Boqii Holding Bundle

Unlocking the Secrets of Boqii Holding Company: How Does It Thrive?

In the booming Chinese pet market, Boqii Holding Company has emerged as a dominant force. This leading Boqii Holding SWOT Analysis provides a deep dive into how Boqii has captured the hearts (and wallets) of pet owners nationwide. Discover the inner workings of this online pet store and its innovative approach to the pet supplies industry.

Understanding the Boqii business model is key to grasping its success. This exploration will uncover its core operations, diverse revenue streams, and strategic maneuvers within the competitive Chinese pet market. Investors, customers, and industry watchers alike will gain valuable insights into Boqii's potential for future growth and its ability to maintain its market leadership in the face of competition. Learn about Boqii Holding Company's financial performance, its products, and how it has achieved its current market share.

What Are the Key Operations Driving Boqii Holding’s Success?

Boqii Holding Company operates as a comprehensive online ecosystem for pet owners, primarily in China. Its core value proposition centers on providing a one-stop shop for pet owners, offering a wide range of products and services. This includes an extensive online retail platform for pet supplies, educational content, community engagement, and integrated pet services.

The company's business model is designed to cater to a broad demographic within the Chinese pet market. Boqii aims to capture both new and experienced pet owners by providing convenience, reliability, and a sense of community. This approach helps foster strong customer loyalty and differentiates Boqii from competitors.

The operational processes of Boqii are multifaceted, encompassing e-commerce infrastructure, technology development, and partnerships with service providers. The company leverages a sophisticated e-commerce infrastructure for product sales, including direct sourcing, warehousing, and a robust logistics network. Technology development is central to its operations, continuously enhancing the user experience on its mobile app and website. Boqii's supply chain management focuses on ensuring product authenticity and timely delivery, while its partnerships expand its reach and diversify its offerings.

Boqii's primary offerings include an online retail platform for pet products, such as food, toys, and health supplements. It provides a rich content hub with pet care information and training guides. The platform also features a vibrant online community where pet owners can connect.

The company employs an e-commerce infrastructure for product sales, including direct sourcing and a robust logistics network. Technology development is key, with continuous improvements to the user experience. Partnerships with local pet service providers expand its service offerings.

Boqii's value lies in its 'one-stop shop' approach, combining product sales, educational content, and community engagement. This creates a convenient and reliable ecosystem for pet owners. The holistic approach fosters strong customer loyalty.

Boqii primarily serves individual pet owners across various demographics and income levels within China. This includes both first-time pet parents and experienced enthusiasts. Boqii's focus is on the Chinese pet market.

Boqii's integrated approach distinguishes it from competitors, many of whom focus solely on product sales or specific services. By combining a vast product selection with educational content, community engagement, and a growing array of pet services on a single platform, Boqii creates a sticky ecosystem. This holistic approach translates into significant customer benefits, offering convenience, reliability, and a sense of belonging for pet owners. To understand how Boqii positions itself against other players in the market, consider exploring the Competitors Landscape of Boqii Holding.

Boqii's operations are centered around a sophisticated e-commerce platform and a strong logistics network. Technology development is crucial for enhancing user experience and personalizing recommendations. Partnerships with local service providers expand its offerings.

- E-commerce infrastructure for product sales, including direct sourcing and warehousing.

- Continuous technology development to improve the user experience.

- Partnerships with local pet service providers.

- Focus on supply chain management to ensure product authenticity and timely delivery.

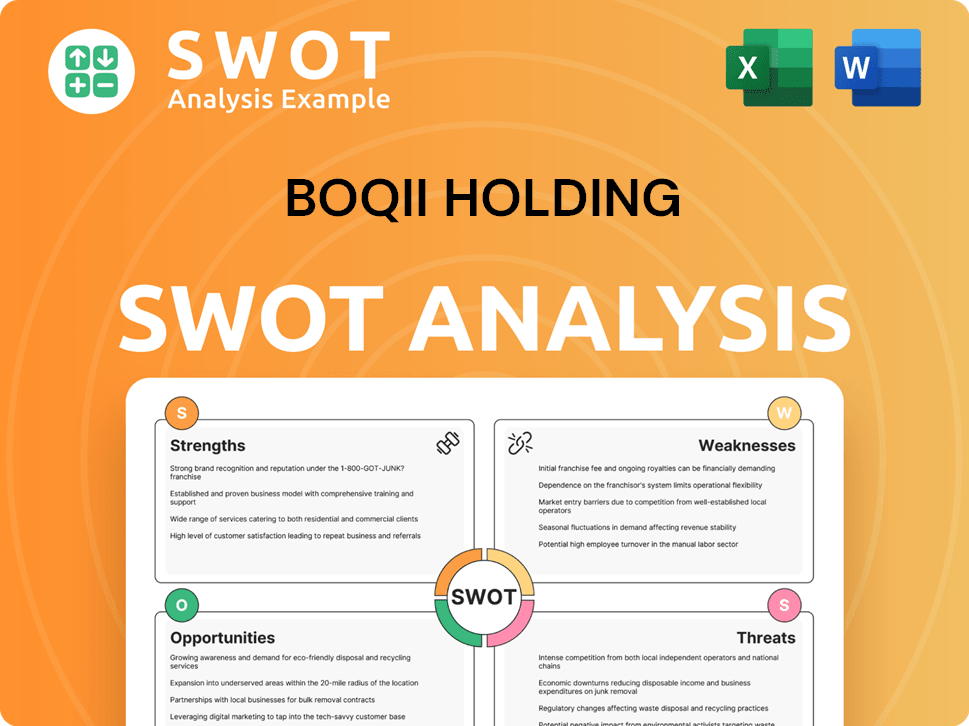

Boqii Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Boqii Holding Make Money?

The primary revenue streams for Boqii Holding Company stem from its online retail operations, focusing on the sale of pet supplies. This e-commerce model, central to the Boqii business model, includes a wide array of products, with pet food and accessories contributing significantly to the company's financial performance. While specific, current percentages for 2024-2025 are not publicly available, the sale of pet products has historically been the dominant revenue source.

Beyond direct product sales, Boqii generates revenue through service fees associated with its integrated pet services platform. This includes commissions or listing fees from service providers, such as groomers and veterinary clinics, who utilize the platform. This approach allows Boqii to diversify its income and tap into the growing demand for pet care services within the Chinese pet market.

Further monetization strategies include advertising and marketing services offered to pet product brands. Brands can use Boqii's platform for banner ads, sponsored listings, and promotional campaigns, reaching a large user base. Additionally, the company explores revenue from membership programs or premium features, although the impact of these varies. For more context on the company's origins, you can read the Brief History of Boqii Holding.

Boqii's revenue model is multifaceted, capitalizing on various opportunities within the online pet store and broader Chinese pet market. This approach enables the company to adapt to market changes and enhance its profitability.

- Online Retail Sales: Primary revenue from selling pet food, supplies, and accessories.

- Service Fees: Commissions from integrated pet services like grooming and veterinary appointments.

- Advertising and Marketing: Revenue from brands advertising on the platform.

- Membership Programs: Potential revenue from premium content or exclusive discounts.

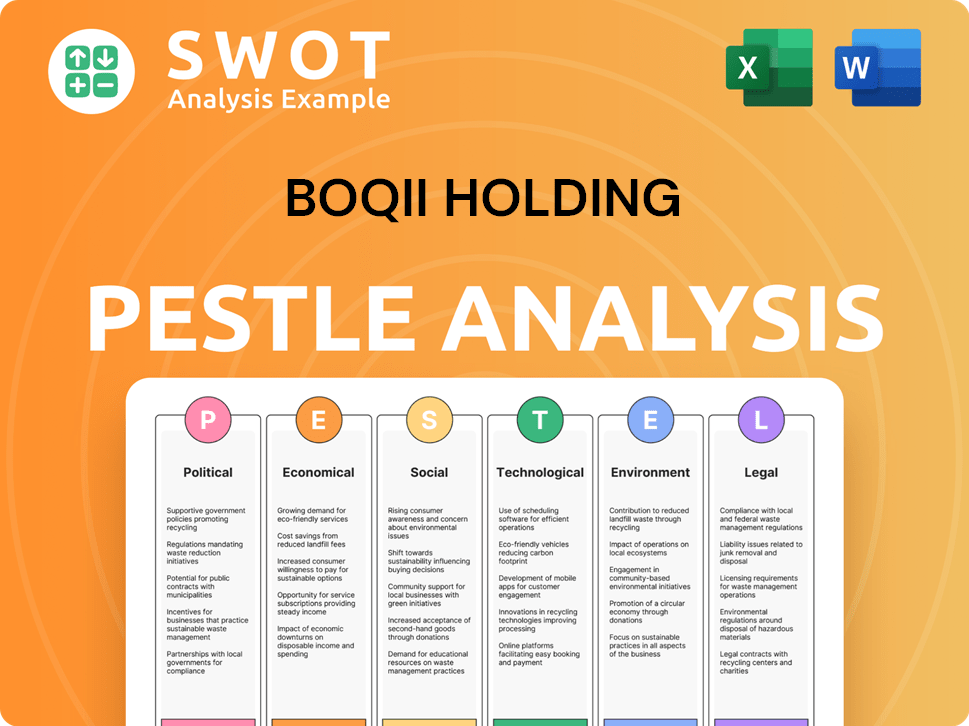

Boqii Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Boqii Holding’s Business Model?

Boqii Holding Company has significantly shaped its operations and financial performance through strategic milestones and moves. A pivotal moment was its initial public offering (IPO) on the New York Stock Exchange, which provided capital for expansion and solidified its market presence. The continuous expansion of its product catalog, including partnerships with international pet brands, has been a strategic move to capture a larger share of the diverse pet product market. Furthermore, the integration of offline pet services, such as grooming and healthcare, through its online platform marked a crucial pivot towards a more comprehensive ecosystem, addressing a broader range of pet owner needs beyond just product purchases.

The company has navigated a dynamic market, facing intense competition within the Chinese e-commerce landscape and the complexities of managing a vast supply chain. To address these challenges, Boqii has invested in enhancing its logistics infrastructure and strengthening its relationships with suppliers to ensure product availability and timely delivery. It has also focused on building a strong community aspect to its platform, fostering user loyalty and engagement, differentiating it from purely transactional e-commerce sites. The Target Market of Boqii Holding includes a broad spectrum of pet owners in China, driving its business model.

Boqii's competitive advantages stem from its strong brand recognition and established trust among Chinese pet owners, creating a significant barrier to entry for new competitors. The company benefits from economies of scale in procurement and logistics, allowing it to offer competitive pricing. Its technology leadership, particularly in developing a user-friendly and feature-rich mobile application, enhances the customer experience and facilitates seamless transactions. Moreover, its comprehensive ecosystem, combining product sales, information, community, and services, creates powerful network effects, where the value of the platform increases with each new user and service provider. Boqii continues to adapt to new trends, such as the increasing demand for premium and specialized pet products, and leverages data analytics to personalize offerings and improve customer satisfaction, thereby sustaining its business model in a rapidly evolving market.

Boqii's IPO on the New York Stock Exchange was a critical milestone, providing capital for expansion. The expansion of the product catalog, including exclusive partnerships, has been a strategic move to capture a larger market share. Integration of offline pet services into its online platform marked a pivot towards a more comprehensive ecosystem.

Investing in logistics infrastructure and strengthening supplier relationships have been key strategic moves. Building a strong community aspect to its platform enhances user loyalty and engagement. Leveraging data analytics to personalize offerings and improve customer satisfaction is a core strategy.

Strong brand recognition and trust among Chinese pet owners provide a significant barrier to entry. Economies of scale in procurement and logistics enable competitive pricing. Technology leadership, particularly in its mobile application, enhances customer experience. The comprehensive ecosystem creates powerful network effects.

Intense competition in the Chinese e-commerce landscape is a major challenge. Managing a vast supply chain for perishable goods presents complexities. Boqii has responded by enhancing logistics and strengthening supplier relationships. Building a strong community aspect to the platform to foster user loyalty.

In 2024, the Chinese pet market was valued at approximately $40 billion, with significant growth expected in the coming years. Boqii's revenue in 2023 was around $200 million, demonstrating its substantial presence in the online pet store market. The company's market share in the online pet supplies segment in China is estimated to be around 10%, positioning it as a key player.

- Boqii's IPO provided capital for expansion, enhancing its market position.

- The company's focus on logistics and supply chain management has improved delivery times and reduced costs.

- Building a strong community through its platform has increased user engagement and loyalty.

- Data analytics are used to personalize offerings, improving customer satisfaction and driving sales.

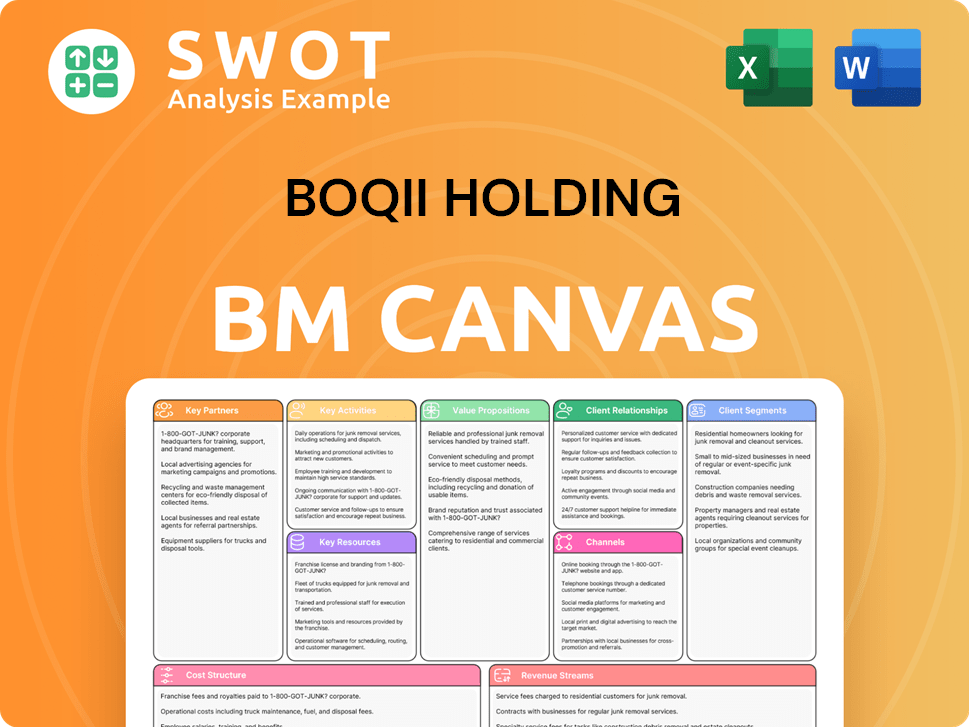

Boqii Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Boqii Holding Positioning Itself for Continued Success?

Boqii Holding Limited holds a prominent position within China's expanding pet industry as a leading online platform. The company has established a strong presence, leveraging its extensive product catalog and integrated service offerings to build substantial customer loyalty. Its primary market is China, where it has built a robust distribution network and brand recognition.

However, Boqii faces several risks. Intense competition from other e-commerce giants and specialized pet platforms in China poses a continuous challenge. Regulatory changes concerning pet ownership, product safety, or e-commerce operations in China could also introduce compliance burdens or impact business practices.

Boqii is a major player in the Chinese pet market. It offers a wide range of pet supplies and services. The company's online platform provides a convenient shopping experience for pet owners.

Competition from other e-commerce platforms is a constant threat. Regulatory changes and consumer preference shifts could also impact the business. Economic downturns affecting consumer spending could reduce spending on pet products.

Boqii is likely to invest in technology to improve user experience and optimize logistics. Expansion into higher-margin services, such as pet clinics, is a viable growth avenue. The company aims to capitalize on the growth of the Chinese pet market.

Boqii's business model focuses on online retail. The company offers a wide variety of pet products and services through its platform. It also emphasizes community engagement to build customer loyalty.

Boqii's growth strategy involves continuous innovation and adaptation. The company aims to expand its services and product offerings. Further integration of online and offline services is a key focus.

- Investing in technology to enhance platform user experience.

- Expanding into higher-margin service offerings.

- Deepening community engagement.

- Exploring new product categories.

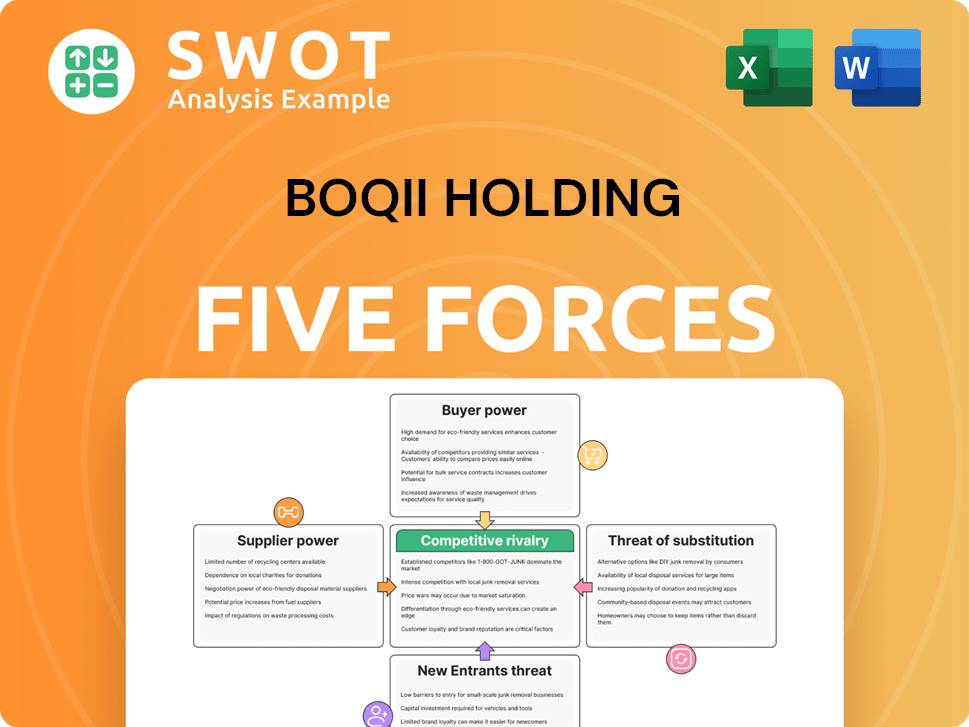

Boqii Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Boqii Holding Company?

- What is Competitive Landscape of Boqii Holding Company?

- What is Growth Strategy and Future Prospects of Boqii Holding Company?

- What is Sales and Marketing Strategy of Boqii Holding Company?

- What is Brief History of Boqii Holding Company?

- Who Owns Boqii Holding Company?

- What is Customer Demographics and Target Market of Boqii Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.