Ackermans & Van Haaren Bundle

Can Ackermans & Van Haaren Continue Its Century-Long Success Story?

Founded in 1876, Ackermans & Van Haaren (AVH) has a rich history of strategic investments and long-term value creation. This article dives into the Ackermans & Van Haaren SWOT Analysis, exploring how this diversified group plans to navigate future market dynamics and capitalize on emerging opportunities. We'll examine their recent moves, including the V.Group investment, and uncover the strategies driving their continued growth.

Ackermans & Van Haaren's (AVH Company) recent acquisitions and investments, such as the stake in V.Group, signal a clear focus on bolstering its investment portfolio and expanding its reach. This analysis will provide insights into the company's business development plans, including its financial performance and outlook. Understanding the growth strategy of Ackermans & Van Haaren is crucial for investors and stakeholders alike, as we explore its expansion plans and international presence, and the impact of market trends on AVH's growth.

How Is Ackermans & Van Haaren Expanding Its Reach?

The Ackermans & Van Haaren (AVH) company is actively pursuing a multi-faceted growth strategy, focusing on both organic growth within its existing core sectors and strategic mergers and acquisitions. A key aspect of their strategy is global expansion.

The company aims for a targeted 10% growth in global investments by the end of 2024, building on a 15% increase in international holdings in the past year through acquiring stakes in companies in emerging markets. This strategy reflects a commitment to diversifying its investment portfolio and capitalizing on opportunities in various markets.

This approach is designed to enhance the company's financial performance and ensure long-term sustainability. The company's strategic moves are carefully planned to align with market trends and maximize returns.

The Marine Engineering & Contracting segment, primarily through DEME, saw its turnover grow by 25% in 2024, exceeding €4 billion for the first time. This growth was driven by strong market demand and an expanded fleet. DEME's order book also reached a new record, exceeding €8 billion.

Delen Private Bank and Bank Van Breda achieved a combined net profit of €327.7 million in 2024, a 24% growth compared to 2023. Total client assets grew to €77.727 million. This growth is partly supported by external expansion of Delen in the Netherlands.

AvH continues to make strategic investments through its Growth Capital segment. Recent investments include Servatus Vermogensmanagement on April 15, 2025, DGN Groep on January 30, 2025, and Petram & Co on January 3, 2025. In 2024, AvH acquired a 33.3% stake in V.Group for $150 million, a global leader in ship management, and a 6.2% stake in Confo Therapeutics for €15 million.

Nextensa is undergoing a strategic transformation, with the acquisition of the Proximus towers in Brussels and the start of the final development phase of Tour & Taxis expected to close in Q1 2025. CFE Group, in collaboration with Ackermans & Van Haaren, is investing in sustainable initiatives such as Deep C Holding for port development in Vietnam and GreenStor for battery parks, with a 100 MW farm in Aubange expected to start construction in 2025.

Ackermans & Van Haaren's expansion initiatives are focused on both organic growth and strategic acquisitions. These moves are designed to strengthen its market position and drive financial performance. This approach is detailed further in an article about the AVH company's financial results and outlook.

- Global expansion with a targeted 10% growth in global investments by the end of 2024.

- Marine Engineering & Contracting segment turnover grew by 25% in 2024, exceeding €4 billion.

- Private Banking sector saw a combined net profit of €327.7 million in 2024, a 24% growth.

- Strategic investments in Growth Capital, including recent acquisitions in 2025.

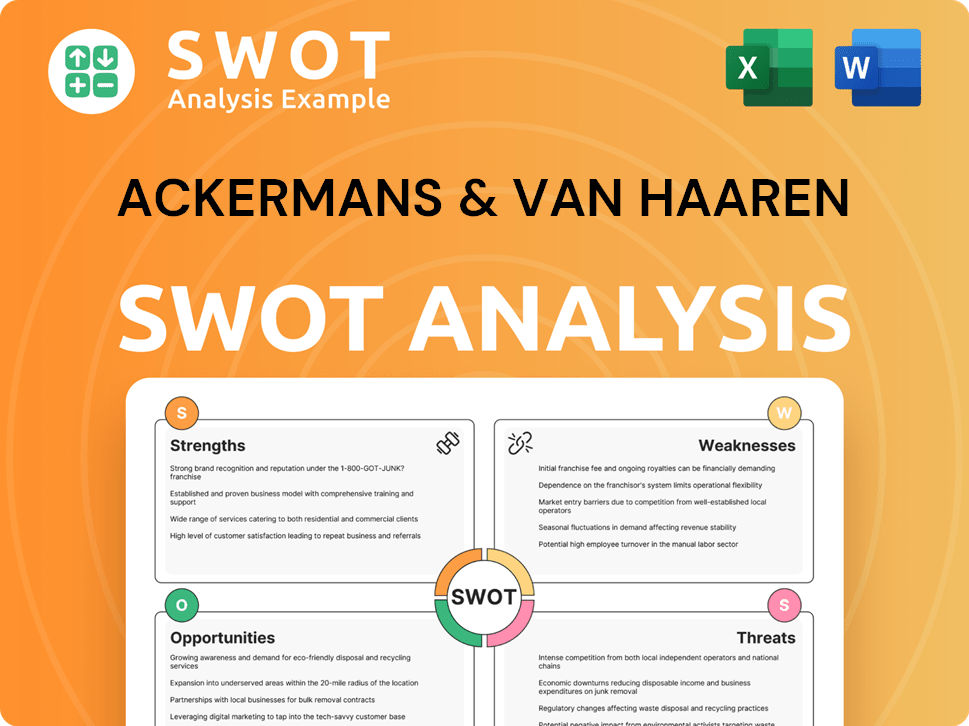

Ackermans & Van Haaren SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ackermans & Van Haaren Invest in Innovation?

The core of the AVH Company's strategy involves a strong focus on innovation and technology to spur growth across its diverse sectors. This approach allows the company to adapt to market changes and meet evolving consumer demands effectively. By strategically integrating new technologies and fostering innovation, Ackermans & Van Haaren aims to enhance operational efficiency and expand its product offerings.

Ackermans & Van Haaren is committed to leveraging technology and innovation to drive sustained growth. This commitment is reflected in its significant investments in research and development, digital transformation, and strategic partnerships. The company's proactive stance ensures it remains competitive and adaptable in a dynamic business environment.

The company's innovation strategy is multifaceted, involving substantial investments in various technological advancements. This includes the integration of AI to improve operational efficiency and the exploration of new business opportunities. The company's approach is geared towards enhancing its market position and ensuring long-term value creation.

Ackermans & Van Haaren plans to invest €150 million in research and development across its subsidiaries in 2024. This investment underscores the company's dedication to enhancing operational efficiency and product offerings. This commitment is crucial for adapting to market changes and consumer demands.

In 2023, AVH Company allocated €100 million to digital transformation initiatives across its sectors. The goal is to achieve a 30% increase in operational efficiency by mid-2024 through these technological integrations. This strategic move highlights the company's commitment to leveraging technology for improved performance.

The company's 2024 annual report highlighted significant investments in technology, especially the widespread integration of AI within the organization. This includes focusing on operational efficiency and continued investment in digital transformation. This strategy is essential for maintaining a competitive edge.

AVH Company actively invests in companies that bring innovative solutions to their respective industries. For instance, in October 2024, the company announced an investment of €5 million in a private placement totaling €15 million for Biotalys NV. This demonstrates a commitment to supporting innovative technologies.

Ackermans & Van Haaren's ESG approach considers the impact of environmental factors on its businesses and vice-versa. The company supports the transition of companies in sectors facing specific ESG challenges towards sustainable business models. The firm aims to reduce its carbon footprint by 25% by 2025.

In 2023, 70% of Ackermans & Van Haaren's portfolio companies had already implemented sustainability initiatives. This demonstrates a strong commitment to environmental responsibility and sustainable business practices. This approach is crucial for long-term value creation.

Ackermans & Van Haaren's Growth Strategy is heavily reliant on technological advancements and innovation to maintain a competitive advantage. This involves significant investment in R&D, digital transformation, and strategic partnerships with innovative companies. These initiatives are designed to enhance operational efficiency and drive Business Development.

- Focus on Digital Transformation: Allocating substantial funds to digitize operations and improve efficiency.

- AI Integration: Implementing AI technologies to streamline processes and improve decision-making.

- Strategic Investments: Investing in companies that offer innovative solutions in their respective industries.

- Sustainability Initiatives: Prioritizing ESG factors and supporting sustainable business models.

- Operational Efficiency: Aiming for significant improvements in operational efficiency through technological integrations.

For a deeper understanding of the AVH Company's business model and revenue streams, you can refer to the article Revenue Streams & Business Model of Ackermans & Van Haaren.

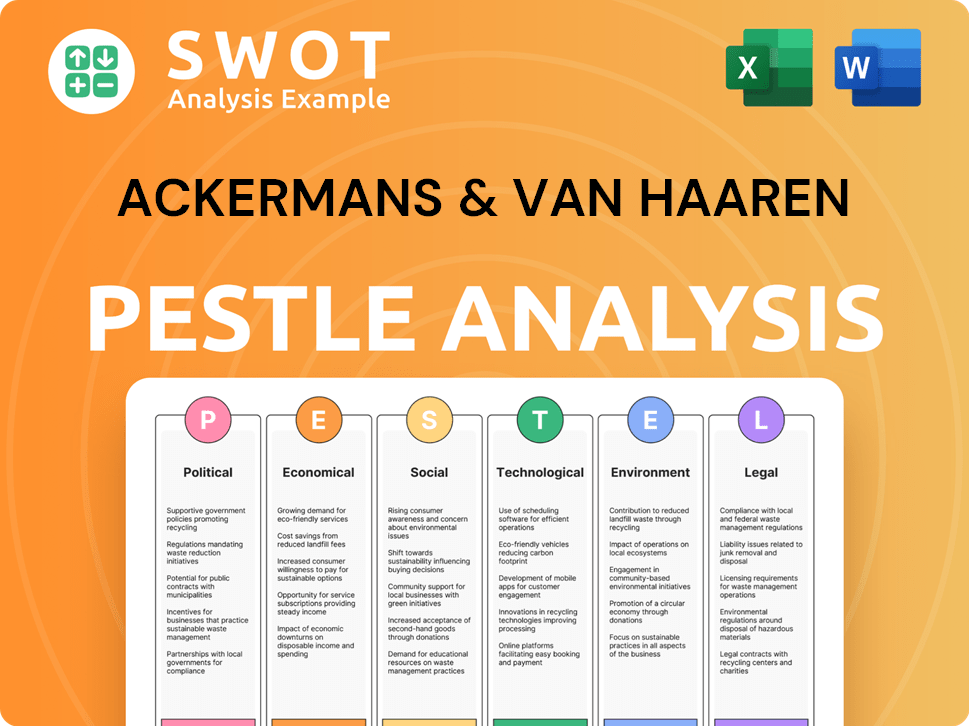

Ackermans & Van Haaren PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ackermans & Van Haaren’s Growth Forecast?

The financial outlook for Ackermans & Van Haaren (AVH) is positive, with expectations of increased net profit in 2025 compared to 2024. This optimistic view is supported by the company's strong performance in recent years and strategic investments across its diverse investment portfolio.

For the full year 2024, AvH's net profit reached €460 million, demonstrating a 15% growth. The AvH group, through its share in participations, generated a turnover of €7.6 billion in 2024, highlighting its significant economic impact. This strong financial performance underscores the effectiveness of the AVH Company's growth strategy and its ability to capitalize on market opportunities.

In 2023, Ackermans & Van Haaren NV achieved record-breaking revenue of €2.7 billion, reflecting a 10% year-over-year increase. The Private Equity division significantly contributed to this growth. Projections for 2024 indicated total revenue of €2.9 billion and a net income of €400 million, with EBITDA at €720 million and EPS at €3.10. The renewable energy sector saw particularly strong growth, with sales rising by 25% in 2023.

As of December 2024, the gross profit margin was 37.0%. The average gross profit margin from 2020 to 2024 was 36.3%. This indicates a consistent ability to maintain profitability.

The company's ROCE has improved, reaching 7.3% over the last five years. This demonstrates efficient capital allocation and effective financial management. This is a key indicator of the company's financial performance.

The board of directors proposed a 12% increase in the dividend to €3.80 per share for the general meeting on May 26, 2025. This reflects confidence in the company's financial strength and commitment to shareholders.

The company's solid financial position is further supported by a net cash position of €335.6 million as of end-March 2025. This provides flexibility for future investments and business development.

The financial performance of Ackermans & Van Haaren showcases a robust and growing business. The company's strategic approach to its investment portfolio and business development has yielded positive results, positioning it well for future growth. For more details on the company's ownership, you can read this article: Owners & Shareholders of Ackermans & Van Haaren.

- Strong revenue growth and profitability.

- Improved ROCE, indicating efficient capital use.

- Increased dividend, reflecting shareholder value.

- Healthy net cash position for future opportunities.

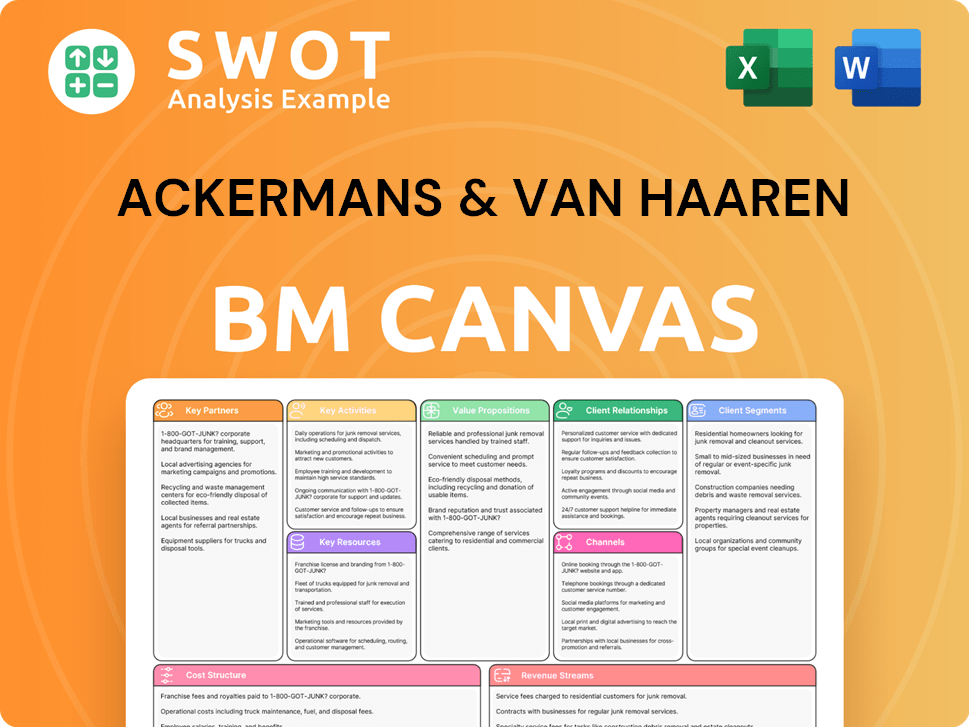

Ackermans & Van Haaren Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ackermans & Van Haaren’s Growth?

The AVH Company faces several potential risks and obstacles that could influence its growth strategy and overall financial performance. These challenges span various aspects of its operations, from market competition and regulatory changes to supply chain vulnerabilities and internal resource constraints. Understanding these risks is crucial for assessing the company's long-term prospects and investment potential. The company's ability to navigate these hurdles will be critical to its continued success.

Market competition remains a persistent challenge across the company's diverse sectors, including Marine Engineering & Contracting, Private Banking, Real Estate, and Energy & Resources. The business must continuously adapt to evolving market dynamics and competitive pressures to maintain its position. Regulatory changes, particularly those related to sustainability, also present significant risks and opportunities, as the company navigates increasing demands for transparency and sustainable practices.

Supply chain vulnerabilities and technological disruption are other ongoing concerns. The company's reliance on complex global supply chains could impact its operations, especially in sectors like Marine Engineering & Contracting and Energy & Resources. Continuous investment in research and development, along with digital transformation, is crucial to maintaining a competitive edge. Moreover, internal resource constraints, such as attracting and retaining skilled talent, can also hinder growth, especially in specialized domains.

The AVH Company operates in highly competitive markets, requiring continuous adaptation to maintain its market position. The need to differentiate itself and innovate is a constant challenge. The company's success depends on its ability to outperform competitors across its various sectors.

Increasing European legislation mandates transparency in sustainability efforts, posing a significant risk. Compliance requires continuous effort and investment. The company is actively working to align with these regulations, viewing them as an opportunity for new strategies and business models.

Supply chain disruptions could affect the Marine Engineering & Contracting and Energy & Resources segments. These sectors rely on complex global supply chains. Managing these vulnerabilities is essential for ensuring operational continuity and avoiding project delays.

Ongoing technological advancements necessitate continuous investment in R&D and digital transformation. The company must stay ahead of the curve to maintain a competitive edge. This requires a proactive approach to innovation and the adoption of new technologies.

Attracting and retaining skilled talent poses a challenge, particularly in specialized fields. The company addresses this through employee development programs. The company plans to allocate €50 million for employee training and development programs in 2024, aiming to increase employee retention rates by 15%.

The real estate sector faces cyclical headwinds, impacting consolidated results. Negative fair value adjustments on its real estate portfolio were seen in 2024. This highlights the importance of diversification to mitigate sector-specific risks.

The company faces increasing pressure to improve its sustainability practices. The company has set ambitious goals, including reducing carbon emissions by 30% by 2030 and aiming for a 100% renewable energy supply in its operations by 2025. Achieving these goals requires significant investment and strategic planning.

The company's investment portfolio is subject to market fluctuations, affecting its financial results. The real estate sector experienced negative fair value adjustments in 2024. The company's ability to navigate these market dynamics is crucial for its overall financial performance.

The diversified nature of the company's portfolio helps buffer against downturns in specific sectors. This illustrates a wise fiscal management approach. The company's strategy to spread risk and capitalize on market opportunities is crucial.

The company's strategic foresight is demonstrated through its proactive approach to sustainability and employee development. The company's investments in employee training and sustainability initiatives reflect a commitment to long-term growth. For more insight, explore the Competitors Landscape of Ackermans & Van Haaren.

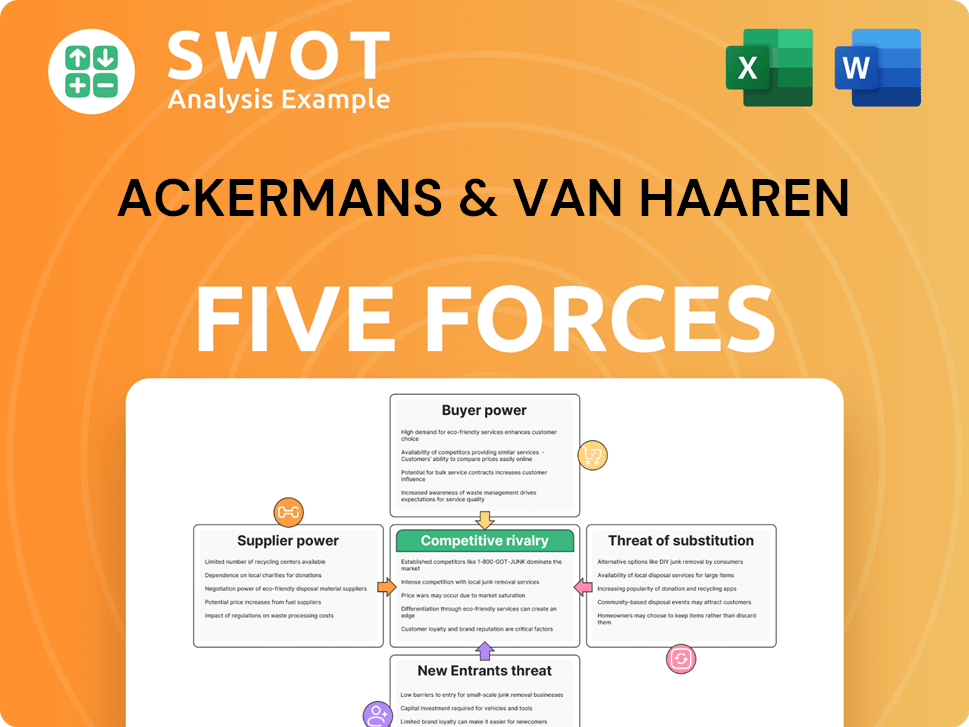

Ackermans & Van Haaren Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ackermans & Van Haaren Company?

- What is Competitive Landscape of Ackermans & Van Haaren Company?

- How Does Ackermans & Van Haaren Company Work?

- What is Sales and Marketing Strategy of Ackermans & Van Haaren Company?

- What is Brief History of Ackermans & Van Haaren Company?

- Who Owns Ackermans & Van Haaren Company?

- What is Customer Demographics and Target Market of Ackermans & Van Haaren Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.