Atmos Energy Bundle

Who Really Owns Atmos Energy?

Understanding the ownership structure of a company like Atmos Energy is vital for investors and stakeholders alike. From its humble beginnings as Amarillo Gas Company in 1906 to its current status as a leading natural gas company, Atmos Energy's journey is a testament to strategic evolution. Discover the key players and pivotal moments that have shaped the Atmos Energy SWOT Analysis and its trajectory.

This exploration will uncover the evolution of Atmos Energy ownership, from its founding to its current landscape. We'll examine how the company, now a major energy provider, transitioned into a publicly traded entity, influencing its governance and strategic direction. Learn about the impact of institutional investors and public shareholders on the utility company's performance and future.

Who Founded Atmos Energy?

The story of the Atmos Energy company begins in 1906 with brothers J.C. and Frank Storm, who established the Amarillo Gas Company. Their foresight in recognizing the need for a gas plant in Amarillo, Texas, marked the initial step in what would become a major energy provider.

While the specific details of the Storm brothers' initial ownership structure are not readily available, their entrepreneurial venture set the stage for the Atmos Energy ownership that would evolve over the following decades. This early phase was critical in establishing the company's foundation in the natural gas industry.

In 1924, the Amarillo Gas Company, along with the Amarillo Oil Company, was acquired by Southwestern Development Company. This transition signaled the first change in Atmos Energy ownership from its founders to a larger entity. The Amarillo Oil Company is notable for drilling the first natural gas well in the Panhandle gas field in 1918.

The acquisition by Southwestern Development Company in 1924 marked a significant shift in ownership.

In 1953, Southwestern's gas distribution businesses were consolidated to form Pioneer Natural Gas Company.

Energas Company was spun off from Pioneer in 1983, becoming an independent, publicly held entity.

Pioneer Corporation, a diversified West Texas energy company, continued to develop, and in 1981, it formed Energas Company as its natural gas distribution subsidiary. The 1983 spin-off of Energas from Pioneer as an independent, publicly held natural gas company was a pivotal moment, transforming its ownership from a subsidiary within a larger corporation to a standalone entity. Charles Vaughan, Energas' first president, played a key role in its early success. For more on the company's strategic direction, you can read about the Growth Strategy of Atmos Energy.

Atmos Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Atmos Energy’s Ownership Changed Over Time?

The ownership structure of Atmos Energy, a prominent natural gas company, has evolved significantly since its public debut. Initially known as Energas, the company spun off in 1983 and later rebranded as Atmos Energy Corporation in October 1988. This transition marked the beginning of its journey as a publicly traded entity, listed on the New York Stock Exchange under the ticker symbol 'ATO'. This shift to public ownership opened the door for institutional investors, mutual funds, and individual shareholders to participate in the company's growth.

The company's expansion through strategic acquisitions has also played a pivotal role in shaping its ownership landscape. Notable acquisitions include Greeley Gas Company in 1993, the merger with United Cities Gas Company in 1997, and the acquisition of TXU Gas Company's distribution and pipeline operations in October 2004. These moves not only broadened its customer base but also influenced the distribution of shares among various stakeholders. Today, Atmos Energy serves over 3 million customers, a substantial increase from the initial 279,000 customers in 1983, reflecting the impact of these strategic ownership and operational changes.

| Event | Date | Impact on Ownership |

|---|---|---|

| Public Spin-off as Energas | 1983 | Transition to public ownership; initial shareholder base. |

| Rebranding to Atmos Energy Corporation | October 1988 | Listing on NYSE (ATO); increased visibility for investors. |

| Acquisition of Greeley Gas Company | 1993 | Expansion of customer base; potential shift in shareholder distribution. |

| Merger with United Cities Gas Company | 1997 | Further expansion; impact on ownership structure. |

| Acquisition of TXU Gas Company operations | October 2004 | Significant expansion of customer base; potential changes in ownership. |

As of June 2025, Atmos Energy Corporation has a substantial institutional presence, with 1536 institutional owners and shareholders holding a total of 188,264,195 shares. Key institutional investors include Vanguard Group Inc. (holding 13.1% of shares), BlackRock, Inc. (7.15%), Wellington Management Group Llp (7.763%), and State Street Corp (6.704%). These major stakeholders significantly influence the company's strategic direction. The aggregate market value of common voting stock held by non-affiliates was approximately $17.83 billion as of March 31, 2024. For more details on the company's financial performance, you can refer to Revenue Streams & Business Model of Atmos Energy.

Atmos Energy's ownership is primarily held by institutional investors.

- The Vanguard Group Inc. is a major shareholder.

- BlackRock, Inc. also holds a significant portion of shares.

- The company's equity capitalization stood at 60.9% as of March 31, 2025.

- The company's stock symbol is ATO.

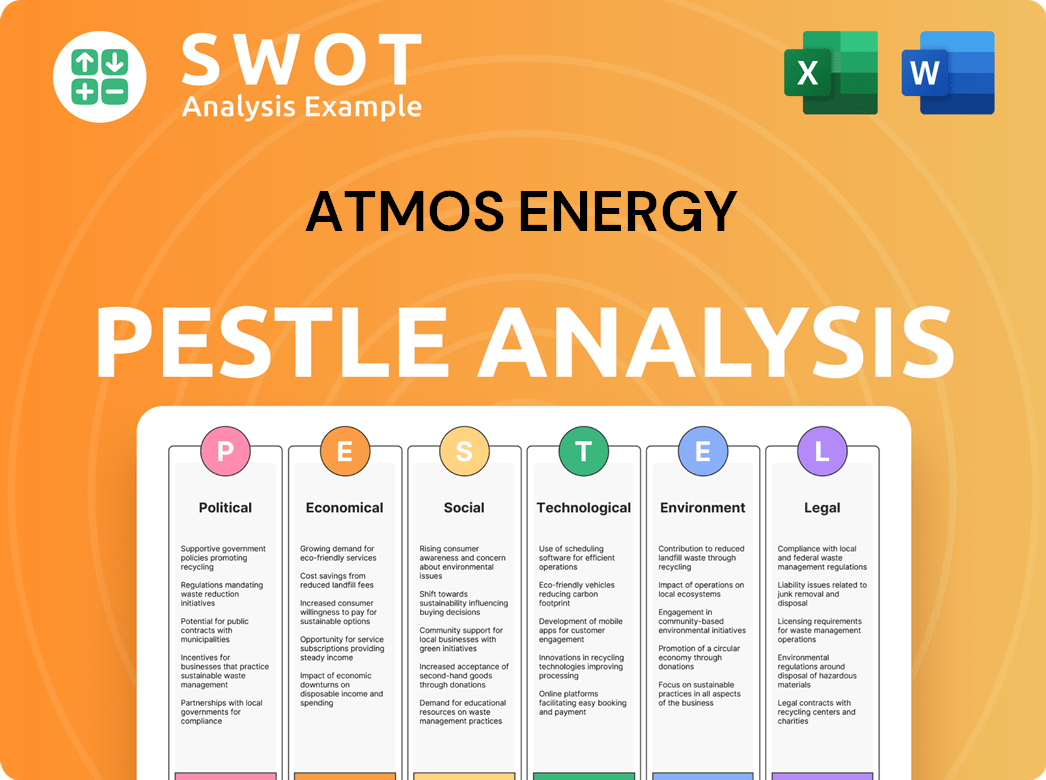

Atmos Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Atmos Energy’s Board?

The current Board of Directors at Atmos Energy Company plays a vital role in guiding the company's vision and strategic direction. As of the 2025 Annual Meeting of Shareholders, the Board is composed of 11 directors, a reduction from the previous 13. This structure is designed to ensure independent oversight of management, along with key strategic and risk-related issues.

Key figures on the Board include Kim R. Cocklin as Chairman, and J. Kevin Akers, serving as President and CEO. Richard A. Sampson holds the position of Lead Director. Other board members include John C. Ale, Kelly H. Compton, Sean Donohue, Rafael G. Garza, Edward Geiser, and Telisa Toliver. Edward Geiser and Telisa Toliver joined the board in September 2024, bringing experience from the energy and renewable power sectors. Notably, the Audit, Human Resources, and Nominating Committees are comprised solely of independent directors, and all standing Board committees are chaired by independent directors.

| Board Member | Title | Year Joined Board |

|---|---|---|

| Kim R. Cocklin | Chairman of the Board | N/A |

| J. Kevin Akers | President and CEO | N/A |

| Richard A. Sampson | Lead Director | N/A |

| John C. Ale | Director | N/A |

| Kelly H. Compton | Director | N/A |

| Sean Donohue | Director | N/A |

| Rafael G. Garza | Director | N/A |

| Edward Geiser | Director | 2024 |

| Telisa Toliver | Director | 2024 |

The voting structure for Atmos Energy, a publicly traded natural gas company, generally follows a one-share-one-vote system. Shareholders of record as of December 13, 2024, were eligible to vote at the annual meeting held on February 5, 2025. The Board nominates individuals for one-year terms, with directors elected by a majority vote. While insider ownership is relatively low at 0.48%, the company emphasizes a strong governance framework with independent oversight. There have been no recent public proxy battles or activist investor campaigns that have significantly reshaped decision-making. If you're interested in learning more about the company's operations, you might find information in an article about the company's history and current standing.

The Board of Directors at Atmos Energy is structured to ensure independent oversight and strategic direction.

- The Board consists of 11 members as of 2025, with key roles held by Kim R. Cocklin and J. Kevin Akers.

- Independent directors chair all standing committees, ensuring unbiased governance.

- The voting structure is one-share-one-vote, and directors are elected annually.

Atmos Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Atmos Energy’s Ownership Landscape?

Over the past few years, the ownership profile of the Atmos Energy company has been shaped by its consistent financial performance and strategic investments. The company reported a net income of $1,042.9 million for fiscal year 2024, translating to $6.83 per diluted share. This marks the 22nd consecutive year of annual earnings per share (EPS) growth. The projected annual dividend for fiscal year 2025 is $3.48, an 8.1% increase from the previous year, and the company boasts a 40-year streak of annual dividend growth, attracting long-term investors.

The company continues to invest heavily in infrastructure modernization and safety. For fiscal year 2025, capital expenditures are projected to be approximately $3.7 billion, with a total of around $24 billion allocated through fiscal year 2029. More than 86% of these expenditures are earmarked for safety and reliability projects. These significant investments in the natural gas distribution and transmission systems are designed to appeal to institutional investors looking for stable, regulated utilities with long-term growth potential.

| Metric | Value | Date |

|---|---|---|

| Net Income | $1,042.9 million | Fiscal Year 2024 |

| Diluted EPS | $6.83 | Fiscal Year 2024 |

| Dividend (Annual) | $3.48 | Fiscal Year 2025 (Projected) |

| Equity Capitalization | 60.9% | March 31, 2025 |

Recent developments include the appointment of new board members in September 2024, such as Edward Geiser and Telisa Toliver, which reflects a focus on diverse expertise, particularly in energy and renewable power. As of June 2025, analyst sentiment is generally positive, with a 'Moderate Buy' consensus rating and an average price target of $156.35, suggesting a potential upside. The company's financial stability is further supported by a 60.9% equity capitalization as of March 31, 2025, and substantial available liquidity.

Increased institutional ownership is a trend among stable utility companies like Atmos Energy. This often makes them attractive as defensive stocks during volatile market conditions, making the company a reliable energy provider.

Atmos Energy's strong financial profile, including a high equity capitalization and available liquidity, reinforces its position. These factors are crucial in maintaining investor confidence and supporting long-term growth for this natural gas company.

While founder dilution is a natural process for a publicly traded company, institutional holdings remain strong. This suggests continued confidence in the company's management and its regulated business model.

There are no public announcements regarding privatization or significant shifts in the company's public listing status. The company's focus remains on delivering consistent financial results.

Atmos Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Atmos Energy Company?

- What is Competitive Landscape of Atmos Energy Company?

- What is Growth Strategy and Future Prospects of Atmos Energy Company?

- How Does Atmos Energy Company Work?

- What is Sales and Marketing Strategy of Atmos Energy Company?

- What is Brief History of Atmos Energy Company?

- What is Customer Demographics and Target Market of Atmos Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.