Atmos Energy Bundle

How Does Atmos Energy Power Your World?

Atmos Energy Company, a leading natural gas provider, is a critical player in the energy sector, delivering essential Atmos gas service across a vast network. This gas utility company operates in eight states, primarily in the South and Midwest, providing a vital service to millions. Understanding the inner workings of this energy company is key to appreciating its impact.

From its extensive pipeline network to its commitment to customer service, Atmos Energy's operations are complex and fascinating. For those interested in a deeper dive, consider exploring the Atmos Energy SWOT Analysis to understand its strengths, weaknesses, opportunities, and threats. This analysis, along with other insights, will provide a comprehensive understanding of the company's position in the market and its future prospects, including information on how to pay Atmos Energy bill online, Atmos Energy customer service phone number, and Atmos Energy rates and plans.

What Are the Key Operations Driving Atmos Energy’s Success?

The core operations of the Atmos Energy Company revolve around the safe and dependable delivery of natural gas. This natural gas provider creates value through two main segments: regulated natural gas distribution and regulated pipeline and storage. The company's value proposition focuses on providing a reliable, affordable, and environmentally responsible energy source essential for daily life and economic activities.

The distribution segment serves residential, commercial, public sector, and industrial customers, supplying natural gas for heating, cooking, and industrial processes. This involves managing a complex network of distribution mains and service lines to ensure efficient gas flow. The pipeline and storage segment supports the distribution business by transporting natural gas from production areas to local distribution systems and storing it for peak demand periods.

Operational processes include rigorous safety protocols, continuous infrastructure maintenance, advanced leak detection, and emergency response systems. The supply chain involves procuring natural gas from various basins and transporting it through an extensive pipeline network. Atmos gas service emphasizes customer service through various channels, including online portals, call centers, and field services. Infrastructure modernization and safety investments are crucial for system integrity and reduced operational risks.

The distribution segment manages a vast network of mains and service lines. This ensures natural gas reaches residential, commercial, and industrial customers. This segment is critical for providing heating, cooking, and industrial fuel.

This segment transports natural gas from production areas to local distribution systems. It also stores gas for peak demand, ensuring supply reliability. Operations include interstate and intrastate pipelines and storage facilities.

Rigorous safety protocols and continuous infrastructure maintenance are essential. Advanced leak detection and emergency response systems are also in place. These measures ensure the safe and reliable delivery of natural gas.

Customer service is provided through online portals, call centers, and field services. The company focuses on providing accessible and efficient support. This enhances customer satisfaction and trust.

In fiscal year 2024, Atmos Energy invested approximately $2.1 billion in system infrastructure, focusing on safety and reliability. The company serves over 3 million customers across 8 states. Their focus on infrastructure modernization has led to significant reductions in emissions and improved safety metrics.

- Infrastructure Investments: Approximately $2.1 billion in 2024.

- Customer Base: Over 3 million customers.

- Service Area: Spans 8 states.

- Safety Focus: Emphasis on reducing leaks and enhancing system integrity.

Atmos Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Atmos Energy Make Money?

The primary revenue streams for the Atmos Energy Company are centered around its regulated natural gas distribution and pipeline and storage businesses. The company's financial success is largely tied to the sale and transportation of natural gas to a wide range of customers. For the fiscal year ending September 30, 2024, the Atmos Energy Company reported operating revenues of approximately $4.3 billion.

The regulated natural gas distribution segment is the largest contributor to revenue. This segment involves delivering natural gas to over 3 million customers. The revenue generated is primarily based on regulated rates approved by state utility commissions, which allow the company to recover its costs and earn a reasonable return on its investments. This model provides a stable financial foundation.

The pipeline and storage segment also plays a crucial role by charging fees for the transportation and storage of natural gas. These fees are also subject to regulatory oversight. The company's monetization strategy is deeply rooted in the regulated utility model, which provides stable and predictable cash flows. This approach helps ensure consistent revenue generation.

The company's capital expenditure program is a key driver of revenue growth. Significant investments are made in pipeline modernization and safety enhancements. This strategy allows the company to grow its rate base and, consequently, its allowed revenues. For fiscal year 2025, the company planned to invest approximately $3.0 billion, with around 85% allocated to system modernization and reliability. This investment strategy ensures continued revenue growth by improving infrastructure and meeting regulatory requirements. You can learn more about the company's background in the Brief History of Atmos Energy.

- Investing in infrastructure improvements is a core part of the company's strategy.

- These investments are designed to enhance safety and reliability.

- The company's regulated status provides a framework for predictable revenue.

- The focus on modernization helps to meet the needs of a growing customer base.

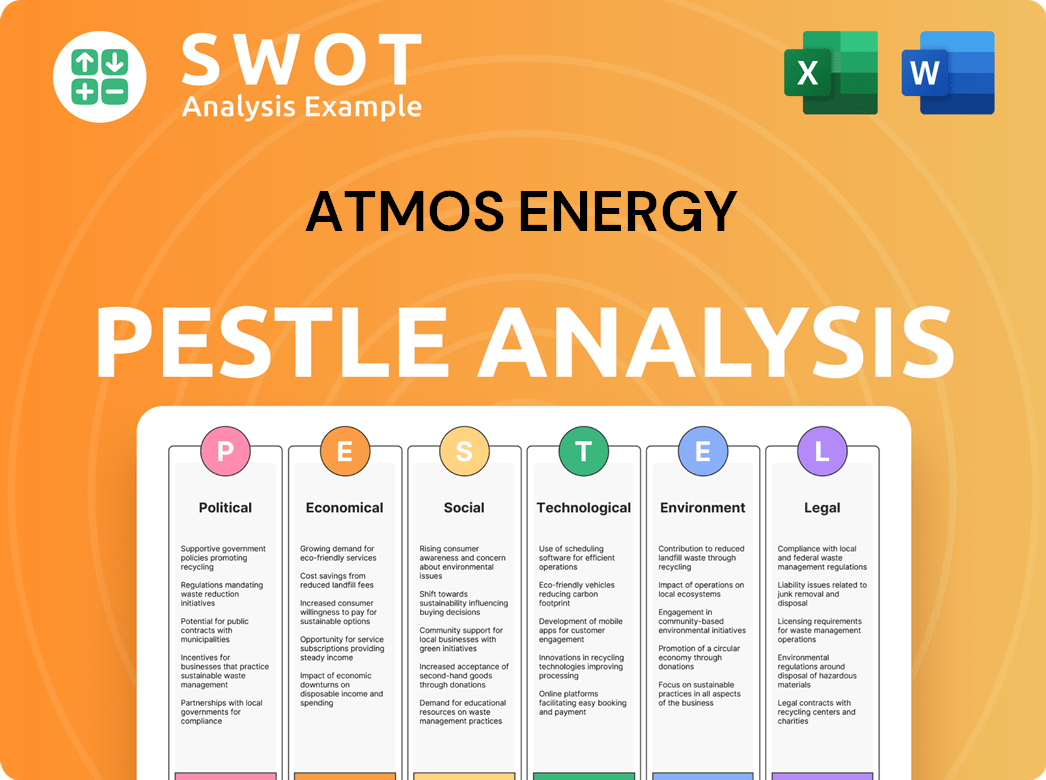

Atmos Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Atmos Energy’s Business Model?

The journey of the Atmos Energy Company has been marked by strategic investments and a strong commitment to safety. These key moves have significantly shaped its operations and financial performance. A major ongoing milestone is the company's robust capital expenditure program, which prioritizes pipeline modernization and safety enhancements. For instance, in fiscal year 2024, Atmos Energy invested approximately $2.8 billion in capital expenditures.

This substantial investment is primarily directed towards enhancing the safety and reliability of its natural gas distribution and transmission systems. This strategic investment not only improves operational integrity but also fuels rate base growth, a crucial element in a regulated utility business. The company has consistently adapted to operational challenges, such as extreme weather events, by leveraging its diverse storage capabilities and pipeline network to ensure continuous service for its customers.

The company's competitive edge is rooted in its extensive regulated asset base, which provides economies of scale and high barriers to entry for potential competitors. Its strong relationships with regulatory bodies, built on a track record of reliable service and adherence to safety standards, further solidify its market position. The company also benefits from the essential nature of natural gas as a fuel source, ensuring consistent demand. For those interested in understanding the company's reach, you might find the Target Market of Atmos Energy article informative.

Significant capital expenditures, with approximately $2.8 billion invested in fiscal year 2024, are focused on pipeline modernization and safety enhancements. These investments are crucial for maintaining and improving operational efficiency.

The company consistently navigates operational challenges, such as extreme weather events, by utilizing diverse storage capabilities and pipeline networks. This ensures continuous service to customers. Focus on safety and reliability is a cornerstone of its strategy.

Its extensive regulated asset base creates high barriers to entry. Strong relationships with regulatory bodies and the essential nature of natural gas as a fuel source contribute to its market position. The company is also adapting to new trends.

The company is investing in pipeline integrity and exploring lower-carbon energy solutions. This includes initiatives focused on reducing methane emissions and enhancing the efficiency of natural gas distribution. These efforts align with evolving environmental standards.

In 2024, Atmos Energy's focus on infrastructure investment and operational efficiency is expected to support continued financial growth. The company's strategic investments in pipeline safety and reliability are designed to ensure long-term value for shareholders.

- Continued investment in infrastructure, with a focus on safety and reliability.

- Strong relationships with regulatory bodies.

- Adaptation to new trends, including environmental performance.

- Consistent demand for natural gas.

Atmos Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Atmos Energy Positioning Itself for Continued Success?

The Atmos Energy Company maintains a strong position in the natural gas distribution sector. As one of the largest natural gas-only distributors in the United States, it serves a diverse customer base across multiple states. This regulated structure provides a degree of stability, setting it apart from more volatile energy sectors and contributing to a significant market share within its operating territories.

Despite its strong market presence,

The company is a leading natural gas provider in the U.S., operating as a gas utility across multiple states. Its regulated status provides revenue stability. Atmos Energy's extensive infrastructure supports a substantial market share.

Regulatory changes and the transition to renewable energy pose challenges. Commodity price fluctuations and operational risks, such as pipeline incidents, are also present. These factors can impact profitability and operational costs.

Atmos Energy is focused on infrastructure modernization to improve safety and reliability. The company plans significant capital expenditures for system enhancements. It aims to reduce emissions and adapt to the evolving energy landscape.

Atmos Energy has projected capital expenditures of between $15 billion and $16 billion for fiscal years 2025-2029. This investment strategy supports long-term growth and stable returns.

Atmos Energy is actively modernizing its infrastructure and focusing on environmental stewardship. The company is investing in system enhancements to improve reliability and reduce methane emissions. These efforts are crucial for adapting to the evolving energy landscape.

- Infrastructure modernization to enhance system reliability.

- Reduction of methane emissions through strategic investments.

- Commitment to adapting to the changing energy environment.

- Focus on maintaining stable returns through prudent investments.

Atmos Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Atmos Energy Company?

- What is Competitive Landscape of Atmos Energy Company?

- What is Growth Strategy and Future Prospects of Atmos Energy Company?

- What is Sales and Marketing Strategy of Atmos Energy Company?

- What is Brief History of Atmos Energy Company?

- Who Owns Atmos Energy Company?

- What is Customer Demographics and Target Market of Atmos Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.