Associated Bank Bundle

How Will Associated Bank Navigate the Future of Banking?

In the ever-evolving financial world, understanding a bank's growth strategy is crucial for informed decisions. Associated Banc-Corp, a significant player in the Midwest, has consistently adapted to the changing market. This piece delves into Associated Bank's Associated Bank SWOT Analysis, exploring its past, present, and future prospects.

Associated Bank's journey, from its roots in Wisconsin to its current regional presence, showcases a commitment to strategic planning and expansion. This analysis will explore the bank's strategic initiatives, including its focus on digital transformation and customer acquisition. We'll examine how Associated Bank aims to enhance its financial performance and navigate the competitive landscape, offering insights into its long-term growth outlook and potential investment opportunities.

How Is Associated Bank Expanding Its Reach?

The expansion initiatives of Associated Banc-Corp are primarily centered around strengthening its presence within its core markets, which include Wisconsin, Illinois, and Minnesota. A key component of this strategy involves optimizing its branch network, incorporating both strategic new openings and consolidations to better align with evolving customer preferences. This approach aims to enhance customer service and operational efficiency.

Associated Banc-Corp is also focused on broadening its product and service offerings. This includes improvements to digital banking platforms, introducing new lending products, and bolstering wealth management and insurance services. These efforts are designed to capture a wider customer base and diversify revenue streams. Strategic partnerships and targeted acquisitions play a crucial role in achieving these objectives, driving the bank's growth strategy.

In 2024, Associated Banc-Corp completed the acquisition of First National Bank of St. Louis. This acquisition expanded its footprint in the St. Louis market and added approximately $1.6 billion in total assets. This move is a clear indication of the company's inorganic growth strategy, aimed at increasing market share and reaching new customer segments. The bank continues to focus on growing its commercial real estate and commercial and industrial loan portfolios.

Associated Banc-Corp is actively managing its branch network through a combination of strategic consolidations and new openings. This approach allows the bank to adapt to changing customer behaviors and market dynamics. The goal is to enhance customer service and operational efficiency.

A key focus is the continuous improvement of digital banking platforms. This includes upgrades to mobile and online banking services to provide a seamless and user-friendly experience. Investment in digital capabilities is a priority for attracting and retaining customers.

Associated Banc-Corp is expanding its product offerings, including new lending products and wealth management services. The introduction of new products aims to capture a broader customer base. This diversification helps to strengthen the bank's financial performance.

The acquisition of First National Bank of St. Louis is a prime example of the bank's inorganic growth strategy. This acquisition increased its market share in the St. Louis market. It also added approximately $1.6 billion in total assets.

Associated Banc-Corp's growth strategy includes optimizing its branch network, enhancing digital banking, and expanding product offerings. These initiatives are supported by strategic acquisitions, such as the First National Bank of St. Louis. The company is focused on sustainable growth and enhanced shareholder value.

- Branch Network Optimization: Balancing consolidation with strategic new openings.

- Digital Banking: Continuous enhancements to mobile and online platforms.

- Product Expansion: Introduction of new lending and wealth management services.

- Strategic Acquisitions: Expanding market presence through acquisitions.

For more detailed insights into the financial performance and strategic direction of Associated Bank, you can explore the information available at Owners & Shareholders of Associated Bank. This provides a comprehensive view of the company's initiatives and future prospects.

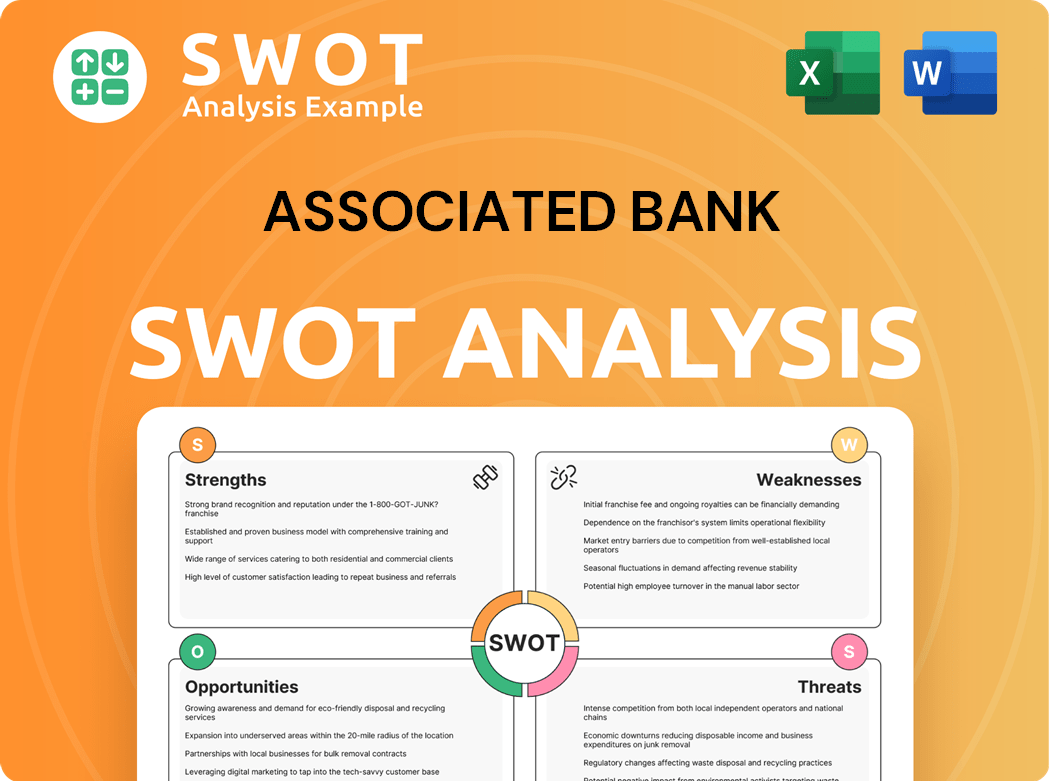

Associated Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Associated Bank Invest in Innovation?

Associated Banc-Corp is actively focusing on innovation and technology to drive its growth strategy and enhance its market position. Their strategic initiatives include significant investments in digital transformation to improve customer experience and operational efficiency. This approach is crucial for maintaining a competitive edge in the rapidly evolving financial landscape, especially within the Midwest market where they have a strong presence.

The bank's commitment to technological advancement is evident in its continuous efforts to improve online and mobile banking platforms. These enhancements aim to provide customers with a more seamless and user-friendly experience. By leveraging technology, Associated Banc-Corp seeks to attract and retain tech-savvy customers while streamlining internal processes.

Associated Banc-Corp's digital transformation strategy includes automating processes, improving data analytics, and strengthening cybersecurity. These efforts are designed to protect customer information and provide more personalized services. The bank's approach to digital transformation is also geared towards improving operational efficiencies and gaining deeper insights into customer behavior.

Associated Banc-Corp is continuously updating its online and mobile banking platforms. These updates include new features to improve user experience and accessibility. The goal is to provide customers with a more convenient and efficient banking experience.

The bank is exploring the use of artificial intelligence (AI) to personalize customer interactions. AI is also being used to improve fraud detection and streamline back-office operations. This helps in enhancing customer service and operational efficiency.

Associated Banc-Corp leverages data analytics to gain insights into customer behavior. This allows for more targeted product offerings and improved service delivery. Data analytics helps in making informed decisions and enhancing customer satisfaction.

The bank collaborates with fintech companies and external innovators to integrate new solutions. This approach ensures that Associated Banc-Corp remains agile and responsive to industry trends. Collaboration helps in staying ahead of the competition.

Associated Banc-Corp is investing in robust cybersecurity measures to protect customer data. These measures are critical in maintaining customer trust and ensuring the security of financial transactions. Cybersecurity is a top priority.

The bank is focusing on automating processes to improve operational efficiency. This includes streamlining internal workflows and reducing costs. Efficiency improvements contribute to the bank's overall profitability.

Associated Banc-Corp's Competitors Landscape of Associated Bank, including its strategic initiatives, are designed to ensure its long-term growth outlook. The bank's focus on digital transformation and technological advancements is critical for its future prospects. This includes enhancing customer experience, improving operational efficiency, and maintaining a competitive edge.

- Digital Transformation: Continuous improvements to online and mobile banking platforms.

- AI Integration: Exploring AI for personalized customer interactions and fraud detection.

- Data Analytics: Leveraging data for targeted product offerings and service improvements.

- Fintech Partnerships: Collaborating with fintech companies for innovative solutions.

- Cybersecurity: Strengthening measures to protect customer data and ensure secure transactions.

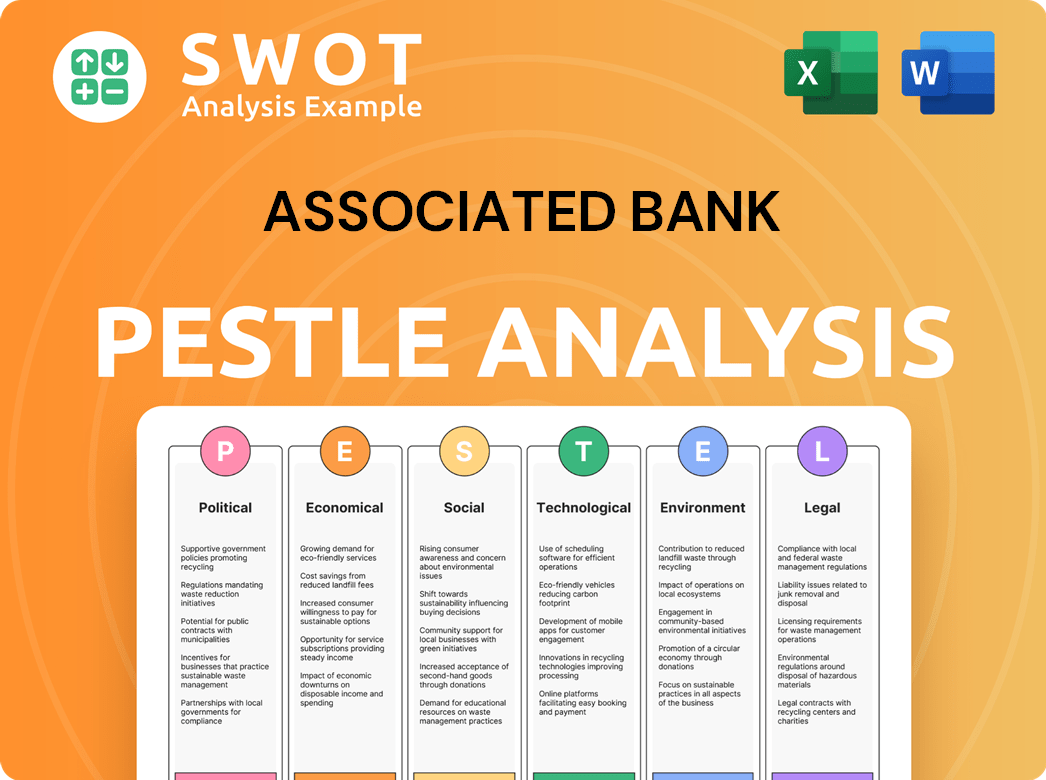

Associated Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Associated Bank’s Growth Forecast?

The financial outlook for Associated Banc-Corp reflects a strategic focus on sustainable growth and profitability. The company demonstrated a steady performance in the first quarter of 2025, reporting net income of $52.3 million, which equated to $0.34 per common share. This performance underscores the bank's ability to navigate a dynamic economic environment effectively.

For the full year 2024, projections for the bank included net interest income between $890 million and $910 million, alongside non-interest income expected to range from $275 million to $285 million. These figures highlight the bank's comprehensive approach to revenue generation, encompassing both interest-bearing and fee-based income streams, which is crucial for its Mission, Vision & Core Values of Associated Bank.

Associated Banc-Corp's strategic goals include achieving a return on average tangible common equity of approximately 14-16% in the medium term, demonstrating a commitment to delivering strong shareholder returns. The bank's strategic plans involve managing its loan portfolio for optimal growth while maintaining robust asset quality. As of the first quarter of 2025, the total loan portfolio was valued at $31.8 billion, with total deposits reaching $35.3 billion. The bank also maintains a strong capital position.

The bank's performance in the first quarter of 2025, with a net income of $52.3 million, showcases its ability to adapt to economic changes. This financial performance is a key aspect of the Associated Bank growth strategy, reflecting its focus on sustainable profitability.

Associated Banc-Corp's strategic planning includes managing its loan portfolio for growth while ensuring strong asset quality. The bank's focus on a return on average tangible common equity of 14-16% in the medium term highlights its strategic commitment.

The bank's robust capital position, with a CET1 ratio of 10.1% as of March 31, 2025, supports its expansion plans and ability to withstand economic challenges. This strong capital base is vital for its market share growth and long-term growth outlook.

Associated Bank's ability to maintain a strong financial position, with careful management of its loan portfolio and a focus on both interest and non-interest income, positions it well within the competitive landscape. The bank's approach helps it to achieve profitability trends.

Associated Bank's future prospects are promising, supported by its strategic initiatives and strong financial foundation. The bank's focus on customer acquisition strategy and digital transformation are key drivers for long-term success.

- Maintaining a robust capital position.

- Managing the loan portfolio for optimal growth.

- Focusing on both interest and non-interest income streams.

- Investing in technology and expansion initiatives.

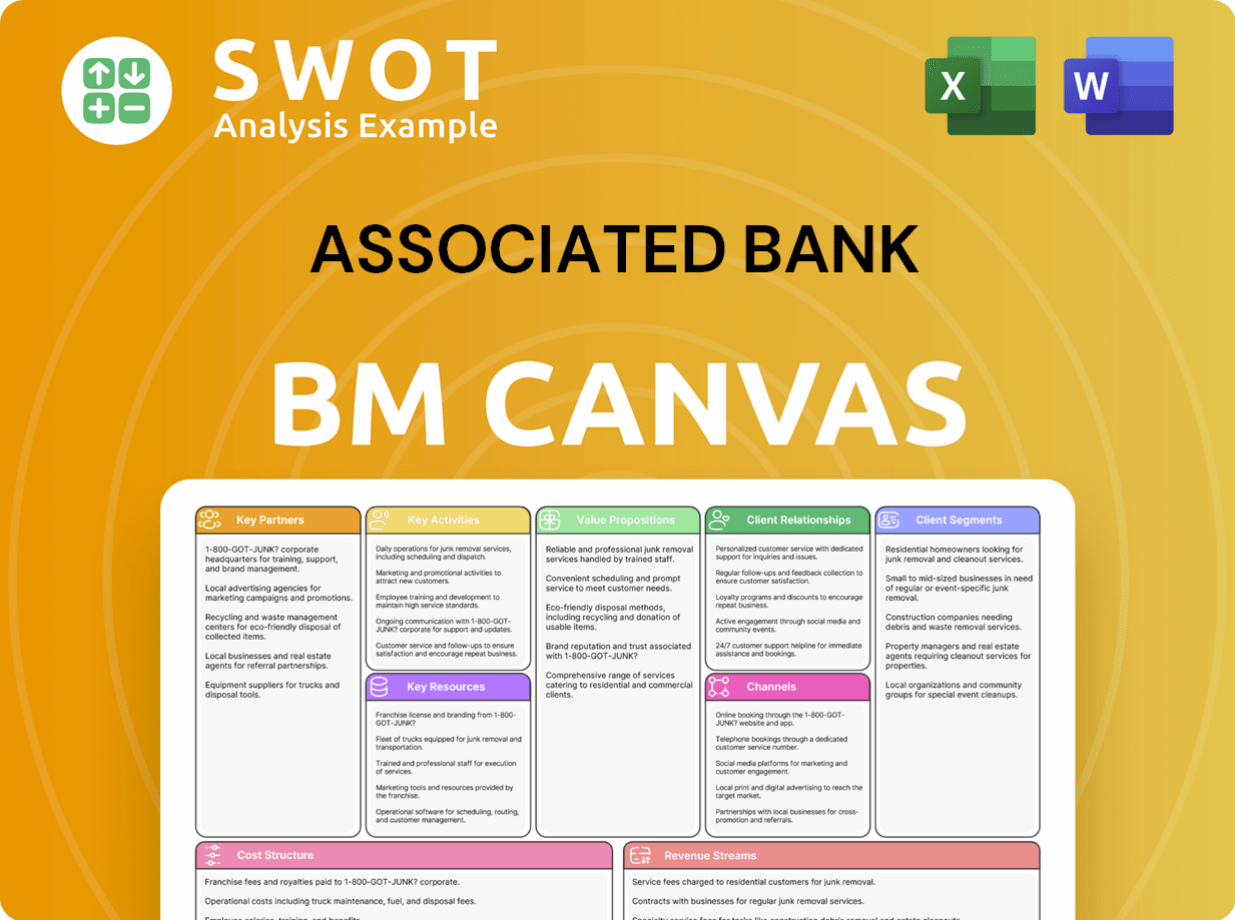

Associated Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Associated Bank’s Growth?

The path for Associated Banc-Corp's growth is not without its challenges. The financial sector is inherently complex, and a variety of risks and obstacles can influence the bank's strategic objectives and future prospects. Understanding these potential pitfalls is crucial for assessing the bank's capacity to achieve its goals and maintain its financial performance.

Associated Banc-Corp faces risks from intense competition, regulatory changes, technological advancements, and economic shifts. These factors require continuous adaptation and robust risk management. The competitive landscape includes large national banks, fintech disruptors, and other regional players, all vying for market share.

Furthermore, the bank must navigate evolving regulatory requirements and the need for continuous investment in technology and cybersecurity. These factors, along with emerging risks, can significantly impact the bank's operations and financial results.

Associated Banc-Corp competes with national banks, fintech companies, and other regional players. This rivalry impacts deposit gathering, lending, and wealth management services. To maintain its market position, the bank must continually innovate and enhance its customer offerings.

Evolving compliance demands, particularly those related to capital adequacy, consumer protection, and cybersecurity, increase operational expenses. Changes in interest rate policies, as set by the Federal Reserve, can directly affect the bank's net interest margin. These regulatory adjustments require ongoing adaptation.

Although less direct, supply chain disruptions can impact the economic health of Associated Banc-Corp's commercial clients. This could potentially lead to loan defaults or reduced business activity. Monitoring and mitigating these indirect risks is crucial for financial stability.

The rapid pace of technological innovation necessitates continuous investment in new platforms and cybersecurity measures. Cyberattacks pose a constant threat, requiring robust defenses and employee training. Maintaining a competitive digital presence is essential for attracting and retaining customers.

Economic downturns can lead to increased loan defaults and reduced demand for financial services. The bank must prepare for potential economic shifts to maintain financial stability and protect its asset base. Proactive risk management is critical during uncertain economic times.

Emerging risks related to climate change and environmental, social, and governance (ESG) factors are increasingly shaping the bank's future trajectory. These factors influence lending policies and investment decisions. Incorporating ESG considerations is essential for long-term sustainability.

Associated Banc-Corp employs a comprehensive risk management framework. This framework includes strong internal controls, scenario planning, and diversification of its loan portfolio and revenue streams. The bank invests in advanced cybersecurity measures and employee training to combat cyber threats. These strategies help the bank navigate and mitigate various risks effectively.

The bank's consistent financial performance and strategic acquisitions suggest a proactive approach to risk mitigation. While specific details of recent obstacles and their solutions may not be fully public, the bank's actions demonstrate its commitment to managing and overcoming challenges. This proactive approach is crucial for sustainable growth.

For a deeper understanding of the bank's target market, consider reading more about the Target Market of Associated Bank. Associated Banc-Corp’s ability to navigate these risks will determine its long-term financial performance and strategic success. By actively managing these obstacles, the bank aims to secure its future prospects and maintain its position in the competitive financial landscape.

Associated Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Associated Bank Company?

- What is Competitive Landscape of Associated Bank Company?

- How Does Associated Bank Company Work?

- What is Sales and Marketing Strategy of Associated Bank Company?

- What is Brief History of Associated Bank Company?

- Who Owns Associated Bank Company?

- What is Customer Demographics and Target Market of Associated Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.