Assured Guaranty Bundle

What's the Story Behind AG Company's Success?

Assured Guaranty Ltd. stands as a titan in the financial guaranty industry, but how did it get there? The company's journey began with a simple yet powerful mission: to fortify the financial markets by guaranteeing the creditworthiness of debt securities. From its inception, Assured Guaranty aimed to provide crucial protection to bondholders, fostering confidence and stability in an often-volatile landscape.

Tracing the Assured Guaranty SWOT Analysis reveals its strategic evolution. This exploration will uncover the key milestones in Assured Guaranty history, detailing how the company navigated economic cycles and solidified its position as a leading provider of bond insurance and financial guaranty services. We'll examine its pivotal role in public finance, infrastructure projects, and structured finance, highlighting its enduring impact on the financial world. Discover the brief history of Assured Guaranty Ltd and its journey through market fluctuations, acquisitions, and its commitment to protecting bondholders.

What is the Assured Guaranty Founding Story?

The story of the AG company began in 1985. It emerged at a time when the financial guaranty industry was becoming more important. The goal was to boost the credit quality of municipal bonds and other debt instruments.

The company was created to offer credit protection to bondholders. This ensured that principal and interest would be paid on time, even if the issuer couldn't. While details about the founders aren't widely known, the company was set up to address risks in the public finance sector. This provided a solution to increase investor confidence and help public projects get funding.

The original business model focused on financial guaranty insurance policies. This insured debt obligations, providing an unconditional guarantee. This allowed issuers to borrow at lower costs, and investors benefited from greater security. Early funding likely came from institutional investors. The creation of Assured Guaranty was a strategic response to the growing market, positioning itself as a reliable partner in managing credit risk.

Assured Guaranty's founding in 1985 marked a significant moment in financial history. The company stepped in to offer a solution for the increasing risks in the public finance sector.

- The company's early focus was on providing financial guaranty insurance.

- This insurance guaranteed the timely repayment of principal and interest on debt obligations.

- The establishment of AG was influenced by the expanding municipal bond market.

- AG aimed to boost investor confidence and help public projects get funding.

The company's early days were shaped by the economic environment of the 1980s. There was a growing demand for credit enhancement products as the municipal bond market expanded. This expansion made the market more complex. AG's creation was a strategic move to address these changes, establishing itself as a reliable partner in managing credit risk. This was a crucial step in its Mission, Vision & Core Values of Assured Guaranty.

AG's initial focus was on financial guaranty insurance. This was designed to improve the creditworthiness of municipal bonds and other debt instruments. This helped issuers get lower borrowing costs and gave investors more security. The company's model was built on providing an unconditional guarantee, which was key to its early success.

AG's early funding likely came from institutional investors. The company's founding was a response to the growing need for credit enhancement products. This was driven by the expansion and increasing complexity of the municipal bond market. The company's role was to offer a dependable solution for managing credit risk.

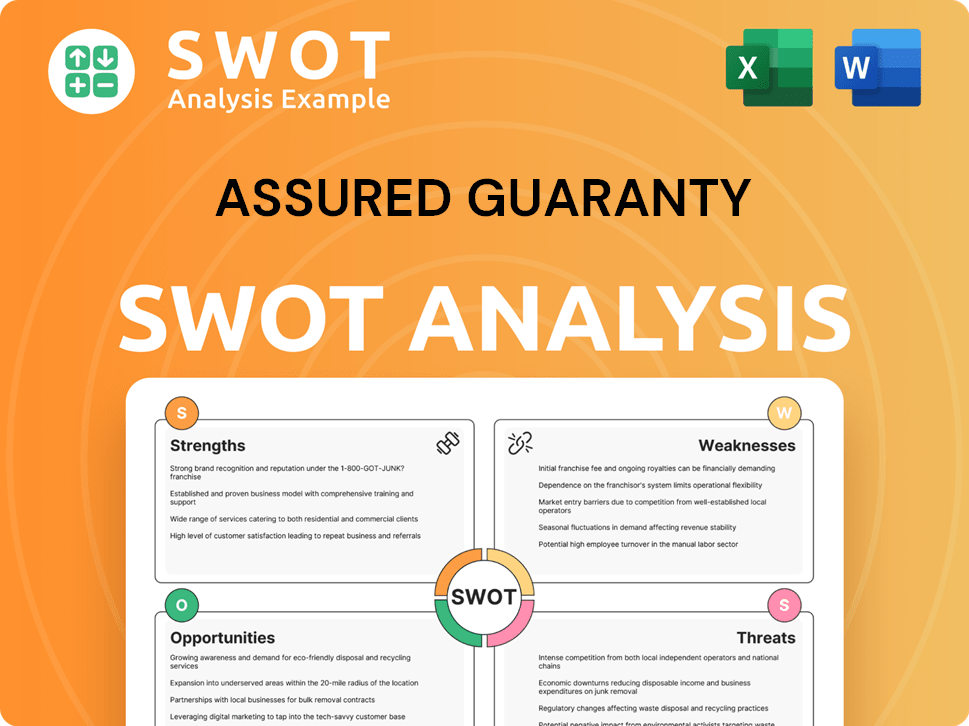

Assured Guaranty SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Assured Guaranty?

The early growth of Assured Guaranty, or AG company, was marked by its strategic entry into the municipal bond insurance market. This sector was experiencing significant expansion, and Assured Guaranty focused on building a robust portfolio of insured bonds. The company expanded its client base among state and local governments, as well as public authorities, by refining its underwriting processes.

Assured Guaranty initially concentrated on the municipal bond insurance market. This involved securing a strong position by insuring bonds issued by state and local governments. The company's early strategy centered on offering financial guaranty to these entities, which helped in establishing its market presence.

While specific early product launches are not extensively detailed, the focus was on refining underwriting processes. Assured Guaranty aimed to ensure the long-term viability of its guarantees. This involved rigorous risk management practices and careful selection of the bonds to be insured.

As Assured Guaranty matured, it explored new avenues for expansion. This included entering structured finance sectors, providing credit enhancement for a broader range of debt instruments. Key acquisitions and mergers played a significant role in its growth strategy, allowing it to consolidate its market position and diversify its offerings.

Maintaining strong financial ratings was crucial for Assured Guaranty during this period. These ratings underpinned the value of its insurance policies to both issuers and investors. The market reception to its services was generally positive, driven by the increasing need for credit enhancement.

The company's early success was built on its ability to provide financial guaranty, which helped in attracting clients and building a strong reputation. Although specific financial data from the earliest years is not readily available, the company's focus on risk management and creditworthiness set the stage for its future growth. By the end of 2024, Assured Guaranty had approximately $360 billion of net par outstanding, reflecting the scale of its operations and the value of its guarantees.

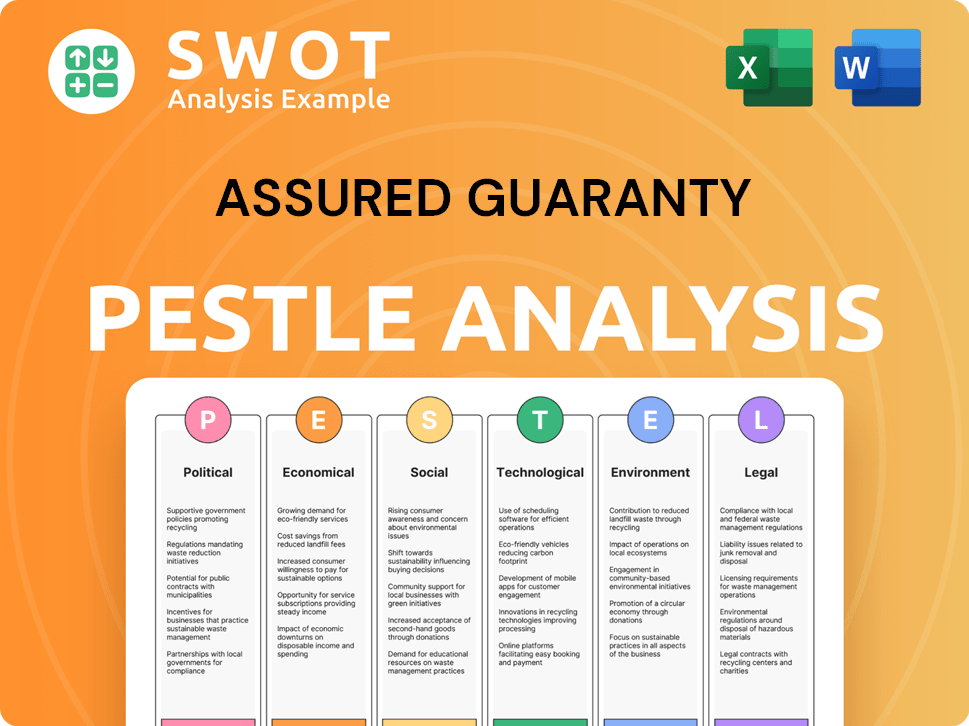

Assured Guaranty PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Assured Guaranty history?

Throughout its history, Assured Guaranty (AG company) has achieved several significant milestones, demonstrating its growth and resilience in the financial guaranty industry. These achievements highlight Assured Guaranty's evolution and its impact on the financial landscape.

| Year | Milestone |

|---|---|

| 1985 | Founded as a financial guaranty company, initially focusing on municipal bonds. |

| 1993 | Expanded its product offerings to include structured finance and other financial instruments. |

| 2004 | Became a publicly traded company, increasing its visibility and access to capital. |

| 2008-2010 | Navigated the global financial crisis, demonstrating resilience and adapting its business strategies. |

| 2014 | Acquired Municipal Assurance Corp., expanding its market share in municipal bond insurance. |

| 2023 | Reported strong financial results, including a significant increase in net income and adjusted operating income, reflecting its robust performance. |

Assured Guaranty has continuously innovated to maintain its competitive edge in the financial guaranty sector. A key focus has been on refining its risk management and underwriting processes to maintain strong financial strength ratings, crucial for the bond insurance industry.

Assured Guaranty has consistently refined its risk management practices, using advanced analytics and modeling to assess and mitigate potential risks. This includes detailed credit analysis and stress testing to ensure the financial stability of the company.

The company has expanded its product offerings beyond traditional municipal bonds to include structured finance products and infrastructure-related debt. This diversification helps to balance its portfolio and capture opportunities in various market segments.

Assured Guaranty is exploring new technologies and data analytics to enhance risk assessment and operational efficiency. This includes using AI and machine learning to improve underwriting and claims processing.

The company has formed strategic partnerships with financial institutions and public entities to expand its market presence and reach. These collaborations provide access to new business opportunities and enhance its distribution capabilities.

Assured Guaranty has expanded its asset management capabilities to diversify revenue streams and leverage its existing insured portfolio. This includes managing assets related to its insurance obligations and generating investment income.

Assured Guaranty focuses on maintaining a strong capital base and adjusting its risk exposure to navigate market volatility. This includes actively managing its capital levels and ensuring compliance with regulatory requirements.

The financial guaranty industry, including Assured Guaranty, has faced significant challenges, particularly during economic downturns and periods of market stress. The 2008 financial crisis tested the industry, leading to substantial claims and requiring strategic adjustments.

The 2008 financial crisis led to unprecedented stress on credit markets, causing significant claims for Assured Guaranty and other financial guarantors. This period necessitated strategic pivots, including strengthening capital and adjusting risk exposure.

Fluctuations in interest rates and economic cycles can affect the demand for bond insurance and the profitability of Assured Guaranty. The company must adapt to changing market conditions and manage its portfolio accordingly.

Changes in regulations and capital requirements can impact the operations and financial performance of Assured Guaranty. The company must comply with evolving regulatory frameworks and adapt its business practices.

The financial guaranty industry is competitive, with other companies vying for market share. Assured Guaranty must differentiate itself through strong financial ratings, innovative products, and effective risk management.

Economic downturns can lead to increased defaults and claims on insured bonds, impacting the financial performance of Assured Guaranty. The company must maintain sufficient capital and reserves to manage potential losses.

Negative publicity or concerns about the financial strength of Assured Guaranty could damage its reputation and affect its ability to attract new business. Maintaining transparency and strong communication is crucial.

To learn more about the company's financial structure and business model, consider reading Revenue Streams & Business Model of Assured Guaranty. The company's ability to adapt, innovate, and manage risks has been crucial to its longevity and success in the financial guaranty market. In 2023, Assured Guaranty reported net income of $490 million and adjusted operating income of $542 million, demonstrating its continued financial strength and resilience.

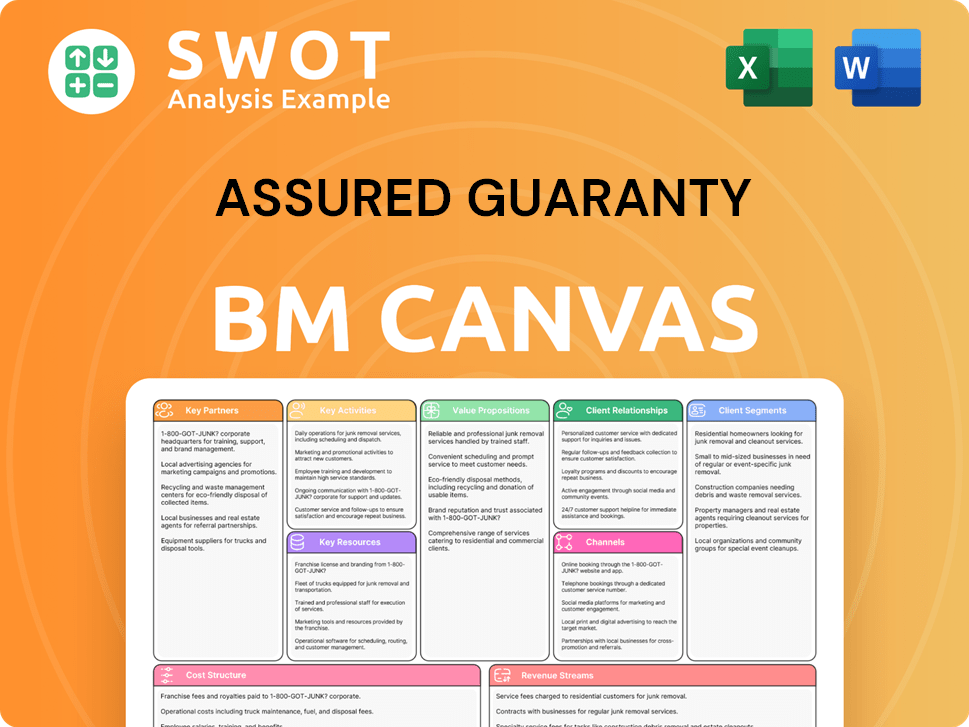

Assured Guaranty Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Assured Guaranty?

The AG company has a history marked by strategic moves and adjustments within the financial guaranty sector. From its founding in 1985, the company has evolved, establishing itself as a key player in bond insurance, expanding into structured finance, and navigating significant financial events. The company has focused on capital optimization and leveraging its business. Recent performance, including $428 million in Gross Written Premiums (GWP) in Q1 2024, demonstrates its continued relevance and demand for its services.

| Year | Key Event |

|---|---|

| 1985 | Founding of Assured Guaranty. |

| Early 1990s | Established itself as a significant player in the municipal bond insurance market. |

| Late 1990s | Expanded into structured finance products. |

| 2000s | Experienced growth through strategic acquisitions, solidifying its market position. |

| 2008 | Navigated the global financial crisis, undertaking significant restructuring and capital strengthening. |

| 2010s | Focused on capital optimization and leveraging its in-force book of business. |

| 2020s | Continued focus on public finance and infrastructure, with an emphasis on asset management and diversification. |

| 2024 | Reported strong financial results, with Gross Written Premiums (GWP) of $428 million in Q1 2024, demonstrating continued demand for its services. |

| 2025 | Anticipated to continue leveraging its expertise in credit enhancement for public finance and infrastructure projects, particularly in the face of ongoing global infrastructure investment needs. |

Assured Guaranty is strategically positioned to benefit from the increasing demand for credit enhancement in public finance and infrastructure projects worldwide. The company is expected to continue focusing on its core financial guaranty business while expanding its asset management capabilities. This strategic positioning is supported by the ongoing need for credit protection in the debt markets.

AG company's forward-looking strategy prioritizes maintaining strong financial ratings and delivering long-term shareholder value. Industry trends, such as growing infrastructure investment and complex debt markets, are expected to create sustained demand for credit protection services. The company is likely to explore growth through strategic partnerships and potential acquisitions.

Assured Guaranty plans to embrace technological advancements to improve operational efficiency and risk management frameworks. This includes leveraging data analytics and automation to enhance its credit assessment processes and optimize its portfolio management. These advancements aim to support the company's long-term growth and stability in the financial guaranty sector.

The company's ability to offer credit protection remains a key aspect of its market position. Assured Guaranty's expertise in credit enhancement for public finance and infrastructure projects is expected to remain crucial. The company's focus on these areas aligns with the growing needs of the global infrastructure investment landscape.

Assured Guaranty Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Assured Guaranty Company?

- What is Growth Strategy and Future Prospects of Assured Guaranty Company?

- How Does Assured Guaranty Company Work?

- What is Sales and Marketing Strategy of Assured Guaranty Company?

- What is Brief History of Assured Guaranty Company?

- Who Owns Assured Guaranty Company?

- What is Customer Demographics and Target Market of Assured Guaranty Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.