1952, to a global testing, inspection, and certification leader. The acquisition of Australian Laboratory Services in 1981 and the 2012 rebranding to ALS Limited marked significant milestones. As a publicly traded entity on the Australian Securities Exchange (ASX: ALQ), the company's ownership is now diversified among institutional investors, mutual funds, and individual shareholders.

The ownership structure of the ALS company has been shaped by strategic acquisitions and capital-raising initiatives. In March 2024, ALS Limited agreed to acquire WESSLING Holding GmbH & Co. KG, a move that expanded its market presence. Furthermore, in May 2025, ALS announced a fully underwritten A$350 million institutional placement and a non-underwritten share purchase plan (SPP) to raise up to A$40 million. These actions have influenced the distribution of shares among shareholders, reflecting the company's strategic growth and financial strategies.

| Ownership Aspect | Details | Data |

|---|---|---|

| Institutional Owners and Shareholders | Number of institutional owners and shareholders | 88 (as of June 2, 2025) |

| Institutional Ownership | Major institutional shareholders | Vanguard, Invesco |

| Public and Individual Investors | Percentage of stock held | Approximately 91.92% (latest TipRanks data) |

As of June 2, 2025, ALS Limited has 88 institutional owners and shareholders. Key institutional holders include Vanguard and Invesco. The company's market capitalization places it within the ASX100. The recent equity raises, including the May 2025 placement of approximately 21.0 million new shares at A$16.70 per share, have diluted existing holdings but are aimed at funding organic investments and future acquisitions. These strategic financial moves highlight the ongoing evolution of the ALS ownership structure and its impact on the ALS stock.

ALS Limited's ownership is distributed among institutional and individual investors.

- Institutional investors hold a significant portion of the shares.

- Recent acquisitions and equity raises have reshaped the ownership structure.

- The company's market capitalization reflects its position in the ASX100.

- The ownership structure supports ALS's global growth strategy.

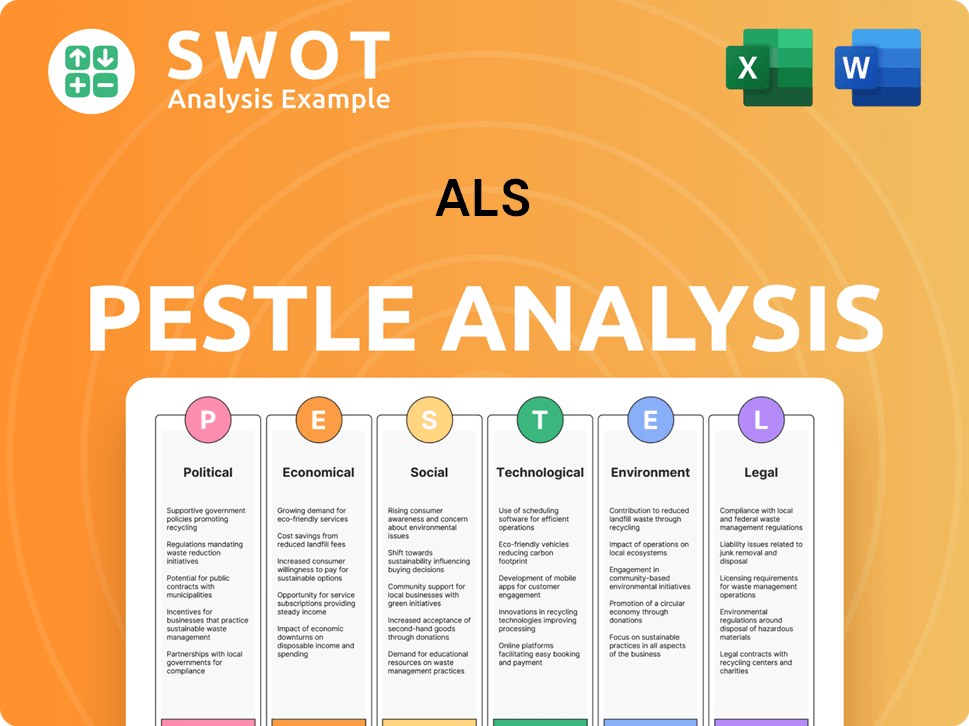

ALS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ALS’s Board?

The Board of Directors of ALS Limited (ALS Group) plays a crucial role in the company's governance. As of July 2024, the ALS Board includes members such as Keith Morgan (Chairperson), Patricia Laurie (Deputy Chairperson), Peter Stapleton, Robert Carroll, Uncle Hewitt Whyman, Janelle Clarke, Terrence Robinson, Raymond Keed, Maxine Kirby (alternate director), Antionette House, and Cindy Fuller. Nigel Garrard was appointed as Chairman of ALS Limited on July 31, 2024, following his appointment as Non-Executive Director on June 7, 2023. Malcolm Deane was appointed CEO and Managing Director in May 2023.

The board oversees the company's strategic direction and ensures accountability to shareholders. Directors are subject to rotational requirements for re-election, with their continued office based on effective contribution. The 73rd Annual General Meeting was held on July 31, 2024. Resolutions considered by shareholders included the election of directors and the adoption of the remuneration report. The company faced a 'first strike' on remuneration in the previous year. The Board also sought an increase in the fee pool for non-executive directors to facilitate board succession and potential future appointments. For more information, you can read the Brief History of ALS.

| Director | Role | Appointment Date |

|---|---|---|

| Keith Morgan | Chairperson | Not Specified |

| Patricia Laurie | Deputy Chairperson | Not Specified |

| Nigel Garrard | Chairman | July 31, 2024 |

The voting structure for ALS Limited (ALS stock), as a publicly listed company, generally operates on a one-share-one-vote basis for ordinary shares. However, specific details on dual-class shares or special voting rights are not prominently disclosed in the available public information for ALS Limited (ASX: ALQ). The Board's role is to govern the company, with the executive leadership team managing daily operations under the Board's direction. For the Aboriginal Legal Service (NSW/ACT) Limited, which shares the 'ALS' acronym but is a distinct entity, governance is community-controlled.

ALS Limited is a publicly traded company (Is ALS a publicly traded company), with governance overseen by a board of directors. The voting structure typically follows a one-share-one-vote system. The Aboriginal Legal Service (NSW/ACT) Limited, a separate entity, is community-controlled, ensuring community ownership and leadership.

- Board of Directors oversees strategic direction.

- Voting operates on a one-share-one-vote basis.

- The ALS Group faced a 'first strike' on remuneration.

- Community control at the Aboriginal Legal Service.

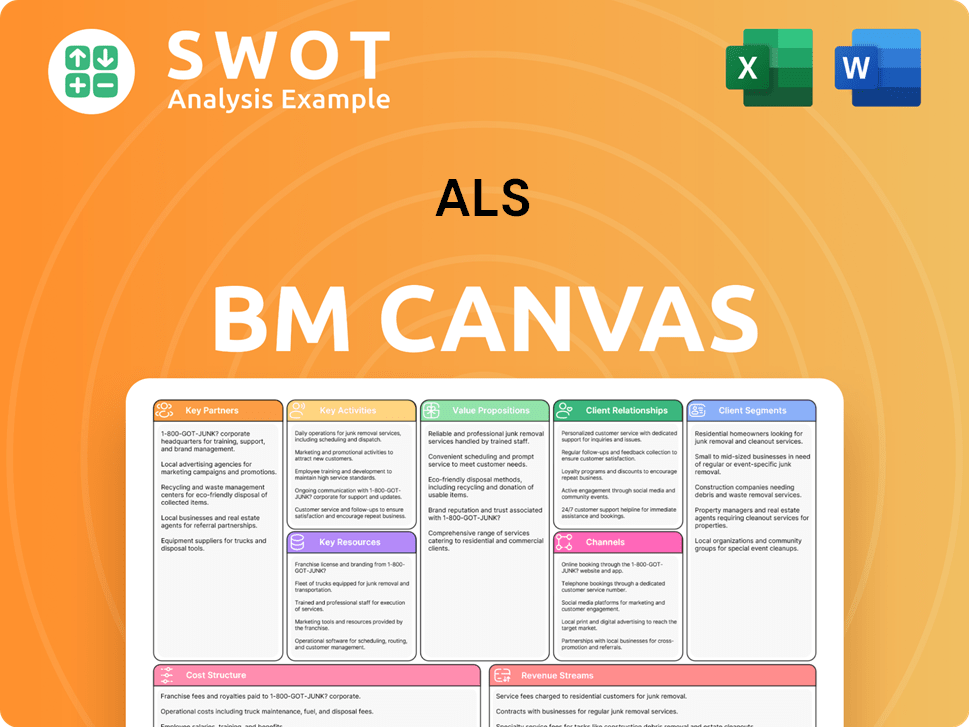

ALS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ALS’s Ownership Landscape?

Over the past few years, ALS Limited, also known as the ALS company, has significantly reshaped its ownership profile through strategic acquisitions and capital management initiatives. A key move was the full acquisition of Nuvisan, a European pharmaceutical testing business. ALS initially held a 49% stake, and in March 2024, it acquired the remaining 51% at no cost, solidifying its control and expanding its presence in the European pharmaceutical market. Another significant acquisition was WESSLING, which officially became part of ALS Limited in June 2024, aiming to boost ALS's growth in markets where it previously had a limited footprint. These actions reflect a broader trend of consolidation within the Testing, Inspection, and Certification (TIC) sector, influencing who owns ALS.

In May 2025, ALS announced a fully underwritten A$350 million institutional placement and a non-underwritten share purchase plan (SPP) to raise up to A$40 million. The placement involved issuing approximately 21.0 million new shares at A$16.70 per share, representing about 4.3% of existing ordinary shares. This equity raising aims to fund organic investments in the laboratory network and maintain financial flexibility for future mergers and acquisitions. Such moves can lead to shifts in ALS ownership structure as new investors come on board, affecting the ALS stock and potentially the company's market capitalization.

| Key Financial Highlights (FY2025) | ||

|---|---|---|

| Underlying Revenue | A$3 billion | Up 16.0% |

| Statutory Net Profit After Tax | A$256.2 million | Significant increase from FY2024 |

| Final Dividend | 19.7 cents per share |

ALS's financial performance, including underlying revenue of A$3 billion and a statutory net profit after tax of A$256.2 million for the fiscal year ending March 31, 2025, demonstrates its commitment to growth and market expansion. The final dividend of 19.7 cents per share further reflects this positive trajectory. These factors, combined with ongoing equity raises, suggest potential shifts in the ALS ownership structure. The company's strategic focus on acquisitions and strong financial results indicates ongoing changes to the ALS Group and its shareholder base, impacting who are the major shareholders of ALS.

The company is experiencing increased institutional ownership and consolidation within the TIC sector.

Major acquisitions include Nuvisan and WESSLING, expanding market presence and capabilities.

Strong revenue growth and profitability, with a significant increase in net profit after tax.

Equity raises to fund organic investments and maintain financial flexibility for future growth.

ALS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ALS Company?

- What is Competitive Landscape of ALS Company?

- What is Growth Strategy and Future Prospects of ALS Company?

- How Does ALS Company Work?

- What is Sales and Marketing Strategy of ALS Company?

- What is Brief History of ALS Company?

- What is Customer Demographics and Target Market of ALS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.