Autodistribution Bundle

Can Autodistribution Adapt to the Evolving Automotive Landscape?

The automotive aftermarket is experiencing a seismic shift, and for a leading distributor like the Autodistribution SWOT Analysis, understanding its customer demographics and target market is paramount. This knowledge is not just advantageous; it's essential for survival and growth in a sector defined by rapid technological advancements and changing consumer demands. The rise of electric vehicles (EVs) and digital commerce is reshaping the industry, making a deep dive into Autodistribution's customer base crucial.

This analysis will delve into the specifics of Autodistribution's customer profile, exploring their geographic distribution, age range, and income levels, alongside their buying behavior and preferences within the automotive industry. Understanding the nuances of market segmentation allows Autodistribution to refine its strategies for customer acquisition and retention. Identifying the ideal customer profile and analyzing customer data are key to reaching the target market and meeting their evolving needs, ensuring Autodistribution remains a leader in the automotive aftermarket.

Who Are Autodistribution’s Main Customers?

Understanding the Growth Strategy of Autodistribution requires a deep dive into its primary customer segments. The company operates primarily in a business-to-business (B2B) model, focusing on the automotive aftermarket. This strategic focus allows for targeted marketing and service delivery, ensuring that Autodistribution meets the specific needs of its core clientele.

The customer demographics of Autodistribution are largely defined by the types of businesses it serves. The company's target market consists mainly of independent garages and authorized dealerships. These businesses rely on Autodistribution for a steady supply of parts and technical support to maintain their operations and meet the needs of their customers.

The automotive industry is constantly evolving, and Autodistribution adapts to these changes by expanding its digital platforms and e-commerce capabilities. This strategy is a response to the growing online automotive parts market, which reached approximately $40 billion in Europe in 2024.

Independent garages and repair shops form a critical customer segment for Autodistribution. They account for roughly 60% of the company's revenue in 2024. These businesses depend on a diverse range of parts and technical support for various vehicle types.

Authorized dealerships represent another significant segment. They require genuine or equivalent parts to maintain their service operations and ensure customer satisfaction. Autodistribution provides the necessary components to support these dealerships.

Autodistribution also serves commercial vehicle operators and workshops. The company supplies heavy-duty parts for trucks, catering to a specific segment within the automotive aftermarket. This diversification helps to broaden its customer base.

With an extensive product range of over 300,000 different product references, Autodistribution effectively meets the varied needs of its customers. The company's adaptability to the evolving automotive landscape, including the rise of BEVs, is evident in its strategic initiatives.

While specific demographic data for Autodistribution's B2B customers isn't publicly detailed, industry trends highlight the changing landscape of the automotive aftermarket. The market is adapting to a younger, more urbanized population with increased purchasing power, especially in expanding markets.

- The growing online automotive parts market, which reached approximately $40 billion in Europe in 2024, indicates a shift towards digital platforms.

- Autodistribution's digital platform (Autossimo) and e-commerce expansion reflect this trend.

- The company has seen a 7% increase in affiliated garages in 2024, demonstrating its channel expansion and focus on its primary customer segment.

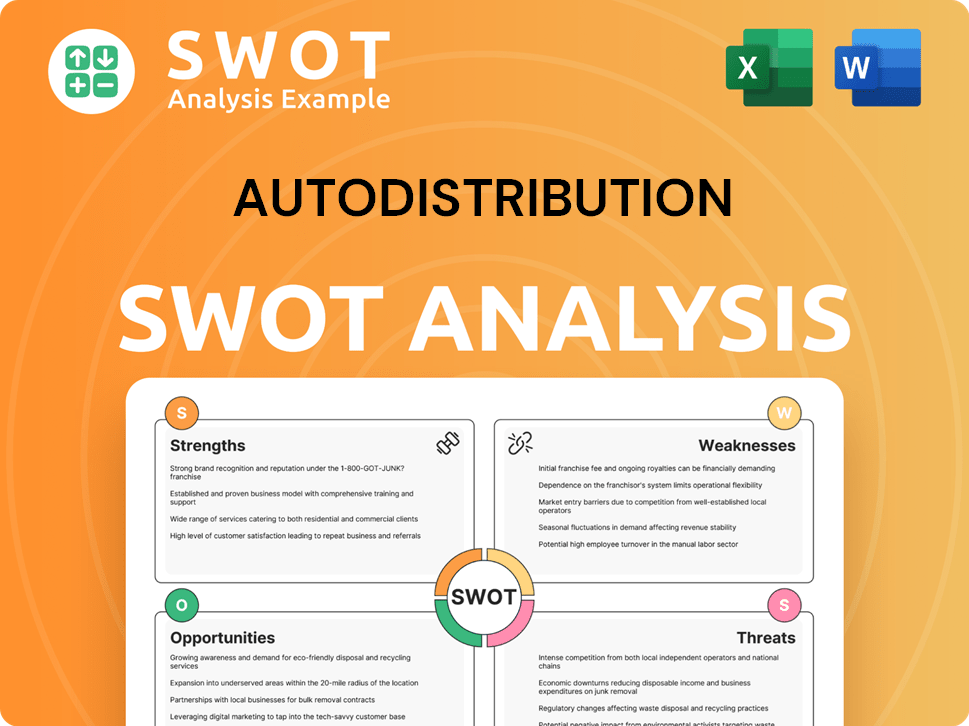

Autodistribution SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Autodistribution’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, and the Growth Strategy of Autodistribution. This is especially true in the automotive industry, where businesses must adapt to changing technological advancements and customer expectations. This chapter delves into the key factors influencing customer decisions, providing insights into how Autodistribution meets these demands.

Autodistribution's customer base, primarily independent garages and authorized dealerships, has specific needs that drive their purchasing decisions. These needs include reliable access to a wide range of automotive parts, timely delivery, and technical support. By focusing on these key areas, Autodistribution aims to enhance customer loyalty and increase market share.

The company's ability to provide a 'one-stop shop' experience is a significant advantage, offering a vast inventory of over 300,000 product references. This extensive selection is critical for meeting the diverse needs of its customer base. The company also focuses on digital tools to improve operational efficiency and customer experience.

Customers require a comprehensive inventory of automotive spare parts and accessories to cater to various vehicle types. This includes both passenger cars and commercial vehicles. A wide range of products ensures that workshops can efficiently service different makes and models.

Ensuring prompt delivery of parts is essential for minimizing vehicle downtime and allowing workshops to complete repairs quickly. Efficient logistics and distribution networks are crucial for meeting this need. This allows workshops to complete repairs efficiently and minimize vehicle downtime.

The increasing complexity of modern vehicles demands specialized skills and diagnostic tools. Providing technical training and support enhances customer expertise. This will also contribute to increased parts sales and customer loyalty.

User-friendly online platforms for detailed product information, easy ordering, and fast delivery are increasingly important. E-commerce platforms are considered 'Stars' in its portfolio, reflecting strong growth and the company's focus on enhancing digital tools to improve operational efficiency and customer experience.

Customers value competitive pricing, B2B discounts, and credit offerings. These factors contribute to increased sales and customer retention. Loyalty is built on consistent value and strong relationships.

Building strong relationships with customers is crucial for long-term success. Addressing customer pain points and providing comprehensive service offerings are key to fostering loyalty. This includes addressing the need for reliable supply chains and specialized technical expertise.

Several factors influence the purchasing behaviors of Autodistribution's customers. These include the need for a wide range of products, timely delivery, technical support, and user-friendly digital platforms. The company's ability to meet these needs directly impacts customer loyalty and market share. Understanding these factors is crucial for identifying the target market and tailoring strategies to meet their specific needs.

- Product Range: A vast inventory of over 300,000 product references allows Autodistribution to serve as a 'one-stop shop', catering to diverse vehicle types.

- Digital Platforms: E-commerce platforms, such as Autossimo, are essential for providing detailed product information, easy ordering, and fast delivery. The global automotive e-commerce market was valued at approximately $400 billion in 2024.

- Technical Support: Offering technical training and support services helps customers enhance their expertise and stay updated with the latest vehicle technologies. The market for automotive technical training saw a 7% growth in 2024.

- Loyalty Programs: B2B discounts and credit offerings contributed to a 15% increase in sales in 2024, demonstrating the importance of competitive pricing and value.

- EV and Digital Trends: Adapting to the growth in EV adoption (a 25% growth in the EV aftermarket in 2024) and digitalization is crucial for remaining relevant in the evolving market.

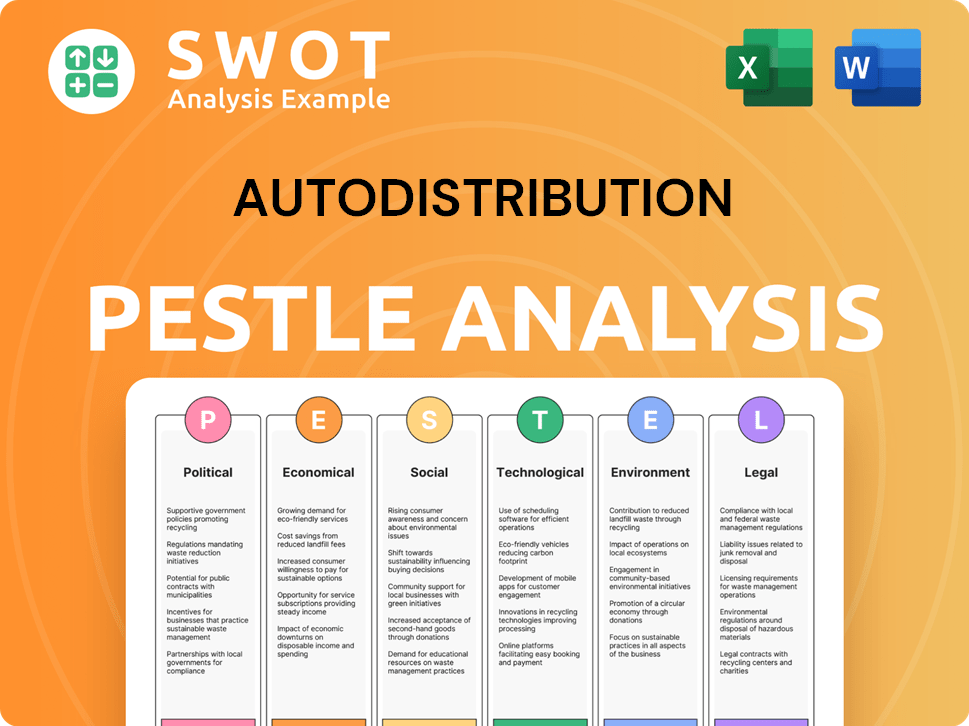

Autodistribution PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Autodistribution operate?

The geographical market presence of the [Company Name] is primarily concentrated in France and extends across Western Europe. In France, the company holds a leading position in the independent distribution of automotive spare parts. The company's strategic focus on its European footprint is evident through its expansion and acquisitions in key markets.

As part of Parts Holding Europe (PHE), the company has a significant presence beyond France, including Belgium, the Netherlands, Luxembourg, Italy, and Spain. This expansion strategy is supported by strategic acquisitions aimed at strengthening its territorial presence. The company's ability to adapt its offerings to meet specific regional demands is crucial for success in the diverse European markets.

The automotive aftermarket in Europe reached approximately €80 billion in 2024, highlighting the substantial market opportunity. This growth is fueled by the company's strategic geographical expansion and its localized approach, which are key to increasing market share and revenue growth.

In France, the company operates through 57 distributors and 350 points of sale. The company's market share in France was estimated at approximately 25% in 2024. This strong presence forms the foundation of its European operations.

International sales represented over 37% of PHE's total revenue in 2024, a rise from 35% in 2023. The company has actively pursued strategic acquisitions to strengthen its territorial presence in key European markets. This expansion is crucial for reaching the target market.

Recent acquisitions include AD Marina and Regenauto in Spain in 2021, and AD Peñalver in 2022. In April 2025, PHE announced the acquisition of AD FRECO Parts in Spain. These acquisitions are vital for understanding the customer demographics analysis of the company.

In February 2025, PHE entered exclusive negotiations for the acquisition of Top Part in Ireland, with an estimated revenue of 50 million euros. This strategic move is part of the company's broader effort to identify the target market.

The company tailors its offerings and partnerships to address regional differences in customer demographics, preferences, and buying power. This includes strong ties with garages and dealerships. This approach is essential for success in the competitive automotive industry.

- Adapting to regional demands.

- Building strong relationships with local partners.

- Focusing on customer preferences to drive sales.

- Understanding the geographic location of the company's customers.

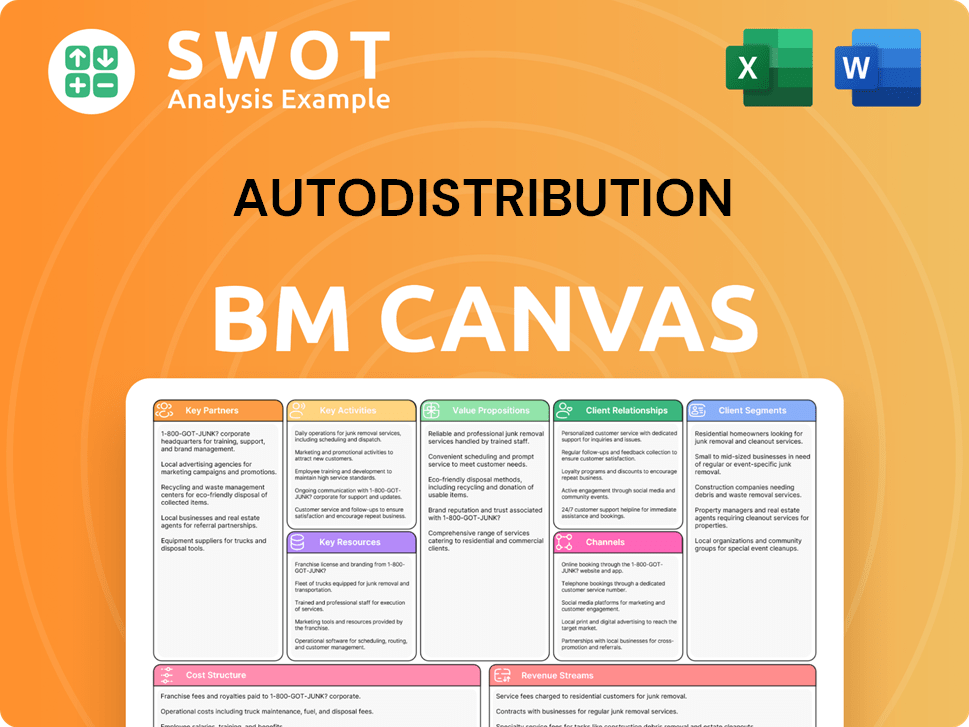

Autodistribution Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Autodistribution Win & Keep Customers?

The company, a prominent player in the automotive industry, employs a comprehensive strategy for acquiring and retaining its business-to-business (B2B) customers, primarily independent garages and authorized dealerships. This approach is crucial for maintaining its market position and driving sustainable growth. Their strategies are designed to target the specific needs and behaviors of the customer demographics within the automotive industry.

A key component of their customer acquisition strategy involves leveraging its extensive distribution network and fostering strong partnerships. This network serves as a direct channel to reach garages, expanding the company's geographic footprint. The company also focuses on digital channels, recognizing the shift toward online sales in the automotive parts sector, which reached approximately $40 billion in Europe in 2024. Digital tools, including AI for ad scheduling, are used to enhance operational efficiency and improve customer experience.

For customer retention, the company emphasizes building strong relationships and providing comprehensive support. This includes technical training and support services, essential for independent garages dealing with increasingly complex vehicle technologies. Value-based pricing and B2B discounts also play a significant role in retaining customers, with such strategies contributing to a noticeable sales boost. The focus on providing dedicated support and personalized services is a key factor in achieving a high customer retention rate.

The company strategically expands its distribution network to increase its reach. In 2024, the network experienced a 7% growth in affiliated garages, demonstrating the success of this expansion strategy. This expansion is a core element of their customer acquisition efforts, allowing for greater market penetration.

The company invests in digital platforms and tools to enhance both acquisition and retention. They recognize the growing importance of online automotive parts sales, which totaled about $40 billion in Europe in 2024. This includes AI-driven ad scheduling to optimize advertising spend and improve customer engagement.

The company provides technical training and support services to its customers. These services are crucial for independent garages dealing with complex vehicle technologies, including EVs. This approach not only enhances customer expertise but also drives increased parts sales and fosters loyalty.

They use value-based pricing and B2B discounts to retain customers. These strategies contributed to a 15% sales increase in 2024. These financial incentives play a vital role in customer loyalty and encourage repeat business within the target market.

The company focuses on building strong relationships and providing comprehensive support to maintain customer loyalty. This includes offering technical training and support services, which are essential for independent garages dealing with complex vehicle technologies.

- Loyalty Programs and Personalization: Although specific details are not extensively detailed, industry best practices suggest that such programs, offering points for purchases or services redeemable for discounts, are effective in encouraging repeat business and making customers feel valued.

- Consistent Communication: Consistent communication and a seamless customer journey across integrated online and offline touchpoints are also key to enhancing customer satisfaction and loyalty.

- High Retention Rate: The company's high customer retention rate, reflected in a sector average of 75% in 2024, is attributed to dedicated support and personalized services, with usage of such systems increasing by 15% in the same year.

- Dedicated Support: Dedicated support and personalized services are key factors in high customer retention rates.

For more insights, consider reading about the Marketing Strategy of Autodistribution.

Autodistribution Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Autodistribution Company?

- What is Competitive Landscape of Autodistribution Company?

- What is Growth Strategy and Future Prospects of Autodistribution Company?

- How Does Autodistribution Company Work?

- What is Sales and Marketing Strategy of Autodistribution Company?

- What is Brief History of Autodistribution Company?

- Who Owns Autodistribution Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.