Bilfinger SE Bundle

Can Bilfinger SE Continue Its Ascent in the Industrial Services Market?

Bilfinger SE, a global leader in industrial services, is actively reshaping its market presence by prioritizing efficiency and sustainability for its clients. This commitment is highlighted by its 'Your Performance Is Our Business' initiative, launched in April 2025, signaling a focused approach to leading the process industry. Since its inception in 1880, Bilfinger has evolved dramatically, and now stands as a key player in the Bilfinger SE SWOT Analysis, offering comprehensive services across multiple sectors.

From its roots as a construction firm, Bilfinger SE has transformed into a comprehensive industrial services provider, serving critical sectors with approximately 31,500 employees across over 25 countries. This expansion reflects a strategic shift towards a full-service model, encompassing everything from engineering and maintenance to digital applications. This article delves into Bilfinger's growth strategy, exploring its future prospects within the dynamic industrial services market, and analyzing its potential for continued financial performance and expansion.

How Is Bilfinger SE Expanding Its Reach?

The expansion initiatives of Bilfinger SE are central to its growth strategy, focusing on both organic and inorganic avenues. This strategic approach aims to broaden its customer base, diversify revenue streams, and adapt to shifts within the industrial services market, especially concerning the energy transition and sustainability solutions. The company's strategic acquisitions and partnerships are key to achieving these goals, positioning it for future growth. For further insights, consider the perspectives of Owners & Shareholders of Bilfinger SE.

Bilfinger SE's growth strategy is significantly influenced by mergers and acquisitions. The acquisition of Stork in April 2024 was a pivotal move, contributing an inorganic revenue growth of approximately 7%-8% in 2024. This impact is projected to increase to 16%-17% in 2025. These acquisitions are designed to enhance Bilfinger's market share and competitiveness within the industrial services sector.

Further demonstrating its commitment to expansion, Bilfinger acquired nZero Group in May 2025. This acquisition expands its footprint in the UK's gas and hydrogen sectors. The company is also integrating approximately 200 McDermott employees into Bilfinger Engineering & Maintenance Central Eastern Europe (Bilfinger E&M CEE) in December 2024, strengthening its engineering capabilities in the Czech Republic.

Bilfinger's strategic acquisitions are a key component of its growth strategy. The acquisition of Stork in April 2024 significantly boosted its revenue, and the acquisition of nZero Group in May 2025 expanded its presence in the UK's gas and hydrogen sectors. These moves are designed to drive revenue growth and enhance its competitive position.

Bilfinger is actively expanding its global presence. The acquisition of nZero Group in the UK and the integration of McDermott employees in Central Eastern Europe are examples of this. The company is also focusing on growth markets in the Middle East, the U.S., and Europe (outside Germany).

Bilfinger is forming strategic partnerships to support its growth. The ten-year strategic partnership with Gasunie, finalized in January 2025, supports the sustainable development of gas transport infrastructure. This partnership builds on a previous collaboration that began in 2024 for engineering services related to hydrogen and CO2 transportation and storage projects.

Bilfinger is allocating significant financial resources to support its expansion. The company plans to allocate up to €100 million-€150 million annually in 2024 and 2025 for bolt-on acquisitions. This investment underscores its commitment to achieving sustained growth and enhancing shareholder value.

Bilfinger's expansion strategy includes strategic acquisitions, geographic expansion, and strategic partnerships. These initiatives are driven by the need to access new customers and diversify revenue streams. The company's focus on the energy transition and sustainability solutions is a key driver of its strategic acquisitions and partnerships.

- Acquisition of Stork (April 2024) contributed to 7%-8% inorganic revenue growth in 2024.

- Acquisition of nZero Group (May 2025) to expand in the UK's gas and hydrogen sectors.

- Integration of approximately 200 McDermott employees into Bilfinger E&M CEE (December 2024).

- Allocating up to €100 million-€150 million annually in 2024 and 2025 for bolt-on acquisitions.

- Ten-year strategic partnership with Gasunie finalized in January 2025.

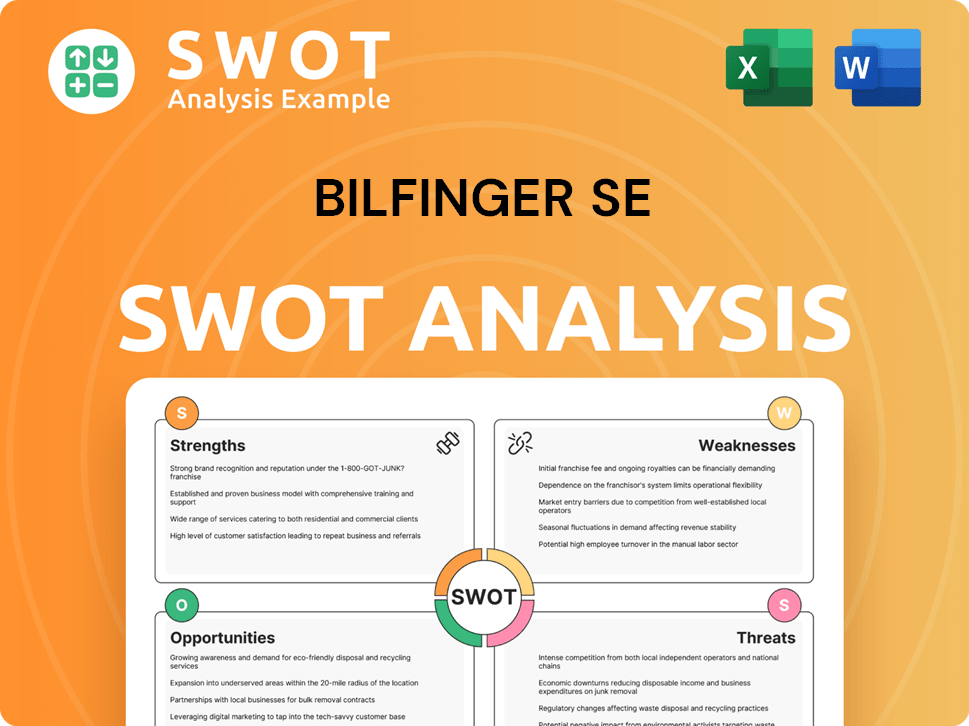

Bilfinger SE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bilfinger SE Invest in Innovation?

The company is actively leveraging innovation and technology to drive its sustained growth within the industrial services market. A key focus is on digital transformation and sustainability initiatives, which are integral to its long-term strategy. This approach allows the company to meet evolving customer needs and preferences in a rapidly changing industry landscape.

The company's strategic investments in digitalization and innovation are designed to enhance operational efficiency, improve service offerings, and support its sustainability goals. These efforts are critical for maintaining a competitive edge and capitalizing on emerging opportunities in the industrial services sector. The company's commitment to these areas reflects a proactive approach to meeting the demands of its customers and the broader market.

To understand the competitive environment, consider the Competitors Landscape of Bilfinger SE.

The company is significantly increasing its capital expenditure on digitalization and innovation. Planned investments are approximately €80 million per year in 2024-2025 and about €100 million a year in 2025 and 2026.

The Bilfinger Connected Asset Performance (BCAP) platform is a cloud-based solution. It integrates data from IT, operational technology (OT), and engineering to enable data migration, process optimization, and predictive analytics.

The company focuses on enhancing efficiency and sustainability for its customers. This includes projects related to carbon capture, hydrogen infrastructure, and sustainable aviation fuel technologies.

Approximately 12% of the company's 2024 revenue was linked to sustainability projects. This positions the company to benefit from global decarbonization trends.

The company aims to reduce its Scope 1 and 2 greenhouse gas emissions by 50% by 2030 compared to 2021. A complete Scope 3 inventory was measured for the first time in 2024.

The company develops in-house mobile applications to increase the efficiency of work processes. These apps also provide increased transparency in operations.

The company's innovation and technology strategy focuses on digital solutions and sustainability. This approach is designed to drive revenue growth and enhance profitability within the industrial services market. The strategic acquisitions and partnerships, such as the nZero Group acquisition and the collaboration with Gasunie, demonstrate the company's commitment to these areas.

- Digitalization: The BCAP platform helps in data integration and process optimization.

- Sustainability: Focus on carbon capture, hydrogen infrastructure, and sustainable aviation fuel.

- Efficiency: In-house mobile applications to improve work processes.

- Financial Commitment: Significant capital expenditure increases for innovation.

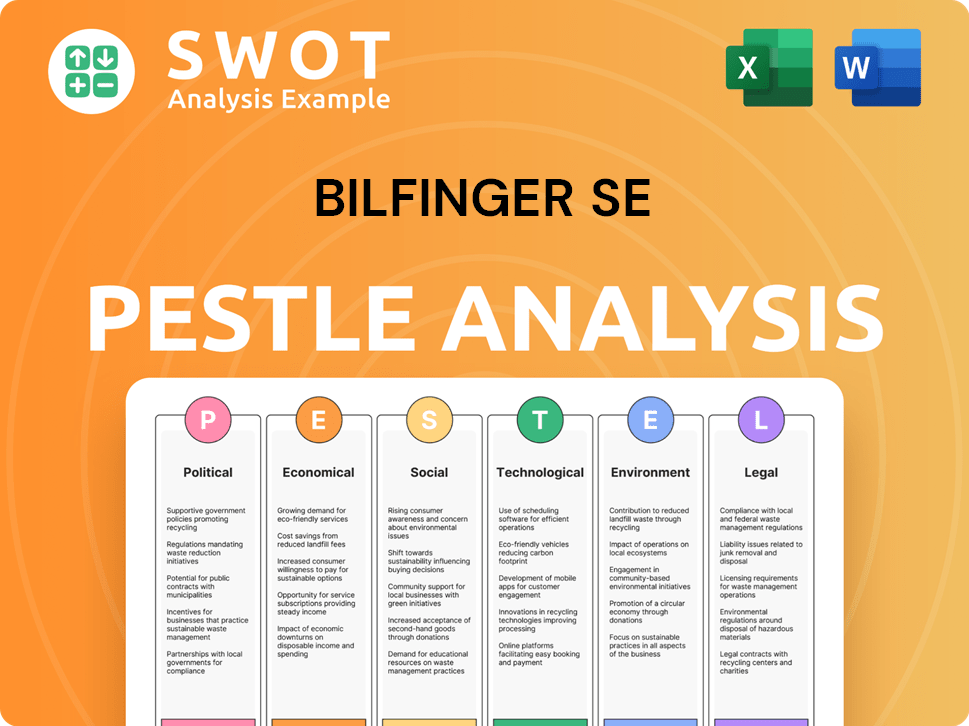

Bilfinger SE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Bilfinger SE’s Growth Forecast?

In 2024, Bilfinger SE demonstrated strong financial performance, achieving all set targets. This success sets a positive tone for its future prospects. The company's focus on the industrial services market and strategic initiatives has driven significant revenue growth and improved profitability. The financial outlook for Bilfinger SE remains positive, supported by its strategic acquisitions and service portfolio expansion.

The company's revenue reached €5,037 million in 2024, marking a 12% increase year-on-year, with 2% organic growth. The EBITA margin improved to 5.2%, resulting in an EBITA of €264 million. The company's commitment to maintaining a conservative balance sheet has been recognized by S&P Global Ratings, which upgraded its long-term issuer credit rating in May 2025.

Bilfinger SE's financial outlook for 2025 is promising, with projected revenue between €5.1 billion and €5.7 billion. The company's strategic focus on engineering and maintenance services, coupled with its global presence, positions it well for continued growth. The company's Q1 2025 results further reinforce this positive outlook, with revenue surging 17% to €1.267 billion.

Bilfinger SE's revenue increased by 12% in 2024, reaching €5,037 million. This growth reflects the company's successful execution of its growth strategy analysis and expansion plans. The organic growth contributed to this positive performance. The company's revenue growth is a key indicator of its success in the industrial services market.

The EBITA margin improved to 5.2% in 2024, resulting in an EBITA of €264 million. This improvement highlights the company's focus on profitability. Net profit for 2024 was €180 million, with earnings per share at €4.79, demonstrating strong financial performance. The company's profitability is a key factor in its competitive landscape.

Free cash flow saw a substantial increase to €189 million in 2024, up 55% from €122 million in 2023. The strong free cash flow generation supports the company's investment opportunities. The company's ability to generate free cash flow is a key factor in its stock forecast.

The company proposed a dividend of €2.40 per share for 2024, reflecting a payout ratio of approximately 53% of adjusted net profit. The dividend reflects the company's commitment to shareholders and its strong financial position. The dividend policy is aligned with the company's strategy.

Looking ahead, Bilfinger anticipates continued growth. The company's mid-term targets include an EBITA margin of 6% to 7%, cash conversion of at least 80%, and average annual revenue growth of 4% to 5%. These targets underscore the company's commitment to sustainable growth and value creation. For more details on the company's target market, you can refer to the Target Market of Bilfinger SE.

Bilfinger expects revenue to be between €5.1 billion and €5.7 billion in 2025. This projection reflects the company's confidence in its expansion plans and its ability to capitalize on opportunities in the industrial services market. This revenue growth is supported by the company's strategic acquisitions.

The company anticipates an EBITA margin ranging from 5.2% to 5.8% in 2025. This outlook indicates continued profitability and operational efficiency. The EBITA margin is a key indicator of Bilfinger SE's profitability.

Free cash flow is projected to be between €210 million and €270 million in 2025. The strong free cash flow will support the company's sustainability initiatives. The company's free cash flow is a key factor in its investment opportunities.

Q1 2025 results show a 17% surge in revenue to €1.267 billion. The EBITA margin expanded to 4.5% from 4.0% in Q1 2024. Free cash flow in Q1 2025 skyrocketed to €109 million, a 354% jump from the prior year.

S&P Global Ratings upgraded Bilfinger's long-term issuer credit rating to 'BBB-' in May 2025. S&P expects Bilfinger's adjusted EBITDA margin to remain above 7.5% in 2025 and 2026. This rating reflects the company's improved profitability and financial strength.

The company has confirmed its mid-term targets, including an EBITA margin of 6% to 7%, cash conversion of at least 80%, and average annual revenue growth of 4% to 5%. These targets demonstrate the company's commitment to long-term value creation. The company's mid-term targets reflect its strategic acquisitions.

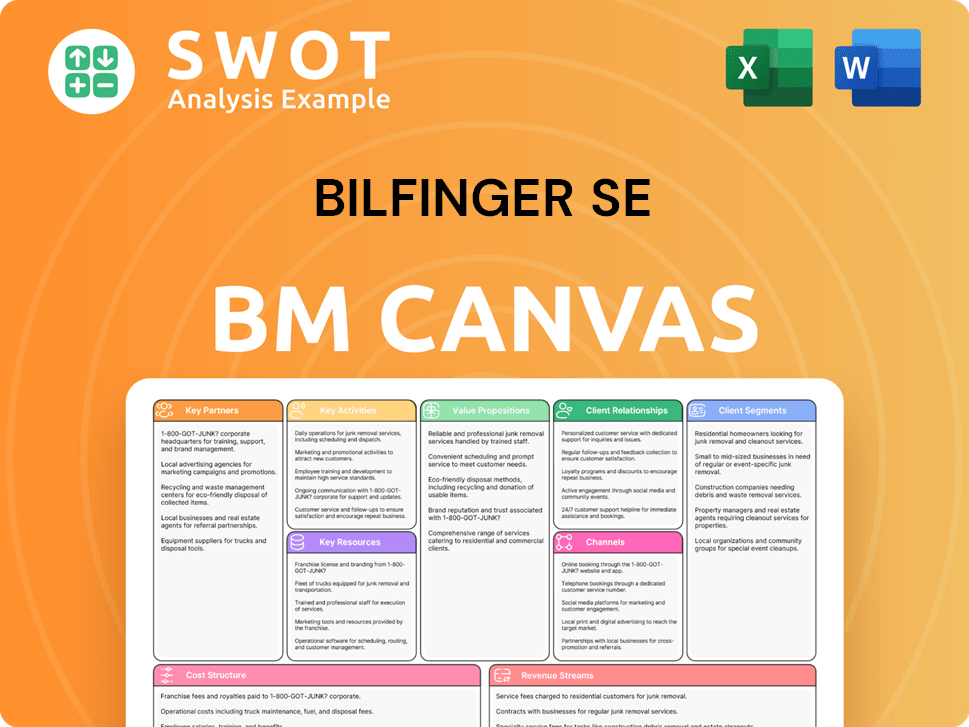

Bilfinger SE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Bilfinger SE’s Growth?

Understanding the potential risks and obstacles is crucial for assessing the Bilfinger SE growth strategy and its future prospects. Several factors could impact the company's ability to achieve its objectives. These challenges span market dynamics, regulatory environments, technological advancements, and internal resource constraints.

Bilfinger SE's operations are subject to market competition and regulatory changes. The company must continuously adapt to maintain its market share. Additionally, supply chain vulnerabilities and technological disruptions pose ongoing threats. The company's ability to attract and retain skilled labor is also critical for sustained growth.

Management employs several strategies to mitigate these risks. Diversifying service offerings and geographical presence helps manage market fluctuations. The focus on 'Operational Excellence' and 'Positioning' as strategic levers aims to ensure cost discipline and enhance market standing. Recent challenges, such as market hesitancy due to political uncertainties, have impacted organic orders received in Q1 2025.

The industrial services market is highly competitive. Bilfinger SE must maintain its competitiveness to preserve its market share. This requires ongoing innovation and efficient operations to stay ahead of rivals.

Regulatory changes in Europe, North America, and the Middle East can affect operations. These changes can influence investment decisions and require careful monitoring and adaptation. Compliance costs can also increase.

Technological advancements pose a constant threat to Bilfinger SE. The company must continuously invest in digital solutions, such as AI and IoT, to avoid disruption. The rapid pace of change requires vigilance.

Supply chain issues can impact project timelines and costs. While not explicitly detailed, such vulnerabilities are inherent in the industrial services sector. Effective supply chain management is crucial for success.

Internal resource constraints, including the need for skilled labor, are significant. Attracting and retaining talent is vital for sustained growth. Workforce reduction initiatives may also create challenges.

Political uncertainties can lead to market hesitancy. This impacted organic orders in Q1 2025. The chemical and petrochemical industries, particularly in Germany, have also presented challenges.

Bilfinger SE diversifies its service offerings and geographical presence to mitigate risks. The focus on 'Operational Excellence' and 'Positioning' helps manage market fluctuations and enhance its market standing. For example, the strategic realignment of its U.S. operations contributed to improved EBITDA margins in 2023.

Bilfinger SE maintains a conservative financial policy. The company targets an S&P Global Ratings-adjusted FFO to debt ratio above 50% to manage financial risks. This approach supports sustainable, profitable growth. For more details, explore the Bilfinger SE expansion plans.

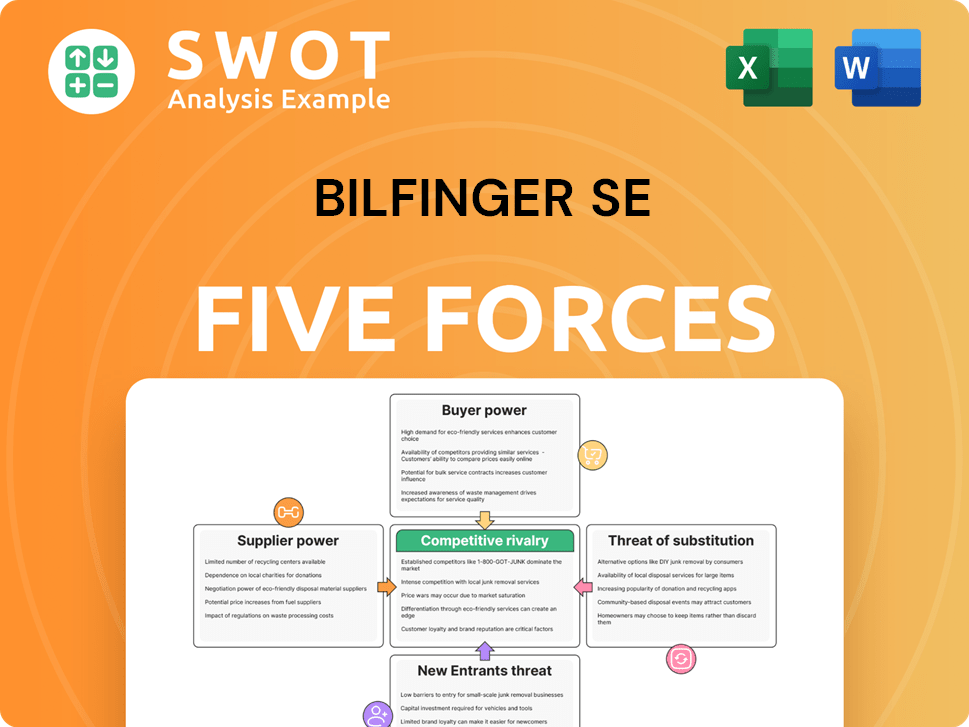

Bilfinger SE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bilfinger SE Company?

- What is Competitive Landscape of Bilfinger SE Company?

- How Does Bilfinger SE Company Work?

- What is Sales and Marketing Strategy of Bilfinger SE Company?

- What is Brief History of Bilfinger SE Company?

- Who Owns Bilfinger SE Company?

- What is Customer Demographics and Target Market of Bilfinger SE Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.