Autodistribution Bundle

How Did Autodistribution Company Revolutionize Auto Parts Distribution?

Ever wondered how a collaborative effort among seven independent distributors reshaped the automotive aftermarket? The Autodistribution SWOT Analysis reveals a fascinating journey. Founded in 1962, this auto parts company began as a centralized purchasing hub in France, a move that would redefine vehicle parts supply. Discover the pivotal moments that transformed Autodistribution into a European leader.

From its early days, the History of Autodistribution showcases remarkable growth and strategic adaptation. This evolution highlights the company's impact on the automotive industry, transforming it into a major player in automotive parts distribution. Explore key milestones and understand how Autodistribution's business model has shaped its current market position.

What is the Autodistribution Founding Story?

The History of Autodistribution began in 1962. It was founded in Arcueil, France. The company's creation addressed the need for a unified approach to purchasing automotive spare parts among independent distributors.

The genesis of the Autodistribution company involved a collaborative effort. Seven independent distributors joined forces to establish a central purchasing entity. This collaboration was designed to improve their combined purchasing power and optimize the supply chain for automotive components.

The initial business model of Autodistribution was built on collective purchasing. This approach allowed for more favorable terms and efficiency in acquiring spare parts. Over time, Autodistribution expanded its network, incorporating both subsidiary and independent distributors, thus strengthening its market presence. The company initially focused on distributing a comprehensive range of automotive aftermarket spare parts, including brakes, suspension components, transmission parts, filters, batteries, and engine oils, ensuring timely delivery to its customers. This early model set the stage for its subsequent growth and its evolution into a comprehensive service provider for the automotive repair and maintenance industry.

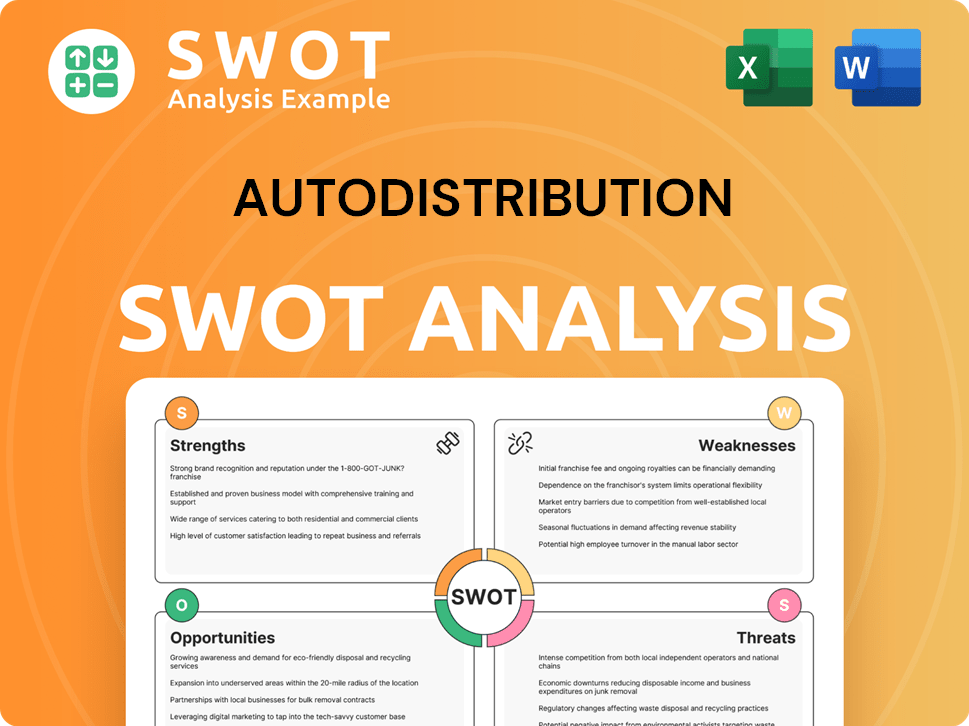

Autodistribution SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Autodistribution?

The Autodistribution company experienced significant growth and expansion early on, strategically structuring its operations and broadening its network. This phase involved diversification and strategic acquisitions, solidifying its position in the automotive parts distribution market. The company's journey includes key milestones in its history, reflecting its evolution over time and impact on the automotive industry.

In 1985, Autodistribution launched its first independent multi-brand repair networks, AD Pro for mechanics and AD Top for bodywork. This initiative established a relationship of trust with repair customers. This move marked a significant shift from just parts distribution to offering comprehensive repair support.

Key acquisitions fueled the company's expansion. The acquisition of Cora in 2006, a specialist in body parts, was a strategic move. Further growth was seen in 2014 with the acquisition of ACR, focusing on mechanical and technical parts. These acquisitions played a vital role in Autodistribution's expansion.

A pivotal step in governance occurred in 2010 with a new structure integrating subsidiary and independent distributors, enabling their participation in strategic decisions. Simultaneously, Autodistribution began its digital transformation with the launch of idgarages.com and ad.fr, enhancing its online presence.

Internationalization became a key driver, starting with the acquisition of Doyen in Belgium. This was followed by expansion into Italy in 2017, the Netherlands in 2018, and Spain in 2019. The acquisition of Oscaro in 2018 marked its entry into the B2C market, complementing its B2B distribution.

By 2023, Parts Holding Europe, including Autodistribution, achieved sales exceeding €2.5 billion, with one-third of revenue generated outside France. In 2024, Parts Holding Europe (Autodistribution) reported sales reaching €2.76 billion, an increase from €2.55 billion in 2023. The company currently employs over 9,500 people, demonstrating its significant European footprint and market position.

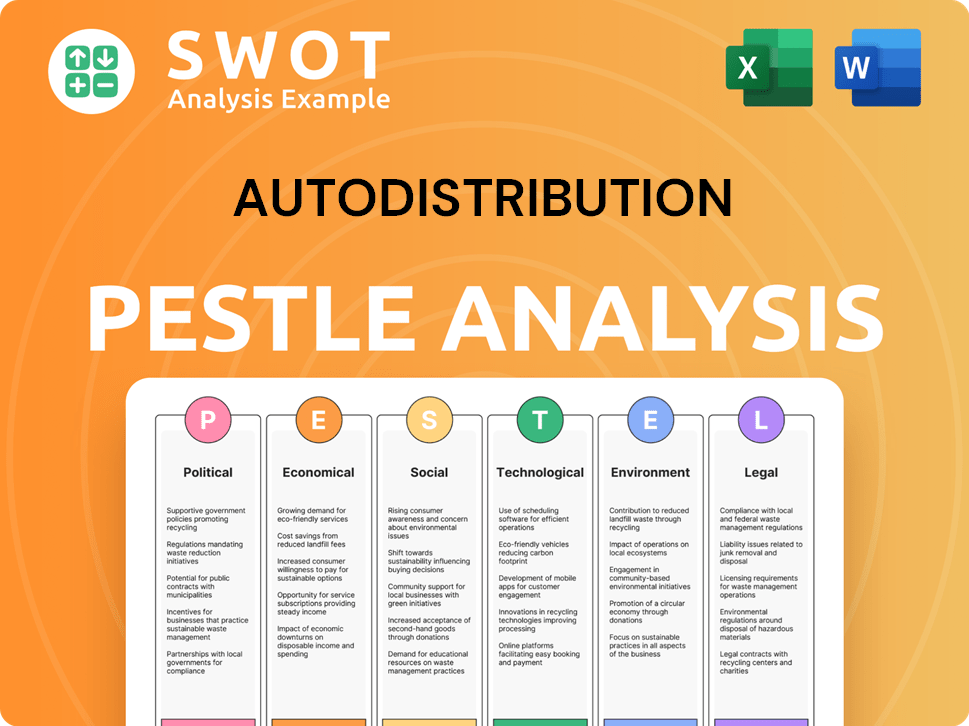

Autodistribution PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Autodistribution history?

The History of Autodistribution showcases significant milestones in the automotive parts distribution industry. These achievements highlight the company's growth and strategic adaptations over time, solidifying its position in the vehicle parts supply chain.

| Year | Milestone |

|---|---|

| 1985 | Established independent multi-brand repair networks, AD Pro and AD Top, expanding service offerings. |

| 2006 | Acquired Cora, strengthening its position in the body parts market. |

| 2014 | Launched idgarages.com and ad.fr, marking a significant digital transformation. |

| 2014 | Acquired ACR, enhancing its mechanical parts offerings. |

| 2018 | Entered B2C online sales through Oscaro, adapting to evolving market demands. |

| April 2025 | Acquired AD FRECO Parts in Spain, expanding its international presence. |

| January 2025 | Acquired Autolux in Belgium, further solidifying its market position. |

| April 2025 | Recognized as a 'best employer' in the Wholesale Trade category by Capital Magazine. |

Autodistribution has consistently innovated to meet market demands. The company's early adoption of independent repair networks and its digital transformation initiatives, including launching online platforms, demonstrate its commitment to adapting to industry changes.

The creation of AD Pro and AD Top in 1985 expanded service offerings beyond parts distribution, providing comprehensive solutions for vehicle maintenance.

Acquisitions such as Cora (2006) and ACR (2014) have strategically broadened the company's product portfolio and market reach within the auto parts company sector.

The launch of idgarages.com and ad.fr in 2014, along with the B2C entry through Oscaro in 2018, reflects a proactive approach to online sales and customer service.

The automotive aftermarket industry faces several challenges. The shift toward electric vehicles (EVs) and software-defined vehicles (SDVs) could reduce demand for traditional spare parts. Intense competition and supply chain disruptions also pose significant hurdles.

The rise of EVs and SDVs presents challenges due to fewer built-in components and potentially reduced maintenance needs, impacting the demand for traditional spare parts and services.

Increased competition from new players in the booming EV market intensifies the need for strategic adaptation and market differentiation within the auto parts distribution sector.

Although easing, supply chain disruptions have presented challenges, requiring efficient inventory management and resilient logistics to maintain service levels.

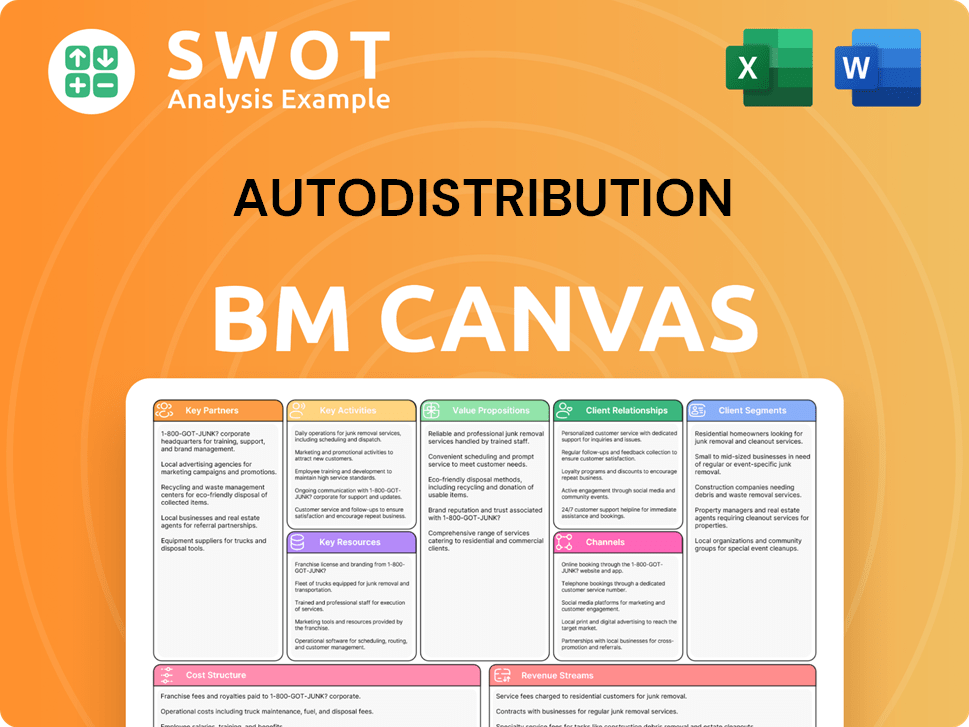

Autodistribution Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Autodistribution?

The Autodistribution company's history demonstrates strategic growth and adaptation within the automotive parts distribution sector. From its founding in France in 1962, the company has expanded its reach through strategic acquisitions and innovative service offerings. Key milestones include the launch of multi-brand repair networks in 1985, international expansion beginning in 2017, and significant moves in the B2C market. The company's evolution showcases its ability to adapt to changing market dynamics and maintain a strong position in the vehicle parts supply industry.

| Year | Key Event |

|---|---|

| 1962 | Founding of Autodistribution in France by seven independent distributors. |

| 1985 | Launch of AD Pro (mechanics) and AD Top (bodywork) multi-brand repair networks. |

| 2006 | Acquisition of Cora, a specialist in body parts. |

| 2010 | Creation of new governance integrating subsidiary and independent distributors. |

| 2014 | Acquisition of ACR (mechanical and technical parts) and initiation of digital transformation with idgarages.com and ad.fr. |

| 2017 | International expansion into Italy. |

| 2018 | Entry into the B2C market with Oscaro and expansion into the Netherlands. |

| 2019 | Further international expansion into Spain. |

| 2023 | Parts Holding Europe (PHE) achieves over 2.5 billion euros in sales. |

| 22 November 2024 | PHE and AD Parts announce the creation of PHI. |

| 13 January 2025 | Acquisition of Autolux (Belgium) by PHE's subsidiary Doyen Auto. |

| 20 February 2025 | PHE enters exclusive negotiations for a majority stake in TOP PART (Ireland). |

| 12 March 2025 | PHE reports steady growth in revenue and earnings for its 2024 annual results. |

| 3 April 2025 | Autodistribution voted best employer in the Wholesale Trade category by Capital Magazine. |

| 24 April 2025 | Acquisition of 75% of AD FRECO Parts (Spain) by PHE through AD Parts Intergroup. |

The automotive industry is projected to grow by 2.1% globally in 2025. This growth will be supported by looser monetary policies and a gradual recovery in consumer spending. However, potential tariffs could pose a downside risk to this forecast. The company's focus on both B2B and B2C channels positions it well for future growth.

Autodistribution, as part of Parts Holding Europe, is positioned to continue its growth trajectory. The company anticipates moderate single-digit growth in 2025, driven by market share gains and a stable adjusted operating margin. The increasing integration of software into vehicles and manufacturing processes will also be a key factor in the industry's evolution.

The transition to electric vehicles (BEVs) is expected to gain momentum, with significant growth projected for BEV volumes. This shift presents both challenges and opportunities for Autodistribution. The company's ongoing strategic acquisitions and commitment to adapting to technological advancements will be crucial. Read more about Revenue Streams & Business Model of Autodistribution.

Autodistribution's focus on both B2B and B2C channels, along with its commitment to adapting to technological advancements and market shifts, positions it to navigate future industry trends. The company's ability to integrate new technologies and expand its market reach will be key to maintaining its leadership in the European automotive aftermarket.

Autodistribution Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Autodistribution Company?

- What is Growth Strategy and Future Prospects of Autodistribution Company?

- How Does Autodistribution Company Work?

- What is Sales and Marketing Strategy of Autodistribution Company?

- What is Brief History of Autodistribution Company?

- Who Owns Autodistribution Company?

- What is Customer Demographics and Target Market of Autodistribution Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.