AutoCanada Bundle

How does AutoCanada stack up in the cutthroat Canadian auto market?

AutoCanada Inc. is navigating a dynamic North American automotive retail landscape, shaped by technological leaps, evolving consumer tastes, and global economic shifts. Recent financial performance, like the Q4 2024 boost from lower interest rates and OEM incentives, highlights the industry's sensitivity to external factors. Understanding the AutoCanada SWOT Analysis is crucial for investors and strategists alike.

This exploration into the AutoCanada competitive landscape will dissect its market position, pinpoint key AutoCanada competitors, and evaluate its competitive advantages. We'll conduct a thorough AutoCanada market analysis, examining the Canadian auto market's trends, challenges, and opportunities to understand AutoCanada's strategic moves in this evolving sector. This deep dive aims to provide actionable insights for informed decision-making within the AutoCanada industry.

Where Does AutoCanada’ Stand in the Current Market?

AutoCanada Inc. holds a significant market position as a leading multi-location automobile dealership group in North America, primarily focused on its Canadian operations. The company operates 64 new light vehicle OEM franchises representing 25 automotive brands across eight Canadian provinces, in addition to its used retail operations and 29 collision centers. This structure allows for a broad market presence across the Canadian auto market.

In 2024, AutoCanada's Canadian dealerships collectively sold approximately 85,000 new and used retail vehicles, demonstrating a substantial volume of sales. The company's strategic focus on streamlining its portfolio and improving operational efficiency highlights its commitment to enhancing profitability and market competitiveness. For a deeper dive into the company's evolution, consider reading a Brief History of AutoCanada.

AutoCanada's extensive network of dealerships and collision centers provides a strong foothold in the Canadian auto industry. This wide reach allows for significant market coverage and customer accessibility. The company's focus on its core Canadian operations is designed to enhance its competitive position.

The company has been actively streamlining its portfolio, including the sale of non-core dealerships and the closure of underperforming locations. These moves are intended to improve profitability. AutoCanada is also divesting its U.S. business to concentrate resources on its Canadian operations.

In Q1 2025, AutoCanada reported a revenue increase of 2.3% year-over-year to $1,240.1 million. Adjusted EBITDA from continuing operations increased by 60.3% to $43 million, driven by cost-cutting measures. These improvements are crucial for enhancing its competitive position.

AutoCanada is targeting $100 million in annual run-rate operating efficiencies and cost savings by the end of 2025. As of March 31, 2025, $57 million in annualized savings had been achieved. These cost-saving measures are designed to boost profitability and enhance the company's market analysis.

AutoCanada's financial leverage increased to 5.5x total net funded debt to bank EBITDA in Q1 2025, although its liquidity position improved with $218 million available under revolving credit facilities. The company's strategic focus remains on its core Canadian dealerships and collision operations, aiming for operational efficiency and cost savings.

- Revenue in Q1 2025: $1,240.1 million.

- Adjusted EBITDA from continuing operations in Q1 2025: $43 million.

- Annualized savings achieved as of March 31, 2025: $57 million.

- Targeted annual run-rate operating efficiencies and cost savings by the end of 2025: $100 million.

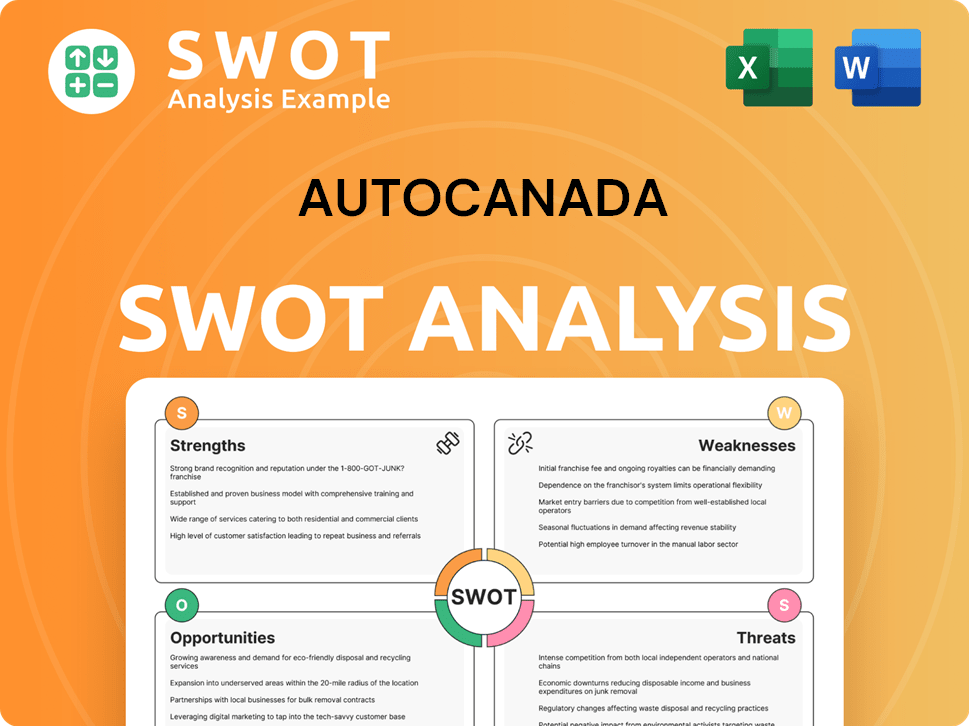

AutoCanada SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging AutoCanada?

Understanding the AutoCanada competitive landscape is crucial for investors and industry analysts. The company operates within a dynamic and multifaceted market, facing competition from various players vying for market share and customer loyalty. This analysis delves into the key competitors shaping AutoCanada's strategic positioning and financial performance.

The Canadian auto market is highly competitive, with numerous dealerships and emerging online platforms. AutoCanada's ability to navigate this environment, adapt to changing consumer preferences, and secure strategic advantages is critical for its long-term success. This overview provides a comprehensive look at the competitive forces influencing AutoCanada's operations.

AutoCanada's competitive landscape is defined by a mix of traditional dealerships, online retailers, and evolving market dynamics. Analyzing these elements helps to understand the challenges and opportunities AutoCanada faces in the Canadian auto market.

AutoCanada's primary competitors are other franchised automobile dealerships. These dealerships sell similar makes of new and used vehicles. They often compete on price and service offerings.

Several publicly traded companies operate in the broader consumer cyclical sector. These companies include E Automotive (TSE:EINC), Winpak (WPK), and Leon's Furniture (LNF).

Within the automotive retail space, AutoCanada faces competition from major players. These include AutoNation, Carvana, and CarMax, which have a significant presence in the market.

Other large dealership groups also compete with AutoCanada. These groups include Sonic Automotive, Group 1 Automotive, and Lithia Motors, among others.

The competitive landscape also includes car manufacturers selling directly to consumers. Private market sellers of used vehicles also contribute to the competition.

Service center chain stores and independent service and repair shops provide additional competition. They compete for customer service and repair business.

The Canadian automotive market is fragmented, offering many acquisition opportunities, but also facing intense competition. AutoCanada competes with other publicly traded automotive retailers and private investors for acquisitions. The normalization of vehicle inventory levels and dealership profit margins are intensifying competition.

- Direct Sales by Manufacturers: Some car manufacturers are selling vehicles directly, bypassing dealerships.

- Used Vehicle Market: Private market buyers and sellers of used vehicles provide competition.

- Acquisition Competition: AutoCanada competes for acquisition opportunities, which can increase costs.

- Market Trends: Normalization of vehicle inventory and profit margins intensifies the competitive environment.

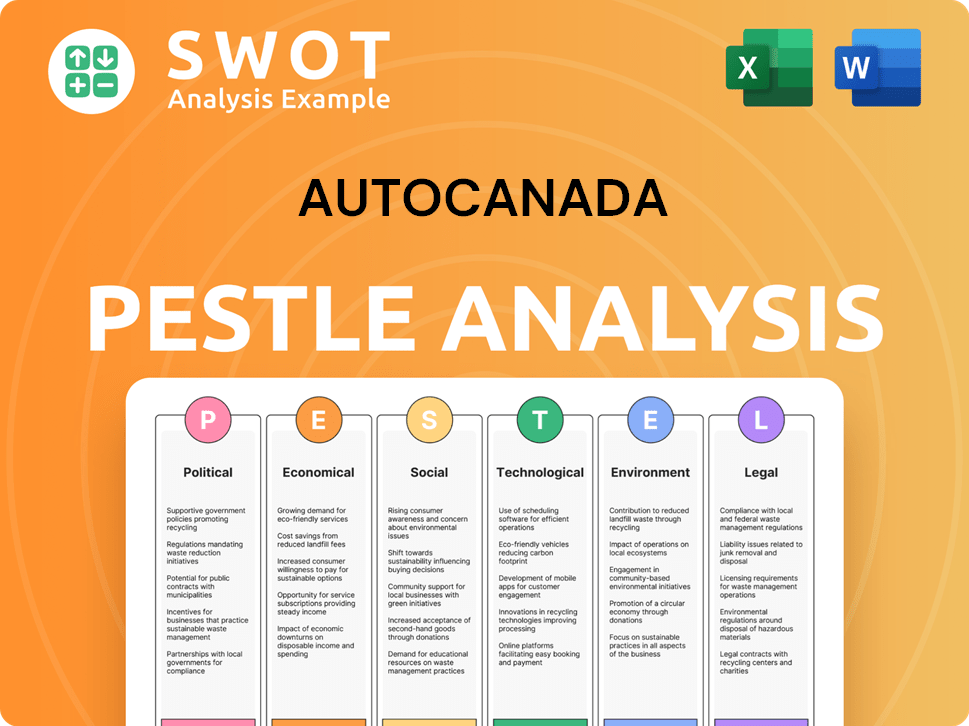

AutoCanada PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives AutoCanada a Competitive Edge Over Its Rivals?

The competitive advantages of AutoCanada stem from its extensive dealership network, strategic operational efficiencies, and a focus on both new and used vehicle sales, as well as aftermarket services. With a significant presence across Canada, the company benefits from economies of scale and a broad geographic reach. This wide reach allows the company to serve diverse customer segments and leverage a comprehensive distribution network for vehicles, parts, and services, which is crucial for its competitive edge in the Canadian auto market.

A core aspect of AutoCanada's current strategy is its 'ACX Operating Method,' which aims to achieve an ambitious target of $100 million in annual run-rate operating efficiencies and cost savings by the end of 2025. This operational transformation is designed to enhance profitability, reduce leverage, and build a foundation for sustainable growth. The company's diversified offerings, including new and used vehicle sales, vehicle leasing, parts, maintenance, collision repair, and the arrangement of financing and insurance, provide multiple revenue streams and customer touchpoints.

By focusing on these key areas, AutoCanada aims to strengthen its financial position and resilience in the Canadian auto market. The company's strategic realignment, including divesting its U.S. operations, is intended to concentrate resources on its core Canadian business. This strategic approach, combined with aggressive cost-cutting initiatives and diversified service offerings, is crucial for navigating the evolving automotive retail landscape and maintaining its competitive edge. For more insights, consider exploring the Marketing Strategy of AutoCanada.

AutoCanada operates 64 franchised dealerships in Canada, representing 25 automotive brands. This extensive network provides broad market coverage and customer access. The company's geographic presence across eight provinces allows for efficient distribution and service delivery, which is a key factor in the AutoCanada competitive landscape.

The 'ACX Operating Method' aims for $100 million in annual run-rate operating efficiencies and cost savings by the end of 2025. As of March 31, 2025, $57 million in annualized savings have been realized. These efficiencies are driven by standardized operations, enhanced cost controls, improved inventory management, and centralized administrative functions.

AutoCanada offers a wide range of services, including new and used vehicle sales, leasing, parts, maintenance, and collision repair. This diversification provides multiple revenue streams and customer touchpoints. The focus on OEM certifications in the collision business contributes to revenue growth and customer demand.

By divesting its U.S. operations, AutoCanada concentrates on its core Canadian market. This strategic focus allows for better resource allocation and enhanced competitiveness. The company’s strong presence in the Canadian auto market is a key advantage.

AutoCanada's competitive advantages are rooted in its extensive dealership network, operational efficiencies, and diversified service offerings. The company's strategic focus on the Canadian market and cost-cutting initiatives further enhance its position. These elements are crucial for navigating the challenges in the Canadian auto market and maintaining a strong competitive edge.

- Extensive Dealership Network: 64 franchised dealerships across Canada.

- Operational Efficiencies: Targeting $100 million in savings by the end of 2025.

- Diversified Revenue Streams: New and used vehicle sales, leasing, parts, and services.

- Strategic Market Focus: Concentrating on the Canadian market.

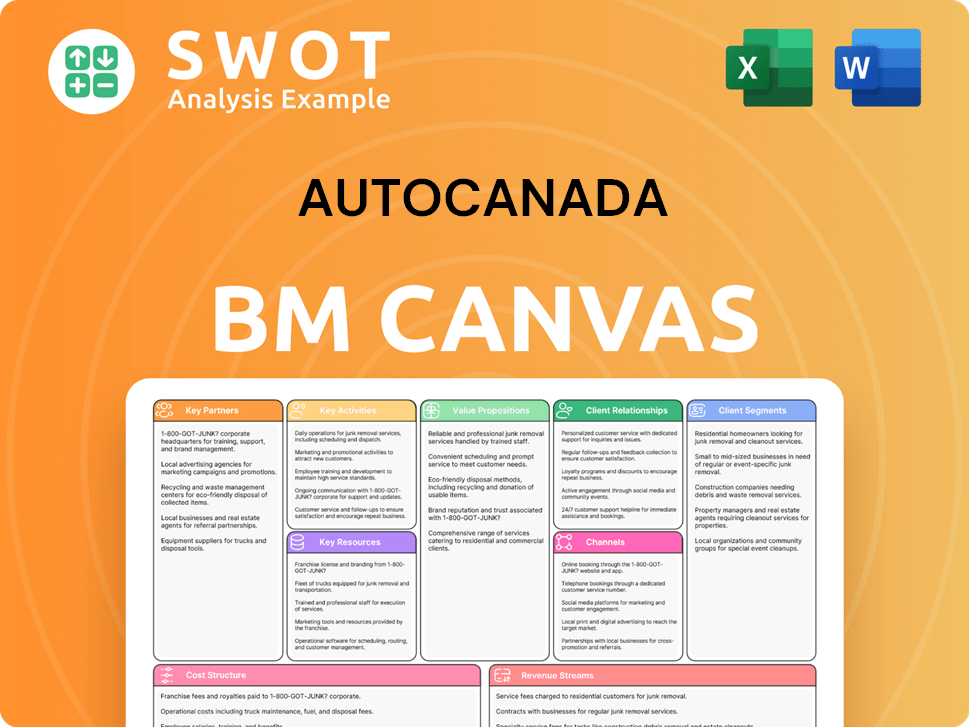

AutoCanada Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping AutoCanada’s Competitive Landscape?

The automotive retail industry is undergoing significant transformation, creating both challenges and opportunities for companies like AutoCanada. Key trends include the growth of electric vehicles (EVs) and the integration of advanced technologies. This dynamic environment requires strategic adaptation to maintain a strong market position. A detailed AutoCanada market analysis is essential to understand its competitive landscape.

AutoCanada faces challenges such as increased financial leverage and evolving consumer preferences. However, the company also has opportunities through its strategic transformation plan and growth initiatives. Understanding the competitive dynamics and financial performance is crucial for investors and stakeholders. For more details on their growth strategy, refer to this insightful piece: Growth Strategy of AutoCanada.

The Canadian auto market is seeing a gradual shift towards EVs and hybrid vehicles. Technological advancements like software-defined vehicles (SDVs) and autonomous driving are reshaping the industry. The global connected car market is projected to grow significantly, influencing AutoCanada's competitive landscape.

AutoCanada faces challenges including high financial leverage, reaching 5.5x total net funded debt to bank EBITDA in Q1 2025. Potential threats include declining demand, increased regulation, and competition. The ongoing 'tariff chaos' could also impact prices and sales, affecting AutoCanada's financial performance.

AutoCanada's strategic transformation plan targets $100 million in annual run-rate operating efficiencies and cost savings by the end of 2025. The company is focusing on core Canadian dealerships and collision operations. Growth opportunities exist in emerging markets and strategic partnerships.

The Canadian new light vehicle market saw strong growth in 2024, with sales reaching 1.86 million units, up 8.2% year-over-year. The forecast for 2025 is slightly lower at 1.84 million units. The used vehicle market is also growing due to economic uncertainties.

AutoCanada is implementing a strategic transformation plan to improve efficiency and reduce costs. This includes standardizing dealership operations and centralizing administrative functions. The company is also divesting its U.S. business to focus on the Canadian market, which is a key element of their AutoCanada industry strategy.

- Focus on core Canadian dealerships and collision operations.

- Targeting $100 million in annual run-rate operating efficiencies by the end of 2025.

- Enhancing cost controls and improving inventory management.

- Capitalizing on growth opportunities in aftermarket and collision repair segments.

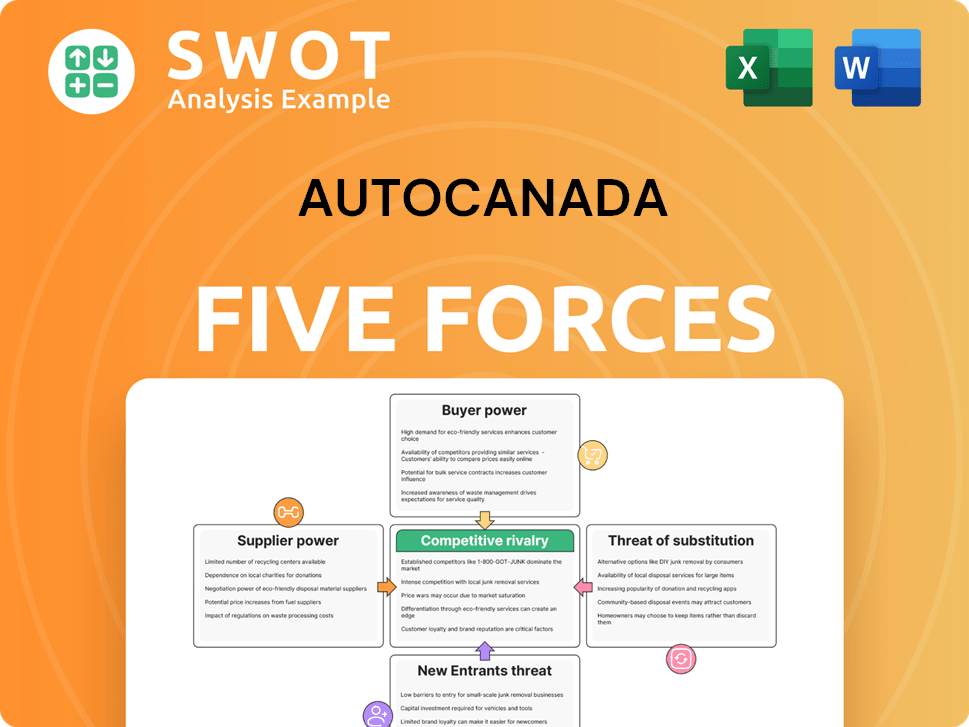

AutoCanada Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AutoCanada Company?

- What is Growth Strategy and Future Prospects of AutoCanada Company?

- How Does AutoCanada Company Work?

- What is Sales and Marketing Strategy of AutoCanada Company?

- What is Brief History of AutoCanada Company?

- Who Owns AutoCanada Company?

- What is Customer Demographics and Target Market of AutoCanada Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.