Associated Bank Bundle

How Does Associated Bank Thrive in the Midwest Banking Scene?

Associated Banc-Corp, a major regional banking company, has been a cornerstone of financial services in the Midwest for over a century. Offering a wide range of Associated Bank SWOT Analysis, from basic accounts and loans to wealth management, it serves both individuals and businesses. Understanding its operations is crucial for anyone interested in the financial landscape.

This financial institution, with its extensive branch network and digital platforms, caters to a large customer base. Its $41.3 billion in assets in 2024 highlight its significance in the regional banking sector. This exploration will uncover the core of Associated Bank's operations, examining its revenue streams, strategic moves, competitive positioning, and future potential. Whether you're looking for an Associated Bank account, or exploring Associated Bank services, this analysis provides valuable insights.

What Are the Key Operations Driving Associated Bank’s Success?

Associated Banc-Corp, a prominent financial institution, delivers value through a broad array of financial products and services. These offerings cater to retail, small business, and corporate clients, encompassing deposit accounts, loans, wealth management, and insurance. The operational framework is multifaceted, integrating physical branches, digital platforms, and specialized teams to serve diverse customer needs.

The bank's core operations involve managing a widespread branch network and robust digital platforms for retail banking, focusing on relationship management and credit underwriting for commercial clients, and utilizing financial advisors for wealth management. Technology and customer service are critical components, ensuring secure digital channels and supporting client inquiries. The supply chain includes technology vendors and third-party service providers, while distribution relies on physical branches, ATMs, and digital platforms.

Associated Banc-Corp distinguishes itself through a strong regional focus and personalized customer service, offering a community bank feel with big bank capabilities. This approach translates into tailored financial advice, accessible banking services, and a deep understanding of local market dynamics. The bank's comprehensive product suite further enhances its value proposition, making it a competitive player in the financial sector.

Associated Bank offers a wide range of services designed to meet diverse financial needs. These services include various deposit accounts, lending products, wealth management solutions, and insurance options. The bank's commitment to both digital and in-person services ensures accessibility and convenience for its customers.

Customers can choose from a variety of Associated Bank account options tailored to their specific needs. These include checking accounts, savings accounts, and money market accounts, each offering different features and benefits. The bank also provides resources to help customers manage their accounts effectively.

The operational processes of Associated Bank are designed to provide efficient and secure banking services. These include managing a network of branches, online and mobile banking platforms, and customer service channels. The bank continually invests in technology to improve its services.

Associated Bank's value proposition centers on its strong regional presence, personalized service, and comprehensive product offerings. This approach allows the bank to build lasting relationships with its customers. The bank's focus on local market dynamics provides tailored financial solutions.

Associated Bank provides a range of features and benefits designed to enhance the customer experience. These include competitive interest rates, convenient online banking, and access to a wide ATM network. The bank also offers personalized financial advice and support.

- Competitive interest rates on savings accounts.

- Convenient online and mobile banking platforms.

- Personalized financial advice and support.

- Extensive ATM network and branch locations.

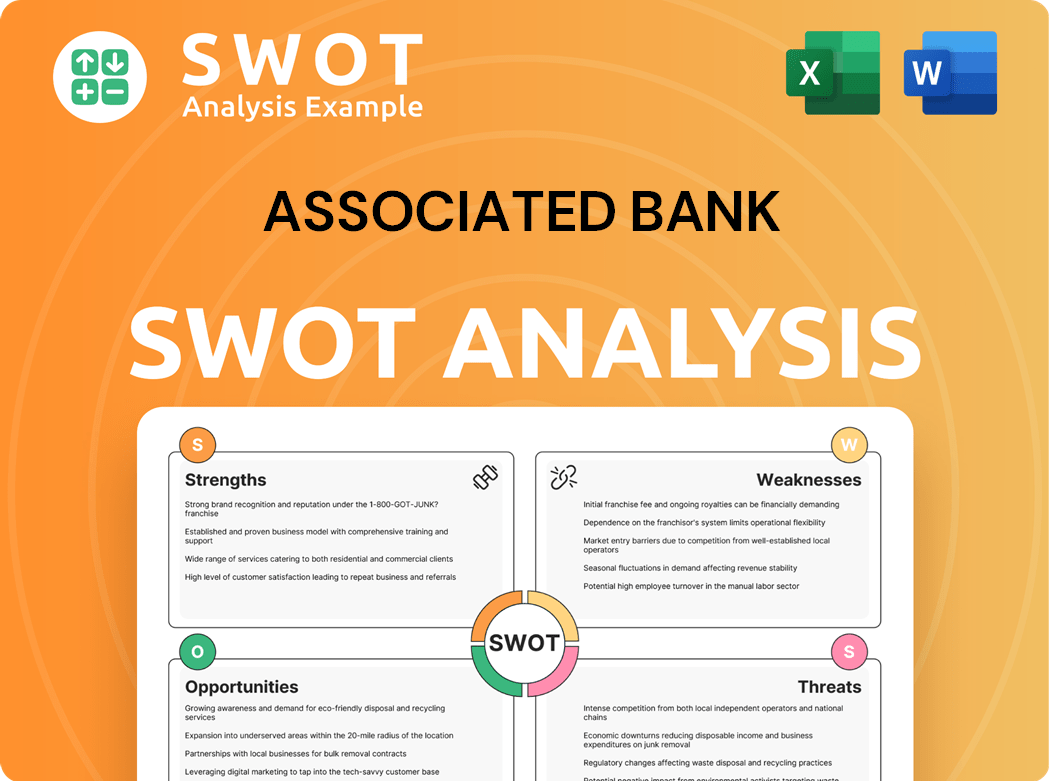

Associated Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Associated Bank Make Money?

Associated Banc-Corp, a prominent financial institution, generates revenue through a combination of interest income and non-interest income streams. Understanding these revenue sources and the strategies employed to monetize them is crucial for assessing the bank's financial health and operational efficiency. The bank's ability to effectively manage these income streams directly impacts its profitability and overall financial performance.

The primary sources of revenue for Associated Banc-Corp are interest income, derived from its lending activities and investment securities, and non-interest income, which includes various fees and charges. The bank's monetization strategies are designed to maximize returns from its core banking operations while diversifying its revenue base to mitigate risks and enhance stability. These strategies are constantly adapted to respond to changing market conditions and customer needs.

Associated Banc-Corp's primary revenue stream is interest income, which is generated from its loan portfolio and investment securities. This income reflects the bank's core lending activities, encompassing commercial and industrial loans, commercial real estate loans, residential mortgages, and consumer loans. The bank strategically manages its loan portfolio to optimize yield while carefully controlling funding costs from deposits and other borrowings. In the first quarter of 2025, Associated Banc-Corp reported net interest income of $269 million, highlighting the significance of this revenue stream. The bank's focus on maintaining a healthy loan portfolio and managing interest rate risk is crucial for sustaining this income source.

Non-interest income is another significant contributor to Associated Banc-Corp's overall revenue, providing diversification and stability. This category includes service charges on deposit accounts, wealth management fees, ATM fees, card-based fees, and other miscellaneous fees. In the first quarter of 2025, non-interest income reached $77 million, with wealth management fees playing a notable role. The bank employs various monetization strategies to maximize revenue from these sources.

- Tiered pricing for deposit accounts, offering different fee structures based on account balances and services used.

- Advisory fees for wealth management services, calculated based on assets under management.

- Transaction fees for specific banking activities, such as wire transfers and overdrafts.

- Revenue from insurance products sold through its Associated Benefits and Risk Consulting (ABRC) segment.

Associated Banc-Corp's approach to revenue generation is multifaceted, focusing on both interest and non-interest income to ensure a robust and diversified financial profile. The bank's strategic management of its loan portfolio, combined with its diverse fee-based services, positions it well to navigate the complexities of the financial market. For more insights into the bank's marketing strategies, consider reading about the Marketing Strategy of Associated Bank.

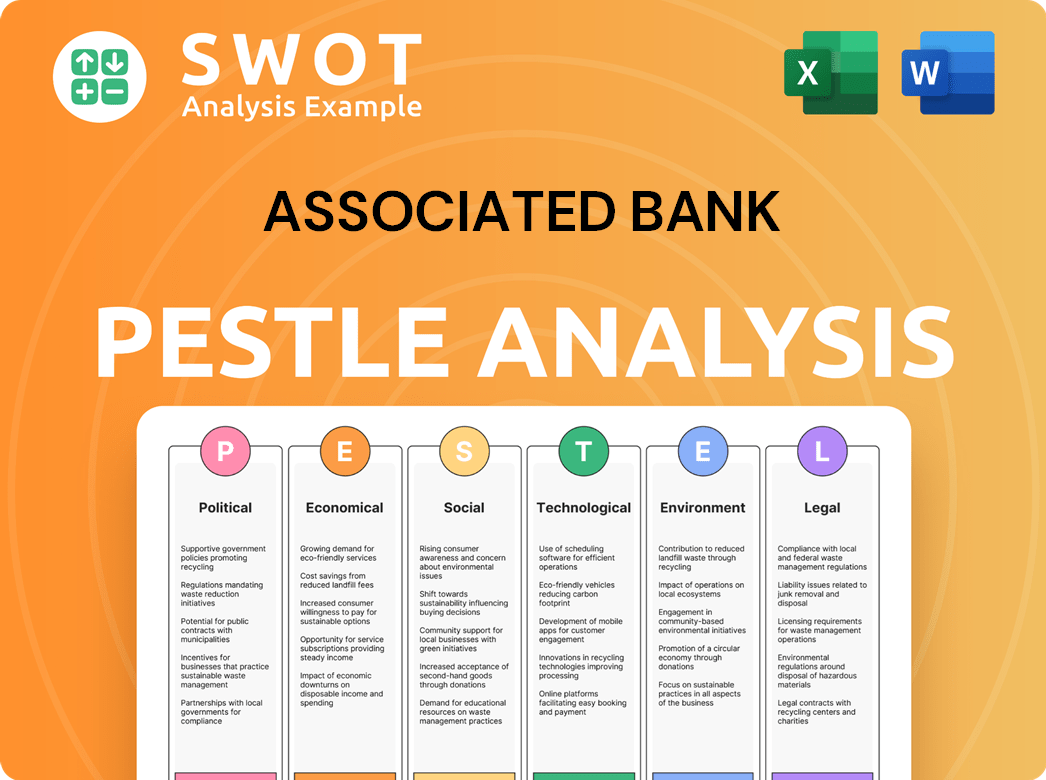

Associated Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Associated Bank’s Business Model?

Associated Banc-Corp has navigated a complex financial landscape, marked by strategic milestones and adaptive responses to market dynamics. The company's journey reflects a commitment to growth, innovation, and customer-centric services. These elements are crucial for maintaining a competitive edge in the banking sector.

One of the most significant recent strategic moves includes the acquisition of First (formerly First Interstate BancSystem, Inc.), which was finalized in April 2024. This strategic acquisition has expanded Associated Banc-Corp's footprint. This expansion is designed to enhance its commercial banking capabilities and diversify its loan portfolio. This acquisition demonstrates the bank's strategy of growth through strategic acquisitions to achieve greater scale and market penetration.

The company has also been focusing on digital transformation. Investments in technology and digital banking platforms have been crucial in enhancing customer experience, improving operational efficiency, and expanding its reach beyond traditional branch networks. This adaptation is vital in a competitive landscape where digital convenience is increasingly a differentiator.

Associated Banc-Corp has a history of strategic moves. The acquisition of First in April 2024 expanded its market presence. The company has also focused on digital transformation to enhance customer experience and operational efficiency. For more details, you can read the Brief History of Associated Bank.

The acquisition of First was a key strategic move. This move was aimed at enhancing commercial banking capabilities. Digital transformation is another key initiative. These moves highlight the bank's commitment to growth and adaptation.

Associated Bank's competitive advantages include strong brand recognition. It has deep-rooted customer relationships in Wisconsin, Illinois, and Minnesota. The bank's diversified business model provides a stable revenue base. It also adapts to new trends, like the increasing demand for digital banking services.

Associated Bank services include retail, commercial, wealth management, and insurance services. The bank's ability to adapt to new trends, such as the increasing demand for digital banking services, and its strategic acquisitions demonstrate its commitment to sustaining its business model and maintaining a competitive edge in a dynamic financial industry. The bank's ability to adapt to new trends, such as the increasing demand for digital banking services, and its strategic acquisitions demonstrate its commitment to sustaining its business model and maintaining a competitive edge in a dynamic financial industry.

Associated Bank focuses on several key areas to maintain its competitive edge. These include strategic acquisitions and digital transformation. The bank also emphasizes customer relationships and a diversified business model.

- Strategic Acquisitions: Expanding market presence and capabilities.

- Digital Transformation: Enhancing customer experience and operational efficiency.

- Customer Relationships: Building strong ties in key operating regions.

- Diversified Business Model: Providing a stable revenue base.

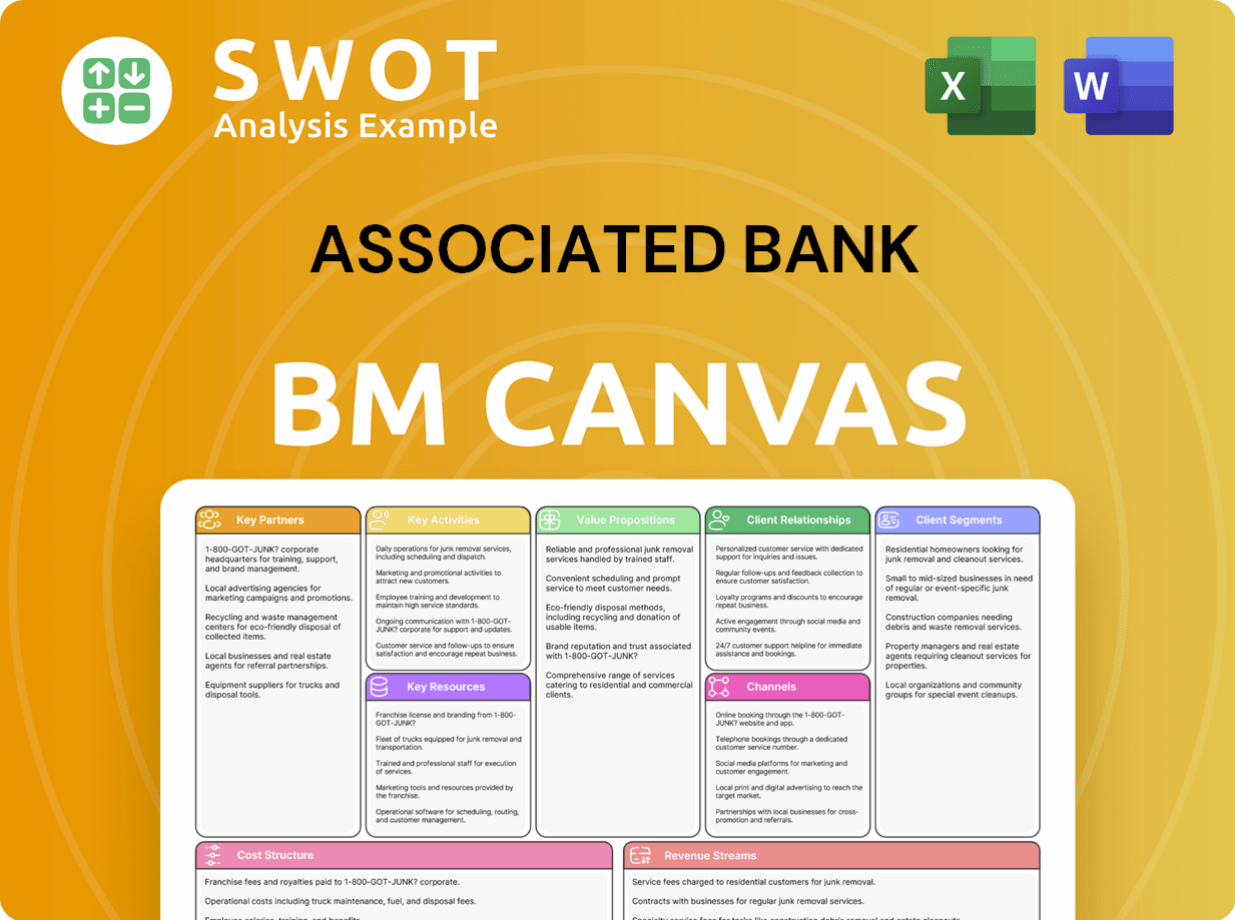

Associated Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Associated Bank Positioning Itself for Continued Success?

Associated Banc-Corp holds a strong regional market position, primarily in Wisconsin, Illinois, and Minnesota. As a banking company, it competes with national and regional banks, and fintech firms. Its focus on these key states, allows it to build customer loyalty through its branch network and local expertise.

The bank faces risks from interest rate changes, impacting net interest income. Regulatory changes and new fintech competitors also pose challenges. Economic downturns in its operating areas could increase loan defaults.

Associated Bank is a significant regional player in the Midwest, focusing on Wisconsin, Illinois, and Minnesota. It competes with a mix of banks and financial institutions. The bank's market share is concentrated in its key states, where it leverages its branch network.

Key risks include interest rate fluctuations, affecting net interest income. Regulatory changes and fintech competition also pose threats. Economic downturns could increase loan defaults. Changes in interest rates, particularly, can impact its net interest income.

Associated Bank is investing in technology to enhance digital capabilities. It aims to grow non-interest income and maintain a diversified business model. The bank focuses on customer-centricity and prudent financial management.

The bank is focused on technology investments to improve digital services. It is also working on optimizing its branch network and considering strategic acquisitions. A disciplined approach to credit risk management is a priority.

In Q1 2024, Associated Banc-Corp reported net income of $70.8 million. The bank's total assets were approximately $39.3 billion as of March 31, 2024. Its efficiency ratio was 57.96% for the first quarter of 2024, indicating its operational efficiency. The bank's focus on digital banking solutions is reflected in the increased use of its mobile app and online banking platforms.

- Net interest income is a key revenue driver.

- Non-interest income sources include service charges and fees.

- The bank's loan portfolio includes commercial and consumer loans.

- Credit quality metrics, such as non-performing assets, are closely monitored.

Associated Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Associated Bank Company?

- What is Competitive Landscape of Associated Bank Company?

- What is Growth Strategy and Future Prospects of Associated Bank Company?

- What is Sales and Marketing Strategy of Associated Bank Company?

- What is Brief History of Associated Bank Company?

- Who Owns Associated Bank Company?

- What is Customer Demographics and Target Market of Associated Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.