Auxly Bundle

What's the Story Behind Auxly Company's Rise?

Journey into the fascinating Auxly SWOT Analysis, a Canadian cannabis company that has carved a significant niche in the competitive weed industry. From its inception in 1987 as Cannabis Wheaton to its current status, Auxly Group's evolution mirrors the dynamic shifts in the Canadian cannabis market. Discover how this Canadian cannabis company transformed from a startup to a key player.

Understanding the Auxly history is crucial for investors and industry watchers alike. Auxly's strategic moves, including key acquisitions and partnerships, have shaped its business model and product portfolio. The company's journey highlights the challenges and opportunities within the Canadian cannabis sector, making it a compelling case study for anyone interested in the weed industry.

What is the Auxly Founding Story?

The story of the Auxly Company, now known as Auxly Group, began in 1987. Initially operating as Cannabis Wheaton, the company was co-founded by Hugo Alves and Ian Rapsey. Hugo Alves later became CEO in August 2019.

The founders saw a significant opportunity in the growing cannabis industry as it moved toward legalization. They aimed to capitalize on this trend by adopting a 'streaming company' model, similar to the mining industry. This involved financing cultivators in exchange for a royalty on their product.

This approach allowed Auxly to reduce the risks associated with building a cannabis company from scratch by partnering with existing or emerging cultivators. Auxly Group's history also includes various funding rounds, including post-IPO funding in 2020 and 2023. A notable investment came from Imperial Brands PLC in September 2019, totaling C$123 million, which also granted global licenses to Imperial Brands' vaping technology. In 2024, Imperial Brands plc converted over $123 million of debt into shares, resulting in a 19.8% ownership.

Auxly Group's foundation was built on strategic partnerships and innovative financial models within the evolving Canadian cannabis market.

- Co-founded in 1987 as Cannabis Wheaton.

- Hugo Alves became CEO in August 2019.

- Initial business model: a 'streaming company' financing cultivators.

- Significant investment from Imperial Brands PLC in September 2019.

For more insights into the company's strategic direction, you can explore the Target Market of Auxly.

Auxly SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Auxly?

The early growth and expansion of the Auxly Company, a prominent cannabis company, were marked by strategic shifts and significant product launches. Initially, the company transitioned from its streaming model to focus on developing, manufacturing, and distributing branded cannabis products. This strategic pivot included the introduction of various product lines under brands like Back Forty and Kolab Project, targeting different consumer segments within the Canadian cannabis market. The Revenue Streams & Business Model of Auxly played a critical role in the company's expansion.

A key element of Auxly's expansion has been its continuous product launches and innovation within the weed industry. In February 2021, the company announced plans for the dried flower market, including new cultivars under the Kolab Project Growers Series. Auxly also increased its pre-roll capacity through custom-built automation, demonstrating a commitment to meeting market demands.

Auxly's financial performance reflects its growth trajectory within the Canadian cannabis market. In Q1 2025, net revenues reached $32.7 million, a 29% increase compared to Q1 2024. Gross Margin on Finished Cannabis Inventory Sold improved to 48% in Q1 2025, up from 38% in Q1 2024. Adjusted EBITDA also saw a substantial increase of 232% in Q1 2025, reaching $7.4 million. For the full year ended December 31, 2024, Auxly reported net revenue of $122.3 million, a 21% increase over the prior year, and an Adjusted EBITDA of $26.7 million, up from $1.5 million in 2023.

Since 2024, Auxly has expanded its sales across all Canadian provinces and territories. The Back Forty brand has consistently held the number one position in Canadian cannabis sales. In Q1 2025, Back Forty's Liquid Imagination and Fire Breath were ranked as the #1 and #3 cultivars in Canada, respectively. Auxly's all-in-one vape maintained a leadership position, holding ten of the top fifteen all-in-one SKU positions nationally.

These growth efforts have solidified Auxly's position in the Canadian cannabis market. As of March 31, 2025, Auxly has become the 4th largest Canadian Licensed Producer, with a market share of 5.8%. This demonstrates the company's successful navigation and expansion within the competitive landscape of the Canadian cannabis industry.

Auxly PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Auxly history?

The Auxly Company has achieved significant milestones, demonstrating resilience and innovation within the Canadian cannabis market. The Auxly Group has consistently grown, adapting to market changes and consumer preferences.

| Year | Milestone |

|---|---|

| 2022 | Recognized as the Licensed Producer of the Year by O'Cannabiz. |

| 2024 | Back Forty brand was the number one cannabis brand in Canada. |

| Q1 2025 | Back Forty brand maintained its position as the number one cannabis brand in Canada. |

| 2024 | Back Forty all-in-one vape was recognized as the 'Innovation of the Year' at the KIND awards. |

| Q1 2025 | Held ten of the top fifteen all-in-one SKU positions nationally in the vapor category. |

Innovation is a core element of the Auxly Group's strategy, driving new product development based on consumer insights. This involves launching new cultivars and strain-specific dried flower offerings, as well as enhancing pre-roll capacity through automation.

The Auxly Company focuses on launching new cultivars to meet the evolving demands of the weed industry. This includes the introduction of unique strains to attract a wide range of consumers.

The company offers strain-specific dried flower products, catering to consumers who seek specific experiences. This approach allows for targeted marketing and product differentiation within the Canadian cannabis market.

Auxly has invested in automating its pre-roll production to increase efficiency and output. This strategic move supports the company's growth and market share in the competitive landscape.

In Q1 2025, the Auxly Group launched the new cultivar Chemzilla in Ontario. This product quickly became the #1 SKU in the 14g flower category, demonstrating successful product innovation.

The Auxly Company faces challenges common in the rapidly evolving Canadian cannabis market, including competitive pressures and the need for operational efficiency. Auxly has taken measures to reduce operating costs and improve margins, ensuring financial stability.

In 2024, the company reduced its total debt by 56% through the conversion of over $123 million of debt into shares by Imperial Brands plc and the repayment of an outstanding standby debenture facility.

Debt reduction continued into Q1 2025, with another 5% reduction from the end of 2024, reflecting ongoing financial discipline. These efforts contribute to improved financial performance.

The strategic shifts and efforts to streamline operations have contributed to improved financial performance. There was a significant increase in Adjusted EBITDA in both 2024 and Q1 2025, indicating enhanced profitability.

Auxly Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Auxly?

The Auxly Company has a rich history marked by significant milestones. Initially founded in 1987, the company, formerly known as Cannabis Wheaton, has evolved over time. Key events include a strategic investment from Imperial Brands plc in September 2019, and the company's focus on profitability in October 2020. Expansion plans and industry recognition followed, with a strategic expansion into the dried flower market announced in February 2021 and the Licensed Producer of the Year award in 2022. Further financial activities and strategic partnerships have shaped Auxly Group's trajectory, including its recent financial performance.

| Year | Key Event |

|---|---|

| 1987 | Auxly Cannabis Group Inc. was founded (originally as Cannabis Wheaton). |

| September 25, 2019 | Imperial Brands plc invested C$123 million in Auxly, including global licenses to Imperial Brands' vaping technology. |

| October 1, 2020 | The company announced measures to reduce its workforce and accelerate its path to profitability. |

| February 18, 2021 | Auxly announced strategic expansion plans for the dried flower market. |

| 2022 | Auxly was recognized as Licensed Producer of the Year by O'Cannabiz. |

| February 16, 2023 | Auxly raised $992K in a Post IPO funding round. |

| April 1, 2024 | Imperial Brands plc completed the conversion of over $123 million in principal and interest debt to shares, resulting in 19.8% ownership of Auxly. |

| August 15, 2024 | Auxly reported Q2 2024 financial results, achieving new revenue and profitability records. |

| November 8, 2024 | Auxly reported record-breaking Q3 2024 financial results, with net revenues of $33.3 million and adjusted EBITDA of $8.3 million. |

| December 31, 2024 | Auxly reported full-year 2024 net revenue of $122.3 million and Adjusted EBITDA of $26.7 million; Back Forty exits 2024 as the #1 brand in Canada. |

| March 20, 2025 | Auxly released financial results for the fourth quarter and full year ended December 31, 2024. |

| May 15, 2025 | Auxly reported Q1 2025 financial results, with net revenues of $32.7 million and adjusted EBITDA of $7.4 million, marking the strongest Q1 in its history. |

Auxly Group is concentrating on long-term, profitable growth within the Canadian cannabis market. This includes a commitment to focused innovation and enhanced product distribution. Operational efficiency and debt reduction are also key components of their strategic plan, positioning the company for sustained success.

The company anticipates continued positive Adjusted EBITDA, aiming to reinforce its leadership position in the Canadian market. Auxly is focused on building a strong foundation for future global opportunities. These financial goals are central to the company's expansion and market strategy.

Auxly remains committed to delivering quality cannabis products that resonate with consumers. This commitment is central to its future direction and aligns with its founding vision. The company's focus on product quality ensures that it continues to meet consumer needs.

Auxly aims to strengthen its leadership in the Canadian cannabis market. The company's strategy includes focused innovation, enhanced product distribution, and operational efficiency. Auxly's strong performance in Q1 2025, with net revenues of $32.7 million and adjusted EBITDA of $7.4 million, demonstrates its market strength.

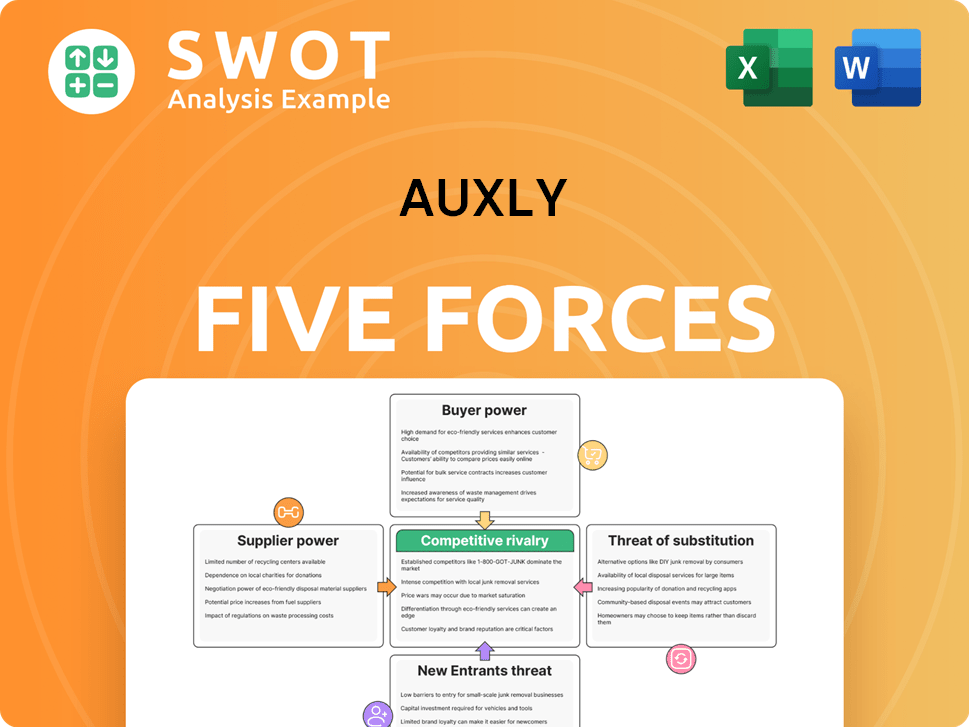

Auxly Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Auxly Company?

- What is Growth Strategy and Future Prospects of Auxly Company?

- How Does Auxly Company Work?

- What is Sales and Marketing Strategy of Auxly Company?

- What is Brief History of Auxly Company?

- Who Owns Auxly Company?

- What is Customer Demographics and Target Market of Auxly Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.