AutoCanada Bundle

How is AutoCanada Revamping Its Sales and Marketing in 2025?

AutoCanada Inc. is undergoing a significant strategic transformation, shifting its focus to enhance profitability and reduce leverage. This evolution includes a bold move away from traditional marketing partnerships, such as exiting its relationship with AutoTrader.ca. Discover how AutoCanada is reallocating its resources and embracing direct digital channels to connect with customers and drive sales.

This strategic shift is reflected in its AutoCanada SWOT Analysis, which highlights the company's renewed emphasis on its core Canadian dealerships and collision repair businesses. The company's updated AutoCanada sales strategy and AutoCanada marketing strategy will be crucial for navigating the competitive automotive industry. This report provides an in-depth AutoCanada market analysis, exploring the company's innovative AutoCanada business model, and how it aims to achieve its ambitious cost-saving targets and improve AutoCanada financial performance through strategic initiatives like optimized AutoCanada customer acquisition strategies and enhanced AutoCanada brand awareness initiatives.

How Does AutoCanada Reach Its Customers?

The Growth Strategy of AutoCanada incorporates a diverse array of sales channels, reflecting an omnichannel approach designed to maximize customer reach and sales. This strategy includes both traditional brick-and-mortar dealerships and digital platforms, ensuring a comprehensive market presence. The company's approach is continually evolving to adapt to changing consumer behaviors and market dynamics.

AutoCanada's sales strategy focuses on integrating physical dealerships with digital retail initiatives. This integration aims to provide customers with a seamless experience, whether they choose to shop online or in person. The company's recent strategic shifts indicate a strong emphasis on enhancing its digital capabilities and optimizing its online presence to drive sales growth.

As of Q1 2025, AutoCanada operates a significant dealership network. This network includes 64 new light vehicle OEM franchises selling 25 automotive brands across eight Canadian provinces. Additionally, it has 3 used vehicle dealerships and 29 collision centers. In 2024, Canadian dealerships sold approximately 85,000 new and used retail vehicles, demonstrating the scale of their sales operations.

AutoCanada's primary sales channel is its network of franchised dealerships. These dealerships are crucial for new and used vehicle sales, as well as providing service, repair, and parts. The physical presence allows for direct customer interaction and supports the overall customer experience.

The company is actively developing its 'used digital retail initiative' to offer online sales. This includes platforms for selling used cars entirely online or through an omnichannel strategy. The acquisition of locations like Haldimand Motors supports this initiative by providing pickup locations for online purchases.

Automotive service, repair, and parts offerings are integral to retaining customers. These services support customer loyalty and generate additional revenue streams. The collision centers further enhance the company's service capabilities.

In April 2025, AutoCanada ended its marketing relationship with AutoTrader.ca, reallocating its $15 million budget to other digital marketing avenues. This shift underscores a focus on direct engagement through the company website and other online platforms. This strategic move aims to enhance brand awareness and improve customer acquisition strategies.

The company's strategic shifts include a focus on digital adoption and omnichannel integration. This involves developing a robust online sales platform and leveraging physical locations for pickup and service. AutoCanada's market analysis indicates a move towards direct engagement through its website and other online platforms.

- Emphasis on new vehicle sales and collision repair as key revenue drivers.

- Redirecting marketing budget to direct digital channels.

- Enhancing customer relationship management (CRM) systems.

- Expanding dealership network and online sales capabilities.

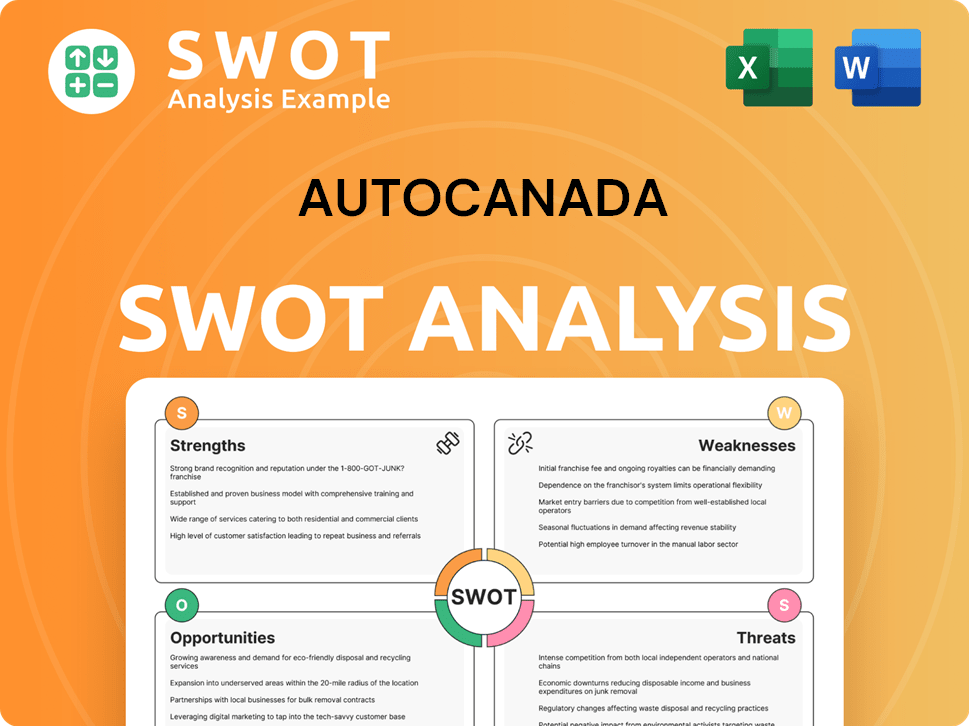

AutoCanada SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does AutoCanada Use?

The company is actively reshaping its marketing approach. This shift involves a move towards more direct and data-driven strategies to boost its AutoCanada sales strategy.

A key change in April 2025 was the termination of its marketing partnership with AutoTrader.ca, which freed up around $15 million in annual marketing spending. This decision followed a detailed analysis indicating that AutoTrader was no longer providing the expected value.

The company is now focusing on direct digital tactics. This includes increased investment in Google vehicle-listing ads and exploring other vehicle marketplaces like CarGurus, as part of its AutoCanada marketing strategy.

The company is increasing its focus on Google vehicle-listing ads. This is a direct way to reach potential customers actively searching for vehicles online. The company is also testing other vehicle marketplaces.

The company plans to intensify its organic marketing efforts on platforms like Instagram, TikTok, and Facebook. This aims to build brand presence and engage directly with potential customers. This is a key component of their AutoCanada digital marketing strategy.

A new vice-president of marketing has been hired to oversee spending and ensure a strong return on investment. This suggests a move towards more data-driven decision-making in marketing.

The move away from a major third-party aggregator suggests a desire for greater control over marketing data and customer insights. This will likely help refine AutoCanada customer acquisition strategies.

The company's overall transformation plan aims for $100 million in annual run-rate cost savings by the end of 2025. This includes enhancing cost controls across all operations, including marketing expenditures.

This strategic pivot reflects a broader industry trend towards leveraging digital channels and optimizing marketing spend for greater efficiency and direct customer engagement. This is a key part of the AutoCanada business model.

These changes reflect a strategic shift towards more efficient and direct marketing methods. The company aims to improve its AutoCanada financial performance by focusing on channels that offer better control and measurable results. For more insights, consider exploring the Competitors Landscape of AutoCanada.

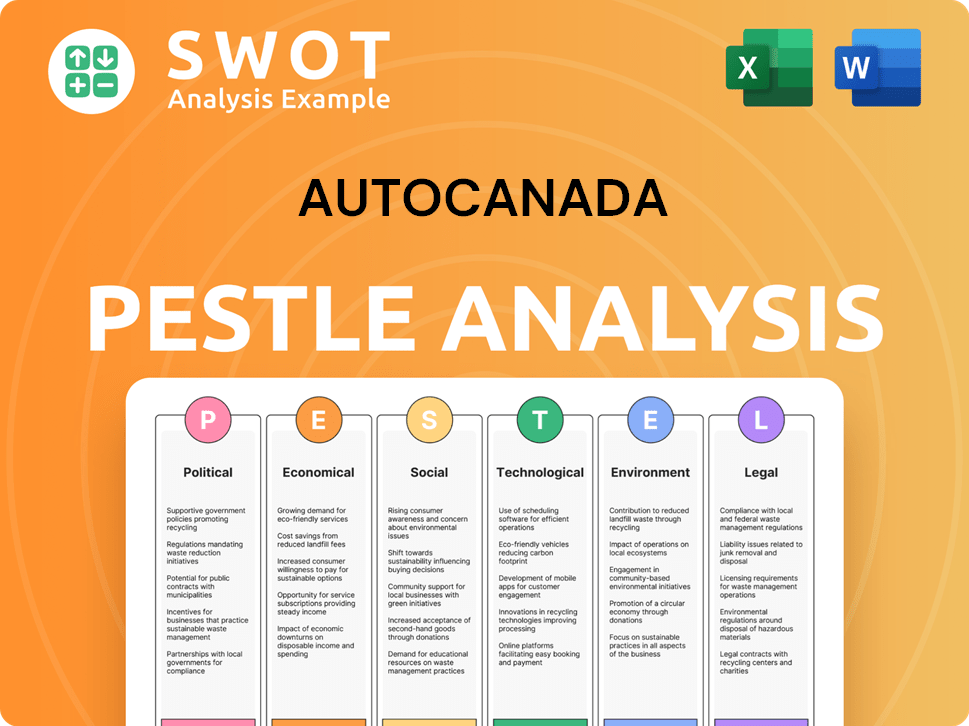

AutoCanada PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is AutoCanada Positioned in the Market?

The company strategically positions itself as a leading player in Canada's personal transportation sector. Its focus is on its core dealership and collision operations. This positions the company as a comprehensive provider within the automotive market, offering a wide range of products and services to meet diverse customer needs.

The brand emphasizes customer service and satisfaction. This is supported by a reported increase of over 13% in customer reputation scores in 2023, outperforming the industry average. This commitment aims to build customer loyalty and ensure vehicle safety through an extensive service network.

Differentiation is achieved through sustainable practices and operational efficiency. This includes offering electric and hybrid vehicles and adopting eco-friendly repair methods. The company's focus on streamlining operations and improving customer experience strengthens its brand perception.

The company prioritizes customer satisfaction across all touchpoints. This involves providing industry-leading customer service and ensuring vehicle safety. The emphasis on customer experience is central to its brand identity.

The company integrates sustainable practices, including offering electric and hybrid vehicles. They also use eco-friendly repair methods. This aligns with the growing consumer demand for environmentally conscious choices.

The company focuses on operational transformation to standardize dealership operations. This includes enhancing cost controls and improving inventory management. These efforts are aimed at improving efficiency and customer experience.

The company offers a wide range of services, including new and used vehicle sales, and collision repair. With 64 new light vehicle OEM franchises, 25 automotive brands, used retail operations, and 29 collision centers, it aims to provide a full range of products and services across various channels.

The company's brand positioning is built on a foundation of customer service, sustainability, and operational efficiency. This approach is designed to create a strong market presence. The company's Growth Strategy of AutoCanada is supported by these key elements.

- Focus on customer satisfaction and loyalty.

- Commitment to sustainable and eco-friendly practices.

- Emphasis on operational transformation and efficiency.

- Offering a wide range of products and services.

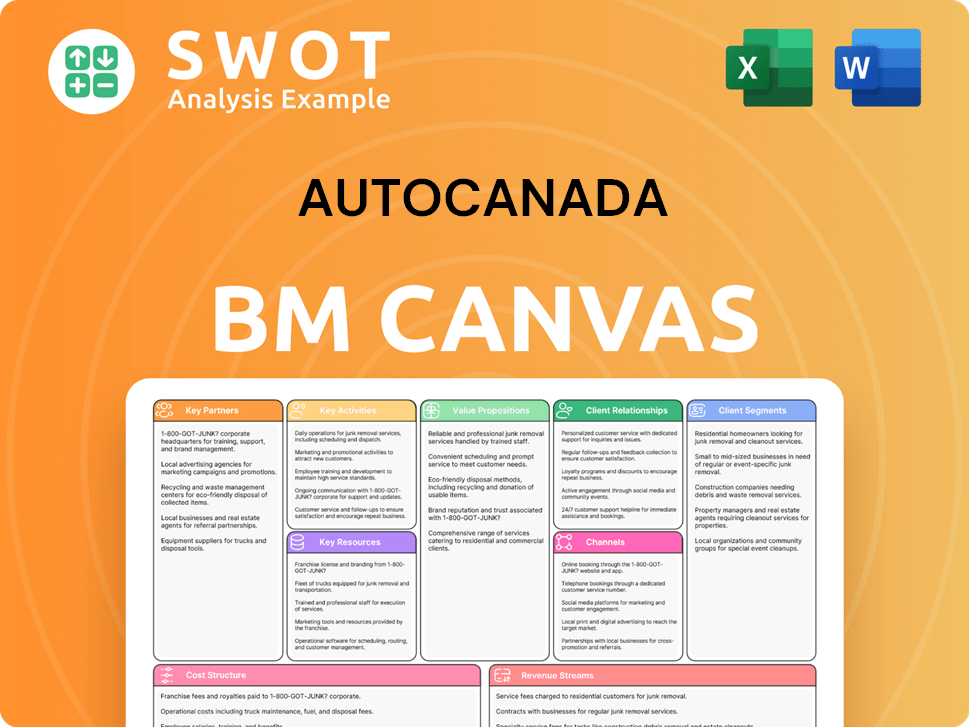

AutoCanada Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are AutoCanada’s Most Notable Campaigns?

The recent strategic initiatives of AutoCanada, particularly in late 2024 and early 2025, showcase a significant shift in its sales and marketing strategy. These efforts are less about large-scale consumer campaigns and more about refining existing strategies to improve efficiency and maximize returns. This approach is driven by a need to adapt to the evolving automotive market and optimize the company's financial performance. For more details, Owners & Shareholders of AutoCanada can find valuable insights.

A major move was the termination of the marketing relationship with AutoTrader.ca in April 2025. This decision redirected an estimated $15 million in annual spending. The goal was to cut costs and improve the return on investment from digital advertising. This shift highlights a focus on more measurable and cost-effective digital engagement.

Beyond marketing, AutoCanada has implemented a comprehensive 'Operational Transformation Plan' launched in Q3 2024. This plan aims to streamline dealership operations and improve customer experience. Early results show significant cost savings, which directly support the company's financial health and competitive position, impacting the AutoCanada business model.

AutoCanada is increasing its investment in Google vehicle-listing ads. It's also actively testing other vehicle marketplaces like CarGurus. This strategic move aims to enhance its online sales strategy and customer acquisition strategies.

The company is dedicating more attention to organic marketing on social media platforms such as Instagram, TikTok, and Facebook. This is part of a strategy to build brand awareness initiatives and engage directly with buyers, improving customer relationship management (CRM).

The 'Operational Transformation Plan' launched in Q3 2024, with pilot dealerships in Western Canada, aims for $100 million in annual run-rate operational expense savings by the end of 2025. This internal transformation supports the AutoCanada dealership network.

Early results from the 'Operational Transformation Plan' showed $48.1 million in annualized run-rate cost savings in Q1 2025. The total savings since the plan's launch in September 2024 is $57.1 million. This focus on efficiency is key to the AutoCanada financial performance.

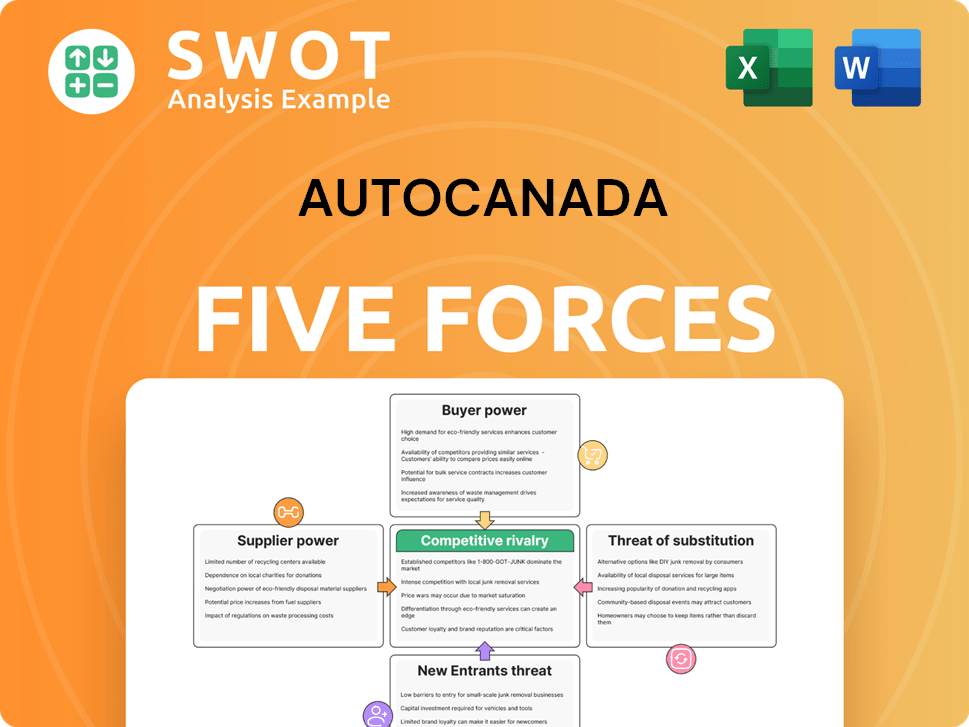

AutoCanada Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AutoCanada Company?

- What is Competitive Landscape of AutoCanada Company?

- What is Growth Strategy and Future Prospects of AutoCanada Company?

- How Does AutoCanada Company Work?

- What is Brief History of AutoCanada Company?

- Who Owns AutoCanada Company?

- What is Customer Demographics and Target Market of AutoCanada Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.