Associated Bank Bundle

How has Associated Bank shaped the financial landscape?

From its humble beginnings in 1874, Associated Banc-Corp has evolved into a significant regional player. Discover the fascinating Associated Bank SWOT Analysis and its journey from a Wisconsin bank to a comprehensive financial institution. Explore how this financial institution has adapted and thrived over the decades, impacting communities across the Midwest.

This exploration of Associated Bank history will uncover its strategic decisions, mergers and acquisitions, and its commitment to community involvement. Understanding the bank's timeline provides valuable insights into its long-term financial performance and its current market position among Wisconsin banks and other financial institutions. Delve into the brief history of Associated Bank in Green Bay and its evolution.

What is the Associated Bank Founding Story?

The story of Associated Bank begins in Green Bay, Wisconsin, on August 24, 1874. It started as the Green Bay Mutual Loan & Building Association, a financial institution designed to serve the local community. This early focus on mutual lending and building set the stage for its future growth and expansion into a full-service commercial bank.

The founders saw a need for accessible financial services in a growing local economy. Their goal was to provide loans and a safe place for deposits, fostering community development through a cooperative approach. This community-centric model was key to its early success.

While specific details about the founders' backgrounds are not widely available, their vision was to create a stable financial institution. Initial funding likely came from local community members and early investors who recognized the need for such an entity. The name reflected its original purpose and community-oriented structure.

Associated Bank's roots are firmly planted in Green Bay, Wisconsin, established in 1874. The bank's initial focus was on community-based financial solutions.

- Founded as the Green Bay Mutual Loan & Building Association.

- Focused on providing loans and secure deposit options.

- Emphasized a cooperative approach to financial support.

- Associated Bank's target market has evolved over time.

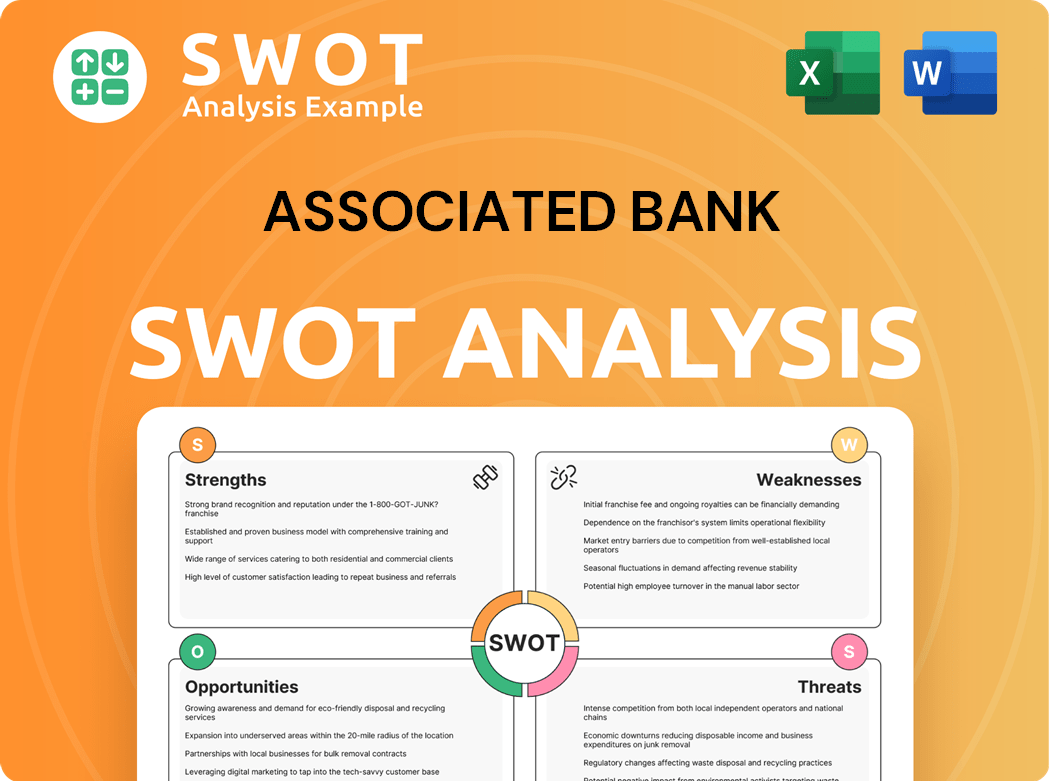

Associated Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Associated Bank?

The early growth of Associated Bank, formerly known as Green Bay Mutual Loan & Building Association, involved a strategic expansion of its services and geographic reach. This Bank history saw the institution evolve from offering mutual loans to providing a broader range of commercial banking services. This expansion was crucial in establishing its presence in Wisconsin.

Associated Bank gradually introduced standard deposit accounts and commercial loans. The exact dates of these introductions are not widely publicized. This diversification helped meet the growing needs of its customer base, solidifying its position as a key financial institution.

Early expansion efforts focused on increasing its presence within Green Bay and the surrounding communities. Opening additional branches allowed the bank to serve a wider clientele. This strategic growth was essential for capturing market share.

The bank underwent incremental capital raises and leadership transitions. These steps were crucial as the bank matured, aiming to strengthen its financial position and management capabilities. Adapting to the economic landscape was key to its success.

This early growth period laid the foundation for significant acquisitions. It also helped establish a multi-state presence. Associated Bank's ability to adapt and expand its services has been a key factor in its long-term success as one of the prominent Wisconsin banks.

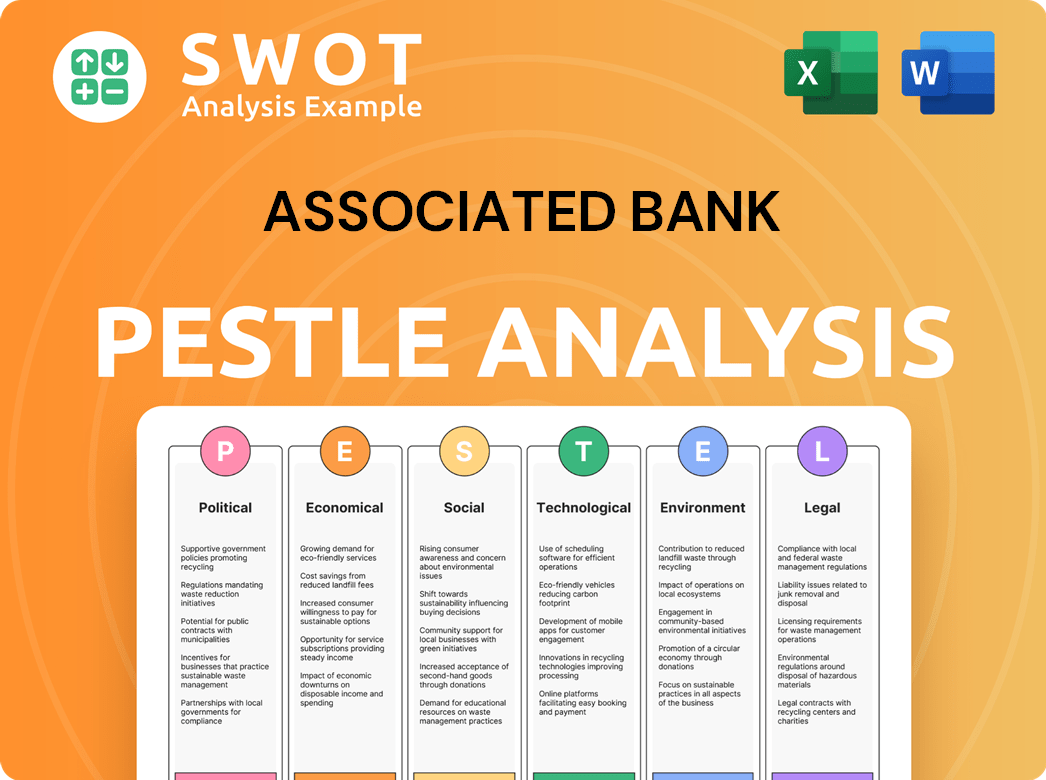

Associated Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Associated Bank history?

The Associated Bank history is marked by key milestones that have shaped its evolution into a significant player in the financial industry. These pivotal moments reflect its adaptation and growth over the years, from its early beginnings to its current status as a leading financial institution.

| Year | Milestone |

|---|---|

| 19th Century | The bank's origins trace back to the late 1800s, starting as a mutual loan and building association, focusing on local community needs. |

| Early 20th Century | Transitioned into a full-service commercial bank, expanding its services and scope to meet the growing financial demands of its customers. |

| 2024 | Associated Banc-Corp acquired First Staunton Bancorp for approximately $70 million, expanding its footprint in Illinois. |

Associated Bank has consistently embraced innovation to enhance its services and customer experience. The introduction of digital banking platforms and mobile applications has provided customers with convenient access to their accounts and financial services. These technological advancements have helped the bank stay competitive and meet the evolving needs of its customer base.

The bank has invested heavily in digital platforms, offering online and mobile banking services to enhance customer convenience.

The mobile app provides customers with easy access to their accounts, allowing them to manage finances on the go.

The bank has integrated electronic payment options to streamline transactions and improve efficiency.

The bank has improved customer service through various channels, including online chat and phone support.

Associated Bank has created specialized lending programs to meet the unique needs of its customers.

The bank has expanded its ATM network to provide customers with convenient access to cash and other services.

Throughout its history, Associated Bank has faced numerous challenges, including economic downturns and increased competition from larger financial institutions and fintech companies. The 2008 financial crisis tested the resilience of the entire banking sector, including Associated Bank. The bank has responded to these challenges through strategic restructuring and a focus on digital transformation, as evidenced by its recent financial performance and strategic initiatives.

The bank has had to navigate through economic downturns, such as the 2008 financial crisis, which impacted the entire banking industry.

The bank faces competition from larger national banks and emerging fintech companies, which requires continuous adaptation.

Changes in financial regulations have required the bank to adapt its operations and compliance measures.

The rapid pace of technological advancements requires constant investment in digital infrastructure and innovation.

Changes in market dynamics and customer preferences necessitate strategic repositioning and adaptation.

The bank faces increasing cybersecurity threats, requiring robust security measures to protect customer data and financial assets.

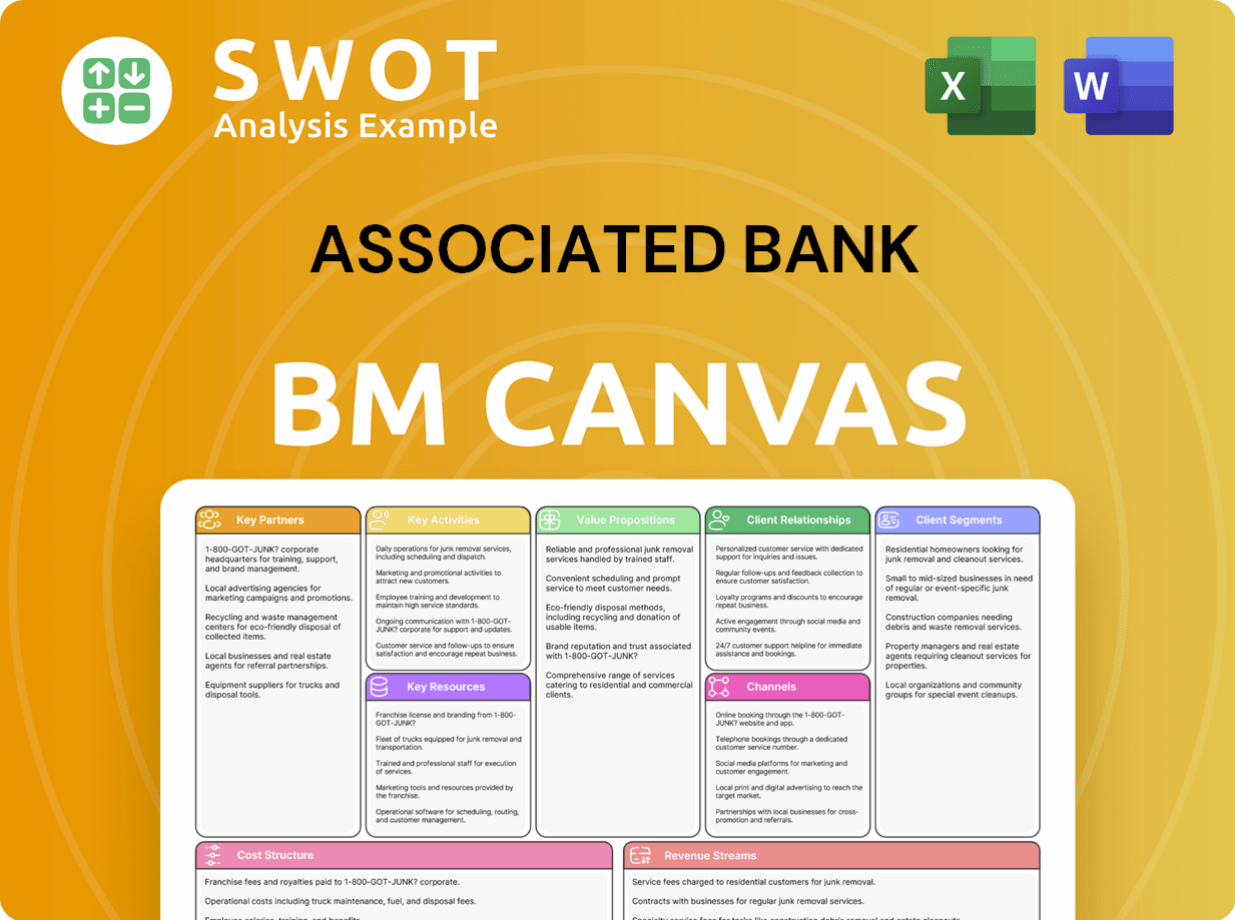

Associated Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Associated Bank?

The Associated Bank history is a story of consistent growth and strategic adaptation within the financial sector. It began as a local institution and evolved into a regional player, navigating economic challenges and embracing technological advancements.

| Year | Key Event |

|---|---|

| 1874 | Founded as Green Bay Mutual Loan & Building Association, marking the beginning of its journey as a financial institution. |

| 1919 | Renamed Associated Bank of Green Bay, signaling a shift in identity and a step towards broader banking services. |

| 1970s-1980s | Experienced significant regional expansion through strategic acquisitions, primarily within Wisconsin, broadening its market presence. |

| 1986 | Formed Associated Banc-Corp as a bank holding company, providing a framework for further growth and diversification. |

| 1990s | Expanded its footprint into Illinois and Minnesota markets, extending its reach and customer base. |

| 2008 | Successfully navigated the challenges of the global financial crisis, demonstrating resilience and stability. |

| 2010s | Focused on digital banking initiatives and customer experience enhancements, adapting to evolving customer preferences. |

| 2024 | Acquired First Staunton Bancorp for approximately $70 million, continuing its strategic expansion through acquisitions. |

| 2025 | Continues to focus on strategic growth and digital transformation, adapting to the evolving financial landscape. |

Associated Bank is committed to expanding its market reach, with a focus on strategic acquisitions. The acquisition of First Staunton Bancorp in 2024 exemplifies this strategy. The bank aims to strengthen its presence in key markets and enhance its service offerings to better serve its customers.

Enhancing digital capabilities remains a key priority for Associated Bank. Investing in technology to improve customer experience is a core initiative. This includes improvements to online banking features and the mobile app, adapting to the growing demand for digital financial services.

The bank's financial health is strong, with a reported net income of $79 million for the first quarter of 2025. The return on average assets is at 0.81%, showcasing its profitability and efficient use of assets. These figures indicate a solid foundation for future growth.

Associated Bank's future is focused on sustainable growth, leveraging its regional strength. The bank is adapting to industry trends, such as increased digitalization and personalized financial services. Leadership is committed to serving communities through an advanced approach to financial services.

Associated Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Associated Bank Company?

- What is Growth Strategy and Future Prospects of Associated Bank Company?

- How Does Associated Bank Company Work?

- What is Sales and Marketing Strategy of Associated Bank Company?

- What is Brief History of Associated Bank Company?

- Who Owns Associated Bank Company?

- What is Customer Demographics and Target Market of Associated Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.