Auxly Bundle

Who Really Controls Auxly Cannabis Group?

In the ever-shifting world of cannabis, understanding the ownership of companies like Auxly Cannabis Group is paramount. Major shifts, such as initial public offerings or changes in leadership, can drastically alter a company's direction. This deep dive into Auxly SWOT Analysis will unravel the complex web of Auxly ownership, revealing the key players shaping its future.

Founded in 2017 as Cannabis Wheaton Income Corp., Auxly Cannabis Group, a consumer packaged goods company based in Toronto, has become a significant player in the Canadian cannabis market. This exploration will examine the evolution of Auxly ownership, from its founders' initial stakes to the influence of institutional investors and public shareholders. By understanding who owns Auxly, investors and stakeholders can gain critical insights into its strategic direction, financial health, and long-term prospects, including the latest news on Auxly and the Auxly stock forecast.

Who Founded Auxly?

Auxly Cannabis Group Inc., originally named Cannabis Wheaton Income Corp., was founded in 2017. Hugo Alves and Chuck Rifici co-founded the company, with Alves taking on the role of CEO. The initial vision focused on a unique streaming and royalty model within the burgeoning cannabis market.

The company's early ownership structure was likely shaped by its innovative approach. The streaming and royalty model aimed to attract capital from investors. This was done in exchange for future revenue streams or equity. Early backing from angel investors was crucial for providing the initial capital.

Early agreements would have included standard vesting schedules for founder shares. This was done to ensure long-term commitment and stability. Buy-sell clauses are common in early-stage companies. These clauses manage potential founder exits or disputes, although specific details for Auxly are not publicly disclosed.

The founders aimed to be a capital provider and partner to licensed producers. This approach differed from solely cultivating cannabis.

Early investors were crucial in providing the initial capital. This funding supported the streaming agreements that were central to Auxly's business model.

Any initial ownership disputes or buyouts would have shaped the distribution of control. This would have influenced the company's direction.

Early agreements likely included vesting schedules. These schedules were designed to ensure commitment from the founders.

Buy-sell clauses are standard in early-stage companies. These clauses help manage potential exits or disputes among founders.

The initial share structure was influenced by the streaming and royalty model. This model was designed to attract early investment.

Understanding the early ownership of Auxly Company is key to grasping its evolution. While specific details on the initial equity split are not fully available, the founding team's vision and the streaming model significantly influenced the early capital structure and the company's trajectory. The company's current share structure and major shareholders can be found in its financial reports, which are publicly available. As of recent reports, the company's market capitalization and stock price history provide insights into the value and performance of Auxly stock. For those interested in investing, information on how to buy Auxly stock and the latest news on Auxly can be found through various financial resources.

Auxly SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Auxly’s Ownership Changed Over Time?

The journey of Auxly Cannabis Group, formerly known as Cannabis Wheaton Income Corp., began with its initial public offering (IPO) on the TSX Venture Exchange in 2017. This event marked a significant transition from private to public ownership, providing a platform for a wider array of investors to participate. While the exact initial market capitalization at the time of the IPO isn't readily available in recent public records, the listing was crucial for raising capital and fueling the company's expansion initiatives.

Following the IPO, the ownership structure of Auxly has seen considerable evolution, encompassing institutional investors, mutual funds, and individual shareholders. Institutional investors, as of March 31, 2024, hold a considerable portion of Auxly's shares, with various investment management firms among the significant holders. The holdings of these institutions can fluctuate, reflecting market dynamics and strategic investment decisions. Additionally, individual insider ownership, which includes shares held by current and former executives and directors, represents a notable segment, aligning their interests with the company's performance.

| Ownership Milestone | Details | Impact |

|---|---|---|

| IPO on TSX Venture Exchange (2017) | Transition from private to public ownership. | Enabled capital raising and operational expansion. |

| Imperial Brands Investment (2019) | Strategic investment through convertible debentures and warrants. | Provided substantial capital and strategic partnership. |

| Ongoing Institutional and Individual Shareholder Activity | Dynamic shifts in shareholding by various investors. | Reflects market sentiment and influences strategic direction. |

The most significant shareholder in Auxly is Imperial Brands, a global tobacco company. As of April 2024, Imperial Brands held approximately 19.8% of Auxly's issued and outstanding common shares on a non-diluted basis, and 27.6% on a partially diluted basis, including warrants. This substantial investment, initiated in 2019, has been pivotal, providing Auxly with considerable financial backing and fostering a strategic alliance that has influenced the company's strategy and governance, particularly in product development and market reach. This has directly impacted Auxly's strategic direction, influencing capital allocation, product innovation, and market expansion.

The ownership of Auxly is a mix of institutional investors, individual shareholders, and a major stake held by Imperial Brands.

- Imperial Brands holds a significant equity position, influencing strategic decisions.

- Institutional holdings fluctuate, reflecting market trends.

- The IPO was a critical step in transitioning to public ownership.

- Understanding the shareholder structure is key to assessing Auxly's strategic direction and financial health.

Auxly PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Auxly’s Board?

The Board of Directors of Auxly Cannabis Group Inc., as of early 2024, includes a mix of individuals representing major shareholders, founders, and independent members. The board's composition reflects the influence of significant investors, such as Imperial Brands. Roger Barlow, formerly Imperial Brands' Global Head of Corporate Development and Ventures, served on Auxly's Board, illustrating the strategic alignment between the two companies. The specifics of the board's current composition and the affiliations of each member to major shareholders can be found in the latest proxy statements.

The board's structure is designed to oversee the company's strategic direction and financial performance. The presence of representatives from major shareholders, like Imperial Brands, ensures that the interests of significant investors are considered in key decisions. This setup is typical for publicly traded companies, with board members tasked with fiduciary duties to act in the best interests of the company and its shareholders. The board's role is crucial in guiding Auxly's long-term planning and market positioning within the competitive cannabis industry.

| Board Member | Affiliation | Role |

|---|---|---|

| Roger Barlow | Imperial Brands | Former Board Member |

| Hugo Alves | Auxly Cannabis Group Inc. | CEO |

| Don Coxe | Independent | Director |

Auxly's voting structure generally follows a one-share-one-vote principle for its common shares. The influence of major shareholders, such as Imperial Brands, extends beyond simple share counts due to their substantial ownership percentage and board representation. The company's decision-making processes are significantly shaped by the presence of a major strategic investor, often leading to alignment on key strategic initiatives and financial oversight. This helps in shaping the company's long-term planning and market positioning.

The board of directors at Auxly plays a vital role in the company's governance and relationship with its shareholders. The board includes members from major shareholders like Imperial Brands. This setup ensures that the interests of significant investors are considered in key decisions.

- Board members oversee strategic direction and financial performance.

- Major shareholders influence decision-making.

- The voting structure generally follows a one-share-one-vote principle.

- The board guides Auxly's long-term planning.

Auxly Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Auxly’s Ownership Landscape?

Over the past few years, Auxly Cannabis Group has seen significant developments in its ownership structure. A key aspect is the continued influence of its strategic partnership with Imperial Brands. As of April 2024, Imperial Brands held approximately 19.8% of Auxly's issued and outstanding common shares on a non-diluted basis and 27.6% on a partially diluted basis. This strong backing has been crucial for Auxly's financial stability and strategic direction, particularly in the Canadian cannabis market.

The cannabis industry's trends, such as increased institutional ownership and consolidation, have also impacted Auxly. While specific share buybacks or secondary offerings haven't been widely publicized for 2024-2025, the company's financial performance remains under scrutiny. The company's public statements often focus on operational achievements and product launches, with less direct commentary on future ownership changes. However, strategic partnerships and capital raises are always considered to support growth in the evolving cannabis landscape. Leadership changes and founder departures, if any, would be detailed in company filings, impacting ownership and governance.

Imperial Brands remains a significant shareholder, shaping Auxly's strategic direction. Institutional ownership and industry consolidation are ongoing trends. Understanding the share structure is key for potential investors looking at Auxly ownership.

The major shareholders of Auxly include Imperial Brands. The company's focus is on product innovation and market penetration within Canada. The company's financial performance and capital structure are constantly under review.

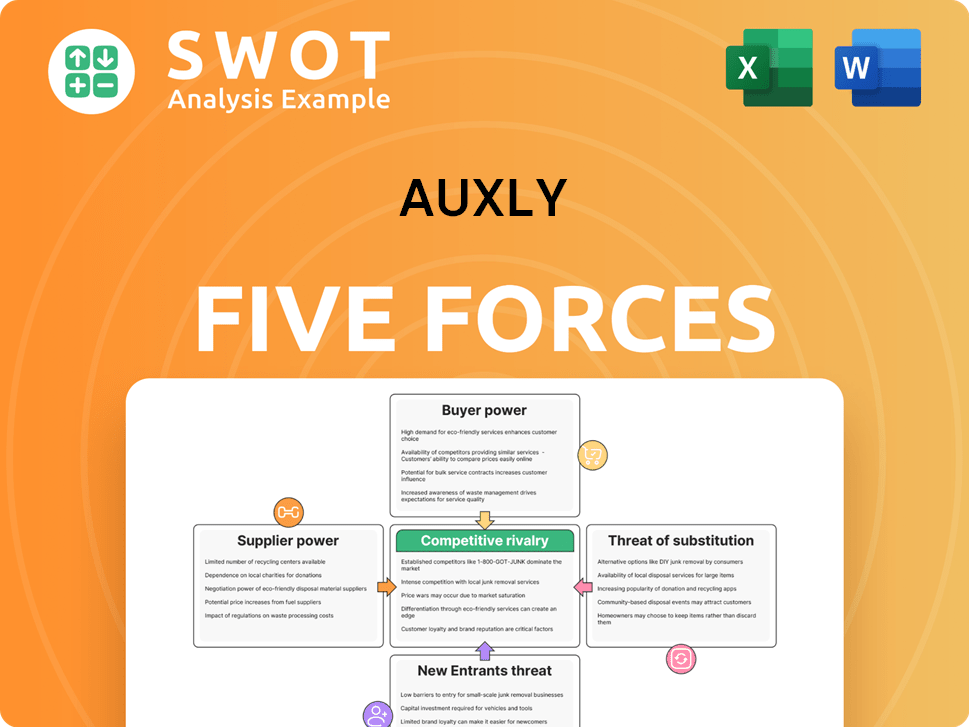

Auxly Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Auxly Company?

- What is Competitive Landscape of Auxly Company?

- What is Growth Strategy and Future Prospects of Auxly Company?

- How Does Auxly Company Work?

- What is Sales and Marketing Strategy of Auxly Company?

- What is Brief History of Auxly Company?

- What is Customer Demographics and Target Market of Auxly Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.