Bilfinger SE Bundle

Unlocking the Secrets of Bilfinger SE: How Does It Thrive?

Bilfinger SE, a global powerhouse in industrial services, is a critical player in sectors like process industries and power plants. Its impressive 2023 financial results, including a €4.577 billion order intake, highlight its robust market presence. But how does the Bilfinger SE SWOT Analysis shape its strategy?

Understanding the Bilfinger company's operations is key for investors and industry watchers alike. Its comprehensive Bilfinger services portfolio, spanning from engineering to maintenance, allows it to address complex client needs. This deep dive into Bilfinger's business will explore its Bilfinger operations, revenue streams, and strategic positioning, offering insights into its resilience and growth potential in a rapidly evolving industrial landscape. We'll also look at the Bilfinger structure and how it contributes to its success.

What Are the Key Operations Driving Bilfinger SE’s Success?

The core of the Bilfinger SE business revolves around providing comprehensive industrial services. This includes a wide range of offerings, from consulting and engineering to maintenance and plant expansions. The Bilfinger company focuses on delivering customized solutions across the entire lifecycle of industrial plants and infrastructure.

Bilfinger's operational processes are highly integrated and specialized. This approach allows the company to enhance efficiency and safety for its clients. The company's commitment to sustainability is also a key driver, helping clients reduce their environmental footprint.

The value proposition of Bilfinger lies in its ability to provide integrated solutions. This approach combines technical expertise with digital tools, leading to improved plant availability and reduced operating costs for clients. This differentiates Bilfinger from competitors that may offer more fragmented services.

Bilfinger services include consulting, engineering, manufacturing, assembly, maintenance, plant expansion, turnarounds, environmental technologies, and digital applications. These services are tailored to meet the specific needs of clients in various industries. This comprehensive approach ensures that Bilfinger can support its clients throughout the entire lifecycle of their industrial assets.

Bilfinger primarily serves customers in the process industries, such as chemicals, petrochemicals, and pharmaceuticals, as well as power plants and the real estate sector. The company's expertise is highly valued in these sectors. Bilfinger adapts its services to meet the unique demands of each industry, ensuring optimal results for its clients.

Bilfinger operations are highly integrated, especially in maintenance and turnarounds. The company uses its engineering expertise and skilled workforce to optimize asset performance and minimize downtime. Supply chain management is also crucial for sourcing specialized components. This ensures efficient service delivery across different geographies.

Bilfinger's value lies in its integrated solutions, combining technical expertise with digital tools. This approach enhances efficiency and safety. The company's sustainability efforts also play a key role. This results in improved plant availability, reduced operating costs, and compliance with environmental regulations for clients.

Bilfinger SE offers significant benefits to its clients through its integrated service approach. This includes improved plant availability and reduced operating costs. The company's commitment to sustainability and compliance with environmental regulations further differentiates it from competitors. This comprehensive approach is detailed in the Marketing Strategy of Bilfinger SE.

- Integrated solutions covering the entire plant lifecycle.

- Technical expertise combined with digital tools for enhanced efficiency.

- Focus on sustainability and environmental compliance.

- Customized services tailored to specific industry needs.

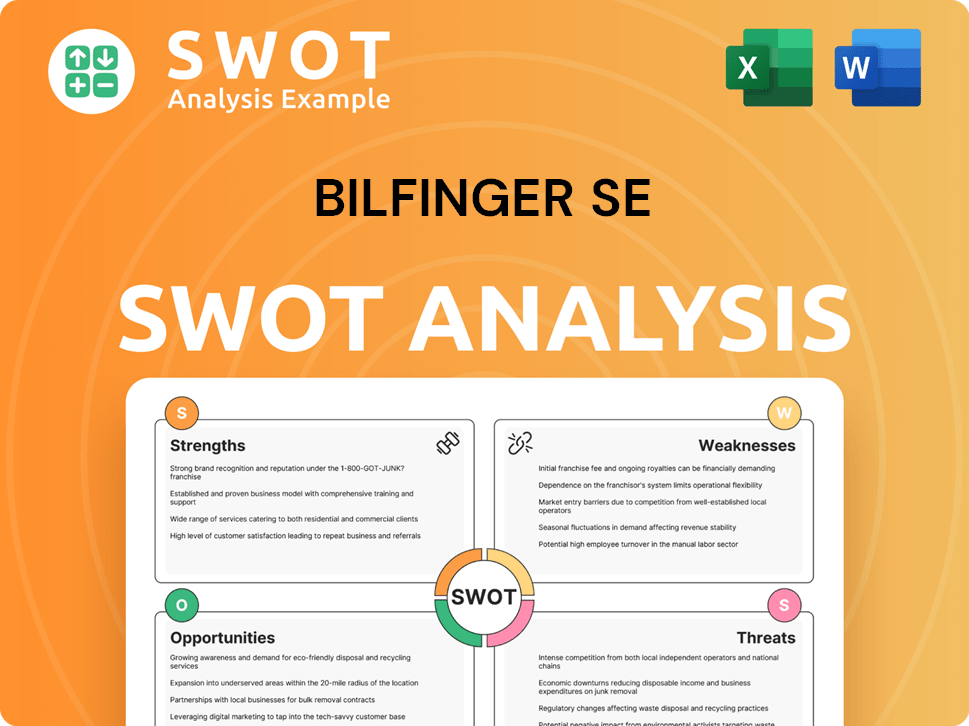

Bilfinger SE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bilfinger SE Make Money?

The Bilfinger SE company generates revenue mainly through its wide range of industrial services. These services are essential for the operations of various industrial clients globally. The company's financial performance reflects its ability to secure and execute projects effectively.

The Bilfinger business model is centered on providing specialized services to industrial clients. This approach allows the company to maintain a consistent revenue stream. The company's success is closely tied to its operational efficiency and ability to meet the evolving needs of the industrial sector.

In fiscal year 2023, Bilfinger reported total revenue of €4.283 billion, indicating the significant scale of its operations. This financial performance underscores the company's strong position in the market and its capacity to deliver value to its stakeholders.

The monetization strategy of the Bilfinger company revolves around project-based contracts and long-term service agreements with industrial clients. These agreements are designed to provide comprehensive solutions, ensuring client satisfaction and repeat business. The company's focus on innovation and sustainability further enhances its value proposition, attracting new clients and expanding its market share. For more details on the company's structure, consider exploring the resources available to Owners & Shareholders of Bilfinger SE.

- Project-Based Contracts: These contracts are common for large-scale projects, such as plant expansions or turnarounds, where the scope of work is clearly defined.

- Long-Term Service Agreements: These agreements cover routine maintenance, digital application support, and other ongoing services, providing a steady revenue stream.

- Cross-Selling Strategies: Leveraging its broad service capabilities, Bilfinger offers bundled solutions to clients, increasing the average revenue per customer.

- Digitalization and Sustainability: The company is expanding its service portfolio in areas like digitalization and sustainability to create new revenue opportunities.

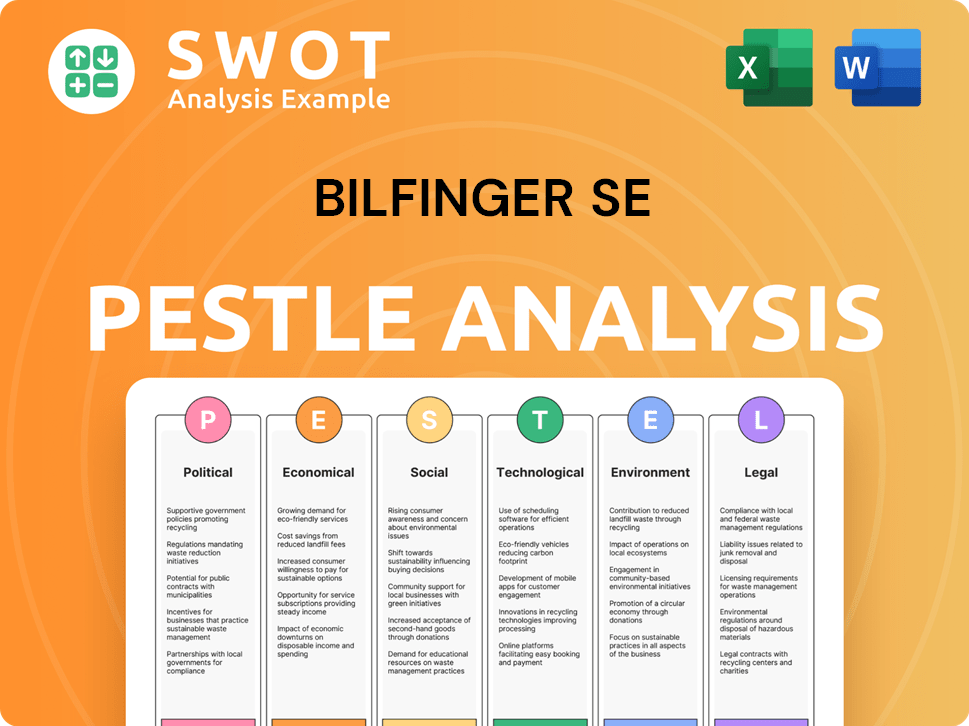

Bilfinger SE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Bilfinger SE’s Business Model?

Bilfinger SE has undergone significant transformations, marked by strategic shifts and key milestones that have shaped its current standing. The Bilfinger company has strategically focused on its core industrial services, divesting from non-core assets to streamline operations and boost profitability. This strategic realignment has been crucial in navigating the dynamic industrial landscape and enhancing its competitive position.

A primary focus for Bilfinger business has been the continuous adaptation to the evolving needs of its clients and the broader industrial sector. This includes investments in digital technologies and sustainability initiatives. The company's ability to deliver complex projects and its commitment to innovation have been pivotal in maintaining its relevance and market share. For further insights, explore the Brief History of Bilfinger SE.

Operational challenges, such as fluctuating raw material prices and geopolitical uncertainties, are addressed through robust risk management and diversification across various industries. Bilfinger services are designed to meet the specific needs of its clients, ensuring operational efficiency and sustainable growth. The company's strategic moves have been instrumental in strengthening its financial performance and market position.

Significant milestones include strategic acquisitions and divestitures aimed at focusing on core industrial services. These moves have helped streamline Bilfinger operations and enhance its market position. The company's history is marked by a series of strategic decisions that have shaped its current structure and capabilities.

Strategic moves include a strong emphasis on digital transformation and sustainability initiatives. Bilfinger has invested in technologies like predictive maintenance and data analytics to optimize service delivery. These initiatives have enhanced operational efficiency and provided added value to clients.

Bilfinger's competitive advantages stem from its extensive technical expertise and long-standing client relationships. The company's strong brand reputation and ability to deliver complex projects provide a significant edge. Furthermore, its focus on digital solutions and sustainability differentiates it from competitors.

In recent financial reports, Bilfinger has demonstrated resilience and growth. For example, in 2024, the company reported a revenue of approximately €4.6 billion, with a strong order intake. These figures reflect the success of its strategic initiatives and operational efficiency. The company's EBITDA margin has consistently improved, indicating effective cost management and profitability.

Bilfinger's strengths include a diversified client base and a global presence. The company's strategy focuses on expanding its service portfolio and geographic footprint. Bilfinger is committed to sustainability, with initiatives aimed at reducing its environmental impact and supporting its clients' sustainability goals.

- Extensive technical expertise and long-standing client relationships.

- Focus on digital solutions and sustainability.

- Strong brand reputation in the industrial services sector.

- Strategic investments in emerging markets and technologies.

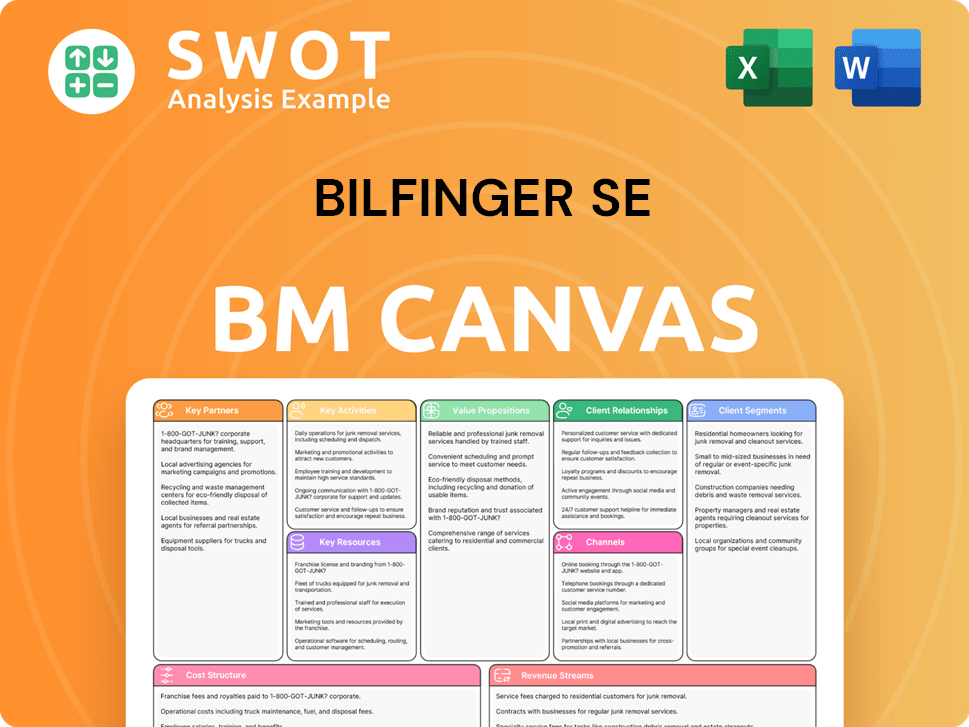

Bilfinger SE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Bilfinger SE Positioning Itself for Continued Success?

The Bilfinger SE company holds a strong position within the industrial services market, competing with both global and regional players. Its market share is significant in specialized areas, such as maintenance and modifications for process industries. The company benefits from high customer loyalty due to the critical nature of its services and long-term client relationships. Bilfinger's global reach, with operations in various regions, further solidifies its industry standing.

Key risks and headwinds that could impact Bilfinger's operations and revenue include economic downturns, regulatory changes, and intense competition. Technological disruption, particularly in automation and artificial intelligence, also presents both opportunities and risks, requiring continuous investment in innovation. The future outlook focuses on sustaining and expanding profitability through strategic initiatives.

Bilfinger operates in a competitive market, offering services like maintenance and engineering. The company's global presence and specialized skills give it an edge. Its focus on long-term contracts and customer relationships supports its market position.

Economic downturns and regulatory changes can affect Bilfinger’s financial performance. Competition from other service providers poses a constant challenge. Technological advancements also require continuous investment and adaptation to stay competitive.

Bilfinger aims to grow by focusing on high-margin services and expanding in growth markets. The company is investing in digitalization and sustainability solutions. They are also leveraging expertise in emerging areas like hydrogen.

The company is focused on enhancing operational efficiency and strengthening its core business. Bilfinger is expanding its presence in attractive growth markets. Strategic investments in digitalization and sustainability are key priorities.

In 2024, Bilfinger's order intake reached approximately €3.4 billion, reflecting stable demand for its services. The company's strategic focus on high-margin services is evident in its adjusted EBITDA margin, which is targeted to be between 6% and 6.5%. They are also leveraging their expertise in emerging areas, like hydrogen and carbon capture, to secure new projects. For more insights, you can explore the Competitors Landscape of Bilfinger SE.

- Focus on high-margin services.

- Expansion in growth markets.

- Investments in digitalization and sustainability.

- Leveraging expertise in hydrogen and carbon capture.

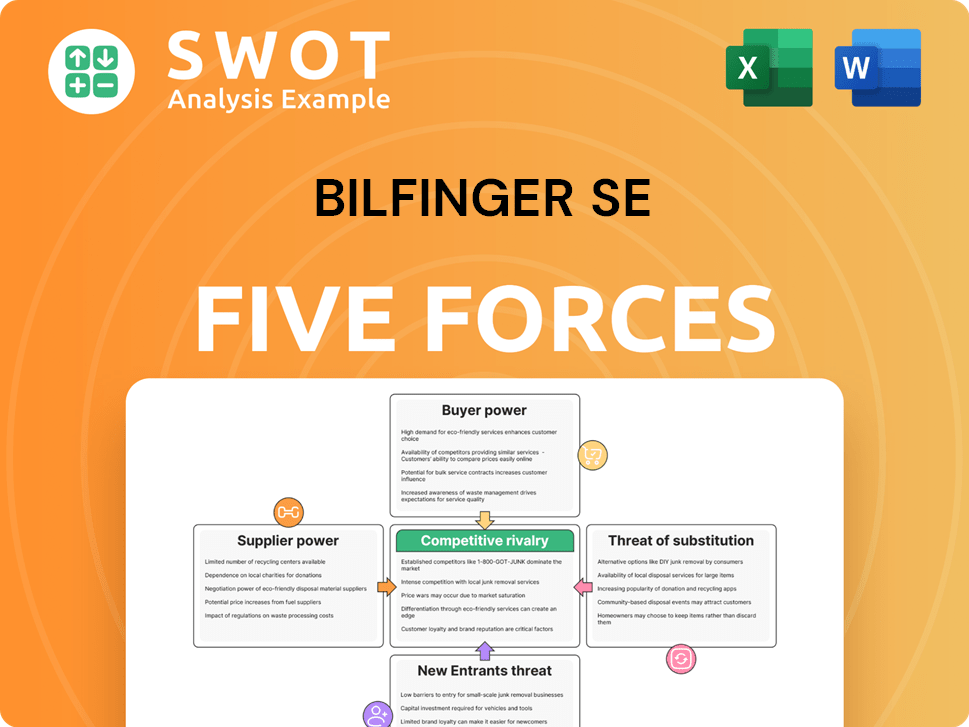

Bilfinger SE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bilfinger SE Company?

- What is Competitive Landscape of Bilfinger SE Company?

- What is Growth Strategy and Future Prospects of Bilfinger SE Company?

- What is Sales and Marketing Strategy of Bilfinger SE Company?

- What is Brief History of Bilfinger SE Company?

- Who Owns Bilfinger SE Company?

- What is Customer Demographics and Target Market of Bilfinger SE Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.