Auxly Bundle

How is Auxly Dominating the Canadian Cannabis Market?

Auxly Cannabis Group Inc. isn't just another player; it's a Canadian powerhouse reshaping the cannabis landscape. With the 'Back Forty' brand leading the charge as Canada's top cannabis brand by the end of 2024, Auxly's sales and marketing strategies are clearly delivering results. But how has this company, founded in 1987, evolved its approach to capture such significant market share, and what can we learn from their success?

This analysis dives deep into Auxly's Auxly SWOT Analysis, dissecting its sales and marketing approach within the competitive cannabis market. We'll explore Auxly's brand building tactics, examining how they drive sales performance and achieve impressive results. Discover the strategies behind Auxly's success, from their distribution channels to their digital marketing campaigns, and gain insights into their customer acquisition strategies.

How Does Auxly Reach Its Customers?

The sales channels of the company, focus primarily on wholesale distribution. The company's strategy involves supplying provincial and territorial cannabis boards across Canada. These boards then distribute products to both recreational and medical markets.

In 2024, a significant portion, approximately 76%, of the company's cannabis sales originated from British Columbia, Alberta, and Ontario. The company maintains sales across all Canadian provinces, as well as the Yukon and Northwest Territories. This distribution model emphasizes established provincial networks.

The company's approach has evolved with the Canadian cannabis market's regulatory changes. It was an early entrant into the Cannabis 2.0 product market. The company distributes and sells these products throughout Canada. The company's strategic focus is on enhancing product distribution and operational efficiency. The company also engages in wholesale bulk cannabis transactions with various licensed producers in Canada.

The primary sales channel is wholesale distribution to provincial and territorial cannabis boards. These boards then supply the recreational and medical markets. This channel accounts for the majority of sales.

The company was an early participant in the Cannabis 2.0 market. It distributes and sells these products across Canada. This includes a range of product types that complement the core cannabis offerings.

The company engages in wholesale bulk cannabis transactions. These transactions are with various licensed producers in Canada. This channel helps to optimize supply chain efficiency.

A significant portion of sales comes from key provinces like British Columbia, Alberta, and Ontario. The company maintains a presence across all Canadian provinces and territories. This broad distribution network supports overall sales performance.

The company's sales strategy has been effective, as demonstrated by consistent revenue growth. Net revenue reached $122.3 million in 2024, a 21% increase from 2023. In Q1 2025, revenue was $32.7 million, a 29% increase compared to Q1 2024. The company's sales strategy is focused on wholesale distribution and strategic partnerships.

- Wholesale distribution to provincial and territorial cannabis boards.

- Focus on Cannabis 2.0 products.

- Bulk wholesale transactions with licensed producers.

- Geographic focus on key provinces and territories.

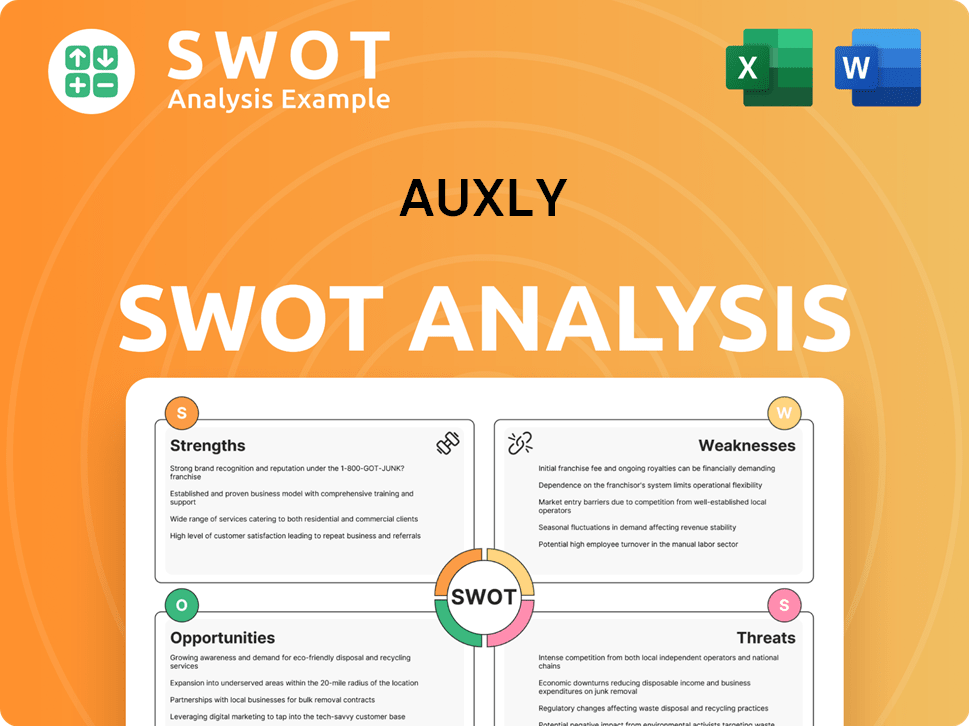

Auxly SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Auxly Use?

The Auxly company employs a multifaceted approach to marketing, focusing on brand building and sales performance within the Canadian cannabis market. Their strategy involves a blend of product innovation, targeted marketing campaigns, and strategic use of social media to connect with consumers. The company strategically invests in marketing initiatives to drive sales and increase brand awareness.

Financial reports indicate that Auxly allocates resources to marketing to support its sales efforts. Selling expenses for the year ended December 31, 2024, were $11.0 million, a rise of $2.5 million compared to 2023. This increase is mainly due to marketing investments and higher Health Canada fees. Similarly, the selling expenses in Q1 2025 increased by $0.7 million over Q1 2024, which is also attributed to marketing initiatives and related fees.

Auxly's marketing strategy highlights product innovation and brand strength, particularly with its 'Back Forty' brand. By early 2025, 'Back Forty' had achieved the number one brand position in Canada. This suggests that product quality, new strain introductions, and innovative formats are key drivers in their marketing mix. The company leverages social media platforms like Twitter, Instagram, Facebook, and LinkedIn to disseminate news and connect with its audience.

Auxly focuses on product innovation to drive sales. The 'Back Forty' brand's success, with the all-in-one vape winning 'Innovation of the Year' at the 2024 KIND awards, highlights this approach.

Brand building is a core component of Auxly's marketing strategy. The 'Back Forty' brand's top position in Canada indicates the success of this approach.

Auxly utilizes social media platforms to connect with its audience. Platforms like Twitter, Instagram, Facebook, and LinkedIn are used to share news and engage with consumers.

The company's sales performance is supported by marketing efforts. Increased selling expenses reflect investments in marketing to drive sales growth.

Successful launches of new cultivars, such as Chemzilla, which became the number one SKU in the 14g flower category in Ontario, demonstrate the effectiveness of this strategy.

The strong performance of products like Liquid Imagination and Fire Breath as top-selling flower products in Canada in 2024 underscores the impact of the marketing strategy.

Auxly's marketing strategy includes product innovation, brand building, and social media engagement to drive sales and enhance its position in the competitive cannabis market. The company's focus on new product launches and top-selling products highlights the effectiveness of its approach.

- Product Innovation: Introducing new strains and formats to meet consumer demand.

- Brand Building: Establishing strong brand recognition and loyalty, as seen with the success of 'Back Forty'.

- Social Media Marketing: Using platforms like Twitter, Instagram, Facebook, and LinkedIn to connect with consumers and disseminate information.

- Sales Performance Focus: Aligning marketing investments with sales growth targets, as indicated by increased selling expenses.

- Data-Driven Decisions: Using sales data to inform product development and marketing campaigns.

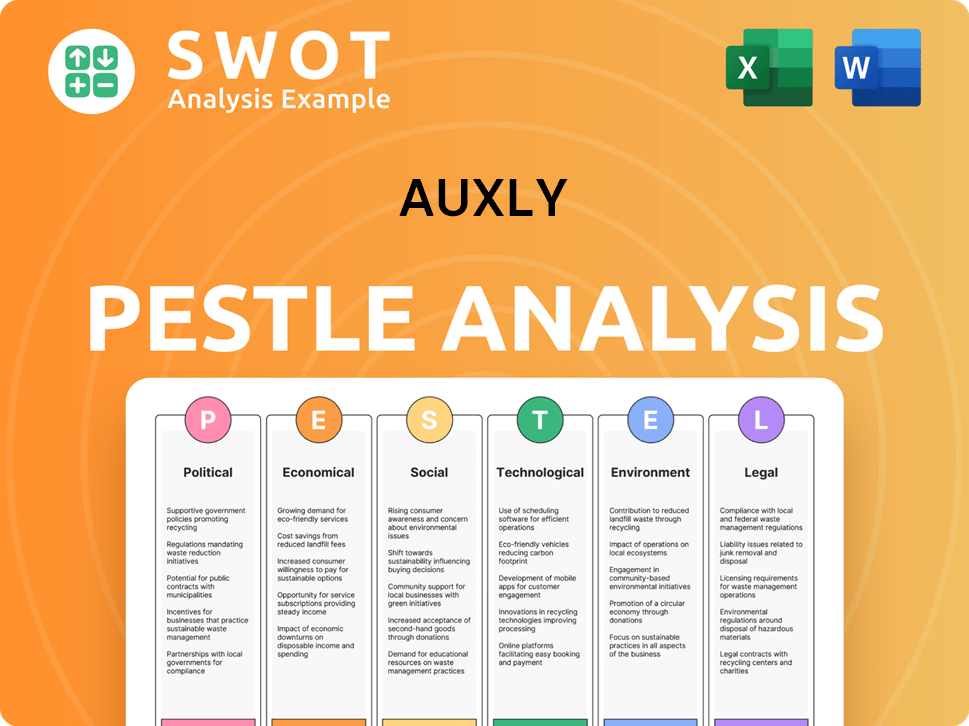

Auxly PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Auxly Positioned in the Market?

The company strategically positions its brands to cater to diverse consumer preferences within the cannabis market. This approach, central to its Growth Strategy of Auxly, emphasizes quality, consistency, and innovation across its portfolio. Its brands, including Foray, Kolab Project, Back Forty, Dosecann, and Parcel, are each designed to appeal to specific segments within the cannabis market.

This strategic brand positioning has been a key driver of its sales performance. For example, the 'Back Forty' brand has achieved significant market leadership. This is attributed to its offerings in popular categories such as all-in-one vapes and non-infused pre-rolls, where it has consistently held top SKU positions in Ontario and nationally.

The company's brand identity is built on its mission to 'help consumers live happier lives through quality cannabis products that they trust and love.' This mission is reinforced by a commitment to consumer insights and a culture of operational agility to respond to rapidly evolving consumer preferences. This focus on product excellence and market responsiveness has been critical to its success in the competitive cannabis market.

Each brand within the portfolio targets a specific consumer segment. Foray is positioned as an inviting brand for curious consumers, while Kolab Project focuses on a refined collection of cannabis products.

'Back Forty' has become the number one cannabis brand in Canada by early 2025. This success is driven by strong sales in key product categories.

The company focuses on product excellence and market responsiveness. This is evident in the recognition of its products and their strong sales performance.

The company emphasizes consumer insights to adapt to changing preferences. This approach supports its mission to provide quality cannabis products.

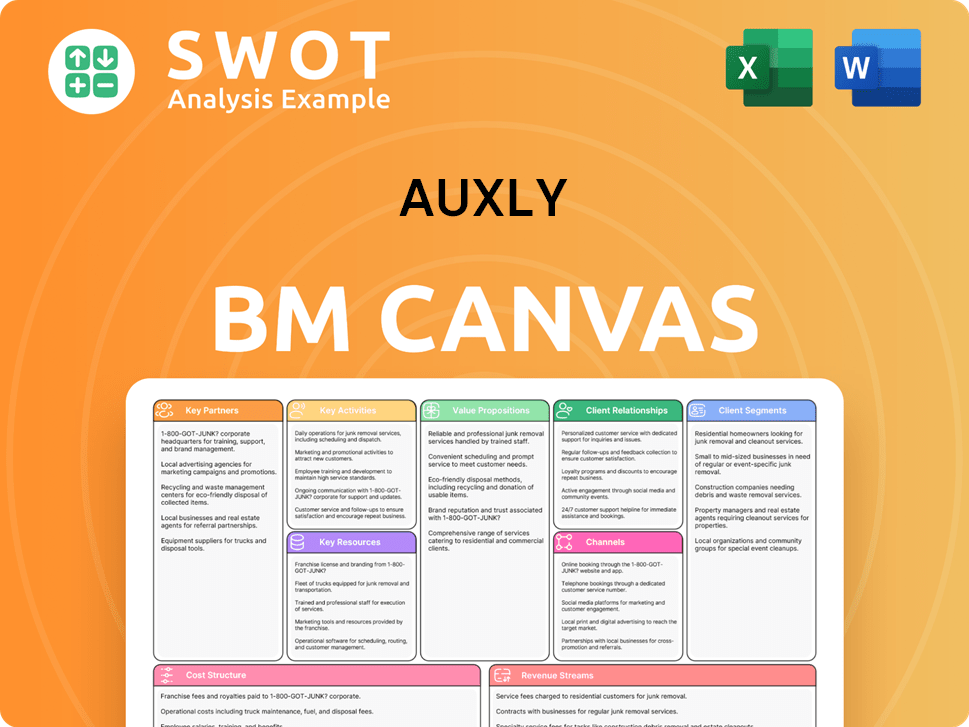

Auxly Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Auxly’s Most Notable Campaigns?

The Growth Strategy of Auxly focuses on product innovation and quality, effectively serving as a continuous marketing effort. This approach has driven significant sales growth and market share within the competitive cannabis market. Auxly's success highlights its strategic product launches and market penetration efforts, rather than traditional, named marketing campaigns. This strategy has proven effective, especially in the Canadian market.

A key element of the Auxly sales strategy has been the consistent performance of its 'Back Forty' brand. It secured the number one position in the Canadian cannabis market by the end of 2024 and maintained that status into early 2025. The 'Back Forty' all-in-one vape was recognized as 'Innovation of the Year' at the 2024 KIND awards. This recognition underscores the effectiveness of Auxly's product-centric approach and brand building.

Auxly's marketing strategy also includes successful ventures in the pre-roll category, holding the top spot nationally for non-infused pre-rolls in 2024. The 'Wedding Pie 10x0.35g pre-rolls' were the best-selling non-infused pre-roll SKU nationally in 2023. The dried flower research and development program also contributed with top-selling products like Liquid Imagination and Fire Breath in 2024. These sales performance achievements demonstrate a robust approach to the cannabis market.

The 'Back Forty' brand was the number one cannabis brand in Canada, a position it held from late 2024 into early 2025. This achievement highlights Auxly's effective brand positioning strategy and sales growth.

The 'Back Forty' all-in-one vape was awarded 'Innovation of the Year' at the 2024 KIND awards. This recognition emphasizes the success of Auxly's product-focused strategy.

Auxly held the number one position nationally in non-infused pre-rolls in 2024. The 'Wedding Pie 10x0.35g pre-rolls' were the top-selling SKU in 2023.

The launch of the Chemzilla cultivar in Ontario quickly became the number one SKU in the 14g flower category in Q1 2025. This demonstrates Auxly's strong distribution channels for cannabis products.

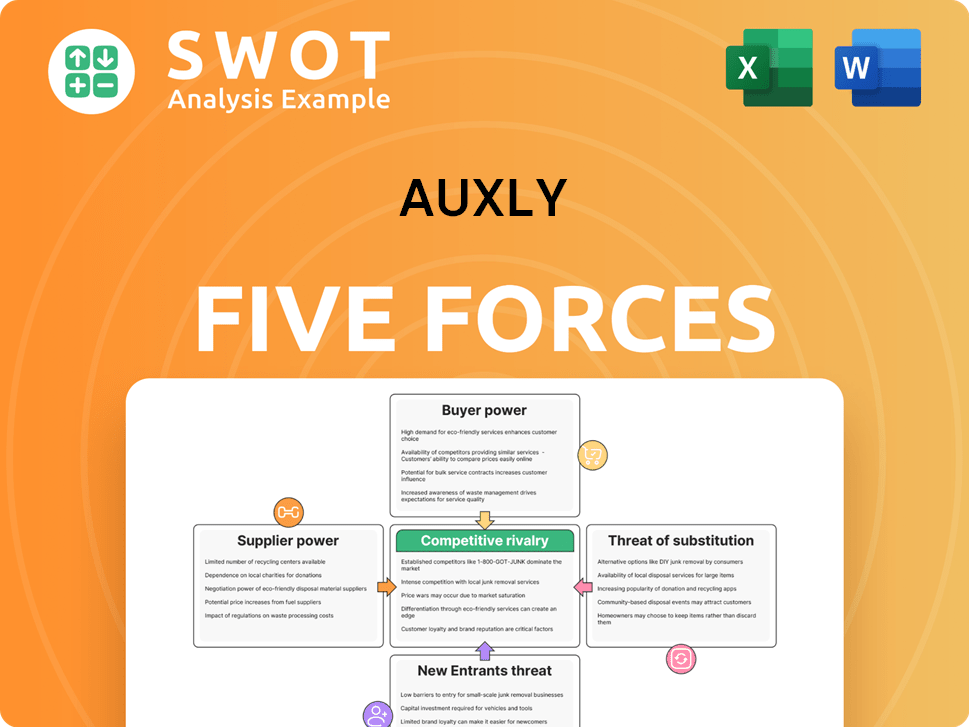

Auxly Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Auxly Company?

- What is Competitive Landscape of Auxly Company?

- What is Growth Strategy and Future Prospects of Auxly Company?

- How Does Auxly Company Work?

- What is Brief History of Auxly Company?

- Who Owns Auxly Company?

- What is Customer Demographics and Target Market of Auxly Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.