Boqii Holding Bundle

How Did Boqii Holding Company Conquer the Chinese Pet Market?

Journey into the captivating Boqii Holding SWOT Analysis to uncover the story of Boqii, a leading force in China's booming pet industry. From its humble beginnings in 2008, Boqii has revolutionized how pet owners in China access supplies and services. Discover the key milestones that propelled Boqii's rise to prominence in the competitive Chinese pet market.

Boqii's story is a testament to its adaptability and foresight in recognizing the evolving needs of pet owners. The company's early focus on building a comprehensive online platform for pet products and community engagement set the stage for its impressive growth. Understanding Boqii's history provides valuable insights into its strategic decisions, market positioning, and the challenges it has overcome within the dynamic Chinese pet market. The company's evolution from an online retailer to a multifaceted platform reflects its commitment to innovation and customer satisfaction.

What is the Boqii Holding Founding Story?

The story of Boqii Holding Company began in China in 2008. The company's roots trace back to December 2007 with the establishment of Guangcheng Technology. This marked the formal beginning of what would become a leading player in the Chinese pet market.

The founders, Hao Liang and Yingzhi Tang, saw a growing need. They recognized the trend of 'pet humanization' in China. This fueled their vision to create a comprehensive platform for the emerging generation of pet owners.

Their focus was on providing a reliable space for pet parents. They wanted to offer a wide range of products and information to support pet well-being. This vision led to the development of a unique business model.

Boqii launched in 2008 with two main components: the Boqii Community and Boqii Mall. The community platform allowed pet owners to share experiences. The mall offered a self-operated online sales platform. This dual approach aimed to build a loyal customer base.

- The Boqii Community was an online platform for pet parents.

- Boqii Mall was a self-operated online sales platform.

- The company aimed to cultivate lifelong customers.

- The founders identified a gap in the market for a centralized platform.

The founders, Hao Liang, Chairman and CEO, and Yingzhi Tang, Co-CEO, CFO, and Director, identified a significant gap in the market. They noticed a lack of a centralized, trustworthy platform for Chinese pet owners. This realization led to the creation of Boqii's initial offerings.

Boqii's early business model focused on creating both an e-commerce platform and a community. This strategy suggests a commitment to long-term customer engagement. For more details on their growth strategy, you can read about the Growth Strategy of Boqii Holding.

The initial funding sources are not explicitly detailed. However, the dual focus on e-commerce and community suggests a strategic investment in customer relationships.

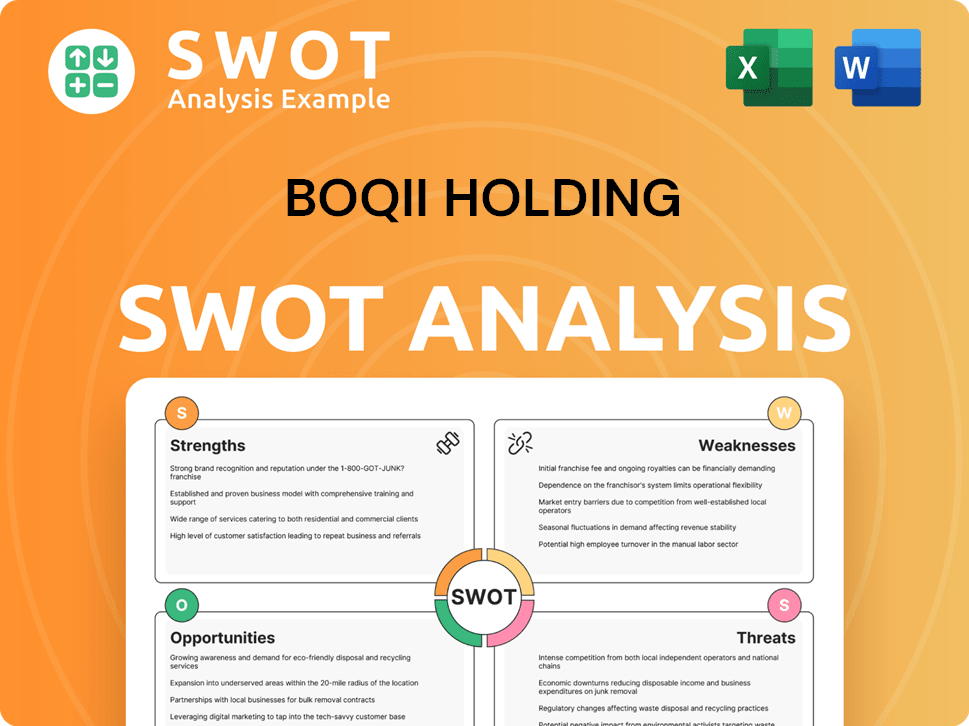

Boqii Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Boqii Holding?

The early growth of Boqii Holding Company centered on developing its e-commerce platform alongside community features, forming an integrated ecosystem. This approach helped establish the company in the burgeoning Chinese pet market. The launch of its mobile app, Boqii Pet, further solidified its position, becoming a leading online community for pet owners. The company's expansion strategy included both online and offline initiatives.

Boqii began with the simultaneous development of its e-commerce platform and community features. By 2008, it had established Boqii Community and Boqii Mall. The launch of the Boqii Pet mobile application in 2014 was a significant step, becoming the largest pet-focused online community in China by 2019 in terms of registered and active users. This early focus on community building helped Boqii gain traction in the Chinese pet market.

By June 30, 2020, Boqii's platform offered access to 17,853 SKUs. Since its inception, it had delivered over 43.2 million online orders. This demonstrates the company's ability to handle a large volume of transactions and fulfill orders efficiently. This focus on e-commerce was crucial for capturing market share in the online pet supplies China sector.

In 2015, Boqii launched its private label, Yoken, initially focusing on pet staple foods. This marked a shift from being solely a retail aggregator to developing its own brands. Subsequent private labels included Mocare for freeze-dry cat and dog food, and D-cat for pet snacks, supplies, pharmaceuticals, and medical care products. By September 30, 2024, these private labels increased their SKUs from 3,088 to 3,546, and their revenue share rose from 27.5% to 29.0% in the first half of fiscal year 2025.

Boqii expanded its reach through an offline distribution network, connecting with over 15,000 physical pet stores and pet hospitals across 250 cities in China. This omni-channel approach aimed to increase brand awareness. The company's IPO on the NYSE in October 2020 was a significant milestone, providing capital for further growth. For more information on the company's stakeholders, read Owners & Shareholders of Boqii Holding.

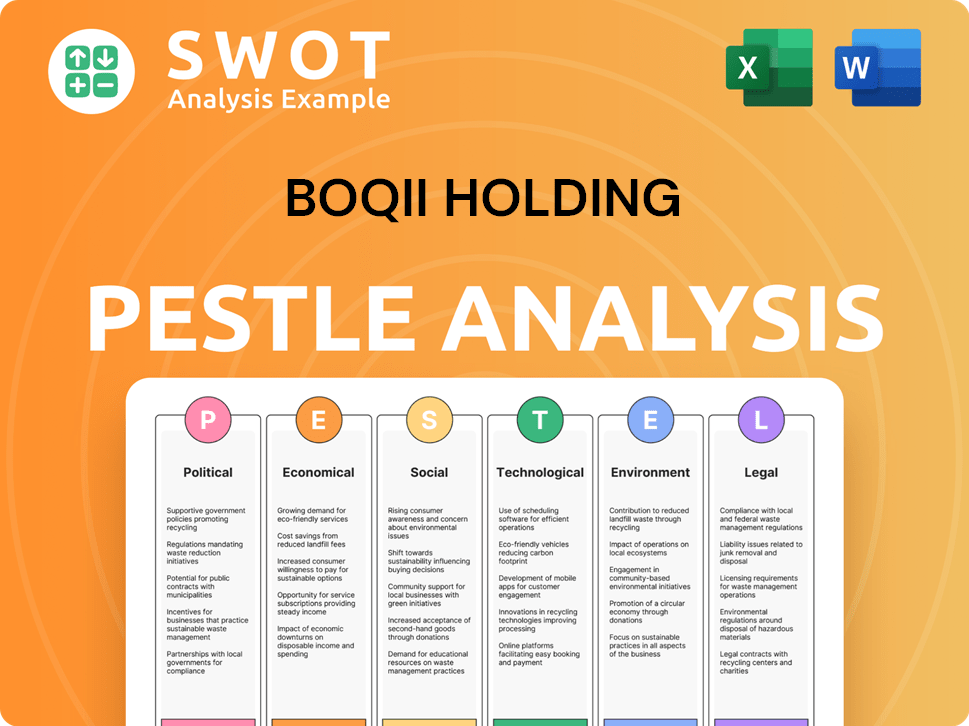

Boqii Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Boqii Holding history?

Boqii Holding Company has marked significant milestones throughout its journey in the Chinese pet market. A key achievement was the launch of the Boqii Pet mobile app in 2014, which became China's largest pet-focused online community by 2019. Another defining moment was Boqii's successful IPO on the NYSE in October 2020, making it the first publicly traded pet-focused platform in China.

| Year | Milestone |

|---|---|

| 2014 | Launched the Boqii Pet mobile app, which became China's largest pet-focused online community by 2019. |

| 2015 | Launched private label brands like Yoken. |

| October 2020 | Boqii Holding Company's IPO on the NYSE, becoming the first publicly traded pet-focused platform in China. |

| October 2023 | Transferred to NYSE American. |

| January 2025 | Implemented a 1-for-10 reverse stock split. |

Boqii Holding Company has been innovative in its approach to the Chinese pet market. The company strategically developed its own private label brands, such as Yoken, Mocare, and D-cat, to offer a wider range of products. This move allowed Boqii to capture a larger share of the market and provide competitively priced items.

Boqii's development of private label brands like Yoken, Mocare, and D-cat expanded its product offerings. By the first half of fiscal year 2025, the number of private label SKUs increased to 3,546.

Boqii expanded its offline network to connect with over 15,000 physical pet stores and hospitals across 250 cities in China. This strategy helped Boqii reach a broader customer base.

The Boqii Pet mobile app became China's largest pet-focused online community. This demonstrated a strong grasp of digital engagement and community building.

Boqii Holding Company has faced several challenges in the competitive Chinese pet market. The company experienced revenue declines, with total revenues decreasing to RMB 249.7 million (US$35.6 million) in the first half of fiscal year 2025. Additionally, Boqii faced compliance issues with the NYSE, leading to a transfer to NYSE American and a reverse stock split.

Boqii's total revenues decreased to RMB 249.7 million (US$35.6 million) in the first half of fiscal year 2025 from RMB 389.4 million in the prior year period. For the fiscal year ending March 31, 2024, Boqii Holding had an annual revenue of $709.35 million, representing a 35.05% decrease compared to the previous fiscal year.

The company faced compliance issues with the NYSE due to its stock trading below the required price. This led to a transfer to NYSE American and a 1-for-10 reverse stock split in January 2025.

The Chinese pet market is highly competitive, requiring continuous adaptation. Boqii has focused on increasing profitability and implementing cost-saving initiatives.

Boqii focused on increasing profitability over sales volume, implementing cost-saving initiatives. These efforts resulted in a 29.3% decrease in operating expenses in the first half of fiscal year 2025.

The company improved its net loss by 21.6% and its gross margin by 70 basis points to 20.7% in the first half of fiscal year 2025. This shows efforts to enhance financial stability.

Boqii has adapted its strategy to focus on profitability and cost-saving measures. This includes a shift toward higher-margin products and operational efficiencies.

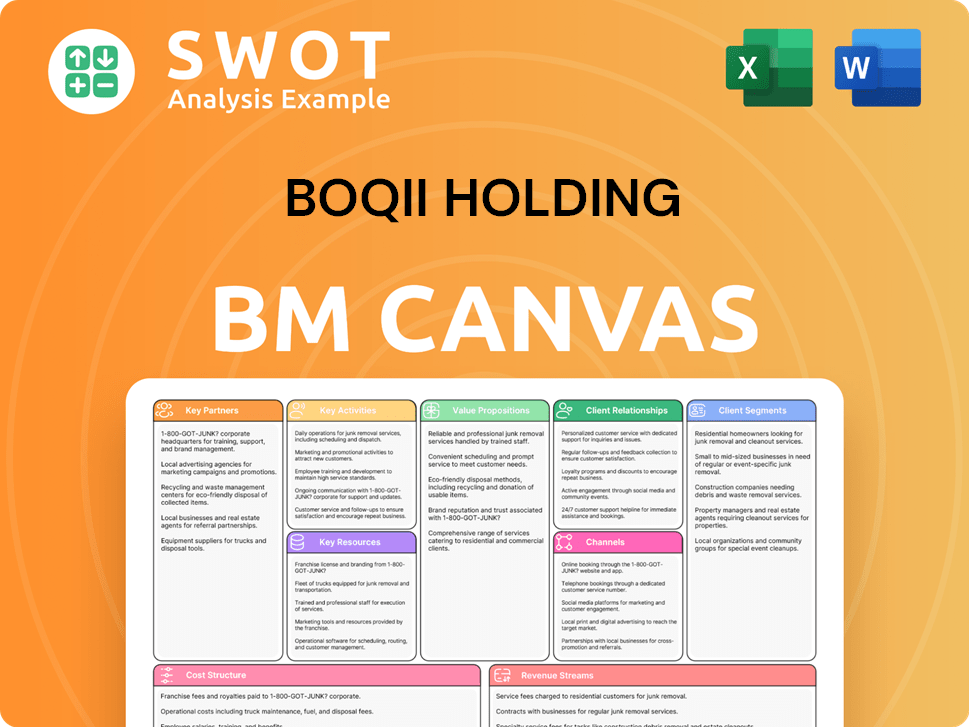

Boqii Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Boqii Holding?

The Boqii history is marked by significant milestones. Beginning in 2008 with the launch of its online platform, Boqii has grown substantially in the Chinese pet market. Key events include the launch of its mobile app in 2014 and its private label brand in 2015. The company achieved a major milestone in October 2020 with its IPO, becoming the first pet-focused platform to be publicly traded in China. Recent developments include strategic investments, board changes, and a listing transfer to NYSE American. Financial results from the first half of fiscal year 2025 show improvements in net loss and gross margin, signaling a strategic shift towards profitability.

| Year | Key Event |

|---|---|

| 2008 | Boqii Community and Boqii Mall were launched, establishing an online retail and content platform. |

| 2014 | Boqii Pet mobile app was launched, becoming China's largest pet-focused online community. |

| 2015 | Private label brand Yoken was launched, focusing on pet staple foods. |

| October 2020 | Boqii Holding successfully completed its IPO on the NYSE. |

| July 2021 | Better Choice Company announced a strategic investment by Boqii Holding Limited. |

| September 2022 | Mr. Kai Fang resigned as Chief Strategy Officer. |

| May 2023 | Board changes were announced, with Mr. Su Zhang appointed as an independent director. |

| October 2023 | Boqii Holding Limited transferred its listing to NYSE American. |

| October 2024 | Boqii filed its annual report on Form 20-F for fiscal year 2024. |

| December 2024 | Boqii announced its fiscal 2025 first half unaudited financial results. |

| January 2025 | Boqii announced an ADS ratio change, a 1-for-10 reverse split on existing ADSs, effective January 21, 2025. |

| May 2025 | Boqii filed an amendment to SEC Form F-1/A. |

Boqii Holding Company is concentrating on enhancing profitability. The company is prioritizing financial health by focusing on strategic initiatives. Boqii is working towards improving its financial metrics, including reducing net loss and increasing gross margin.

The company is expanding its private label brands, such as Yoken and Mocare. These brands are increasing their SKUs and revenue share. Boqii's strategy includes a focus on cost-saving measures to improve operational efficiency.

In the first half of fiscal year 2025, total revenues were RMB 249.7 million (US$35.6 million). Net loss decreased by 21.6% to RMB 29.6 million (US$4.2 million). Gross margin improved to 20.7% due to the company's strategic shifts.

Boqii aims to leverage its established online platform and expanding offline network. The company is focused on capitalizing on its competitive advantages within the Chinese pet market. Boqii's leadership emphasizes empowering the pet ecosystem to drive future success.

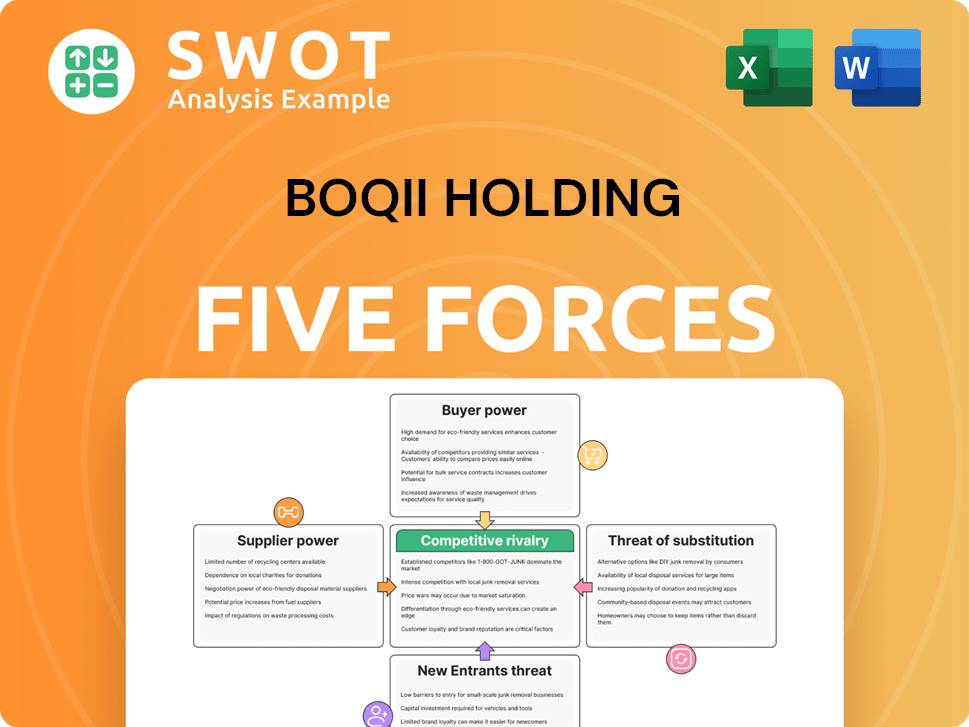

Boqii Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Boqii Holding Company?

- What is Growth Strategy and Future Prospects of Boqii Holding Company?

- How Does Boqii Holding Company Work?

- What is Sales and Marketing Strategy of Boqii Holding Company?

- What is Brief History of Boqii Holding Company?

- Who Owns Boqii Holding Company?

- What is Customer Demographics and Target Market of Boqii Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.