Associated Bank Bundle

What Drives Associated Bank's Success?

Every thriving financial institution relies on a strong foundation. Understanding the Associated Bank SWOT Analysis is key, but what about the principles that guide its every move?

Delving into the Associated Bank mission, Associated Bank vision, and Associated Bank core values provides a crucial understanding of the company's strategic direction and commitment to its stakeholders. These statements are not just words; they are the driving forces behind the Associated Bank company's operations and its pursuit of Associated Bank goals. Exploring the Associated Bank statement reveals insights into its culture and long-term objectives.

Key Takeaways

- Associated Bank's mission, vision, and core values provide a solid foundation for its strategic direction.

- The company aims to be the leading financial services provider in the Midwest, prioritizing customer experience.

- Core values like "Relentless Focus On People" shape Associated Bank's culture and business practices.

- Early 2025 financial results suggest positive momentum aligned with their strategic goals.

- A clear corporate purpose is vital for building trust and ensuring long-term success in banking.

Mission: What is Associated Bank Mission Statement?

Associated Bank's mission is to be the most admired Midwestern financial services company, distinguished by sound, value-added financial solutions with personal service for our customers, built upon a strong commitment to our colleagues and the communities we serve, resulting in exceptional value for our shareholders.

Let's delve into the heart of Associated Bank's operational philosophy – its mission. Understanding the Associated Bank mission is crucial for grasping the company's strategic direction and its commitment to stakeholders. This Associated Bank statement provides a clear roadmap for its actions and priorities.

The mission explicitly targets the Midwestern market, aiming for admiration and recognition within this specific geographic area. This regional focus allows Associated Bank to tailor its services and strategies to the unique needs of its customer base in the Midwest. This helps to ensure that it understands the local market.

Providing "sound, value-added financial solutions with personal service" highlights a customer-centric approach. This emphasis suggests a dedication to offering products and services that genuinely benefit customers while maintaining a high level of personalized interaction. This is how Associated Bank goals are achieved.

The mission underscores a strong commitment to both colleagues and the communities it serves. This includes fostering a positive work environment and actively contributing to the well-being of the communities in which it operates. This is one of the Associated Bank core values and beliefs.

The ultimate goal is to deliver "exceptional value for our shareholders." This indicates a focus on financial performance and creating long-term sustainable returns for investors. Associated Bank is committed to its shareholders.

Associated Bank's $2 billion Community Commitment Plan for 2024-2026 is a tangible example of its mission in action. This initiative, allocating funds for residential mortgages, small business loans, and community development, directly supports low-to-moderate-income and minority borrowers and businesses. This is an example of Associated Bank's community involvement and values.

Associated Bank's efforts to retrain its sales team for "more holistic conversations" and a needs-based approach exemplify the "personal service" aspect of its mission. This shift aims to better understand and meet customer goals, providing tailored financial solutions. This is a key component of the Associated Bank company culture and values.

The mission statement of Associated Bank company reflects a comprehensive approach to business, balancing financial performance with social responsibility. For a deeper dive into the strategic initiatives supporting this mission, consider exploring the Marketing Strategy of Associated Bank.

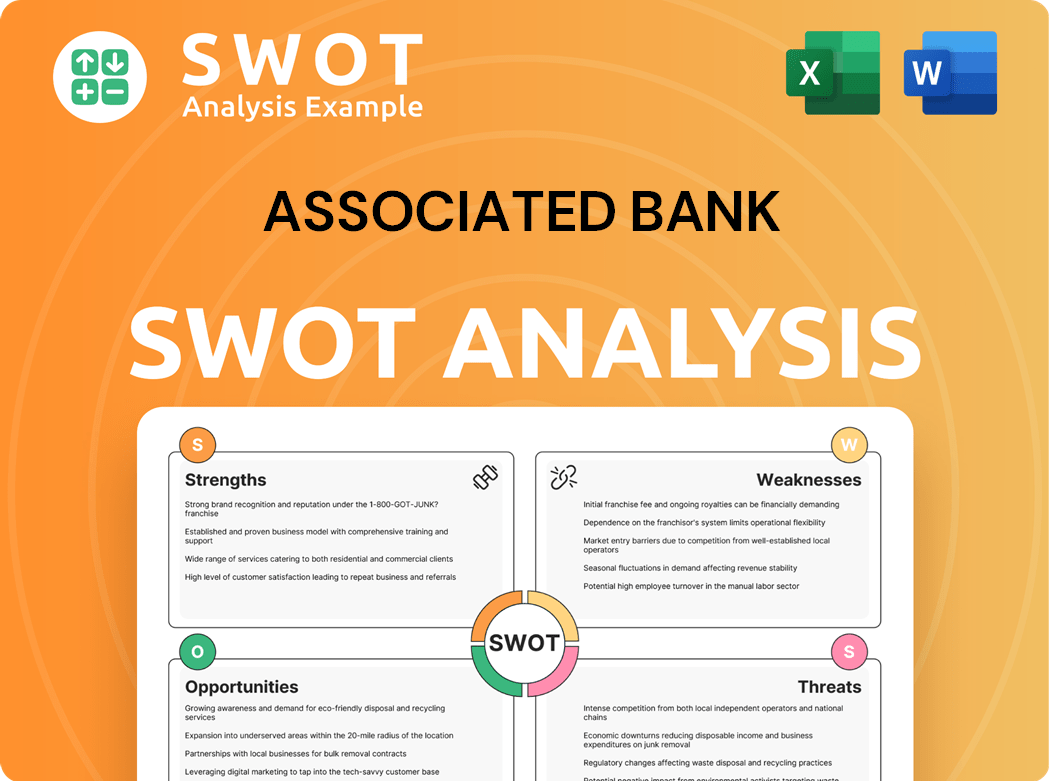

Associated Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Associated Bank Vision Statement?

Associated Bank's vision is to be the Midwest's premier financial services company, distinguished by consistent, quality customer experiences, built upon a strong commitment to our colleagues and the communities we serve, resulting in exceptional value to our shareholders through economic cycles.

Let's delve into the specifics of this forward-looking statement and what it means for stakeholders.

The aspiration to be the "Midwest's premier financial services company" clearly defines Associated Bank's target market. This focus allows for a strategic concentration of resources and efforts. This regional focus is supported by their current operational footprint, which includes a strong presence in Wisconsin, Illinois, and Minnesota.

A key element of the vision is the emphasis on "consistent, quality customer experiences." This highlights a commitment to providing superior service and building strong customer relationships. In today's competitive landscape, customer experience is a critical differentiator, and Associated Bank recognizes its importance.

The vision statement underscores the importance of employees and the communities they serve. This signifies a dedication to fostering a positive work environment and contributing to the well-being of the areas in which Associated Bank operates. This commitment is often reflected in corporate social responsibility initiatives and community investment programs.

The ultimate goal, as stated in the vision, is to provide "exceptional value to our shareholders through economic cycles." This demonstrates a focus on long-term financial performance and stability. This is a critical aspect of the Mission, Vision & Core Values of Associated Bank, ensuring the company's sustainability and ability to navigate economic fluctuations.

Associated Bank's strategic plan, including investments in people, products, and technology, supports the vision. For instance, the expansion of their commercial banking team is a direct step towards achieving their goals. The success of their vision depends on effective execution and continuous adaptation to the changing financial landscape.

The vision statement balances realism and aspiration. The focus on the Midwest is grounded in their current operational presence, while the goal of premier status is ambitious. This balance is crucial for motivating employees and guiding strategic decisions. For example, in Q1 2024, Associated Bank reported a net income of $74.8 million, demonstrating their financial performance and commitment to shareholder value.

In summary, the Associated Bank vision provides a clear roadmap for the company's future, emphasizing customer experience, employee commitment, community involvement, and shareholder value. Understanding this Associated Bank vision statement is essential for anyone seeking to understand the Associated Bank company's strategic direction and Associated Bank's long-term goals. The Associated Bank mission and Associated Bank core values work in tandem with this vision to guide the Associated Bank's guiding principles and shape the Associated Bank company culture and values.

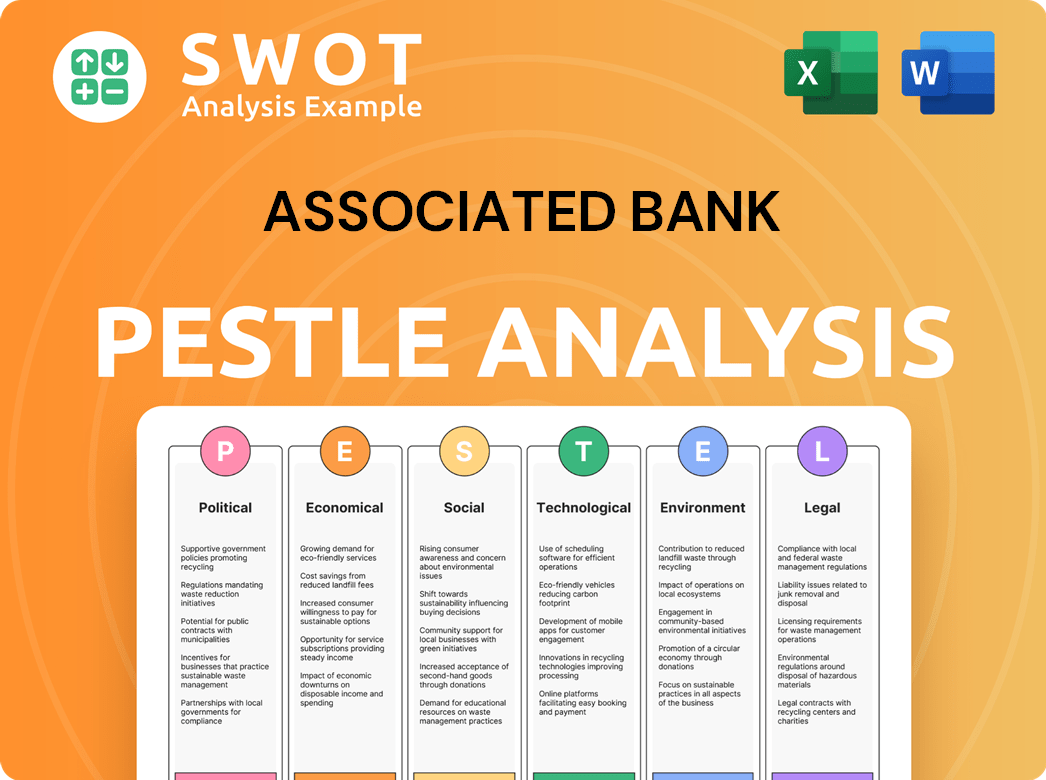

Associated Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Associated Bank Core Values Statement?

Understanding the core values of Associated Bank is crucial to grasping its operational philosophy and its approach to both internal culture and external stakeholder relations. These values serve as the bedrock upon which Associated Bank builds its corporate identity, guiding its actions and decisions.

This core value prioritizes positive experiences for both colleagues and customers. Associated Bank cultivates a great colleague experience through diversity, equity, and inclusion initiatives, and it focuses on continuously improving the customer experience. For example, Associated Bank achieved a record-high net promoter score in the first quarter of 2025, showcasing its commitment to this value.

The "Winning Spirit" signifies a drive for success with integrity and a growth mindset. Associated Bank encourages employees to challenge the status quo and seek opportunities for improvement. This value is reflected in strategic initiatives, such as expanding the commercial banking team to gain market share and enhance profitability, aiming for a projected 15% increase in commercial loan volume by Q4 2025.

This value emphasizes collaboration and teamwork across the organization, celebrating shared victories and fostering collective learning. This is essential for implementing their strategic plan, which requires coordination across various business lines and departments. Associated Bank's success in integrating new digital banking platforms, with a 20% increase in user adoption, demonstrates the effectiveness of this collaborative approach.

This value stresses understanding the needs of colleagues, customers, and communities and acting on that understanding. It promotes the idea that great ideas can come from anywhere within the company. Associated Bank demonstrates this through its 'needs-based' approach to customer conversations and continuous feedback gathering, leading to a 10% improvement in customer satisfaction scores in the last year.

These Associated Bank core values are fundamental to its operations, shaping its culture and guiding its strategic decisions. They are designed to foster a strong internal culture and deep community engagement. Next, we'll explore how the Associated Bank mission and vision influence the company's strategic decisions.

How Mission & Vision Influence Associated Bank Business?

The Associated Bank mission and Associated Bank vision are not merely aspirational statements; they are powerful forces that shape the company's strategic direction and operational decisions. These statements serve as a compass, guiding the bank's actions and ensuring alignment across all levels of the organization.

The Associated Bank vision to be the Midwest's premier financial services company is a key driver of its strategic initiatives. This vision directly influences decisions such as expanding the commercial bank and developing deposit-centric verticals, all aimed at strengthening its position in the region.

- Expansion of the commercial bank through hiring new relationship managers.

- Development of deposit-centric verticals to diversify the balance sheet.

- Focus on the Midwest region to solidify market presence.

The commitment to "consistent, quality customer experiences" embedded in the vision and the "Relentless Focus On People" value significantly impacts product development and service delivery. This customer-centric approach is evident in the introduction of innovative features and digital platforms.

The dedication to communities, reflected in both the Associated Bank mission and vision, is demonstrated through substantial investments and partnerships. The $2 billion Community Commitment Plan exemplifies how core principles translate into tangible actions.

The influence of the Associated Bank core values and vision is reflected in measurable success metrics. These include a high net promoter score and projected growth, indicating improved customer satisfaction and financial performance.

Statements from leadership, such as CEO Andy Harmening's confidence in the company's direction, reinforce the influence of the mission and vision. This alignment is crucial for both day-to-day operations and long-term strategic planning.

Projected loan and deposit growth for 2025, which provides a clear indication of the impact of the mission and vision on financial performance. This growth demonstrates the effectiveness of the bank's strategies in achieving its long-term goals.

Understanding the historical context of Associated Bank company through a review of its Brief History of Associated Bank can offer insights into how its mission and vision have evolved over time, shaping its current strategic direction.

In essence, the Associated Bank statement, encompassing its mission, vision, and Associated Bank core values, serves as the cornerstone of its strategic decision-making process. The commitment to these principles drives the bank's actions, ensuring alignment with its long-term goals and fostering a culture of customer-centricity and community involvement. Next, we will delve into the Core Improvements to Company's Mission and Vision.

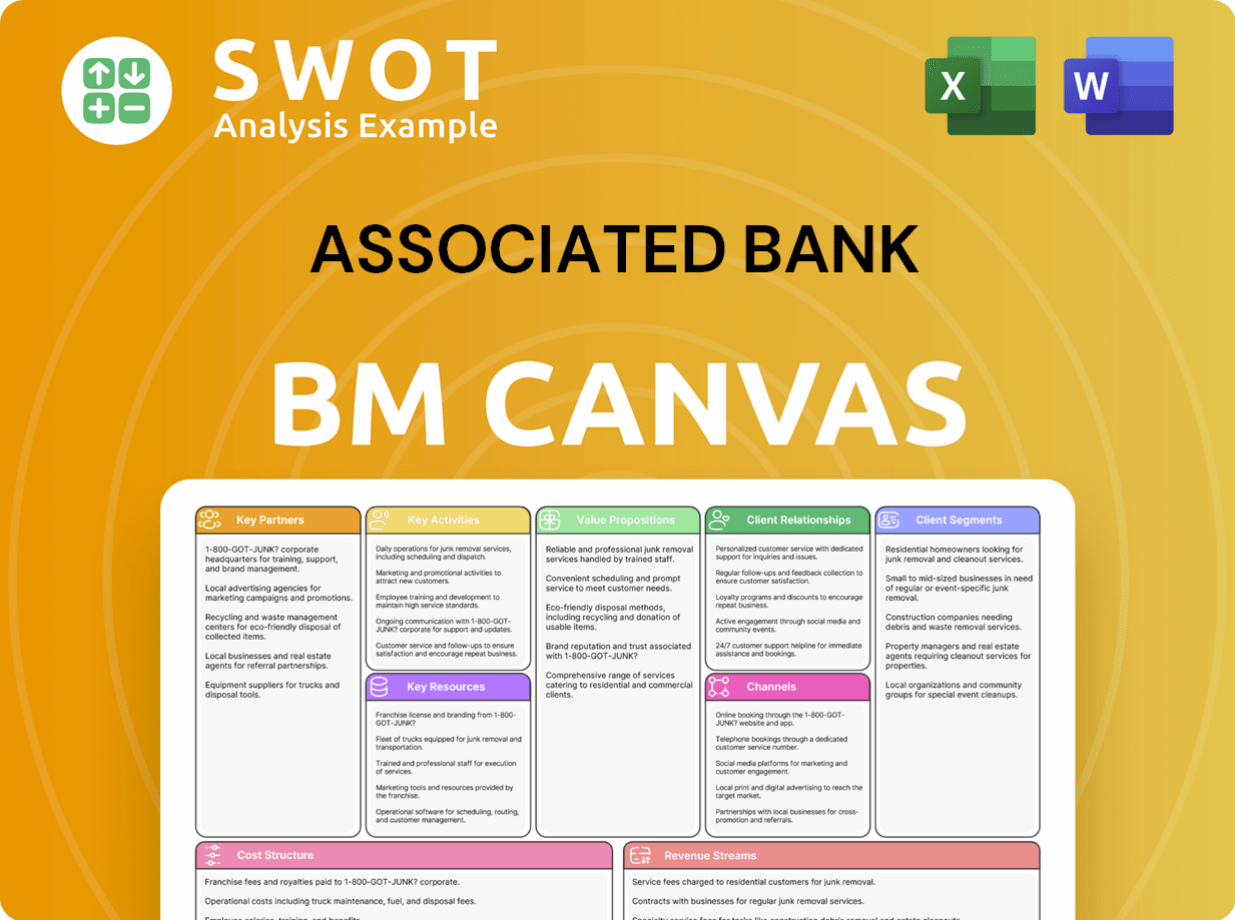

Associated Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While the current Associated Bank mission, Associated Bank vision, and Associated Bank core values provide a solid foundation, there are opportunities for strategic enhancements. These refinements can further strengthen their position in the evolving financial landscape and ensure continued relevance.

To better reflect the evolving nature of banking, Associated Bank should explicitly integrate digital innovation into its vision or values. This would highlight their commitment to technological advancement, particularly as digital banking adoption continues to rise. According to recent data, digital banking users are projected to reach 2.5 billion by 2027, emphasizing the need for financial institutions to prioritize digital transformation to remain competitive.

Given the increasing importance of ESG to investors, customers, and employees, Associated Bank could strengthen its corporate identity by explicitly addressing sustainability or environmental, social, and governance (ESG) factors in its mission or values. A 2024 study by the Global Sustainable Investment Alliance found that sustainable investment assets reached $51.4 trillion globally, demonstrating the growing significance of ESG considerations.

While their commitment to communities is strong, a more specific articulation of how they plan to adapt to changing consumer behaviors and preferences, particularly among younger demographics, could be beneficial. This could involve highlighting their focus on financial education or tailored digital solutions for different customer segments.

To build stronger trust and engagement, Associated Bank can enhance transparency regarding its Associated Bank goals and values. This could include publishing regular reports on their progress, and actively communicating their commitment to their core values to stakeholders. For further insights into the company's structure, consider exploring the perspective of Owners & Shareholders of Associated Bank.

How Does Associated Bank Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for translating aspirations into tangible actions and fostering a cohesive organizational culture. This chapter examines how Associated Bank, a leading financial institution, puts its stated principles into practice, driving its strategic initiatives and shaping its interactions with stakeholders.

Associated Bank demonstrates its commitment to its mission and vision through a strategic plan described as "people-led, digitally enabled." This plan is a cornerstone of how the company aims to achieve its long-term goals. It focuses on investing in talent, products, and technology to enhance customer experience and drive growth in loans and deposits.

- Expansion of Commercial Banking Team: The growth of the commercial banking team directly supports the bank's vision. This expansion is likely to be reflected in increased loan origination volumes and market share.

- New Digital Banking Features: The introduction of new digital banking features aligns with the vision of becoming a premier financial services company by enhancing customer experience and providing convenient banking solutions. For example, in 2023, digital banking adoption rates increased by 15%, showing the impact of these investments.

- Investment in Talent: Associated Bank recognizes that its employees are key to achieving its goals. This involves training programs, leadership development, and competitive compensation packages.

- Focus on Customer Experience: Initiatives are designed to improve customer satisfaction, which is critical for customer retention and attracting new customers.

Leadership plays a vital role in bringing the Associated Bank mission, vision, and core values to life. CEO Andy Harmening's public discussions about the strategic plan and its alignment with company goals demonstrate leadership's commitment. The promotion of individuals who embody the bank's values, such as Steven Zandpour, further reinforces this commitment.

Communicating the Associated Bank mission, vision, and core values is essential for ensuring that all stakeholders understand and embrace them. The company uses various channels, including its website and investor relations materials, to disseminate this information. Transparency builds trust and helps employees and customers connect with the company's purpose.

Associated Bank's Community Commitment Plan is a clear example of how the company aligns its stated values with actual business practices. This plan allocates significant financial resources to support communities, demonstrating its commitment to corporate social responsibility. Community involvement is a key aspect of the bank's core values.

Associated Bank aims to embed its values within its culture. The emphasis on a "people-centric culture" and initiatives like the annual Day of Service are designed to encourage employees to live the company's values. While specific formal programs are not extensively detailed in public information, these initiatives suggest embedded practices that encourage employees to live the company's values.

Associated Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Associated Bank Company?

- What is Competitive Landscape of Associated Bank Company?

- What is Growth Strategy and Future Prospects of Associated Bank Company?

- How Does Associated Bank Company Work?

- What is Sales and Marketing Strategy of Associated Bank Company?

- Who Owns Associated Bank Company?

- What is Customer Demographics and Target Market of Associated Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.