Autodistribution Bundle

Can Autodistribution Maintain Its Dominance in the Automotive Aftermarket?

The automotive aftermarket is constantly evolving, and Autodistribution has consistently adapted to stay ahead. Following the 2023 acquisitions of Précisium and Groupe Flauraud, the company's growth strategy is more critical than ever. This article explores Autodistribution's journey, from its 1962 founding to its current status as a major player in Europe's vehicle parts distribution landscape.

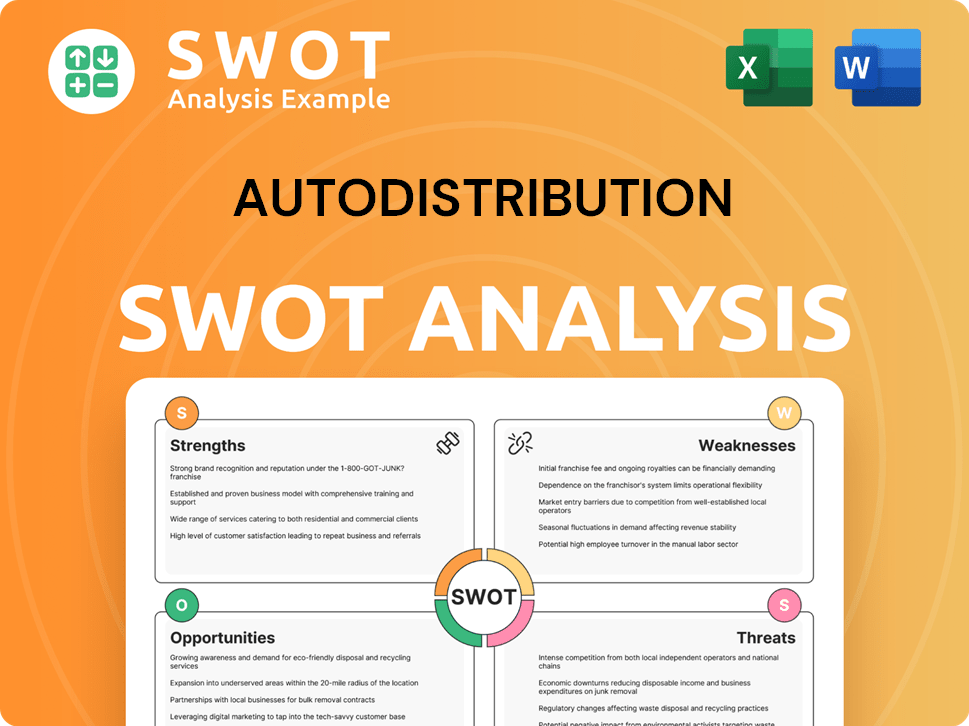

Autodistribution's strategic moves, including its expansion plans and technological integrations, are crucial for navigating the dynamic automotive industry trends. Understanding the company's Autodistribution SWOT Analysis is essential for assessing its future prospects within the automotive distribution company sector. This analysis will provide insights into how Autodistribution plans to overcome challenges and capitalize on opportunities in the evolving market for automotive parts, including the impact of electric vehicles and the importance of supply chain management automotive.

How Is Autodistribution Expanding Its Reach?

The Autodistribution growth strategy is built on a multi-faceted approach. This includes expanding geographically, diversifying its product offerings, and strategically acquiring other companies. The company aims to strengthen its presence in Europe, especially through acquisitions that complement its existing network. This strategy is a key element of its future prospects.

A significant step in this strategy was the integration of Précisium and Groupe Flauraud in 2023. This move significantly increased its market share in France. It demonstrates a clear commitment to consolidating its leadership in the domestic market. Beyond acquisitions, the company actively explores new product categories and service offerings. This is to diversify its revenue streams and adapt to the evolving automotive industry trends.

The company is also focusing on enhancing its service offerings. This includes technical training and support for its network of customers. This approach helps to build stronger relationships and increase customer loyalty. The company's expansion plans also involve partnerships, ensuring a consistent supply of high-quality products. While specific timelines for international expansion are not publicly detailed, the company's consistent M&A activity indicates a sustained effort towards broader European market penetration.

The primary focus is on strengthening its presence in Europe. This involves strategic acquisitions and market consolidation. The company aims to increase its market share and expand its customer base across the continent. This is a key aspect of the company's future prospects.

The company is expanding its product portfolio to include parts for electric and hybrid vehicles. This aligns with the increasing demand in the automotive market. It also focuses on diversifying its revenue streams to reduce dependency on traditional vehicle parts.

The company actively seeks out and integrates other companies to expand its market reach. The acquisitions of Précisium and Groupe Flauraud in 2023 are examples of this strategy. These acquisitions are designed to complement the existing network and enhance market share.

The company is focused on enhancing its service offerings, such as technical training and support. This is to build stronger relationships with its customers. This approach helps to increase customer loyalty and improve the overall customer experience.

The company's expansion initiatives are designed to drive growth and strengthen its position in the automotive distribution industry. These initiatives include strategic acquisitions, product diversification, and service enhancements. These efforts are critical for navigating the challenges faced by automotive distribution companies and capitalizing on the opportunities presented by the evolving market.

- Acquisitions: The company continues to seek out and integrate other companies to expand its market reach.

- Product Expansion: The company is expanding its product portfolio to include parts for electric and hybrid vehicles.

- Service Improvements: The company is focused on enhancing its service offerings, such as technical training and support.

- Partnerships: The company is strengthening its collaborations with leading automotive parts manufacturers.

Autodistribution SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Autodistribution Invest in Innovation?

The company strategically leverages technology and innovation to maintain its competitive edge within the automotive aftermarket sector. This approach is crucial for driving sustained growth, aligning with broader automotive industry trends. Investments in digital transformation are central to optimizing operations and enhancing customer experiences.

The company's commitment to innovation is evident in its continuous efforts to refine its digital infrastructure and service platforms. These initiatives demonstrate a proactive stance in using technology for operational efficiency and ensuring customer satisfaction. The focus on technology is also a key aspect of the company's supply chain management automotive strategy.

The company is exploring the application of advanced technologies like AI and data analytics. These tools are used to predict demand, personalize service offerings, and optimize pricing strategies. For example, predictive analytics can help anticipate parts failures, allowing garages to proactively order necessary components. This proactive approach is vital in the vehicle parts distribution landscape.

Focus on optimizing the supply chain, enhancing inventory management, and improving customer experience. Implementation of advanced logistics software and e-commerce platforms to streamline order processing and delivery.

Exploring the use of AI and data analytics to predict demand, personalize service offerings, and optimize pricing strategies. Predictive analytics can help anticipate parts failures, allowing garages to proactively order necessary components.

Optimizing the logistics network to reduce carbon emissions and promoting the distribution of eco-friendly automotive products. This aligns with the growing emphasis on sustainable practices within the automotive industry.

Enhancing customer experience through e-commerce platforms. Streamlining order processing and delivery through digital channels is a key focus.

Using advanced logistics software to optimize the supply chain. This includes improving inventory management and ensuring timely delivery of parts.

Improving customer experience through digital initiatives. This includes providing better online tools and personalized service offerings.

The company’s investment in technology and innovation is crucial for its Revenue Streams & Business Model of Autodistribution. The company's focus on digital transformation, AI, and sustainability positions it well for future growth. These strategies address the challenges faced by automotive distribution companies by improving efficiency and customer service. The company's commitment to these areas is essential for maintaining a competitive advantage in the evolving automotive parts market. Market analysis in 2024 indicates a growing demand for advanced solutions in the automotive aftermarket.

The company's approach includes digital transformation, AI integration, and sustainability initiatives.

- Digital Transformation: Implementing advanced logistics software and e-commerce platforms to streamline order processing and delivery.

- AI and Data Analytics: Using AI to predict demand, personalize service offerings, and optimize pricing strategies.

- Sustainability: Optimizing the logistics network to reduce carbon emissions and promote eco-friendly products.

- Customer Experience: Enhancing customer experience through digital initiatives and personalized services.

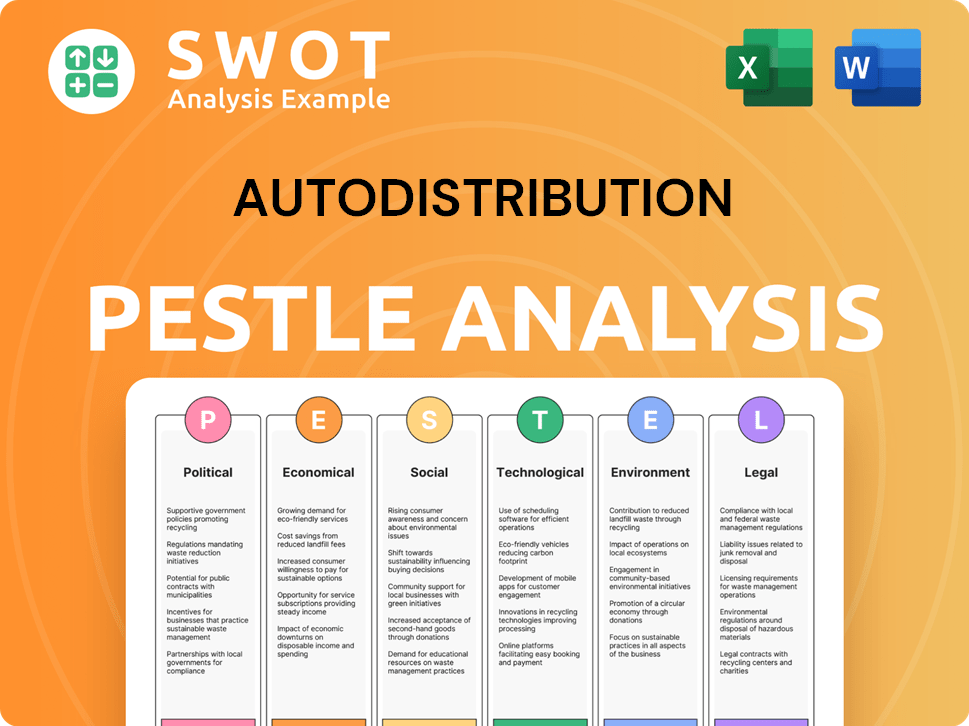

Autodistribution PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Autodistribution’s Growth Forecast?

The financial outlook for Autodistribution, an automotive distribution company, is shaped by its position within the European automotive aftermarket. As a privately held entity, specific financial details are not publicly available. However, industry analysis and strategic moves offer insights into its financial trajectory. The company's growth strategy is closely tied to the overall health and trends within the automotive sector.

The European automotive aftermarket is expected to see consistent growth. Projections indicate a compound annual growth rate (CAGR) of roughly 2-3% in the coming years. This growth is fueled by factors such as an aging vehicle fleet and the increasing complexity of automotive technology. Autodistribution's strategic focus on acquisitions and operational efficiencies positions it to capitalize on these market dynamics. The company's financial strategy involves leveraging market consolidation and operational improvements.

Autodistribution's acquisitions, like the 2023 consolidation in France, are expected to drive revenue growth and increase market share. While precise financial targets for 2024-2025 are not disclosed, the company's ongoing investments in expansion and technological advancements suggest a positive outlook for future profitability. The ability to secure significant acquisitions highlights a strong financial capacity and strategic intent to seize market opportunities. For a deeper understanding of the company's target market, explore the Target Market of Autodistribution.

The automotive industry is undergoing significant changes, including the rise of electric vehicles (EVs) and the integration of advanced technologies. These trends influence the demand for vehicle parts and the distribution strategies of companies like Autodistribution. The shift towards EVs is reshaping the aftermarket, creating new opportunities and challenges.

Vehicle parts distribution involves managing a complex supply chain to ensure timely availability of parts. This includes sourcing, warehousing, and delivering parts to various customers. Efficient supply chain management is crucial for Autodistribution to maintain its competitive edge and meet customer demands effectively.

Effective supply chain management is critical for Autodistribution. This involves optimizing inventory levels, streamlining logistics, and leveraging technology to improve efficiency. The company's ability to manage its supply chain efficiently directly impacts its financial performance and ability to meet market demands.

Autodistribution's expansion plans likely include strategic acquisitions and investments in new markets. These initiatives aim to increase its geographical footprint and enhance its market share. Expansion is a key component of its growth strategy, supported by its financial capacity.

Mergers and acquisitions (M&A) play a vital role in Autodistribution's growth strategy. These activities allow the company to consolidate its market position, acquire new technologies, and expand its customer base. Successful M&A activity is a key indicator of its financial health and strategic direction.

Market analysis helps Autodistribution understand industry trends, customer needs, and competitive dynamics. This analysis informs its strategic decisions, including product offerings, pricing strategies, and expansion plans. Regular market analysis is essential for adapting to changes.

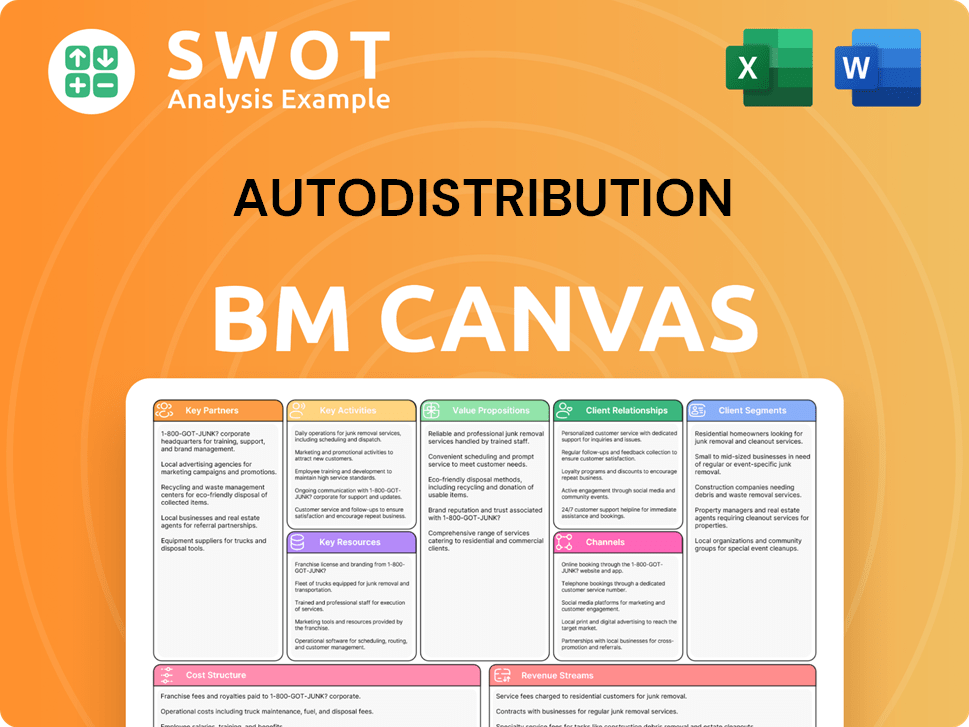

Autodistribution Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Autodistribution’s Growth?

The path to growth for an automotive distribution company like [Company Name] is paved with potential risks and obstacles that could impact its future. Successfully navigating these challenges is crucial for maintaining a competitive edge in the dynamic automotive industry. Understanding and proactively addressing these issues is key to the company's long-term success and sustainability.

Intense competition and evolving market dynamics present significant hurdles. The automotive parts market is subject to rapid technological advancements, shifts in consumer preferences, and economic fluctuations. Adapting to these changes requires strategic agility and a keen understanding of market trends to maintain profitability and market share.

The company's growth strategy faces several potential challenges that require careful consideration and proactive management. These challenges include intense market competition, regulatory changes, supply chain vulnerabilities, technological disruptions, and internal operational complexities. Addressing these issues will be vital for [Company Name]'s continued success.

The automotive distribution sector is highly competitive, with both traditional distributors and new online players vying for market share. This necessitates constant adaptation of pricing strategies and service offerings to remain competitive. The company must innovate to stay ahead.

Regulatory changes, particularly those related to environmental standards for vehicles and automotive parts, can significantly affect product availability. These changes can require substantial adjustments to inventory and supply chain management. Staying compliant is essential.

Supply chain vulnerabilities, often exacerbated by geopolitical events or global disruptions, can lead to delays and increased costs in sourcing essential parts. Diversifying suppliers and building resilient supply chains are crucial for mitigating these risks. Companies should implement strategies to improve their Mission, Vision & Core Values of Autodistribution.

The rapid shift towards electric vehicles (EVs) necessitates significant investment in new product lines and technical training. This can strain resources and require substantial adaptation. Keeping up with the pace of innovation is vital.

Managing the integration of acquired companies and ensuring consistent service quality across an expanding network can present operational challenges. Streamlining operations and maintaining high service standards are essential for sustained growth. This is a crucial part of the company's expansion plans.

Economic downturns can significantly impact consumer spending on automotive parts and services. Companies must prepare for potential shifts in demand and adjust their strategies accordingly. Market analysis 2024 is crucial.

To mitigate these risks, [Company Name] employs several strategies. These include diversifying its product portfolio to reduce reliance on specific product lines, building robust supplier relationships to ensure a stable supply chain, and continuously monitoring market trends and regulatory landscapes to adapt proactively. These proactive measures are key to the company's long-term success.

The company's strategy of acquiring and integrating key players demonstrates its efforts to consolidate market power. This approach enhances resilience against competitive pressures and strengthens its position in the automotive parts market. This strategy also helps to improve the automotive distribution supply chain.

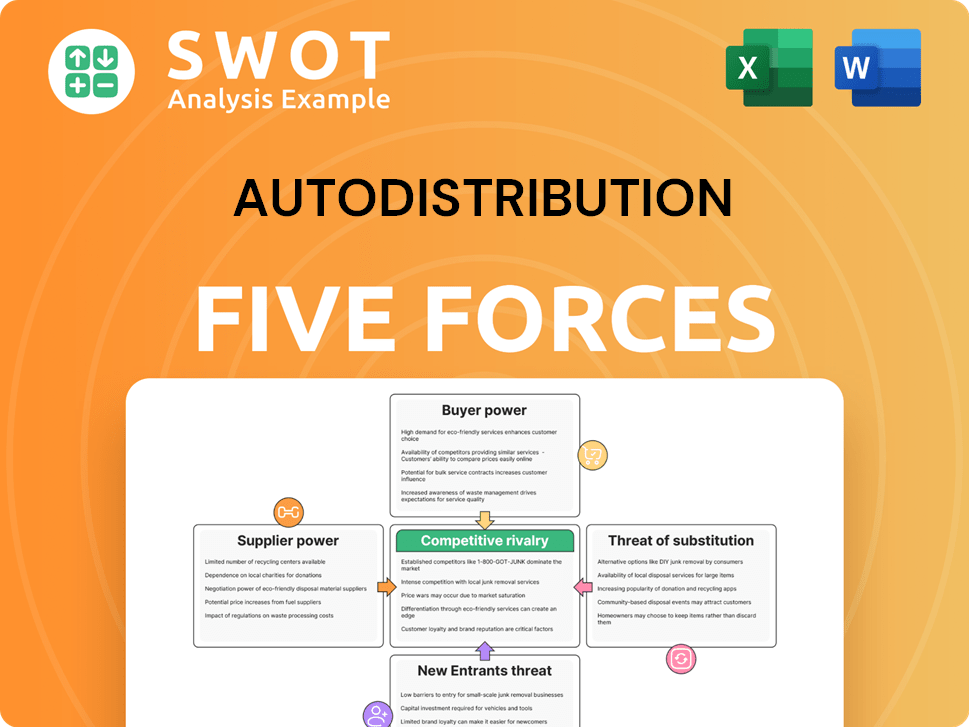

Autodistribution Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Autodistribution Company?

- What is Competitive Landscape of Autodistribution Company?

- How Does Autodistribution Company Work?

- What is Sales and Marketing Strategy of Autodistribution Company?

- What is Brief History of Autodistribution Company?

- Who Owns Autodistribution Company?

- What is Customer Demographics and Target Market of Autodistribution Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.