Ackermans & Van Haaren Bundle

Unveiling the Inner Workings of Ackermans & Van Haaren?

Ackermans & Van Haaren (AVH), a prominent Belgian investment company, operates across diverse sectors, from marine engineering to real estate. But how does AVH company actually function, and what drives its sustained success? Understanding the AVH business model is key to appreciating its strategic approach to long-term value creation.

This exploration into How AVH works will dissect the company's operational strategies, revenue streams, and market positioning. We'll examine the Ackermans & Van Haaren SWOT Analysis to understand its strengths and weaknesses. Whether you're an investor, a business strategist, or simply curious, this analysis provides a comprehensive look at AVH's financial performance and investment portfolio breakdown, offering insights into this diversified group's enduring appeal and how it manages its investments.

What Are the Key Operations Driving Ackermans & Van Haaren’s Success?

The AVH company, or Ackermans & Van Haaren, operates through a diversified portfolio of companies, focusing on long-term value creation and active portfolio management. This approach allows AVH to engage in various sectors, each with its unique operational dynamics and value propositions. Understanding how AVH works involves recognizing the strategic guidance and financial strength it provides to its subsidiaries, fostering their leadership in their respective markets.

The core operations of Ackermans & Van Haaren are structured around several key sectors, including Marine Engineering & Contracting, Private Banking, Real Estate, and Energy & Resources. Each sector contributes to AVH's overall value proposition through specialized services and strategic investments. This decentralized yet strategically guided approach enables each subsidiary to excel in its market while benefiting from the group's financial stability and strategic oversight.

The AVH business model is designed to create value through a mix of operational excellence and strategic investments. The company's success is rooted in its ability to identify and nurture promising businesses, providing them with the resources and support needed to thrive. The value proposition is built on a foundation of trust, bespoke financial planning, and a deep commitment to preserving and growing client wealth.

DEME, a subsidiary of AVH, specializes in complex dredging, environmental, and offshore energy solutions. This involves using specialized equipment and advanced engineering for large-scale projects like port development and offshore wind farm installations. The value lies in executing technically demanding projects efficiently.

This segment offers tailored wealth management and private banking services. Operations center on personalized client relationships and sophisticated financial analysis. The value proposition is built on trust, bespoke financial planning, and commitment to growing client wealth.

Extensa develops, manages, and invests in high-quality office, retail, and logistics properties. Value is created through rental income and capital appreciation. The focus is on providing premium, well-located real estate assets.

This sector focuses on sustainable resource management and energy transition initiatives. It represents a smaller part of the overall portfolio, contributing to AVH's diversification. Details on specific projects and financial contributions are less detailed.

AVH's operational uniqueness lies in its decentralized yet strategically guided approach. Subsidiaries lead in their respective markets, benefiting from the group's financial strength and strategic oversight. Supply chains vary widely, from marine equipment logistics to secure digital platforms for private banking.

- Decentralized Management: Subsidiaries operate with significant autonomy.

- Strategic Oversight: AVH provides financial and strategic guidance.

- Diverse Supply Chains: Reflects the varied nature of its businesses.

- Focus on Sustainability: Increasingly important across all sectors.

Ackermans & Van Haaren SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ackermans & Van Haaren Make Money?

The revenue streams of Ackermans & Van Haaren (AVH) are diversified, reflecting its presence in multiple sectors. This Belgian investment company generates income from its core segments, including marine engineering, private banking, real estate, and energy & resources. The AVH business model is designed to create a resilient financial structure by spreading its investments across various sectors.

Marine Engineering & Contracting, a significant contributor, relies on project-based contracts. Private Banking generates revenue through asset management fees and commissions. Real Estate earns income from rental properties and sales. The Energy & Resources segment's revenue depends on the specific business models of its investments.

AVH's monetization strategies emphasize long-term perspectives and recurring income. The company leverages its expertise in project execution for large-scale contracts, particularly in marine engineering. The diversity of these revenue streams provides stability against market fluctuations.

The primary revenue streams and their associated financial data highlight the operational strategies of AVH. Key elements include:

- Marine Engineering & Contracting: DEME, a key subsidiary, had an order book of €7.9 billion as of the first quarter of 2024, indicating substantial future revenue potential.

- Private Banking: Delen Private Bank's assets under management (AuM) reached €53.5 billion as of December 31, 2023, demonstrating a significant recurring revenue stream.

- Real Estate: The fair value of investment properties held by Extensa, AVH's real estate arm, was €1.3 billion as of December 31, 2023, providing stable rental income and potential sales gains.

- Energy & Resources: Revenue is tied to the specific business models of the sustainable ventures in which AVH invests, such as energy production or resource management.

Ackermans & Van Haaren PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Ackermans & Van Haaren’s Business Model?

The evolution of Ackermans & Van Haaren (AVH), a prominent Belgian investment company, is characterized by strategic milestones that have shaped its operational and financial performance. These include significant expansions and shifts in its investment focus, reflecting its adaptability to market changes. The company's ability to navigate complex economic landscapes and capitalize on emerging opportunities has been a key driver of its sustained success. Understanding how AVH works requires examining its key strategic moves and the competitive advantages that underpin its business model.

A core strategic focus for AVH involves sustainability and energy transition, particularly within its Marine Engineering & Contracting arm, DEME. This commitment is demonstrated through substantial investments in renewable energy projects, especially in offshore wind, and environmental solutions. Simultaneously, the consistent growth of assets under management in Private Banking, such as at Delen Private Bank, showcases successful client acquisition and retention strategies. The strategic management of its real estate portfolio under Extensa also plays a crucial role in optimizing returns from property holdings. For investors looking to understand the company's trajectory, exploring Brief History of Ackermans & Van Haaren provides valuable context.

AVH's operational strategies are designed to address challenges such as complex regulatory environments and supply chain disruptions. Its competitive edge is further enhanced by its strong brand reputation, financial strength, and diversified portfolio. The specialized expertise within its operating companies, like DEME’s dredging technology and Delen Private Bank’s wealth management acumen, provides a significant advantage. AVH's active portfolio management ensures it remains competitive and can capitalize on emerging opportunities.

AVH has consistently adapted its portfolio to align with market trends and opportunities. A notable milestone is the expansion into renewable energy through DEME, which has become a leader in offshore wind projects. The growth of Delen Private Bank's assets under management represents a significant achievement in private banking.

AVH's strategic moves include a strong emphasis on sustainability, particularly in its marine engineering division. This involves investing in renewable energy projects like offshore wind farms. The company actively manages its real estate portfolio to optimize returns. Furthermore, AVH focuses on client acquisition and retention in private banking.

AVH's competitive advantages include its strong brand reputation and financial strength, enabling significant investments. The specialized expertise within its operating companies, such as DEME’s cutting-edge dredging technology and Delen Private Bank’s wealth management acumen, provides a significant competitive edge. AVH's diversified portfolio offers resilience and adaptability to changing market conditions.

In recent financial reports, AVH has demonstrated robust performance. For instance, DEME’s order book in offshore energy has shown strong growth, reflecting successful strategic pivots. Delen Private Bank continues to grow its assets under management, indicating successful client acquisition and retention. The company's overall financial health is supported by its diversified investment portfolio.

AVH faces operational challenges such as navigating complex regulatory environments and managing risks in large-scale infrastructure projects. Supply chain disruptions, a global issue, also impact its marine operations. However, the company leverages several competitive advantages to mitigate these challenges and maintain its market position.

- Strong Brand Reputation: Built over decades, enhancing trust and attracting investments.

- Financial Strength: Enables significant investments in key sectors and projects.

- Diversified Portfolio: Provides resilience against market fluctuations.

- Specialized Expertise: Within its operating companies, offering a competitive edge.

- Active Portfolio Management: Adapts to new trends and technology shifts.

Ackermans & Van Haaren Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Ackermans & Van Haaren Positioning Itself for Continued Success?

The AVH company maintains a strong industry position, particularly in its core sectors. Through DEME, it is a global leader in marine engineering and contracting, and its private banking arms, Delen Private Bank and Bank J.Van Breda & Co, hold significant market shares in Belgium and Luxembourg. Extensa, the real estate arm, also possesses a notable portfolio.

Understanding the AVH business model involves recognizing its diversified structure. The company operates across marine engineering, private banking, and real estate. This diversification helps mitigate risk, but the company remains exposed to sector-specific challenges and broader economic cycles. AVH investments are strategically allocated across these sectors to capitalize on growth opportunities and generate long-term value.

In marine engineering and contracting, Ackermans & Van Haaren ranks among the global leaders, particularly through its subsidiary DEME. Delen Private Bank and Bank J.Van Breda & Co hold strong positions in the Belgian and Luxembourgish private banking markets. Extensa has a valuable real estate portfolio.

Economic downturns can impact investment banking and real estate. Fluctuating commodity prices and the cyclical nature of marine infrastructure projects pose risks. Regulatory changes and geopolitical instability also create challenges. New competitors in renewable energy could emerge.

The future outlook for AVH is focused on sustainable growth across its core sectors. Strategic initiatives include expanding in offshore renewable energy, organic growth in private banking, and active real estate portfolio management. The company aims to create long-term value and adapt to market changes.

How AVH works is by investing in market-leading companies and fostering innovation. It maintains a disciplined approach to capital allocation to ensure resilience and profitability. The company's strategy is built on a diversified portfolio and long-term value creation.

The company's strategic focus includes expanding its presence in offshore renewable energy and organic growth in private banking. Ackermans & Van Haaren financial performance is closely tied to the success of these initiatives and the overall economic climate. For detailed insights into the ownership structure and shareholder information, you can refer to the article Owners & Shareholders of Ackermans & Van Haaren.

- Continued investment in market-leading companies.

- Focus on innovation within its portfolio.

- Disciplined capital allocation.

- Adaptation to evolving market dynamics.

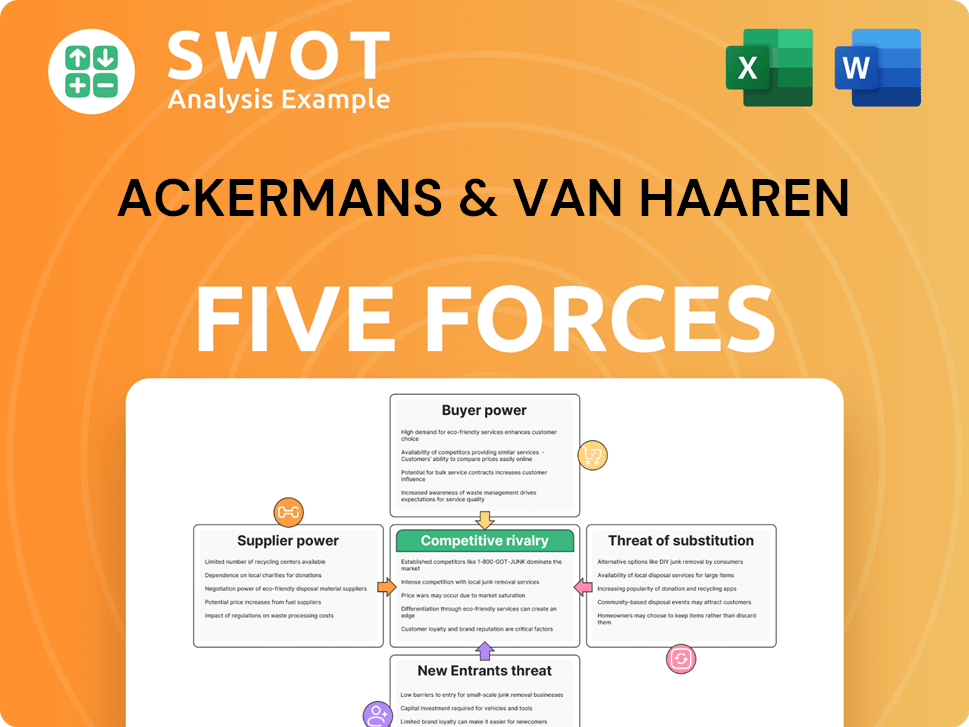

Ackermans & Van Haaren Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ackermans & Van Haaren Company?

- What is Competitive Landscape of Ackermans & Van Haaren Company?

- What is Growth Strategy and Future Prospects of Ackermans & Van Haaren Company?

- What is Sales and Marketing Strategy of Ackermans & Van Haaren Company?

- What is Brief History of Ackermans & Van Haaren Company?

- Who Owns Ackermans & Van Haaren Company?

- What is Customer Demographics and Target Market of Ackermans & Van Haaren Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.