Bilfinger SE Bundle

How Has Bilfinger SE Transformed Over Time?

Journey back in time to uncover the fascinating Bilfinger SE SWOT Analysis and its evolution from a German engineering company to a global industrial services powerhouse. From its humble beginnings in 1880 as Bernatz Ingenieurwissenschaft, this company has navigated a complex landscape of industrial growth and market shifts. Discover the key milestones and strategic decisions that shaped the

This

What is the Bilfinger SE Founding Story?

The story of the Bilfinger SE company begins in the late 19th century. It's a tale of engineering, construction, and strategic partnerships that shaped a major player in the industrial services sector. This brief history of Bilfinger SE company highlights its evolution from a small engineering firm to a global enterprise.

The founding of Bilfinger SE, a prominent German engineering company, can be traced back to 1880. This is when August Bernatz, a master builder, established an engineering business called Bernatz Ingenieurwissenschaft in Lorraine, Germany. The company's early focus was on civil and industrial construction, laying the groundwork for its future endeavors.

In 1883, Bernatz moved his business to Mannheim. The company went through several name changes and partnerships. It became Bernatz & Grün in 1886, and then in 1892, Paul Bilfinger joined as a partner, leading to the company's rebranding as Grün & Bilfinger. This marked a significant shift in its identity.

Grün & Bilfinger's early work centered on civil and industrial construction. Two other companies, Julius Berger Tiefbau AG and Berlinische Boden-Gesellschaft, founded in 1890, also played a role in Bilfinger's history.

- The initial business model revolved around engineering and construction.

- Dresdner Bank held significant stakes in these companies.

- The 1960s saw a plan to create a large, internationally competitive construction company.

- Early services likely included hydraulic engineering projects.

The roots of Bilfinger SE are intertwined with other companies. Julius Berger Tiefbau AG and Berlinische Boden-Gesellschaft, both founded in 1890, also contributed to the company's history. Dresdner Bank held significant stakes in all three entities. This fostered a plan in the 1960s to build a large, internationally competitive construction company.

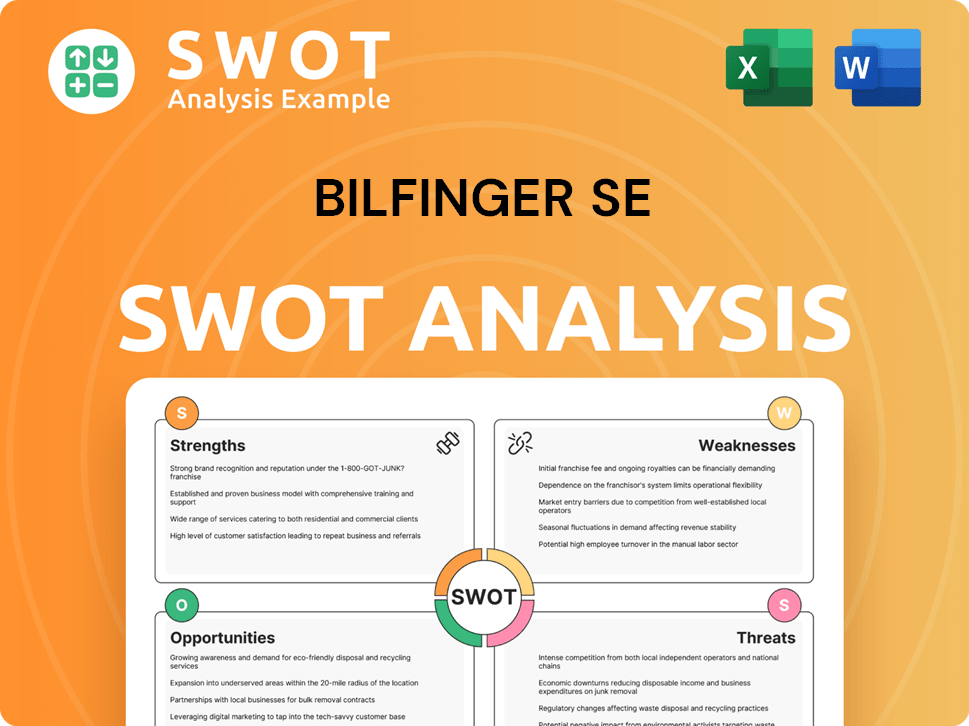

Bilfinger SE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Bilfinger SE?

The early growth and expansion of Bilfinger SE were characterized by strategic mergers and acquisitions. This period saw significant shifts in the company's structure and focus. These changes were crucial in shaping

In 1969, Julius Berger AG merged with Bauboag, the successor to Berlinische Boden-Gesellschaft. This merger was a key step in consolidating the company's position. Grün & Bilfinger AG acquired a majority stake in the merged entity in 1970. By 1975, these companies fully integrated, forming Bilfinger + Berger Bauaktiengesellschaft.

Bilfinger expanded its footprint through acquisitions, beginning in 1978 with a 50% stake in Fru-Con, which it fully acquired in 1984. The company also acquired Baulderstone Hornibrook in 1993 and Razel in 1994. Razel was later sold in 2008 for €137 million. These acquisitions were part of a broader strategy to increase market presence and diversify its portfolio.

A significant shift occurred at the turn of the 21st century as

In the years following the name change, Bilfinger acquired several companies in the industrial, power plant, and real estate service sectors. Simultaneously, it systematically reduced its construction activities. This strategic realignment allowed

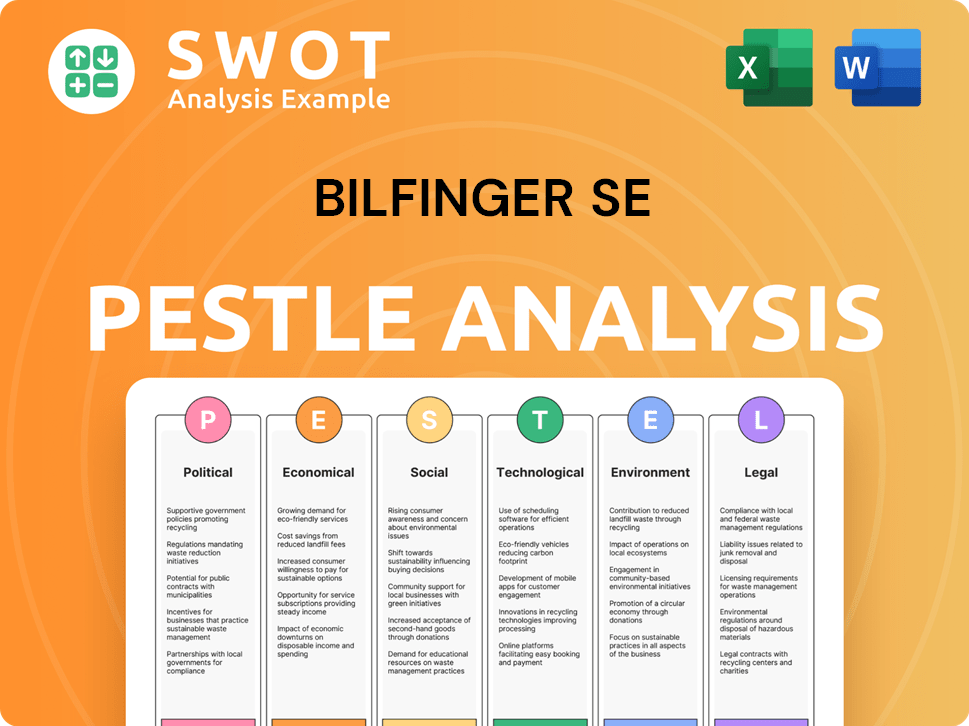

Bilfinger SE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Bilfinger SE history?

The Bilfinger SE company journey has been marked by strategic shifts and significant achievements, evolving from its construction roots to a prominent industrial services provider. This transformation is evident in its rebranding and expansion of service offerings.

| Year | Milestone |

|---|---|

| 2010 | The company changed its legal form to Societas Europaea (SE), reflecting its European focus. |

| 2012 | Renamed to Bilfinger SE, signaling a shift from its construction background to an industrial services focus. |

| 2015 | Restructuring phase, including job cuts, to streamline operations and adapt to market changes. |

| 2020 | Settlement of €18.2 million reached with former directors due to alleged compliance breaches and unsuccessful acquisitions. |

| 2024 | Improved operating performance, achieving an S&P Global Ratings-adjusted margin of 7.5%. |

A key innovation is its comprehensive service portfolio, covering the entire value chain from consulting to digital applications. This integrated approach aims to enhance efficiency and sustainability for clients in the process industry. Bilfinger is investing in digitalization, with planned capital expenditures of about €100 million annually for 2025 and 2026.

Bilfinger is actively investing in digitalization to enhance its service offerings and improve operational efficiency.

The company provides a full range of services, from consulting and engineering to maintenance and digital applications, to meet diverse client needs.

Bilfinger aims to improve sustainability for its customers in the process industry through its integrated service offerings.

The Bilfinger faced challenges, including historical issues during World War II and a multi-year restructuring that involved job cuts. Market conditions and political uncertainties in the chemical and petrochemical industries have also presented obstacles.

During the Second World War, the company employed Jewish slave laborers, a dark chapter in its history.

The company underwent a multi-year restructuring, including significant job cuts, to adapt to changing market conditions and streamline operations.

The chemical and petrochemical industries, particularly in Germany, have presented ongoing challenges due to market conditions and political uncertainties impacting customer investment behavior.

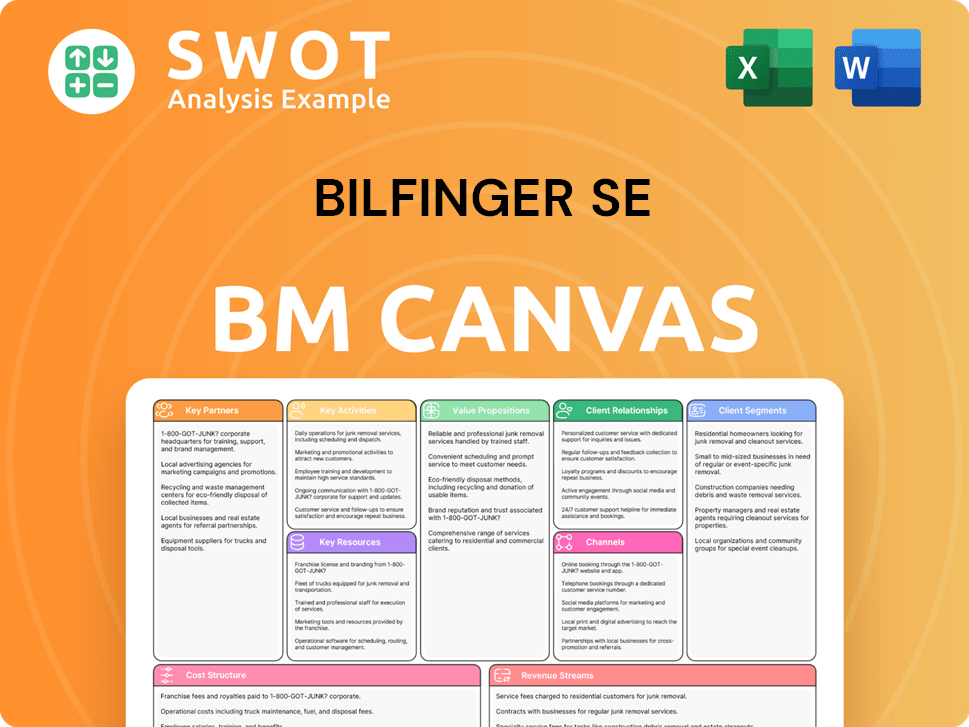

Bilfinger SE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Bilfinger SE?

The Bilfinger SE has a rich history, evolving from its origins in the late 19th century to become a prominent German engineering company. This Bilfinger history includes significant mergers, acquisitions, and strategic shifts that have shaped its current position in the industrial services sector.

| Year | Key Event |

|---|---|

| 1880 | August Bernatz establishes Bernatz Ingenieurwissenschaft, marking the beginning of the company. |

| 1892 | Paul Bilfinger joins as a partner, leading to the formation of Grün & Bilfinger. |

| 1975 | Grün & Bilfinger AG merges with Julius Berger-Bauboag AG, resulting in Bilfinger + Berger Bauaktiengesellschaft. |

| 2001 | The company is renamed Bilfinger Berger AG. |

| 2005 | Bilfinger acquires the Babcock Borsig Service Group. |

| 2010 | Bilfinger undergoes a transformation to Societas Europaea (SE). |

| 2012 | The company is renamed Bilfinger SE. |

| 2014 | The civil engineering division is sold. |

| 2016 | The facilities management and real estate business is divested. |

| 2024 | Revenue increased by 12% year-on-year to €5 billion. |

| 2025 | Q1 revenue surged 17% to €1.267 billion, with the EBITA margin expanding to 4.5%. |

Bilfinger is concentrating on sustainable profitable growth. The company aims to strengthen its position as a solution partner for efficiency and sustainability. This includes a focus on the process industry, specifically in energy, chemicals & petrochemicals, pharma & biopharma, and oil & gas sectors.

The company is targeting an EBITA margin of 6 to 7 percent. It aims for cash conversion of at least 80 percent. The goal is average annual revenue growth of 4 to 5 percent by 2025-2027.

For 2025, Bilfinger projects revenue between €5.1 to €5.7 billion. It anticipates free cash flow to be between €210 and €270 million. These projections reflect the company's confidence in its strategic direction and market opportunities.

Bilfinger plans to continue investing in digitalization and innovation. The company is well-positioned to benefit from the shift towards sustainable energy sources. The focus on industrial efficiency is expected to drive demand for its services.

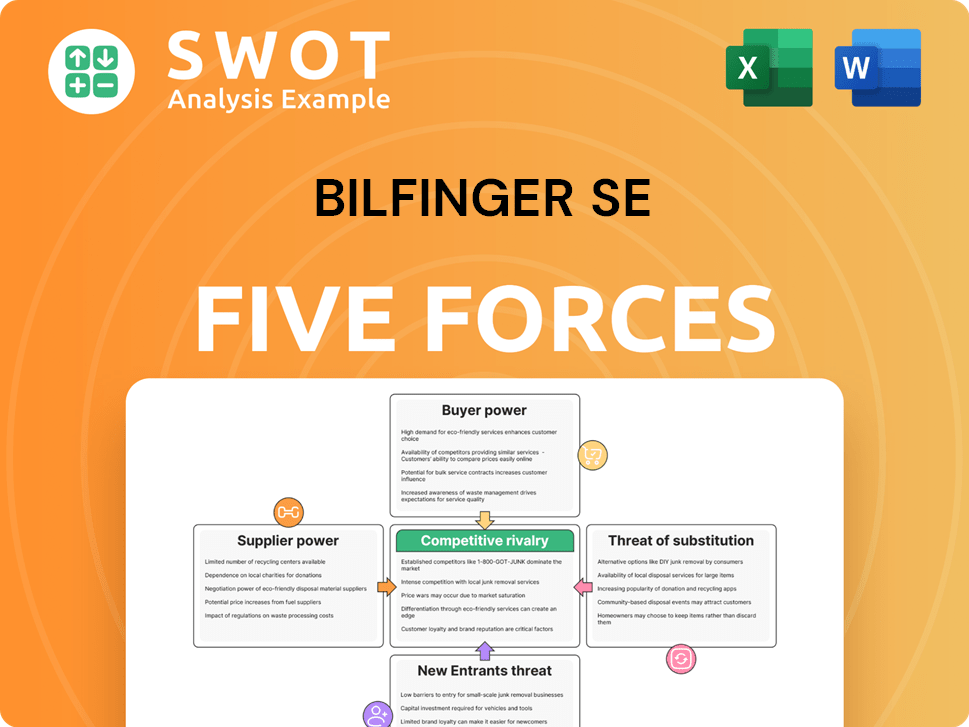

Bilfinger SE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Bilfinger SE Company?

- What is Growth Strategy and Future Prospects of Bilfinger SE Company?

- How Does Bilfinger SE Company Work?

- What is Sales and Marketing Strategy of Bilfinger SE Company?

- What is Brief History of Bilfinger SE Company?

- Who Owns Bilfinger SE Company?

- What is Customer Demographics and Target Market of Bilfinger SE Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.