AutoCanada Bundle

What's the Story Behind AutoCanada's Rise?

AutoCanada, a major player in the North American automotive retail sector, has an intriguing history. Founded in Edmonton, Alberta, in 2006, the company set out to reshape the Canadian car dealership landscape. Their strategy focused on consolidation and standardization, mirroring successful models in the United States.

From its beginnings, AutoCanada aimed to become a national force in the AutoCanada SWOT Analysis. The company's journey includes strategic acquisitions and operational improvements, adapting to the evolving Canadian auto industry. Today, with a focus on its Canadian operations and a transformation plan targeting significant cost savings, AutoCanada continues to evolve, making it a compelling case study in the automotive retail sector. Understanding the brief history of AutoCanada provides valuable insight into its current market position and future prospects, including its expansion strategy and financial performance history.

What is the AutoCanada Founding Story?

The story of the [Company Name] begins with a strategic vision to transform the Canadian automotive retail landscape. The company, incorporated on October 29, 2009, traces its roots back to 2001, when its predecessor started building a national, multi-location car dealership group. This initiative aimed to bring a successful U.S. model to the Canadian market.

The core strategy involved acquiring and operating franchised dealerships across Canada. This approach allowed the company to offer a wide array of automotive products and services. These included new and used vehicles, leasing options, parts, maintenance, and collision repair services. The company also provided financing and insurance solutions through third-party sources, with the sale of used cars historically being a major revenue driver.

A key milestone in the company's growth was its Initial Public Offering (IPO) on the Toronto Stock Exchange (TSX) in 2006. This IPO, which listed the company under the symbol 'ACQ,' provided the financial resources needed to expand its operations. The company's formation as a consolidation play, focusing on acquiring existing dealerships, suggests a strategic approach to achieve scale and efficiency within the fragmented Canadian auto industry. For more details on the company's structure, consider exploring the resources available for Owners & Shareholders of AutoCanada.

Here are some important dates and facts about AutoCanada:

- 2001: The predecessor entity begins its strategy to build a national dealership group.

- 2006: The company completes its Initial Public Offering (IPO) on the Toronto Stock Exchange (TSX).

- 2009: AutoCanada Inc. is formally incorporated.

- The company's headquarters are located in Edmonton, Alberta.

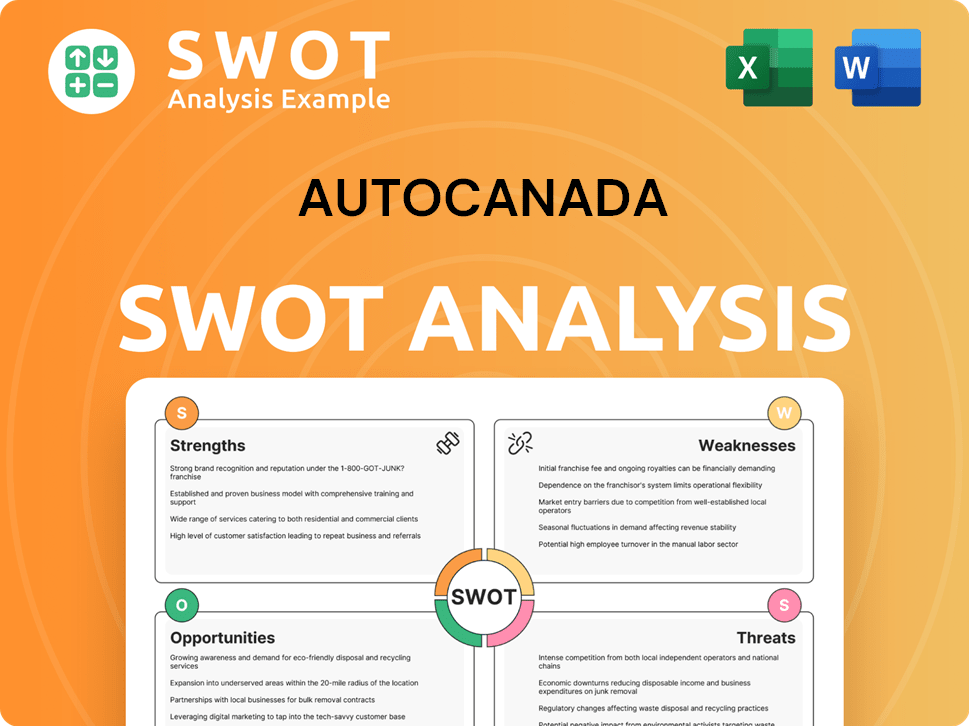

AutoCanada SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of AutoCanada?

In its early years, the AutoCanada company focused on rapidly expanding its network of franchised dealerships across Canada. This expansion strategy involved acquiring existing dealerships and establishing new locations under agreements with various automobile manufacturers. This growth phase included significant acquisitions and strategic moves to increase its market presence and diversify its brand portfolio within the Canadian auto industry.

A key development was the acquisition of the Nurse Chevrolet Cadillac dealership and collision center in Whitby, Ontario, on June 25, 2024. By 2024, AutoCanada's Canadian operations included 64 franchised dealerships representing 25 brands across 8 provinces, along with 29 collision centers. These dealerships sold approximately 85,000 new and used retail vehicles in 2024.

The company's U.S. operations, under the Leader Automotive Group, also expanded. By 2024, it grew to 17 franchised dealerships with 15 brands in Illinois. These dealerships sold around 12,900 new and used retail vehicles in 2024, contributing to the overall expansion strategy.

Facing market challenges, AutoCanada initiated a strategic realignment in late 2024 and early 2025. This included divesting non-core assets, such as the sale of two Canadian Stellantis dealerships in September 2024, which generated $86.5 million in sales in the trailing 12-month period ending June 30, 2024. Proceeds were used to reduce debt.

AutoCanada restructured its RightRide used vehicle business, closing seven underperforming locations in Q3 2024 and all remaining locations by March 4, 2025, to eliminate an $11 million annual Adjusted EBITDA loss. The company also announced plans to divest its entire U.S. business, classifying it as a discontinued operation as of December 31, 2024, to concentrate on its core Canadian operations and reduce complexity.

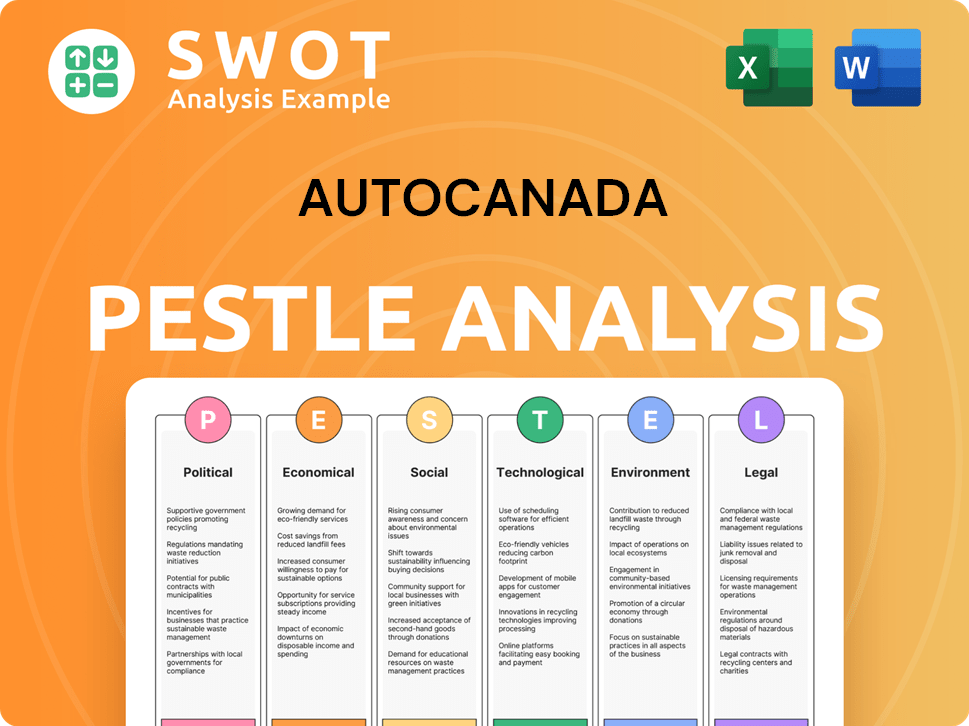

AutoCanada PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in AutoCanada history?

The AutoCanada company has achieved several significant milestones, including expanding its dealership network across Canada and the U.S., marking its presence in the automotive retail sector.

| Year | Milestone |

|---|---|

| 2024 | Generated revenue exceeding $5.3 billion and sold over 97,000 retail vehicles. |

| 2024 | Sale of non-core Stellantis dealerships, generating $59.5 million. |

| March 4, 2025 | Closure of all RightRide locations. |

| March 31, 2025 | Achieved $57.1 million in annualized run-rate savings through the ACX Operating Method. |

A key innovation is the 'ACX Operating Method,' launched in Q3 2024, which aims to standardize operations and enhance cost controls. This method targets $100 million in annual run-rate cost savings by the end of 2025, focusing on various operational improvements.

This method focuses on standardizing dealership operations, enhancing cost controls, improving inventory management, and centralizing administrative functions.

The company divested its U.S. business and non-core Stellantis dealerships to focus on Canadian operations.

Focus on reducing operational costs to improve profitability and financial health.

Despite these advancements, AutoCanada has faced challenges, including market downturns and affordability pressures in the Canadian auto industry. These factors led to a decline in revenue and net income in the third and fourth quarters of 2024.

The company experienced revenue declines in Q3 and Q4 2024 due to market conditions.

Q4 2024 saw a net loss of $(38.4) million, and Q1 2025 reported a net loss of $(3.2) million.

The company is focusing on its Canadian operations and restructuring to enhance profitability.

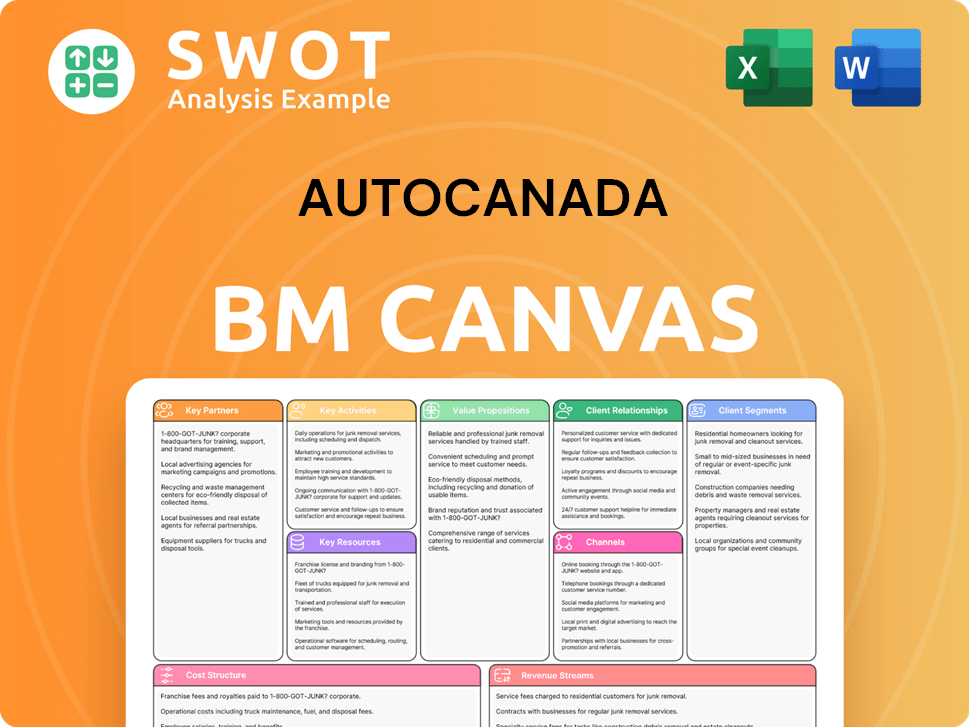

AutoCanada Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for AutoCanada?

The AutoCanada story began in 2001 with a vision to create a national automobile dealership group in Canada. The company, then known as the 'Fund,' laid the groundwork for what would become a significant player in the Canadian auto industry. The company has since navigated the ups and downs of the automotive retail sector, evolving through strategic acquisitions, IPOs, and operational adjustments to meet market demands. The AutoCanada history reflects a journey of growth and adaptation, positioning it as a leading car dealerships Canada.

| Year | Key Event |

|---|---|

| 2001 | The 'Fund,' a predecessor entity, started its strategy to become a national multi-location automobile dealership group in Canada. |

| 2006 | The 'Fund' completed its IPO on the TSX. |

| October 29, 2009 | AutoCanada Inc. was officially incorporated under the Canada Business Corporations Act. |

| January 1, 2011 | AutoCanada Inc. amalgamated with its subsidiary, AutoCanada GP Inc., continuing under the name AutoCanada Inc. |

| December 19, 2024 | AutoCanada reached an agreement with the Federal Trade Commission to resolve an investigation. |

| December 27, 2024 | The company amended its senior credit facility to include add-backs for specific one-time expenses, including $20 million USD for FTC settlement expenses. |

| December 30, 2024 | AutoCanada closed a second credit facility amendment. |

| February 14, 2025 | The company terminated its Volvo franchise in Illinois, receiving $0.9 million in cash. |

| March 4, 2025 | AutoCanada closed all remaining RightRide locations as part of a strategic shift, eliminating an $11 million annual Adjusted EBITDA loss. |

| March 19, 2025 | AutoCanada reported its Q4 2024 financial results, including the sale of three non-core Stellantis dealerships for $59.5 million and the decision to divest its U.S. business. |

| April 1, 2025 - June 30, 2025 | AutoCanada announced a temporary increase in its Total Net Funded Debt to EBITDA ratio to navigate the ongoing tariff environment and support strategic initiatives. |

| May 14, 2025 | AutoCanada announced its Q1 2025 financial results, with revenue from continuing operations increasing by 2.3% year-over-year to $1,240.1 million, and achieving $57.1 million in annualized run-rate savings toward its $100 million target by the end of 2025. |

AutoCanada is focused on its 'Operational Transformation Plan,' aiming for $100 million in annual run-rate cost savings by the end of 2025. This plan, using the 'ACX Operating Method,' standardizes operations, enhances cost controls, improves inventory management, and centralizes administrative functions. This strategic approach is designed to improve efficiency.

The company is actively seeking buyers for its U.S. dealerships, expecting the sale to be completed 'within the year' from March 2025. This move allows AutoCanada to concentrate on its more profitable Canadian operations. The U.S. business recorded a $24.2 million Adjusted EBITDA loss in 2024, making the divestiture a strategic financial decision.

Despite a potentially cooling Canadian new light vehicle market in early 2025 and industry forecasts projecting flat sales, AutoCanada is committed to increasing resilience and maximizing profitability. Analysts at Cox Automotive forecast overall retail sales to grow 1.2% to 20.1 million in 2025. The used vehicle market shows a positive outlook.

AutoCanada's leadership emphasizes simplifying the business, reducing operating costs, and strengthening the financial foundation. This aligns with the original vision of building a robust and efficient dealership group. The company's strategic focus on cost savings and operational efficiency is designed to enhance its financial performance. To learn more about AutoCanada's business model, check out Revenue Streams & Business Model of AutoCanada.

AutoCanada Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of AutoCanada Company?

- What is Growth Strategy and Future Prospects of AutoCanada Company?

- How Does AutoCanada Company Work?

- What is Sales and Marketing Strategy of AutoCanada Company?

- What is Brief History of AutoCanada Company?

- Who Owns AutoCanada Company?

- What is Customer Demographics and Target Market of AutoCanada Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.