Autodistribution Bundle

How Does Autodistribution Stack Up in the Automotive Aftermarket?

The automotive aftermarket is experiencing a massive transformation, propelled by technology and shifting consumer demands. This dynamic environment sets the stage for a deep dive into the Autodistribution SWOT Analysis and the competitive landscape it navigates. With a global market valued in the hundreds of billions, understanding the key players and their strategies is crucial.

This analysis will dissect the Autodistribution competitive landscape, providing a comprehensive Autodistribution industry analysis to understand its position amidst fierce Autodistribution market competition. We'll explore the strategies employed by automotive parts distributors in the evolving vehicle parts market, identifying key rivals and assessing their impact on the aftermarket auto parts sector. The insights will help investors and industry professionals understand the challenges and opportunities within this dynamic market.

Where Does Autodistribution’ Stand in the Current Market?

Autodistribution holds a strong position in the European automotive aftermarket, particularly in France. The company's operations focus on distributing a wide range of aftermarket automotive spare parts. This includes essential components like brakes, suspension systems, transmission parts, filters, batteries, and engine oils, catering to the needs of both independent garages and authorized dealerships.

The company's value proposition centers on providing a comprehensive selection of high-quality automotive parts, ensuring quick and reliable delivery to its diverse customer base. Autodistribution's extensive distribution network and strong relationships with garages and dealerships give it a competitive edge. This allows the company to meet the demands of the aftermarket auto parts market efficiently.

In 2024, Autodistribution's revenue was approximately €3.5 billion. The company's market share in France was estimated at 25% in 2024, reflecting its strong influence on supplier negotiations within the automotive parts distributors sector.

Parts Holding Europe (PHE), the parent company, has been actively expanding its geographical presence. This includes acquisitions like AD FRECO Parts in Spain in April 2025 and Autolux in Belgium in January 2025. These moves are part of a strategy to strengthen its position and diversify offerings across Europe.

Autodistribution serves a diverse customer base, including independent garages and authorized dealerships. Its primary product lines include essential aftermarket automotive spare parts. This includes brakes, suspension, transmission, filters, batteries, and engine oils.

Autodistribution's extensive distribution network, with numerous branches, provides a significant competitive edge. This makes it difficult for new entrants to quickly gain market share. The company's financial health, as reflected by PHE's steady growth in revenue and earnings in 2024, further underscores its strong standing in the industry.

Autodistribution’s strong market position is supported by its significant market share in France and its substantial revenue. The company's strategic acquisitions and extensive distribution network contribute to its competitive advantages within the Target Market of Autodistribution.

- Strong market share in France, estimated at 25% in 2024.

- Revenue of approximately €3.5 billion in 2024.

- Ongoing expansion through strategic acquisitions.

- Extensive distribution network.

Autodistribution SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Autodistribution?

The Autodistribution competitive landscape in the automotive aftermarket is intensely competitive, featuring a mix of major international distributors, local players, and online platforms. The Autodistribution industry analysis reveals a dynamic environment where companies constantly adapt to changing market demands and technological advancements. Understanding the key competitors is crucial for Autodistribution market competition to maintain and improve its market position.

The automotive aftermarket is undergoing significant changes, influenced by e-commerce, consolidation, and evolving business models. These factors are reshaping the competitive dynamics, pushing companies to innovate and adapt. The shift towards online sales and the emergence of new players are crucial trends to consider when analyzing the Autodistribution competitive landscape.

While specific market share data for individual competitors isn't always available, the automotive parts distributors market is highly competitive. The competitive environment is shaped by various factors, including pricing strategies, product availability, and the efficiency of distribution networks. The industry's evolution requires constant adaptation to stay competitive.

Key competitors include Mister Auto, GT2i, and R-M Paint. These companies challenge Autodistribution through various means, including e-commerce and specialized product offerings.

Online platforms like Mister Auto leverage e-commerce to offer convenience, competitive pricing, and a wider selection of products. This pushes traditional distributors to modernize their digital operations.

Emerging players and changing business models, including automotive service brokers, are disrupting traditional distribution and sales channels. These new entrants add complexity to the competitive landscape.

The automotive aftermarket is experiencing rapid consolidation through mergers and acquisitions by private equity and private-equity backed businesses. This intensifies competition for high-quality privately owned businesses.

Key trends include the increasing importance of e-commerce and the consolidation of market players. These trends require companies to adapt their strategies to remain competitive.

Parts Holding Europe (PHE), Autodistribution's parent company, has been actively engaged in acquisitions in Spain and Belgium in 2025, signaling a trend of consolidation to expand market reach and strengthen competitive positions.

Other significant competitors and similar companies include Auto Village, Traction, and World Parts Supply. These companies compete with Autodistribution in various segments of the vehicle parts market. To learn more about the Autodistribution industry trends and challenges, you can refer to this article.

To compete effectively, Autodistribution and similar companies must focus on several key strategies. These include enhancing their e-commerce capabilities, optimizing their distribution networks, and expanding their product offerings.

- E-commerce Integration: Developing robust online platforms to meet the growing demand for online purchasing.

- Supply Chain Optimization: Improving the efficiency of logistics and distribution to ensure timely delivery.

- Product Diversification: Expanding the range of products offered to cater to a wider customer base.

- Strategic Acquisitions: Considering mergers and acquisitions to expand market reach and consolidate their position.

Autodistribution PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Autodistribution a Competitive Edge Over Its Rivals?

Analyzing the Owners & Shareholders of Autodistribution reveals a competitive landscape shaped by established players and evolving market dynamics. Understanding the competitive advantages of companies like Autodistribution is crucial for assessing their market position and future prospects within the automotive parts distribution sector. This industry analysis delves into the key strengths that enable Autodistribution to maintain its competitive edge.

Autodistribution's success is built on a foundation of a robust distribution network, a strong market presence, and a comprehensive suite of service offerings. These elements collectively create significant barriers to entry for new competitors. The company's ability to adapt to industry trends and customer preferences is critical for sustained success in the dynamic vehicle parts market.

The company's extensive network of branches and established relationships with independent garages and authorized dealerships across France and Europe are key competitive advantages. This infrastructure, developed over decades, presents a substantial barrier to entry for new entrants. The company's substantial market share, estimated at approximately 25% in France in 2024, provides significant leverage in negotiations with suppliers, potentially leading to favorable terms and pricing.

Autodistribution's vast network of branches and established relationships with independent garages and dealerships across France and Europe forms a significant barrier to entry. This network, built over many years, is difficult and costly for new competitors to replicate. This extensive reach ensures widespread availability of parts and services.

The company's strong brand identity and its independent garage affiliation program, which includes approximately 350 participants in France, fosters customer loyalty. These programs offer valuable support, including technical training and communication tools, enhancing the capabilities and loyalty of its network. This focus on customer service strengthens Autodistribution's market position.

Autodistribution's operational efficiencies are demonstrated by its €3.5 billion revenue in 2024. This highlights its strong market presence and ability to manage the high fixed costs associated with warehousing and logistics. Effective operations are crucial for profitability and competitive pricing.

The company's substantial market share grants it significant leverage in negotiations with suppliers. This can lead to better terms and pricing, which can be passed on to customers. These strong supplier relationships are vital for maintaining competitiveness in the automotive parts market.

Autodistribution's competitive advantages are rooted in its extensive distribution network, strong brand recognition, and operational efficiencies. These factors contribute to its ability to maintain a significant market share and sustain profitability in the automotive parts distribution sector. The company's focus on customer service and support further strengthens its position.

- Extensive distribution network across France and Europe.

- Strong brand identity and customer loyalty programs.

- Operational efficiencies and robust supplier relationships.

- Substantial market share, providing leverage in negotiations.

Autodistribution Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Autodistribution’s Competitive Landscape?

The automotive aftermarket is experiencing a period of significant transformation, driven by technological advancements, the rise of electric vehicles (EVs), and evolving consumer behaviors. The Marketing Strategy of Autodistribution must adapt to these shifts to maintain a competitive edge. This necessitates a deep understanding of the current industry trends and a proactive approach to address future challenges and capitalize on emerging opportunities within the automotive parts distributors sector.

The competitive landscape for Autodistribution and other vehicle parts market participants is becoming increasingly complex. The ability to navigate these changes will determine the success of companies in the aftermarket auto parts sector. The future outlook hinges on strategic investments, adaptability, and a keen focus on meeting the evolving needs of both consumers and the automotive industry.

Technological advancements are reshaping the industry, with ADAS, OTA updates, and predictive maintenance requiring specialized solutions. The rise of EVs, although currently representing a smaller portion of the global vehicle parc (around 4-5% in 2024), is gaining momentum. Digitalization and e-commerce are also changing consumer purchasing habits, with online sales of automotive parts expected to grow from 5% in 2024 to almost 10% by 2030.

Challenges include the need for continuous investment in new technologies and training. The shift to EVs poses a threat to the traditional ICE parts market. Cybersecurity threats are increasing, with incidents surging to 409 in 2024 from 295 in 2023, posing a risk to interconnected systems. Regulatory changes, such as tightening CAFE standards, also influence the aftermarket.

Opportunities include the increasing average age of vehicles on the road, which will drive demand for maintenance and replacement parts. Emerging markets and product innovations tailored to EVs and connected cars offer growth potential. Strategic partnerships can enhance technological capabilities. Autodistribution's continued acquisitions, like recent moves in Spain and Belgium, will expand its geographical footprint.

Adaptation strategies include expanding the geographical footprint and diversifying offerings. Focusing on supporting its network of garages with training and tools for new technologies is crucial. The company's strategy to remain resilient includes continued acquisitions and a focus on supporting its network of garages with training and tools for new technologies.

To thrive in the Autodistribution competitive landscape, companies must focus on several key areas. These include investing in new technologies, adapting to the growth of EVs, and strengthening digital capabilities.

- Invest in specialized training and tools to service modern vehicles equipped with ADAS and other advanced technologies.

- Develop and offer EV-specific parts and services to capitalize on the growing EV market.

- Enhance e-commerce platforms and logistics to meet the increasing demand for online purchasing.

- Form strategic partnerships to bolster technological expertise and expand market reach.

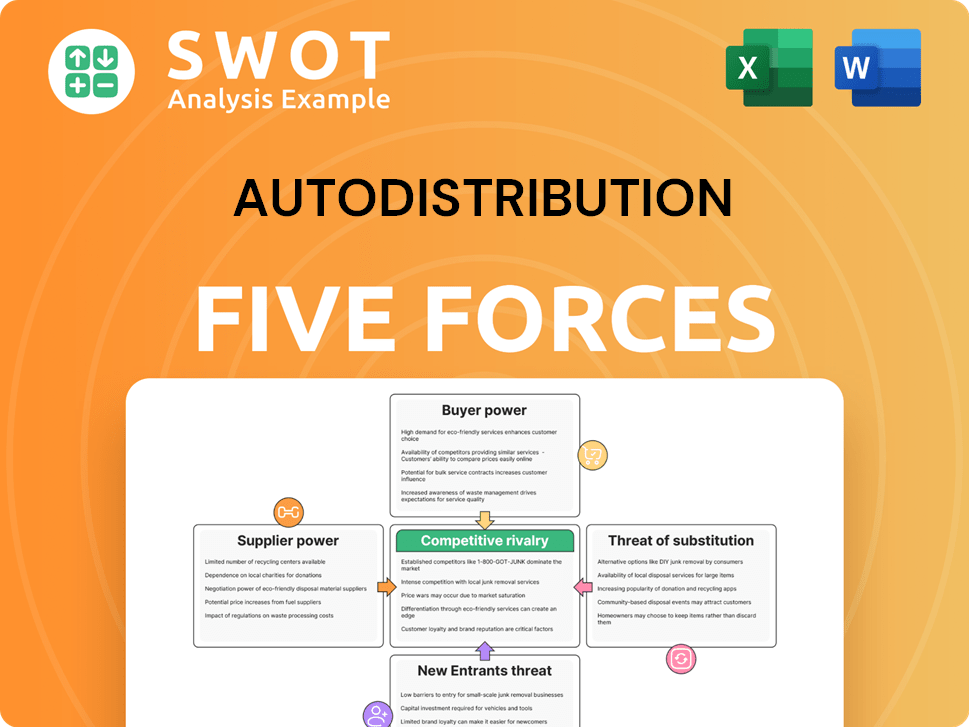

Autodistribution Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Autodistribution Company?

- What is Growth Strategy and Future Prospects of Autodistribution Company?

- How Does Autodistribution Company Work?

- What is Sales and Marketing Strategy of Autodistribution Company?

- What is Brief History of Autodistribution Company?

- Who Owns Autodistribution Company?

- What is Customer Demographics and Target Market of Autodistribution Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.