Bilfinger SE Bundle

How Does Bilfinger SE Navigate the Industrial Services Arena?

In today's rapidly evolving industrial sector, understanding the competitive landscape is crucial for informed decision-making. Bilfinger SE, a global leader in industrial services, faces a dynamic environment shaped by digitalization and sustainability demands. This article provides a comprehensive analysis of Bilfinger SE's competitive positioning within its industry, examining its key rivals and strategic advantages.

To gain a deeper understanding of Bilfinger SE's performance, we will dissect its Bilfinger SE SWOT Analysis, explore its market share analysis, and compare it against its key competitors. This comprehensive Bilfinger SE market analysis will also delve into the company's business strategy, recent acquisitions, and future growth prospects within the context of current industry trends and challenges. Furthermore, we will consider Bilfinger SE's financial performance, regional market presence, and competitive advantages to offer actionable insights.

Where Does Bilfinger SE’ Stand in the Current Market?

Bilfinger SE is a prominent player in the industrial services sector, particularly in Europe. The company specializes in maintenance, modifications, and operational support for process industries. Its services span the entire value chain, from consulting and engineering to manufacturing and maintenance, with a strong focus on digital applications.

The company's core operations revolve around serving the chemical, petrochemical, energy, and pharmaceutical industries. This targeted approach allows Bilfinger to offer specialized expertise and tailored solutions. Its value proposition centers on providing integrated and efficient services that enhance the operational performance of its clients.

Geographically, Bilfinger maintains a strong presence across Europe, with additional operations in North America and the Middle East. It serves a diverse customer base, including major industrial corporations and utility providers. The company's strategic shift towards higher-value services and digital solutions reflects industry trends and enhances its competitive positioning.

Bilfinger concentrates on the chemical, petrochemical, energy, and pharmaceutical sectors. This strategic focus allows for specialized service offerings. The company provides services across the entire value chain, from consulting to maintenance, including environmental technologies and digital applications.

The service portfolio includes consulting, engineering, manufacturing, assembly, maintenance, plant expansion, and turnarounds. Digital solutions and environmental technologies are also key components. Bilfinger's offerings are designed to improve operational efficiency and support clients' long-term goals.

Bilfinger has a strong presence in Europe, with operations in North America and the Middle East. This global footprint allows the company to serve a diverse customer base. Its strategic locations support its ability to deliver services efficiently across different regions.

In 2023, Bilfinger reported an order intake of €4,524 million and sales of €4,476 million. The company achieved a positive adjusted EBIT of €104 million. These figures demonstrate stable financial health and continued relevance in the market.

The Growth Strategy of Bilfinger SE highlights the company's strategic initiatives. Bilfinger's competitive landscape includes various players in the industrial services sector. The company's focus on specialized services and digital solutions provides a competitive edge.

- Bilfinger's strong position in the European process industry is a key strength.

- The company's financial performance, including a positive adjusted EBIT, indicates stability.

- Strategic emphasis on higher-value services enhances its market positioning.

- Digital transformation and predictive maintenance are crucial for future growth.

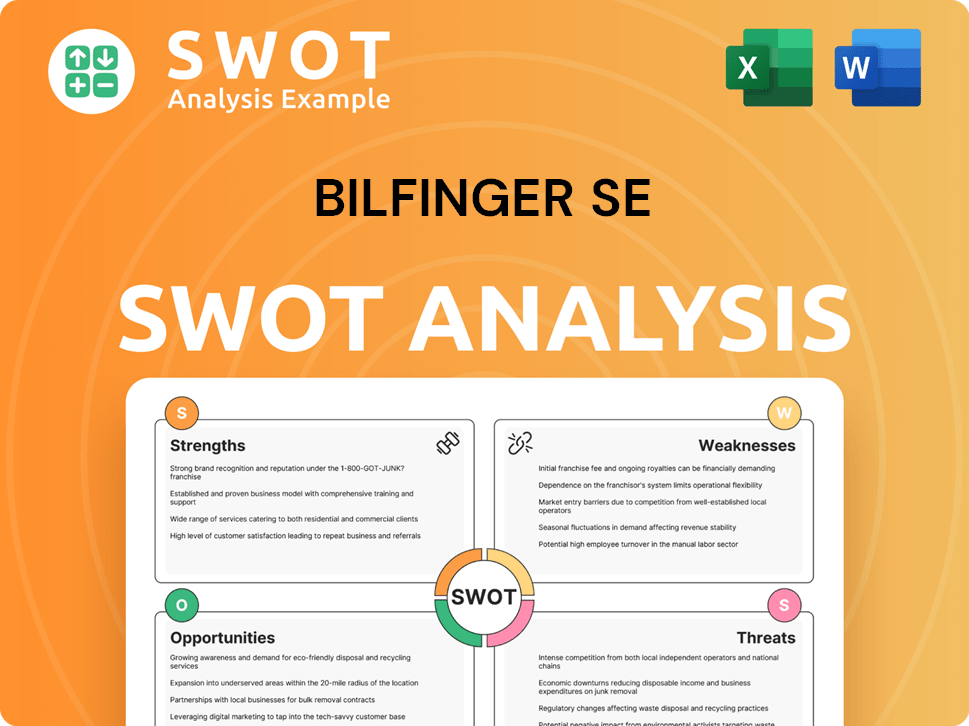

Bilfinger SE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Bilfinger SE?

The Bilfinger SE competitive landscape is characterized by a diverse array of companies vying for market share in the industrial services sector. Understanding the key players and their strategies is crucial for assessing Bilfinger SE's competitive positioning and future growth prospects. A thorough Bilfinger SE market analysis reveals the dynamics of this highly competitive environment.

The Bilfinger SE industry faces constant evolution, driven by technological advancements, changing client demands, and economic fluctuations. This necessitates continuous adaptation and innovation in service offerings and operational strategies. Analyzing the Bilfinger SE financial performance relative to its competitors provides insights into its strengths and areas needing improvement.

Bilfinger SE's business strategy must account for the competitive pressures from both direct and indirect competitors. The ability to differentiate through specialized services, technological integration, and strategic partnerships will be essential for maintaining and enhancing its market position. The competitive landscape is further shaped by mergers and acquisitions, which can significantly alter the industry's structure.

Bilfinger SE competitors include major international engineering and construction firms. These companies offer similar industrial maintenance and project services. They compete on a global scale, often bidding for large-scale industrial projects.

Fluor Corporation is a significant competitor, providing engineering, procurement, construction, and maintenance services worldwide. Fluor's extensive global reach and diverse service offerings make it a direct competitor in many of Bilfinger SE's core markets.

Jacobs Solutions offers professional services across various sectors, including advanced facilities and critical infrastructure. Jacobs often overlaps with Bilfinger SE's engineering and consulting offerings, particularly in specialized industrial projects.

Wood Group focuses on energy and industrial markets, providing consulting, projects, and operations services. Wood Group competes directly with Bilfinger SE in maintenance and asset integrity management, especially in the oil and gas sector.

Indirect competitors include local specialized maintenance providers and larger engineering consultancies. These players often focus on specific regions or service niches. They challenge Bilfinger SE's market share in particular segments.

New and emerging players, particularly in digital solutions and sustainable technologies, are disrupting traditional service models. These companies are leveraging technology to offer innovative services, such as AI-driven predictive maintenance, which puts pressure on established firms.

Competitors employ various strategies to gain market share, including aggressive pricing, continuous innovation, strong brand recognition, and extensive global networks. For example, the adoption of digital twin technology is becoming widespread. Understanding these strategies is crucial for Bilfinger SE's strategic planning.

- Pricing Strategies: Competitors may use competitive pricing to win contracts, particularly in large-scale projects.

- Technological Innovation: Investment in digital tools, such as AI-driven predictive maintenance, is a key differentiator.

- Global Distribution: Extensive global networks allow competitors to serve clients worldwide.

- Mergers and Acquisitions: Consolidations in the engineering and construction sector create larger, more integrated service providers.

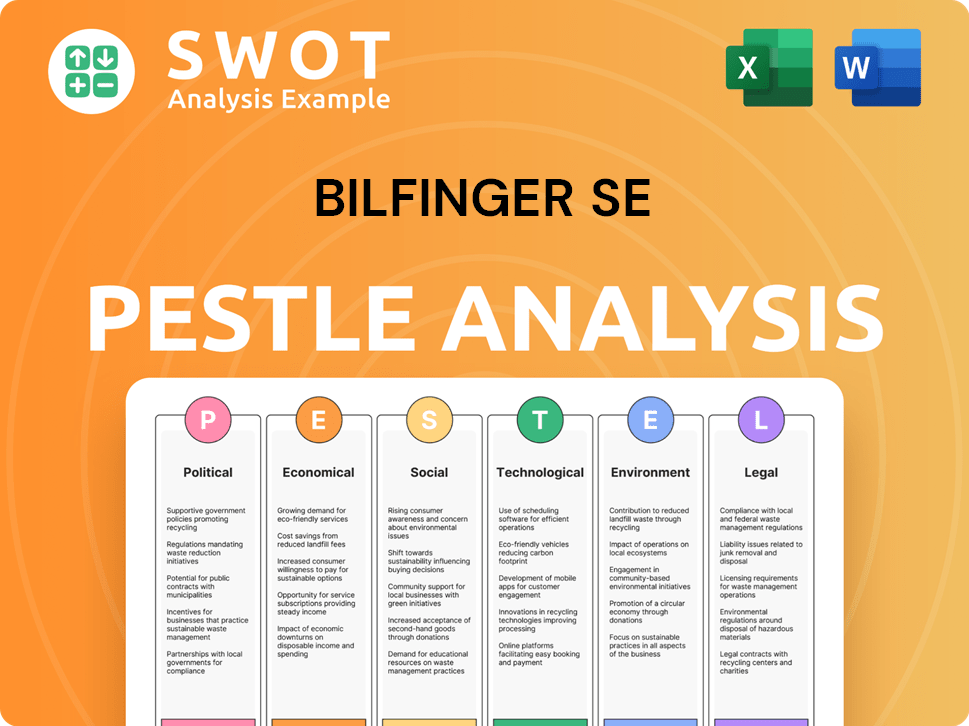

Bilfinger SE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Bilfinger SE a Competitive Edge Over Its Rivals?

Understanding the competitive advantages of Bilfinger SE is crucial for a thorough Bilfinger SE competitive landscape analysis. The company's strengths are rooted in its deep industry expertise and comprehensive service offerings. These advantages allow it to maintain a strong market position within the industrial services sector. A detailed look at these advantages helps to understand Bilfinger SE's competitive positioning.

Bilfinger SE's success is also tied to its established client relationships and global footprint. The company's ability to serve multinational clients across various geographies provides a significant edge. Furthermore, its ongoing investments in digital solutions and sustainable technologies demonstrate its commitment to innovation and staying ahead of industry trends. Analyzing these elements provides insights into the company's Bilfinger SE business strategy.

The industrial services sector is dynamic, and Bilfinger SE faces challenges from rapid technological changes and aggressive competitors. Despite these pressures, its core strengths continue to provide a solid foundation. This analysis is essential for anyone interested in Bilfinger SE market analysis and its future growth prospects.

Bilfinger SE has extensive know-how in complex industrial processes, particularly in the chemical, petrochemical, energy, and pharmaceutical industries. This specialized knowledge allows the company to deliver tailored solutions. This deep understanding of the Bilfinger SE industry is a key advantage.

The company offers a broad range of services, from consulting and engineering to digital applications and environmental technologies. This allows Bilfinger SE to act as a single-source provider. This simplifies procurement and project management for clients.

Bilfinger SE benefits from strong brand equity built over decades of reliable service. This fosters significant customer loyalty, particularly in long-term maintenance contracts. Consistent performance and trust are paramount.

The company's global presence enables it to serve multinational clients across various geographies. This provides a local presence that many smaller competitors cannot match. This is a critical factor in Bilfinger SE vs competitors comparison.

Bilfinger SE's competitive advantages include deep industry expertise, a comprehensive service portfolio, and strong client relationships. The company's global footprint and investment in digital and sustainable technologies also contribute to its success. These factors are crucial in the Bilfinger SE competitive advantages.

- Industry Expertise: Extensive knowledge in key sectors such as chemicals and energy.

- Service Breadth: Offering a wide range of services from consulting to digital solutions.

- Client Loyalty: Strong relationships built on decades of reliable service.

- Global Presence: Serving multinational clients with a local presence.

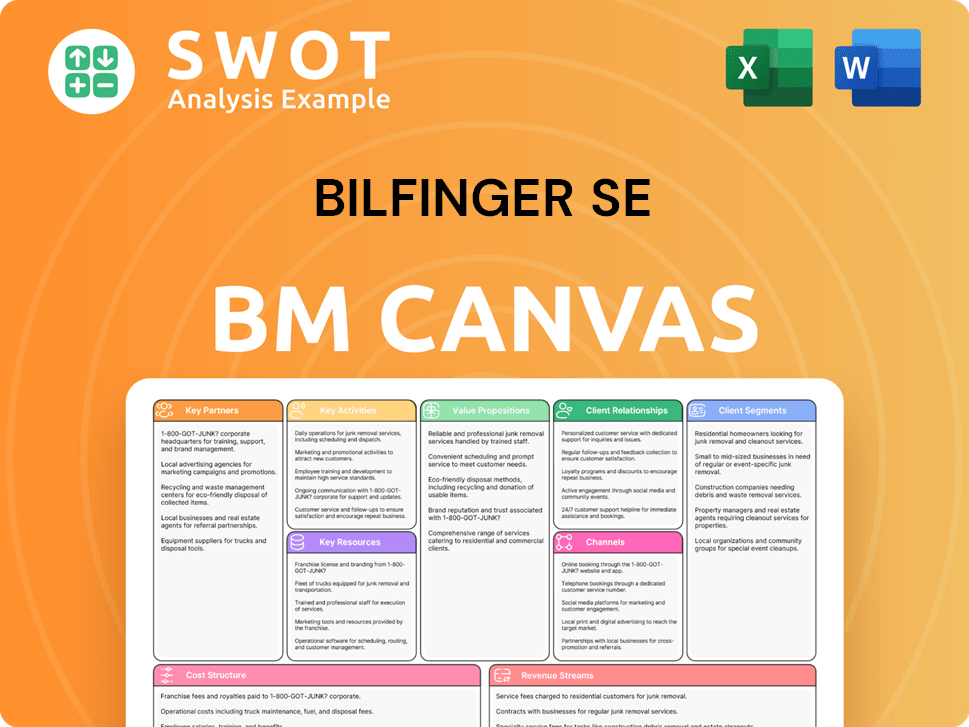

Bilfinger SE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Bilfinger SE’s Competitive Landscape?

The industrial services sector, where Bilfinger SE operates, is experiencing significant shifts driven by technological advancements, regulatory changes, and global economic dynamics. Understanding the current Bilfinger SE competitive landscape requires a deep dive into these trends. The company's ability to navigate these changes will be crucial for its future success. Recent developments and strategic decisions by Bilfinger highlight its adaptation to these market forces.

Key risks include economic volatility, supply chain disruptions, and the evolving regulatory environment, especially concerning ESG factors. The future outlook for Bilfinger SE is closely tied to its ability to capitalize on opportunities in digitalization, sustainability, and emerging markets. Strategic initiatives and partnerships will play a vital role in strengthening its market position and driving sustainable growth. The company's financial performance and business strategy will be critical indicators of its success.

Digitalization is transforming the industrial services sector. This includes the use of predictive maintenance, AI, and digital twins. Sustainability and decarbonization are becoming increasingly important, creating opportunities in green energy infrastructure. These trends are reshaping the Bilfinger SE industry.

Economic shifts, including inflation and supply chain disruptions, pose challenges. The demand for skilled labor remains a persistent issue. The rise of new market entrants specializing in niche solutions could fragment the market. These challenges require strategic responses.

Opportunities exist in emerging markets and further development of digital offerings. Strategic partnerships can expand reach in areas like hydrogen and carbon capture. Focusing on operational excellence and aligning services with sustainable solutions is key. The Target Market of Bilfinger SE is expanding.

Bilfinger is focusing on operational excellence and expanding digital offerings. The company is aligning its services with the growing demand for sustainable industrial solutions. These strategies are designed to strengthen its Bilfinger SE competitive positioning.

The industrial services sector is experiencing significant changes due to digitalization and sustainability demands. Economic challenges and the need for skilled labor are ongoing issues. Strategic responses, including digital expansion and sustainable solutions, are vital. These factors will influence Bilfinger SE financial performance and market share analysis.

- Digital transformation and sustainability initiatives are critical.

- Economic volatility and supply chain issues are significant risks.

- Strategic partnerships and emerging market expansion are key opportunities.

- Operational excellence and talent development are essential for success.

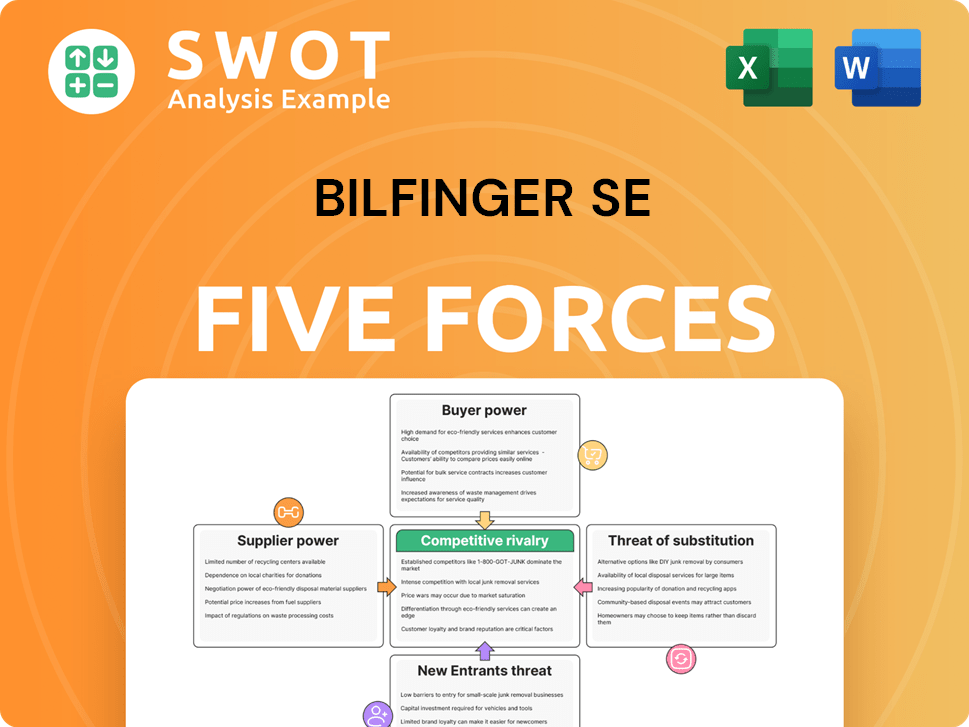

Bilfinger SE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bilfinger SE Company?

- What is Growth Strategy and Future Prospects of Bilfinger SE Company?

- How Does Bilfinger SE Company Work?

- What is Sales and Marketing Strategy of Bilfinger SE Company?

- What is Brief History of Bilfinger SE Company?

- Who Owns Bilfinger SE Company?

- What is Customer Demographics and Target Market of Bilfinger SE Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.