Atmos Energy Bundle

How Did Atmos Energy Become a Natural Gas Giant?

Journey back in time to uncover the Atmos Energy SWOT Analysis and the fascinating Atmos Energy history, a story that began in the heart of Texas. From its humble beginnings as a natural gas pioneer, Atmos Energy has evolved into a leading energy provider. Discover how this Atmos Energy company navigated the complexities of the energy sector.

This brief history of Atmos Energy reveals a company that has consistently adapted to the changing energy landscape. The Atmos Energy company timeline showcases strategic mergers and acquisitions, solidifying its position as a key player in gas distribution. Today, this natural gas company continues to serve millions, a testament to its enduring vision and commitment to providing essential energy services.

What is the Atmos Energy Founding Story?

The story of Atmos Energy, a significant natural gas company, began in the early 20th century in the Texas Panhandle. This energy provider has a rich history rooted in the vision of its founders and the evolving energy landscape. Understanding the Atmos Energy history provides insights into its growth and impact on the gas distribution sector.

The journey of Atmos Energy company started with the Storm brothers. They arrived in Amarillo, Texas, from Missouri with the goal of establishing a coal gas business. Their involvement in oil wildcatting led to a pivotal discovery, shaping the future of the company. This discovery was a major gas field.

This pivotal discovery led to the establishment of Amarillo Gas Company, marking a significant step in the company's history. The primary objective was to develop and expand the use of natural gas as a practical energy source. In 1924, Southwestern Development Company acquired Amarillo Oil and Amarillo Gas, streamlining operations. The initial business model centered on distributing natural gas to various communities.

The early days of Atmos Energy involved overcoming financial hurdles to build pipelines.

- The company's roots trace back to 1906 in the Texas Panhandle.

- The Storm brothers initially aimed to start a coal gas business.

- They discovered a major gas field, leading to the formation of Amarillo Gas Company.

- Charles K. Vaughan, the founding chairman, instilled values that continue to guide the company.

The company was later renamed Pioneer Natural Gas Company in 1953, consolidating Southwestern's gas distribution businesses. One of the key challenges during the establishment was securing financing. This was required to construct pipelines during the early 20th century. Charles K. Vaughan, the founding chairman, played a crucial role. He instilled values of honesty, integrity, and strong moral character, which have remained central to the company's operations. For more information about the company's reach, consider reading about the Target Market of Atmos Energy.

Atmos Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Atmos Energy?

The early growth and expansion of Atmos Energy involved significant consolidation and strategic acquisitions. From its beginnings as a spin-off, the natural gas company quickly grew through targeted purchases of utility assets. This expansion has been a key factor in its evolution into a major energy provider.

Atmos Energy history began with the consolidation of various gas distribution businesses into Pioneer Natural Gas Company in 1953. A pivotal moment occurred in 1983 when Energas, the natural gas distribution division of Pioneer, was spun off. This spin-off marked the beginning of Atmos Energy's independent journey.

In October 1988, Energas officially changed its corporate name to Atmos Energy Corporation. The company's stock began trading on the New York Stock Exchange under the ticker symbol 'ATO'. This listing provided access to capital for future growth and acquisitions, fueling its expansion.

Atmos Energy employed a strategy of acquiring utility assets to expand its reach. The purchase of Greeley Gas Company in 1993 was one of the early acquisitions. The acquisition of Mississippi Valley Gas in 2002 was another significant step. A major acquisition in October 2004 further expanded its reach when it acquired the distribution and pipeline operations of TXU Gas Company.

Atmos Energy reached a significant milestone in July 1997 when it acquired its one-millionth customer. By fiscal year 2023, the company had grown from 279,000 customers in 1983 to over 3.3 million customers. In fiscal year 2024, the company added over 59,000 new residential and commercial customers, with more than 46,000 of those in Texas.

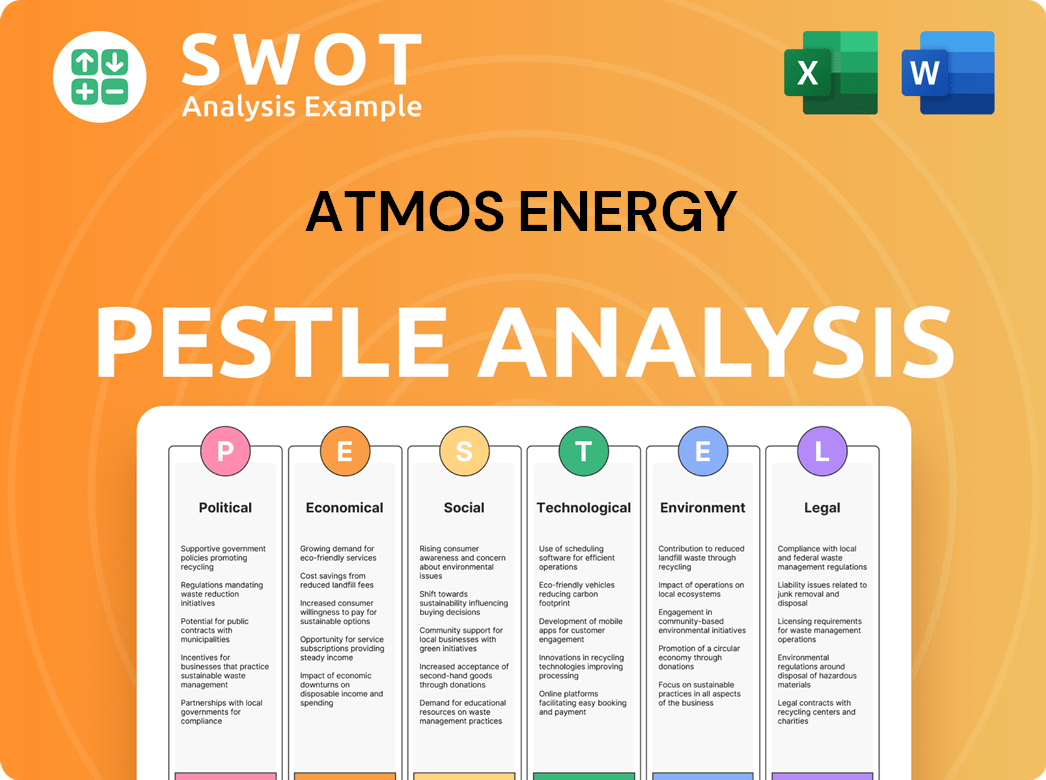

Atmos Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Atmos Energy history?

The Atmos Energy history reflects a journey marked by significant milestones and strategic decisions. The company's commitment to growth and operational excellence has been a constant throughout its evolution as a leading natural gas company and energy provider.

| Year | Milestone |

|---|---|

| Fiscal Year 2024 | Earnings per diluted share increased for the 22nd consecutive year, and dividends increased for 40 consecutive years, demonstrating consistent financial performance. |

| Fiscal Year 2023 | Invested $2.8 billion in infrastructure, with 85% allocated to safety and reliability projects, replacing over 900 miles of mains and 47,000 service lines. |

| Fiscal Year 2024 | Capital spending reached $2.9 billion, with 83% dedicated to safety and reliability projects, replacing over 850 miles of mains and 55,000 service lines. |

Innovations at Atmos Energy include the development of zero net energy (ZNE) homes in partnership with Habitat for Humanity, showcasing the company's role in reducing carbon footprints. As of early 2024, 12 ZNE homes have been completed, highlighting a forward-thinking approach to energy solutions.

Atmos Energy has partnered with Habitat for Humanity to develop Zero Net Energy (ZNE) homes.

This innovation demonstrates the company's commitment to sustainable energy solutions.

Established over a quarter-century ago, the 'AtmoSpirit' culture guides operations.

It emphasizes principles like 'Inspire Trust' and 'Focus on the Future' for employee conduct.

Significant investments in infrastructure are a continuous innovation.

This ensures safety and reliability in gas distribution.

Despite these achievements, Atmos Energy has faced challenges, including market downturns and the need for continuous infrastructure modernization. Moody's Ratings downgraded Atmos Energy's rating to A2 from A1 in April 2025, due to substantial capital expenditure and higher debt levels.

Moody's downgraded Atmos Energy's rating to A2 from A1 in April 2025.

This was due to substantial capital expenditure and higher debt levels.

The company faces increased operating expenses.

This includes rising bad debt, as highlighted in the Q2 2025 earnings call.

Atmos Energy addresses regulatory lag through rate adjustments.

These adjustments support revenue growth.

Atmos Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Atmos Energy?

The Atmos Energy history began in 1906 in the Texas Panhandle, evolving through several key acquisitions and strategic shifts. From its early days as a regional gas provider, it has grown into a major natural gas company serving millions of customers. The company's journey includes significant milestones, such as becoming a publicly traded entity and expanding its service territory through strategic acquisitions. Atmos Energy's commitment to safety, reliability, and customer service has been a constant throughout its history, shaping its growth and market position.

| Year | Key Event |

|---|---|

| 1906 | Company history begins in the Panhandle of Texas. |

| 1924 | Southwestern Development Company acquires Amarillo Oil and Amarillo Gas. |

| 1953 | Southwestern's gas distribution businesses are consolidated as Pioneer Natural Gas Company. |

| 1981 | The company is incorporated and becomes a fully regulated natural gas-only distributor. |

| 1983 | Energas, the natural gas distribution division of Pioneer, is spun off as an independent, publicly held company. |

| October 1988 | Energas changes its name to Atmos Energy Corporation and begins trading on the NYSE. |

| 1993 | Acquires Greeley Gas Company. |

| July 1997 | Reaches the milestone of one million customers. |

| 2002 | Acquires Mississippi Valley Gas. |

| October 2004 | Acquires distribution and pipeline operations of TXU Gas Company. |

| Fiscal 2023 | Celebrates 40th anniversary as an independent company; invests $2.8 billion in safety and reliability projects. |

| Fiscal 2024 | Reports consolidated net income of $944.5 million and capital expenditures of $2.7 billion. |

| March 31, 2025 | Total assets reach $26.98 billion. |

| May 7, 2025 | Reports Q2 fiscal 2025 net income of $485.6 million and raises fiscal 2025 EPS guidance to $7.20 - $7.30. |

Atmos Energy projects substantial capital expenditures through fiscal year 2029, with a significant portion allocated to safety and reliability. This strategic investment is designed to support long-term earnings and dividend growth. The company's commitment to infrastructure upgrades and expansion underscores its dedication to providing reliable natural gas services.

In fiscal year 2024, Atmos Energy reported a consolidated net income of $944.5 million. The company's fiscal 2025 capital expenditures are expected to be around $3.7 billion. The Q2 fiscal 2025 net income was $485.6 million, and the company raised its fiscal 2025 EPS guidance to $7.20 - $7.30.

Atmos Energy is focused on expanding its services responsibly while maintaining financial discipline and environmental stewardship. The company's vision includes being the safest natural gas provider, which guides its infrastructure investments and customer service initiatives. This approach ensures the company meets the growing demand for natural gas.

The company plans approximately $24 billion in capital expenditures through fiscal year 2029, with over 86% allocated to safety and reliability enhancements. These investments are crucial for supporting long-term earnings and dividend per share growth. This forward-looking strategy aligns with Atmos Energy's commitment to providing essential services.

Atmos Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Atmos Energy Company?

- What is Growth Strategy and Future Prospects of Atmos Energy Company?

- How Does Atmos Energy Company Work?

- What is Sales and Marketing Strategy of Atmos Energy Company?

- What is Brief History of Atmos Energy Company?

- Who Owns Atmos Energy Company?

- What is Customer Demographics and Target Market of Atmos Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.