ALS Bundle

Unveiling ALS: How Does This Global Giant Thrive?

ALS Limited stands as a pivotal player in the testing, inspection, and certification (TIC) sector, ensuring quality and safety across numerous industries. With a substantial market capitalization, ALS company offers essential services, from analytical testing to expert consulting, impacting sectors from mining to pharmaceuticals. Understanding ALS's operations is crucial for anyone seeking to navigate the complexities of global markets and regulatory landscapes.

This exploration will dissect the core functions of ALS, examining how its diverse ALS SWOT Analysis contributes to its success. We'll delve into the specifics of ALS services, including ALS testing methodologies and the crucial role it plays in environmental testing, water quality testing, and food safety analysis. Furthermore, we'll investigate the company's global presence, including ALS laboratory locations and its impact on industries like oil and gas, providing a comprehensive view of this industry leader.

What Are the Key Operations Driving ALS’s Success?

The core operations of the ALS company revolve around providing comprehensive analytical testing services across various industries. This involves a global network of laboratories and testing facilities designed to ensure product quality, safety, and compliance. The company's value proposition is built on its technical expertise, extensive global reach, and commitment to accuracy and independence.

The company's services are segmented into four key areas: Minerals, Environmental, Life Sciences (Food & Pharmaceutical), and Industrial. Each segment offers specialized testing and analysis tailored to the specific needs of its clients. This operational model supports a wide range of industries, from mining and environmental monitoring to food safety and industrial applications.

The value proposition of the ALS company is centered on delivering reliable and accurate results. This helps clients reduce operational risks, improve product quality, and ensure regulatory compliance. The company's focus on innovation and technology, combined with its global presence, allows it to serve a diverse clientele effectively.

Provides geochemical analysis, metallurgical testing, and mine site services. Supports exploration, mining, and production activities. Offers essential data for resource evaluation and extraction processes.

Focuses on analyzing water, soil, and air samples for contaminants. Aids in environmental monitoring and remediation efforts. Helps clients meet regulatory requirements and protect ecosystems.

Offers testing for food safety, nutritional analysis, and pharmaceutical product quality control. Ensures the safety and efficacy of food and pharmaceutical products. Supports compliance with stringent industry standards.

Includes asset integrity management, tribology, and condition monitoring for various industrial applications. Helps clients optimize equipment performance and prevent failures. Contributes to operational efficiency and safety.

The operational processes of the ALS company are highly specialized and technologically advanced, utilizing state-of-the-art laboratory equipment and methodologies. The company's robust supply chain, continuous technology development, and strategic partnerships are crucial for delivering its services. Clients access results and reports through secure online portals, supported by direct client support. This ensures that the ALS services meet the diverse needs of its global customer base. For more insights into the competitive landscape, consider reviewing the Competitors Landscape of ALS.

The ALS laboratory utilizes advanced technology and methodologies to ensure accurate and reliable results. Continuous investment in new analytical techniques and automation enhances efficiency. This commitment to innovation supports the company's global operations and diverse service offerings.

- Sample Collection: Involves specialized logistics and field sampling expertise.

- Technology Development: Ongoing investment in new analytical techniques and automation.

- Supply Chain: Procurement of reagents, consumables, and sophisticated instrumentation.

- Distribution: Digital platforms for results and reports, complemented by client support.

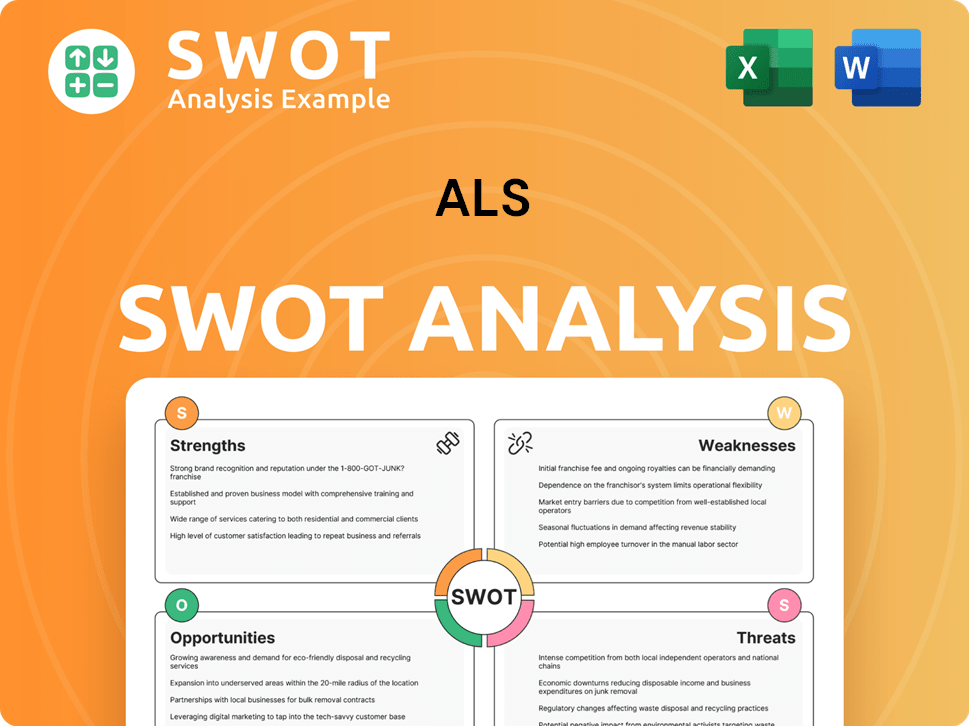

ALS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ALS Make Money?

The ALS company generates revenue primarily through fees for its comprehensive testing, inspection, and certification services. Their revenue streams are diversified across key operating divisions: Minerals, Environmental, Life Sciences, and Industrial. The company's financial performance is closely tied to global economic trends and specific industry demands.

Historically, the Minerals division has been a significant contributor, driven by global mining activity and commodity prices. Environmental testing services also contribute substantially, fueled by increasing regulatory scrutiny and corporate sustainability initiatives. The Life Sciences segment, encompassing food and pharmaceutical testing, has shown consistent growth due to heightened food safety concerns and pharmaceutical R&D.

Monetization strategies at the ALS laboratory are primarily service-fee based, where clients pay for specific tests, analyses, or consulting engagements. The company often employs tiered pricing models based on sample volume, turnaround time, and complexity of analysis. For large corporate clients or ongoing projects, long-term contracts are common, providing a stable revenue base.

The ALS company uses a multifaceted approach to generate revenue and maximize profitability. This includes a focus on diverse service offerings and strategic client relationships. The company's ability to adapt to changing market conditions and client needs is crucial for its financial success.

- Service-Fee Based Model: Clients pay for specific ALS services like analytical testing and consulting.

- Tiered Pricing: Prices vary based on sample volume, turnaround time, and complexity.

- Long-Term Contracts: Stable revenue from large clients through ongoing projects.

- Bundled Services: Comprehensive solutions across multiple testing requirements.

- Cross-Selling: Introducing clients to additional ALS testing services.

- Strategic Acquisitions: Expanding capabilities and geographical reach.

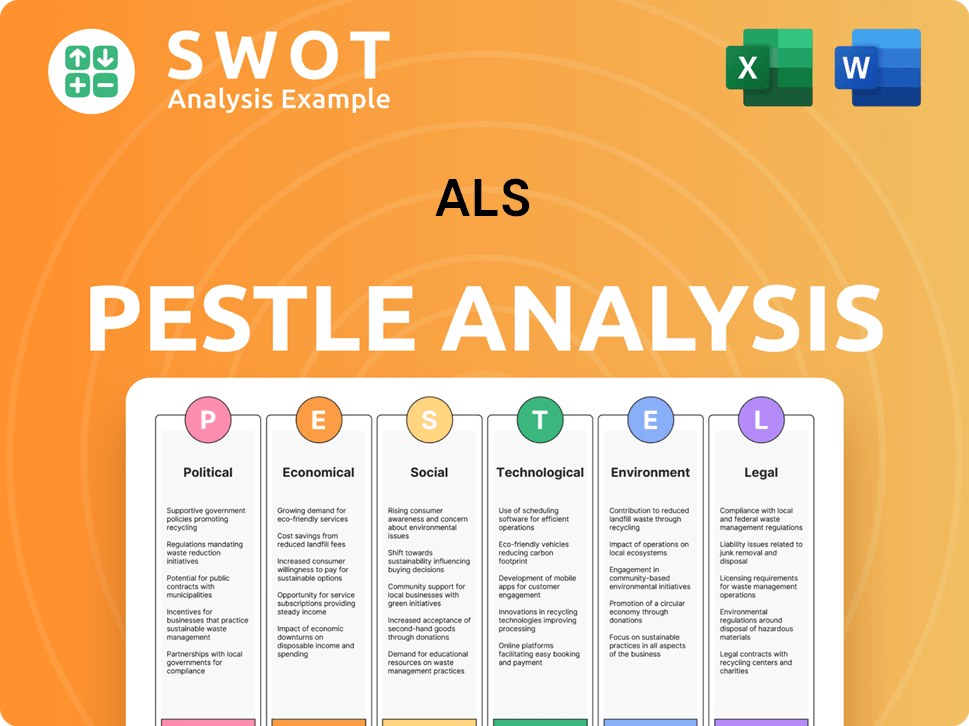

ALS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ALS’s Business Model?

The journey of ALS Limited has been marked by significant milestones and strategic shifts that have shaped its operational and financial trajectory. A key aspect of its growth has been a consistent strategy of global expansion, often through acquisitions of specialized testing laboratories. These moves have allowed the company to enter new geographic markets and broaden its service offerings, particularly in the environmental and life sciences sectors.

Strategic acquisitions of companies with strong presences in specific regions or with niche testing capabilities have been instrumental in broadening its market reach and strengthening its technical expertise. The company has navigated operational challenges such as fluctuating commodity prices impacting its Minerals division and regulatory changes across various jurisdictions. Its response has often involved diversifying its service portfolio to reduce reliance on any single sector and investing in advanced technology to improve efficiency and analytical precision.

ALS's competitive advantages are multifaceted. Its strong brand reputation, built over decades, signifies reliability, accuracy, and independence in the TIC industry. Technology leadership is another significant edge, with continuous investment in cutting-edge laboratory equipment and analytical methodologies, allowing it to offer a wider range of tests and achieve higher levels of precision. Economies of scale, derived from its extensive global network of laboratories, enable cost efficiencies and faster turnaround times.

ALS has expanded its global footprint significantly through strategic acquisitions. The company's history includes numerous acquisitions to broaden its service offerings and geographical reach. These moves have been crucial in solidifying its position in the analytical testing market.

A key strategic move for ALS has been the diversification of its service portfolio. This includes expanding into environmental testing, life sciences, and food safety analysis. Investment in advanced technology and automation has also been a priority to enhance efficiency and accuracy in its ALS laboratory operations.

ALS maintains a competitive edge through its strong brand reputation and technological advancements. The company benefits from economies of scale due to its extensive global network. It also continuously adapts to new trends, such as the increasing demand for ESG-related testing, to maintain its market position.

In recent financial reports, ALS has demonstrated consistent revenue growth, driven by its diversified service offerings and global presence. The company's financial performance is influenced by commodity prices in its Minerals division and the overall demand for ALS services in various sectors. The company's revenue in the financial year 2024 was approximately $2.2 billion.

ALS's competitive advantages are rooted in its strong brand reputation, technological leadership, and global network. The company's focus on accuracy and reliability has built a strong reputation within the ALS company.

- Strong brand reputation for reliability and accuracy.

- Continuous investment in cutting-edge laboratory equipment.

- Extensive global network enabling economies of scale.

- Adaptation to new trends, such as ESG testing.

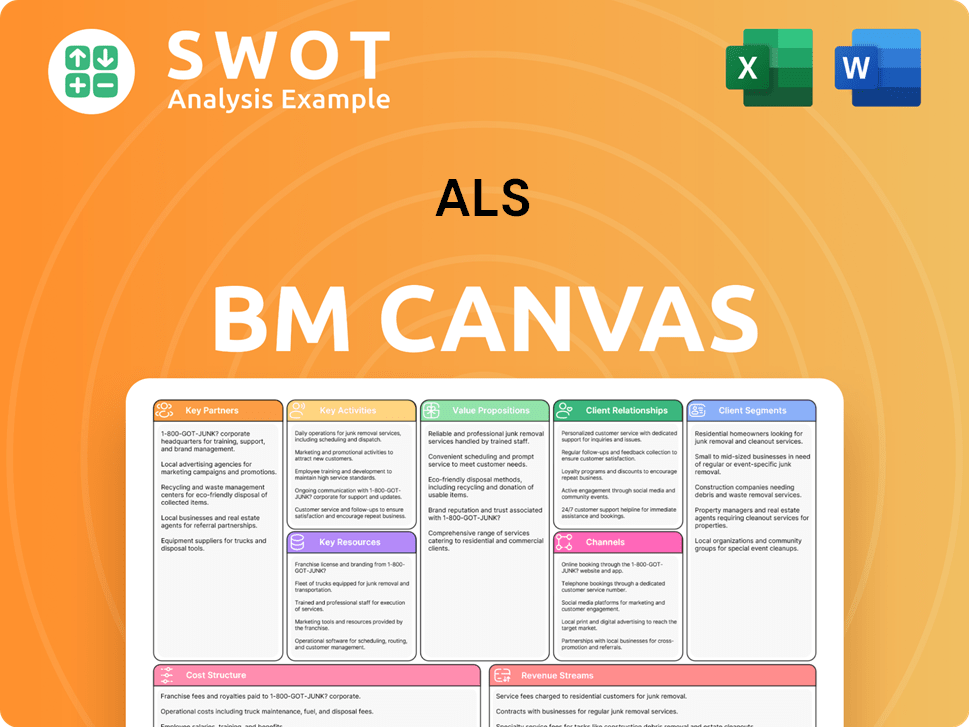

ALS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ALS Positioning Itself for Continued Success?

The ALS company holds a prominent position within the global testing, inspection, and certification (TIC) sector. It is recognized for its extensive global network, broad service offerings, and strong reputation for technical excellence. While specific market share data for 2024-2025 is subject to ongoing market dynamics, ALS is considered a top-tier player alongside other major global TIC companies.

The company's customer loyalty is generally high due to the critical nature of its ALS services and the trust clients place in its accuracy and independence. ALS's global reach, with operations across numerous countries, provides a diversified revenue base and access to various regional markets. The company's position benefits from the increasing demand for quality and compliance across various industries, including environmental testing, mining, and food safety analysis.

ALS is a leading player in the global TIC industry, known for its comprehensive service portfolio. Its global presence and diverse customer base contribute to its robust market position. The company's strong reputation for quality and technical expertise supports its competitive advantage.

Regulatory changes and new competitors pose potential risks to ALS. Technological disruptions, such as advancements in on-site testing, could alter the traditional laboratory model. The company must adapt to changing consumer preferences and sustainability demands.

ALS plans to sustain and expand its profitability through strategic investments and acquisitions. The company focuses on innovation, sustainability, and capitalizing on emerging market trends. Continued digitalization and geographical diversification are key.

ALS is investing in advanced analytical capabilities and pursuing strategic acquisitions. It is actively participating in the evolving landscape of global regulatory and industry standards. The company emphasizes innovation and leveraging its global network.

ALS faces challenges from regulatory changes and technological advancements. The company must adapt to the evolving needs of its clients and increasing sustainability demands. Opportunities exist in high-growth sectors and through strategic acquisitions.

- Adaptation to regulatory changes and technological advancements.

- Expansion into high-growth sectors like life sciences.

- Strategic acquisitions to complement existing services.

- Focus on sustainability and product transparency.

ALS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ALS Company?

- What is Competitive Landscape of ALS Company?

- What is Growth Strategy and Future Prospects of ALS Company?

- What is Sales and Marketing Strategy of ALS Company?

- What is Brief History of ALS Company?

- Who Owns ALS Company?

- What is Customer Demographics and Target Market of ALS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.