Ackermans & Van Haaren Bundle

How Did Ackermans & Van Haaren Become a Belgian Investment Powerhouse?

Journey back in time to explore the fascinating Ackermans & Van Haaren SWOT Analysis and its remarkable transformation! From humble beginnings in 1876, this Belgian holding company has navigated nearly 150 years of economic shifts. Discover how this AVH history has shaped its current status as a diversified investment firm, listed on major European indices.

This Company profile of Ackermans & Van Haaren offers a glimpse into the AVH history, revealing a strategic evolution from dredging to a multi-sector investment portfolio. The Belgian holding company has consistently demonstrated an ability to adapt and thrive, making it a compelling case study in long-term value creation. Understanding the AVH business strategy provides valuable insights for investors and business strategists alike, highlighting the importance of diversification and active portfolio management.

What is the Ackermans & Van Haaren Founding Story?

The AVH history begins in 1876, marking the formation of a partnership between Nicolaas van Haaren and Hendrik Willem Ackermans. This Belgian holding company started with construction and dredging as its core activities.

Their early focus on infrastructure development laid the groundwork for future ventures. The formal incorporation of Ackermans & Van Haaren NV occurred in 1924, solidifying their presence in the industry.

Key events shaped the early years of Ackermans & Van Haaren.

- In 1888, the company secured its first major contract in Belgium, constructing forts along the Meuse in Namur.

- A significant international expansion occurred in 1903 with their first transatlantic contract. This involved dredging work for the port of Bahia Blanca in Rosario, Argentina.

- The company's initial vision was to leverage expertise in marine engineering and contracting, identifying opportunities in infrastructure development.

Early financial details and specific anecdotes are not widely publicized, but the company's sustained growth suggests a strong foundation built on entrepreneurial spirit and strategic foresight. The company's early success in securing contracts, both domestically and internationally, highlights its early capabilities and ambitions. The company's long-term success demonstrates the effectiveness of its initial strategic focus on infrastructure.

Ackermans & Van Haaren SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Ackermans & Van Haaren?

The early growth of Ackermans & Van Haaren, a prominent Belgian holding company, showcases a strategic evolution from its dredging roots. This period was marked by diversification and key acquisitions, transforming the company into a diversified investment firm. The company's adaptability to market changes and commitment to long-term value creation are evident in its early expansion.

A significant step in the AVH history occurred in 1964. The company diversified into the oil and gas industry through drilling operations with Forasol – Foramer. This marked a strategic shift from marine contracting to broader industrial investments, showcasing the company's forward-thinking approach. This early diversification set the stage for future growth.

In 1974, the dredging activities merged with CFE, leading to the creation of Dredging International. This subsidiary became a cornerstone of the Marine Engineering & Contracting segment. Dredging International continues to be a key part of the company's operations, reflecting its enduring importance in the AVH business timeline.

The company went public in 1984, with shares listed on the Brussels Stock Exchange at an initial price of 1.95 euros. The 1990s brought further expansion and diversification, with the acquisition of Belcofi – Delen in 1992. This entry into private banking strengthened the group's portfolio.

In 1994, the acquisition of privatized Société Nationale d'Investissement facilitated the start of Growth Capital and Real Estate & Senior Care segments. The investment in SIPEF in 1997 expanded the portfolio into tropical agriculture, initiating the Energy & Resources segment. These moves highlight the company's strategic approach to building a diversified investment portfolio, as discussed in Mission, Vision & Core Values of Ackermans & Van Haaren.

Ackermans & Van Haaren PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Ackermans & Van Haaren history?

The Belgian holding company, Ackermans & Van Haaren (AVH), has achieved significant milestones throughout its history. These achievements highlight the company's growth and strategic adaptations within the investment firm landscape.

| Year | Milestone |

|---|---|

| 2013 | Merger of DEME with CFE, strengthening its position in marine engineering and contracting. |

| 2022 | Separate listing of DEME Group on Euronext Brussels, showcasing its independent strength. |

| 2024 | Acquisition of a 33.3% stake in V. Group for approximately 150 million US dollars, aligning with its strategy to support sustainable market leaders. |

AVH has consistently focused on innovation to enhance its business operations. In 2023, the company allocated €100 million to digital transformation initiatives, aiming for a 30% increase in operational efficiency by mid-2024 through technological integrations.

AVH invested €100 million in digital transformation in 2023.

The goal is to increase operational efficiency by 30% by mid-2024 through technological integrations.

The acquisition of a stake in V. Group reflects a commitment to sustainable market leaders.

Despite its successes, Ackermans & Van Haaren has faced challenges, including market fluctuations and competitive pressures. However, the company has demonstrated resilience, reporting a 15% increase in net profit for 2024, reaching 460 million euros.

AVH has had to adapt to market downturns across its diverse sectors.

The company faces competitive pressures within its various business areas.

AVH reported a 15% increase in net profit for 2024, reaching 460 million euros.

Ackermans & Van Haaren Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Ackermans & Van Haaren?

The AVH history is marked by significant milestones, reflecting its evolution from a construction firm to a diversified Belgian holding company. Founded in 1876, the company initially focused on construction projects, expanding into dredging and international ventures. Key moments include the first transatlantic contract in 1903, the incorporation of Ackermans & Van Haaren NV in 1924, and the IPO on the Brussels Stock Exchange in 1984. Strategic acquisitions, such as Belcofi – Delen in 1992, broadened its scope into private banking, and investments in SIPEF in 1997 initiated the Energy & Resources segment. The DEME Group's separate listing in 2022 and the achievement of a €460 million net profit and a €7.6 billion turnover in 2024 underscore its financial strength and strategic growth.

| Year | Key Event |

|---|---|

| 1876 | First cooperation between Nicolaas van Haaren and Hendrik Willem Ackermans, marking the company's founding. |

| 1888 | First contract in Belgium for the construction of forts along the Meuse in Namur. |

| 1903 | First transatlantic contract for dredging works in Rosario, Argentina. |

| 1924 | Incorporation of Ackermans & Van Haaren NV. |

| 1964 | First diversification into on and offshore oil drilling with Forasol – Foramer. |

| 1974 | Merger of dredging activities of Ackermans & Van Haaren and CFE, creating Dredging International (now DEME). |

| 1984 | Initial Public Offering (IPO) on the Brussels Stock Exchange. |

| 1992 | Acquisition of Belcofi – Delen, marking entry into Private Banking. |

| 1994 | Acquisition of privatized Société Nationale d'Investissement, leading to the start of Growth Capital and Real Estate & Senior Care segments. |

| 1997 | Investment in SIPEF, initiating the Energy & Resources segment. |

| 2013 | Merger of DEME with CFE. |

| 2022 | DEME Group separate listing on Euronext Brussels. |

| 2024 | Achieved a net profit of 460 million euros and a turnover of 7.6 billion euros across the group. |

| 2025 (Q1) | Reports a solid start to the year and confirms forecast of a higher net profit in 2025 compared to 2024. |

Ackermans & Van Haaren anticipates continued growth, aiming for a higher net profit in 2025. This expectation is fueled by a strong order book at DEME and increased client assets at Delen Private Bank and Bank Van Breda. The company's focus on its business strategy includes global expansion and strategic investments.

The company plans to invest €150 million in research and development in 2024 to enhance operational efficiency and product offerings. This commitment to innovation is coupled with a strong focus on sustainability, including a 25% reduction in its carbon footprint by 2025 and active engagement with portfolio companies on CO2 reduction plans for 2030.

Analyst predictions suggest a positive trend for ACKB shares, with a long-term increase expected. The potential for growth is significant, with projections indicating a possible value of 294.973 EUR by 2030. This positive outlook reflects the company's strong financial performance and strategic investments.

The company's forward-looking strategy remains deeply rooted in its founding vision of long-term value creation and sustainable growth. It continues to adapt to evolving industry trends, such as climate change and digitalization, ensuring its relevance and success in the future. The company is focused on long-term value creation.

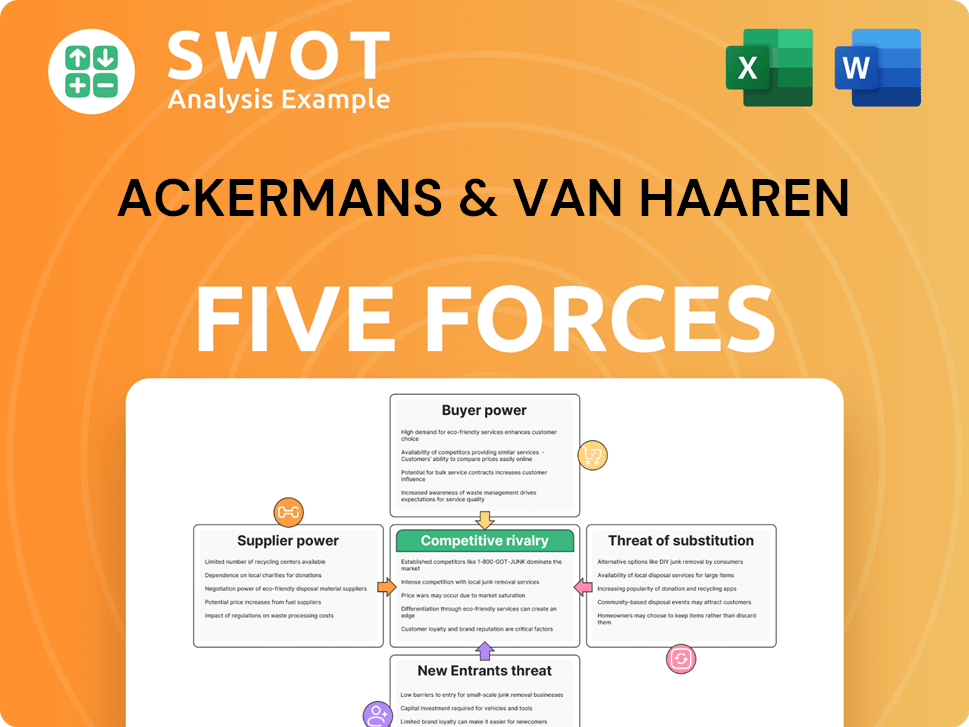

Ackermans & Van Haaren Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Ackermans & Van Haaren Company?

- What is Growth Strategy and Future Prospects of Ackermans & Van Haaren Company?

- How Does Ackermans & Van Haaren Company Work?

- What is Sales and Marketing Strategy of Ackermans & Van Haaren Company?

- What is Brief History of Ackermans & Van Haaren Company?

- Who Owns Ackermans & Van Haaren Company?

- What is Customer Demographics and Target Market of Ackermans & Van Haaren Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.